SPAC Stock Frenzy: Is This The Next MicroStrategy?

Table of Contents

Understanding the SPAC Phenomenon

What are SPACs?

SPACs, or special purpose acquisition companies, also known as blank check companies, are shell corporations listed on a stock exchange with the sole purpose of merging with a private company to take it public. This process, known as a de-SPAC transaction, offers a quicker and often less expensive alternative to a traditional initial public offering (IPO). The SPAC raises capital through an IPO, and then searches for a suitable target company to acquire. Once a merger is agreed upon, the combined entity begins trading under the SPAC's ticker symbol.

The Allure of SPACs for Investors

SPACs offer several advantages, making them appealing to both investors and companies seeking a public listing. For investors, SPAC IPOs can present opportunities for higher returns than traditional IPOs, particularly in the early stages. SPAC investment also provides access to pre-revenue companies with high growth potential, often in innovative sectors. For companies, going public through a SPAC merger is typically faster and less costly than a traditional IPO, reducing the time and resources needed for the listing process.

- Lower regulatory hurdles compared to traditional IPOs. The regulatory process for SPACs can be streamlined compared to traditional IPOs, resulting in faster timelines.

- Potential for high returns on early investment. Early investors in successful SPACs can see significant returns if the merged company performs well.

- Access to pre-revenue companies with high growth potential. SPACs often target high-growth companies in emerging sectors that might not be ready for a traditional IPO.

- Reduced risk associated with due diligence for investors (although this should be carefully considered). While still requiring due diligence, the SPAC structure often provides some pre-vetting of the target company.

MicroStrategy's Impact and the Current Market

MicroStrategy's Bitcoin Strategy and Stock Performance

MicroStrategy's aggressive Bitcoin investment strategy, spearheaded by CEO Michael Saylor, significantly impacted its stock performance. While the initial investment was met with skepticism, the subsequent rise in Bitcoin's price resulted in a substantial increase in MSTR stock value. This bold move highlighted the potential for non-traditional strategies within publicly traded companies, indirectly boosting interest in SPACs as a vehicle for similar ventures.

Comparing MicroStrategy's Success to Current SPAC Trends

MicroStrategy's success is a compelling case study, but it's crucial to understand the nuances. While its Bitcoin strategy directly benefited from the cryptocurrency's market growth, many current SPACs operate in vastly different sectors. The current market sentiment toward SPACs is more cautious than it was at the height of the SPAC boom, with increased regulatory scrutiny and a more volatile overall economic climate. Therefore, a direct comparison is misleading. Successful SPAC mergers require careful selection of target companies with strong fundamentals and a clear path to profitability.

- Discuss the risks associated with mimicking MicroStrategy's strategy. Blindly following MicroStrategy’s strategy is extremely risky. Bitcoin’s price is highly volatile, and other similar investments may not yield the same results.

- Analyze the different sectors in which SPACs are currently active. SPACs are currently active in various sectors, from technology and healthcare to renewable energy and consumer goods, each with its unique risks and opportunities.

- Highlight the importance of thorough due diligence before investing in a SPAC. Due diligence is paramount. Investors must carefully examine the target company's financials, management team, and market potential before investing.

Risks and Potential Pitfalls of Investing in SPACs

Identifying Red Flags in SPAC Investments

Investing in SPACs carries significant risks. Dilution of existing shares after the merger is common, reducing the value of initial investments. Management conflicts of interest can also arise, impacting the merged company's performance. Furthermore, the inherent volatility of the market can lead to substantial losses, especially in the short term. Investors must be wary of SPACs with unrealistic projections, weak management teams, and a lack of transparency in their financial statements.

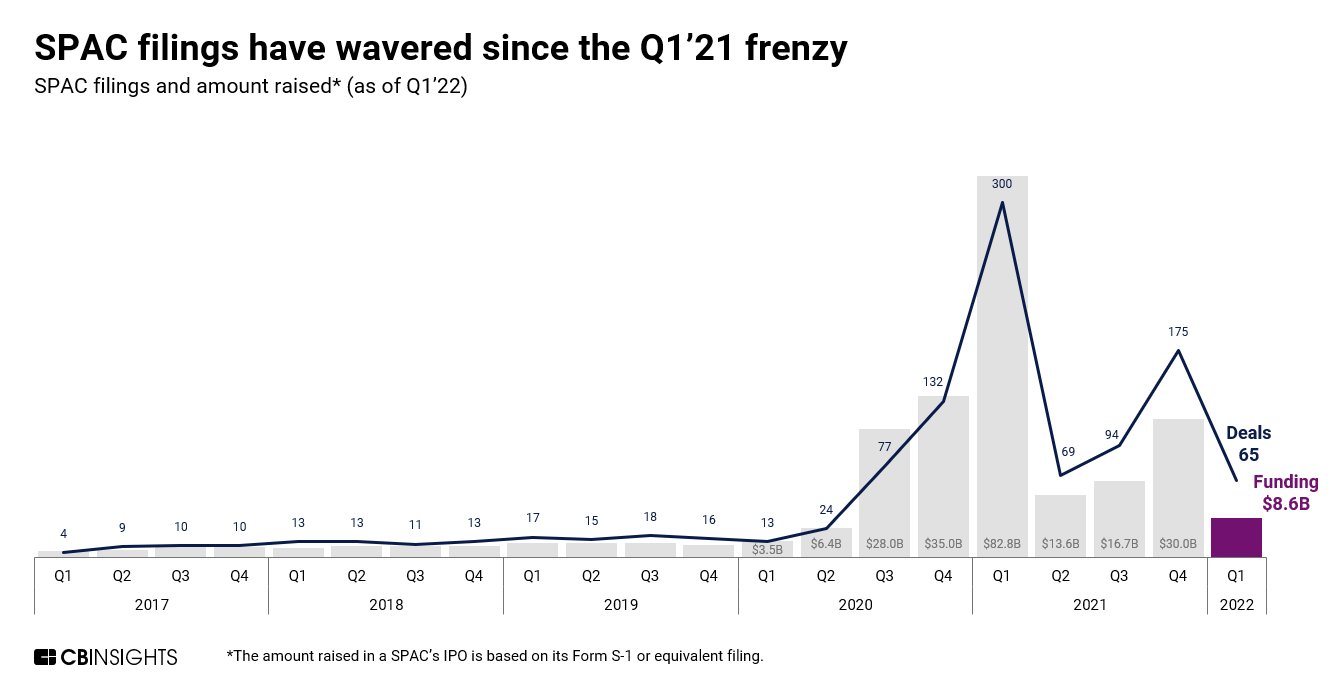

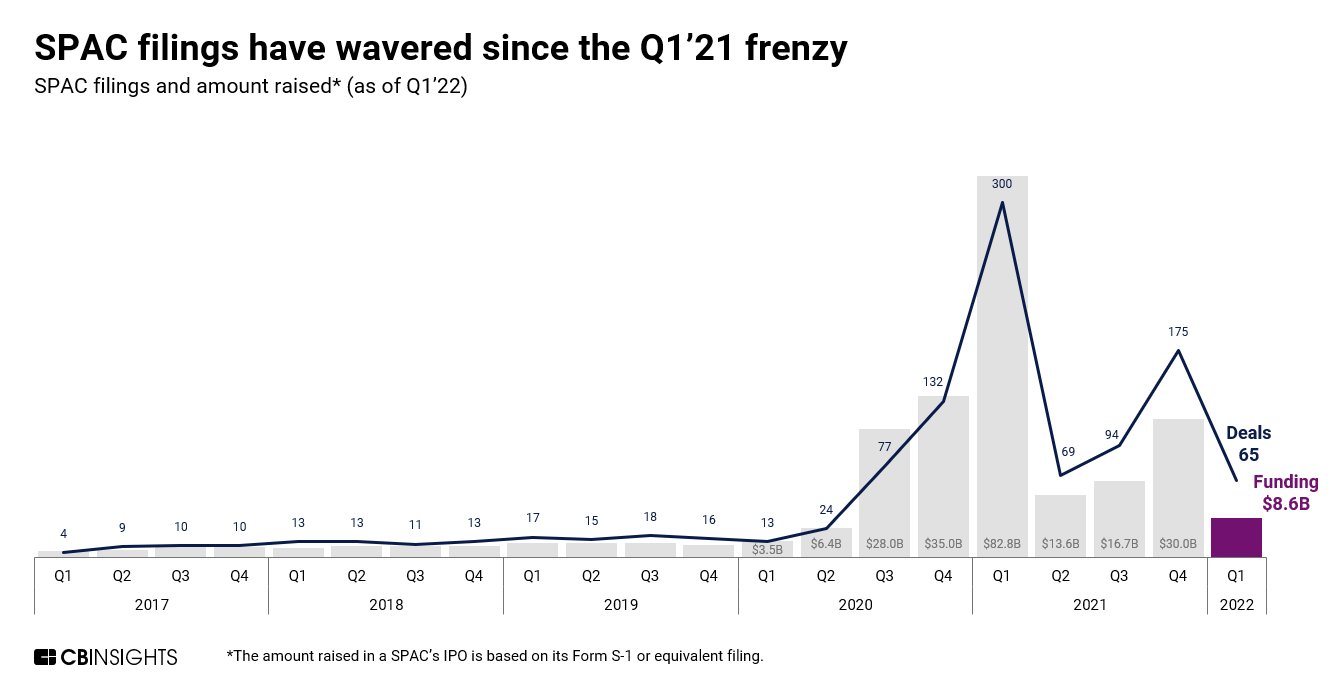

Regulatory Scrutiny and Future of SPACs

Increased regulatory scrutiny from the SEC and other financial authorities is shaping the future of SPACs. New regulations are being implemented to enhance transparency and protect investors. This heightened regulatory environment may reduce the appeal of SPACs for some companies and investors, potentially leading to a more cautious and sustainable market.

- Potential for poor performance after the merger. Many SPAC mergers don't result in the expected returns, and some merged companies even fail entirely.

- Lack of transparency in some SPAC deals. Some SPAC deals lack sufficient transparency, making it challenging for investors to conduct thorough due diligence.

- High short-term speculation leading to price volatility. The speculative nature of SPAC investments can lead to significant short-term price volatility, making them a risky proposition for many investors.

Conclusion

The current SPAC stock frenzy presents both significant opportunities and substantial risks. While the MicroStrategy success story serves as a compelling example, it’s crucial to approach SPAC investments with caution and thorough due diligence. The parallels are undeniable, but mimicking MicroStrategy's strategy without careful consideration could lead to significant losses. Understand the inherent risks associated with SPACs, perform thorough research, and diversify your portfolio to mitigate potential losses. Don't jump on the SPAC stock frenzy bandwagon blindly; make informed decisions to navigate this dynamic market successfully. Remember to always consult with a financial advisor before making any SPAC investments.

Featured Posts

-

Andor Season 2 Could Fan Favorite Rebels Appear A Timeline Analysis

May 08, 2025

Andor Season 2 Could Fan Favorite Rebels Appear A Timeline Analysis

May 08, 2025 -

Ethereum Price Analysis Resistance Broken 2 000 On The Horizon

May 08, 2025

Ethereum Price Analysis Resistance Broken 2 000 On The Horizon

May 08, 2025 -

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025 -

Counting Crows Snl Performance A Defining Moment

May 08, 2025

Counting Crows Snl Performance A Defining Moment

May 08, 2025 -

Ethereum Price Dip 67 Million In Liquidations Raise Concerns

May 08, 2025

Ethereum Price Dip 67 Million In Liquidations Raise Concerns

May 08, 2025