Hong Kong Dollar Peg: Recent US Dollar Purchases And Market Impact

Table of Contents

Recent US Dollar Purchases by the HKMA

The HKMA plays a crucial role in maintaining the Hong Kong dollar peg. Its primary responsibility is to ensure the stability of the Hong Kong dollar within the designated band against the US dollar. To achieve this, the HKMA actively intervenes in the foreign exchange market, buying or selling US dollars as needed. While precise figures for recent purchases aren't always publicly released immediately due to market sensitivity, news reports and HKMA statements indicate substantial interventions during periods of pressure on the peg. For instance, [insert specific example with date and source if available – e.g., "In October 2023, the South China Morning Post reported that the HKMA purchased X billion USD to defend the peg"].

- Reasons behind the purchases: These interventions are typically triggered by factors such as increased speculation against the HKD, significant capital outflows from Hong Kong, or other market forces pushing the exchange rate toward the weak end of the band.

- Mechanisms for defending the peg: The HKMA primarily defends the peg by buying US dollars in the open market, increasing demand and thus supporting the HKD. This action often involves manipulating interest rates.

- Associated interest rate changes: To make the HKD more attractive and discourage selling, the HKMA often raises interest rates concurrently with US dollar purchases. This makes it more expensive to borrow HKD and more lucrative to hold it, thus supporting the peg.

Impact on the Hong Kong Dollar Exchange Rate

The immediate effect of the HKMA's US dollar purchases is typically a strengthening of the Hong Kong dollar against the US dollar, pushing the exchange rate back towards the middle of the permitted band. While the peg itself remains largely stable due to these interventions, there can be short-term volatility as market participants react. After the interventions, stability generally returns, although sustained pressure could lead to further actions.

- Exchange rate fluctuations: [Insert chart or graph here illustrating HKD/USD exchange rate fluctuations around the time of the US dollar purchases. Clearly source the data, e.g., "Source: Bloomberg"]. The chart should visually demonstrate the HKMA's impact.

- Consequences for businesses and individuals: For businesses, exchange rate fluctuations can impact import and export costs, while for individuals, it can affect travel expenses and investments in foreign currencies. However, the overall impact is usually minimized due to the peg's effectiveness.

- Implications for foreign exchange trading: The HKMA's interventions can create opportunities and risks for foreign exchange traders, requiring careful analysis of market conditions and the HKMA's actions.

Implications for Interest Rates

The link between US dollar purchases, the Hong Kong dollar peg, and interest rates is direct. When the HKMA buys US dollars, it increases demand for the HKD, pushing up interest rates. This makes borrowing more expensive for businesses and consumers in Hong Kong.

- Effects on monetary policy: The HKMA's actions directly influence monetary policy in Hong Kong, impacting inflation and economic growth. This is usually closely tied to US monetary policy due to the peg.

- Relationship with US interest rates: Because of the peg, Hong Kong's interest rates tend to track closely with US interest rates, though not always perfectly. Differentials can influence capital flows.

- Consequences for investment decisions: Changes in interest rates resulting from HKMA interventions can significantly impact investment decisions, both domestically and internationally.

Market Sentiment and Investor Confidence

The HKMA's US dollar purchases generally aim to bolster confidence in the Hong Kong dollar and the overall market. However, the frequency and scale of these interventions can also be interpreted as a signal of underlying vulnerabilities. Therefore, while designed to maintain stability, large-scale interventions can sometimes create uncertainty.

- Capital inflows and outflows: Frequent interventions might signal a weakening of investor confidence, potentially leading to capital outflows. Conversely, successful interventions can reassure investors, leading to inflows.

- Impact on stock market performance: The overall market sentiment, influenced by the perceived strength of the Hong Kong dollar, can impact the stock market's performance. Periods of uncertainty tend to create volatility.

- Effect on Hong Kong's economic outlook: Maintaining a stable exchange rate is crucial for Hong Kong's economic health. Uncertainty around the peg can negatively impact economic growth and investment.

The Future of the Hong Kong Dollar Peg

The long-term sustainability of the Hong Kong dollar peg depends on various factors, and recent events have brought the topic under increased scrutiny. The peg has proven remarkably resilient, but external shocks could present challenges.

- Impact of external factors: Factors like US monetary policy changes, global economic slowdowns, and geopolitical events can all significantly affect the Hong Kong dollar and the stability of the peg.

- Alternative scenarios: While the current peg is likely to remain, alternative scenarios, such as a widening of the band or even a shift to a floating exchange rate, remain theoretical possibilities, although unlikely in the near future.

- Potential reforms or adjustments: The HKMA might consider adjustments to the mechanism to enhance resilience against future shocks, but significant alterations are unlikely without major shifts in the global economic landscape.

Conclusion

Recent US dollar purchases by the HKMA highlight the ongoing effort to maintain the Hong Kong dollar peg against the US dollar. While these interventions generally succeed in stabilizing the exchange rate and supporting investor confidence, they also underscore the challenges inherent in maintaining this linked exchange rate system. Understanding the complexities of the Hong Kong Dollar Peg mechanism and its impact on interest rates, market sentiment, and the broader economy remains crucial. Stay informed about the ongoing developments concerning the Hong Kong Dollar Peg and its implications for the Hong Kong economy by following reputable financial news sources and regularly reviewing updates on the HKMA's actions. Understanding the intricacies of the Hong Kong Dollar Peg is crucial for navigating the Hong Kong financial market effectively.

Featured Posts

-

Reform Uks Farage Sides With Snp For Scottish Parliament Election

May 04, 2025

Reform Uks Farage Sides With Snp For Scottish Parliament Election

May 04, 2025 -

Chinas Electric Vehicle Onslaught Is The Us Prepared To Compete

May 04, 2025

Chinas Electric Vehicle Onslaught Is The Us Prepared To Compete

May 04, 2025 -

Opec Decision Looms As Big Oil Holds Firm On Production

May 04, 2025

Opec Decision Looms As Big Oil Holds Firm On Production

May 04, 2025 -

Ftc Appeals Activision Blizzard Acquisition A Deep Dive

May 04, 2025

Ftc Appeals Activision Blizzard Acquisition A Deep Dive

May 04, 2025 -

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025

Latest Posts

-

Ohio Train Derailment The Extended Impact Of Toxic Chemical Exposure In Buildings

May 04, 2025

Ohio Train Derailment The Extended Impact Of Toxic Chemical Exposure In Buildings

May 04, 2025 -

Toxic Chemicals From Ohio Train Derailment A Building Contamination Investigation

May 04, 2025

Toxic Chemicals From Ohio Train Derailment A Building Contamination Investigation

May 04, 2025 -

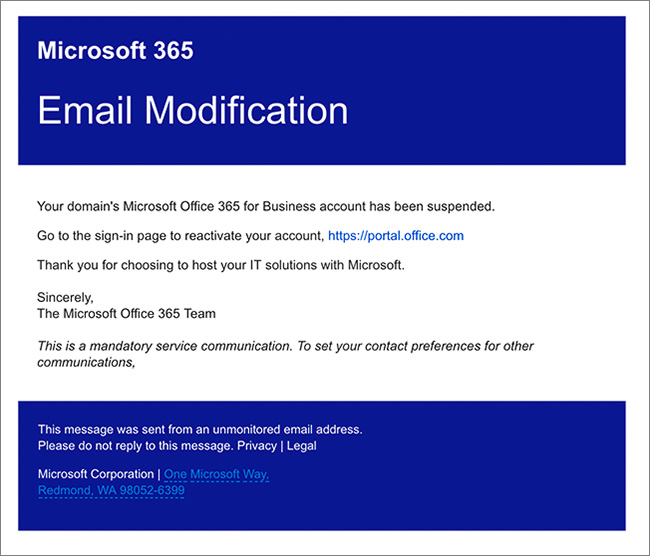

Office365 Security Failure Leads To Millions In Losses For Executives

May 04, 2025

Office365 Security Failure Leads To Millions In Losses For Executives

May 04, 2025 -

Federal Charges Massive Office365 Executive Email Account Hack

May 04, 2025

Federal Charges Massive Office365 Executive Email Account Hack

May 04, 2025 -

Crook Accused Of Millions In Office365 Executive Email Account Theft

May 04, 2025

Crook Accused Of Millions In Office365 Executive Email Account Theft

May 04, 2025