Navigating The Belgian Merchant Market: Financing Options For A 270MWh BESS

Table of Contents

Understanding the Belgian Regulatory Landscape for BESS Projects

Successfully financing a BESS project in Belgium requires a thorough understanding of the regulatory environment. This includes navigating the grid connection process, identifying revenue streams, and leveraging available tax incentives.

Grid connection and regulatory approvals

Connecting a 270MWh BESS to the Belgian grid involves several crucial steps. Navigating the Elia connection process, the Belgian transmission system operator, is critical. This includes submitting a comprehensive application, undergoing technical feasibility studies, and securing all necessary permits. Delays at this stage can significantly impact project timelines and costs.

- Elia grid connection application process: A detailed application, including technical specifications, interconnection agreement, and environmental impact assessment, must be submitted to Elia.

- Environmental impact assessments: Comprehensive environmental studies are mandatory to assess the project's potential impact on the surrounding environment.

- Building permits: Securing the necessary building permits from local authorities is also a vital step in the process.

- Relevant legislation: Understanding legislation related to renewable energy integration, grid stability, and safety regulations is crucial for compliance.

Revenue streams and market participation

The profitability of a Belgian BESS project hinges on the available revenue streams. The Belgian energy market offers various opportunities for BESS participation, generating income through various services.

- Capacity markets: Participating in capacity markets provides revenue for providing grid stability and reserve power.

- Intraday trading: BESS can participate in intraday electricity markets, buying and selling energy based on price fluctuations.

- Participation in balancing services: Providing frequency regulation and other balancing services to Elia can generate consistent revenue streams.

- Potential for long-term power purchase agreements (PPAs): Securing long-term PPAs with energy consumers can provide a stable and predictable income stream.

Tax incentives and government subsidies for BESS

The Belgian government offers various tax incentives and subsidies to promote the deployment of renewable energy technologies, including BESS. These incentives can significantly reduce project costs and improve financial viability.

- Investment tax credits: Tax credits are available for investments in renewable energy infrastructure, including BESS.

- Subsidies for renewable energy integration: Specific subsidies might be available for projects that support the integration of renewable energy sources into the grid.

- Regional development funds: Regional governments might offer additional financial support for projects located in specific regions.

- EU funding opportunities: Various EU funds and programs support renewable energy projects, offering additional financing opportunities.

Exploring Financing Options for a 270MWh BESS in Belgium

Securing financing for a large-scale BESS project requires exploring diverse funding sources. A combination of debt and equity financing is often the most effective strategy.

Debt financing

Traditional debt financing options include bank loans, green bonds, and project finance. Each has its advantages and disadvantages.

- Bank loan requirements: Banks typically require detailed financial projections, robust risk assessments, and strong project sponsors.

- Green bond issuance process: Issuing green bonds can attract investors interested in sustainable projects, but involves complexities in structuring and marketing the bonds.

- Project finance structuring: Project finance involves structuring the financing around the cash flows generated by the BESS project itself.

- Credit rating impact: A high credit rating can significantly improve the terms and conditions of debt financing.

Equity financing

Equity financing involves raising capital by selling a share of ownership in the project. Options include private equity, venture capital, and partnerships.

- Investor due diligence: Potential investors conduct thorough due diligence to assess the project's financial viability and risks.

- Equity dilution considerations: Raising equity capital often results in dilution of the original owners' equity stake.

- Negotiating equity investment terms: Negotiating favorable terms, including valuation and control, is crucial.

- Strategic partnerships: Partnering with energy companies or utilities can provide access to capital, expertise, and market access.

Hybrid financing models

Combining debt and equity financing optimizes the capital structure, reducing risk and leveraging the advantages of both approaches.

- Blending bank loans with equity investments: This approach balances the stability of debt financing with the flexibility of equity.

- Leveraging mezzanine financing: Mezzanine financing sits between debt and equity, offering a hybrid solution with flexible terms.

- Optimizing debt-to-equity ratios: Finding the optimal balance between debt and equity is key to minimizing financial risk.

Mitigating Risks in Belgian BESS Financing

BESS projects face various risks that must be carefully assessed and mitigated during the financing process.

Regulatory risk

Changes in regulations can impact project profitability. Analyzing policy stability and potential future changes is crucial.

- Policy stability: The stability of Belgian energy policy regarding renewable energy and energy storage is a critical factor.

- Changes in grid connection rules: Future changes in grid connection rules could impact the project's feasibility and profitability.

- Potential for future taxes or levies: The potential introduction of new taxes or levies on energy storage could affect the project's economics.

Market risk

Energy price volatility influences BESS project returns. Hedging strategies and accurate price forecasting are essential.

- Hedging strategies: Implementing hedging strategies to mitigate price risk is crucial for protecting project profitability.

- Price forecasting models: Accurate price forecasting models help in evaluating potential returns and managing risk.

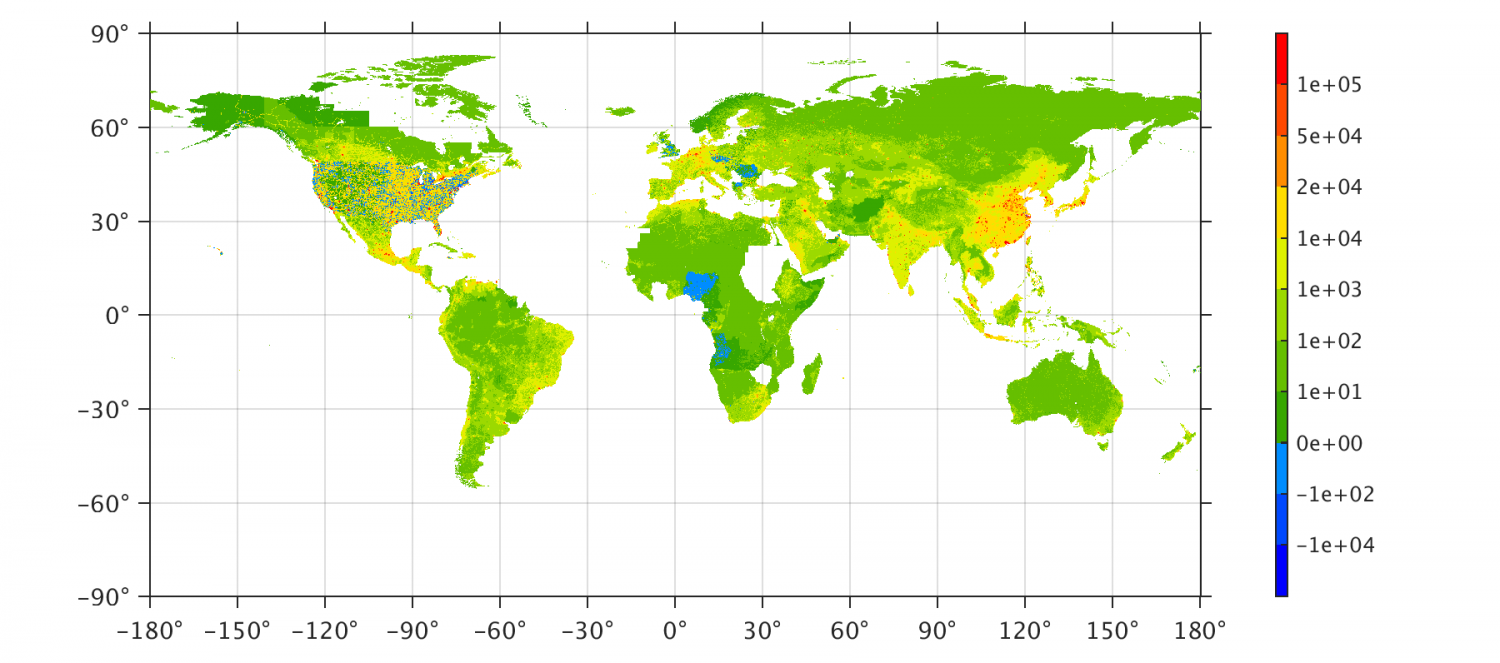

- Impact of renewable energy penetration: The increasing penetration of renewable energy in the Belgian market can impact energy prices and BESS profitability.

Technological risk

Battery technology, performance, and maintenance costs present potential challenges.

- Battery lifespan: Understanding the expected lifespan of the battery technology is crucial for long-term financial planning.

- Warranty considerations: Negotiating comprehensive warranties with battery suppliers is vital to protect against unexpected failures.

- Maintenance contracts: Securing reliable maintenance contracts is important for ensuring optimal performance and minimizing downtime.

- Technology advancements: Staying updated on advancements in battery technology can inform investment decisions and improve long-term value.

Conclusion

Securing financing for a 270MWh BESS project in Belgium requires a comprehensive understanding of the regulatory landscape, available financing options, and potential risks. By thoroughly understanding the Belgian merchant market dynamics and exploring a diverse range of funding solutions, developers can successfully navigate the complexities of this exciting sector. Through strategic planning and a well-structured financial strategy, the development of large-scale BESS projects like this 270MWh system can significantly contribute to Belgium's renewable energy goals. To learn more about optimizing your Belgian BESS financing strategy, contact our experts today for a personalized consultation.

Featured Posts

-

Kivinin Kabugunu Yemek Faydali Mi Zararli Mi Tam Bir Rehber

May 04, 2025

Kivinin Kabugunu Yemek Faydali Mi Zararli Mi Tam Bir Rehber

May 04, 2025 -

Fabio Christen Campeon De La Vuelta Ciclista A La Region De Murcia

May 04, 2025

Fabio Christen Campeon De La Vuelta Ciclista A La Region De Murcia

May 04, 2025 -

Analyzing The Countrys Evolving Business Hot Spots

May 04, 2025

Analyzing The Countrys Evolving Business Hot Spots

May 04, 2025 -

The Thunderbolts Marvels Gamble On Anti Heroes

May 04, 2025

The Thunderbolts Marvels Gamble On Anti Heroes

May 04, 2025 -

Are The Thunderbolts Marvels Salvation Or A Misfire

May 04, 2025

Are The Thunderbolts Marvels Salvation Or A Misfire

May 04, 2025

Latest Posts

-

Ohio Train Derailment The Extended Impact Of Toxic Chemical Exposure In Buildings

May 04, 2025

Ohio Train Derailment The Extended Impact Of Toxic Chemical Exposure In Buildings

May 04, 2025 -

Toxic Chemicals From Ohio Train Derailment A Building Contamination Investigation

May 04, 2025

Toxic Chemicals From Ohio Train Derailment A Building Contamination Investigation

May 04, 2025 -

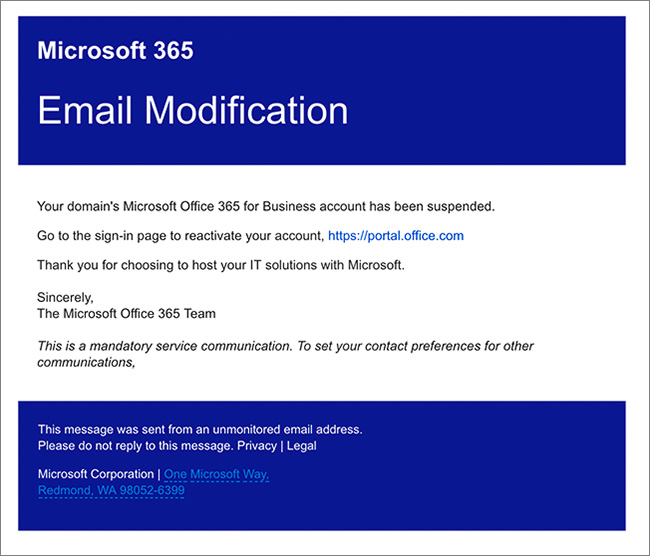

Office365 Security Failure Leads To Millions In Losses For Executives

May 04, 2025

Office365 Security Failure Leads To Millions In Losses For Executives

May 04, 2025 -

Federal Charges Massive Office365 Executive Email Account Hack

May 04, 2025

Federal Charges Massive Office365 Executive Email Account Hack

May 04, 2025 -

Crook Accused Of Millions In Office365 Executive Email Account Theft

May 04, 2025

Crook Accused Of Millions In Office365 Executive Email Account Theft

May 04, 2025