BlackRock ETF: Billionaire Investment Strategy And 2025 Projections

Table of Contents

Understanding BlackRock's ETF Dominance

BlackRock's influence on the ETF market is undeniable. Their iShares brand boasts a massive share of the global ETF market, managing trillions in assets under management (AUM). This dominance stems from a combination of factors, including a robust product suite and a well-established reputation.

Market Share and Asset Under Management (AUM)

BlackRock's market share consistently places them at the top of the ETF provider landscape. Their AUM is a testament to investor confidence.

- Market Share: BlackRock holds a significant percentage of the global ETF market, exceeding competitors by a substantial margin. Precise figures fluctuate, but their lead is consistently considerable.

- Growth Trends: BlackRock's ETF AUM has demonstrated consistent growth year-over-year, reflecting the increasing popularity of ETFs as a preferred investment vehicle.

- Popular BlackRock ETFs: Flagship ETFs like the iShares Core S&P 500 ETF (IVV) and the iShares CORE U.S. Aggregate Bond ETF (AGG) are cornerstones of many diversified portfolios, further solidifying BlackRock's position. These ETFs track major market indices, offering broad market exposure with low expense ratios.

Investment Philosophy and Strategies

BlackRock's success is rooted in a combination of passive and active management strategies. Their ETF creation and management are driven by rigorous research and analysis.

- Passive Management: Many BlackRock ETFs employ passive management strategies, tracking specific indices like the S&P 500 or the MSCI EAFE Index. This approach offers broad market exposure at a low cost.

- Active Management: While known for passive offerings, BlackRock also offers actively managed ETFs, where professional portfolio managers make investment decisions aiming to outperform benchmarks.

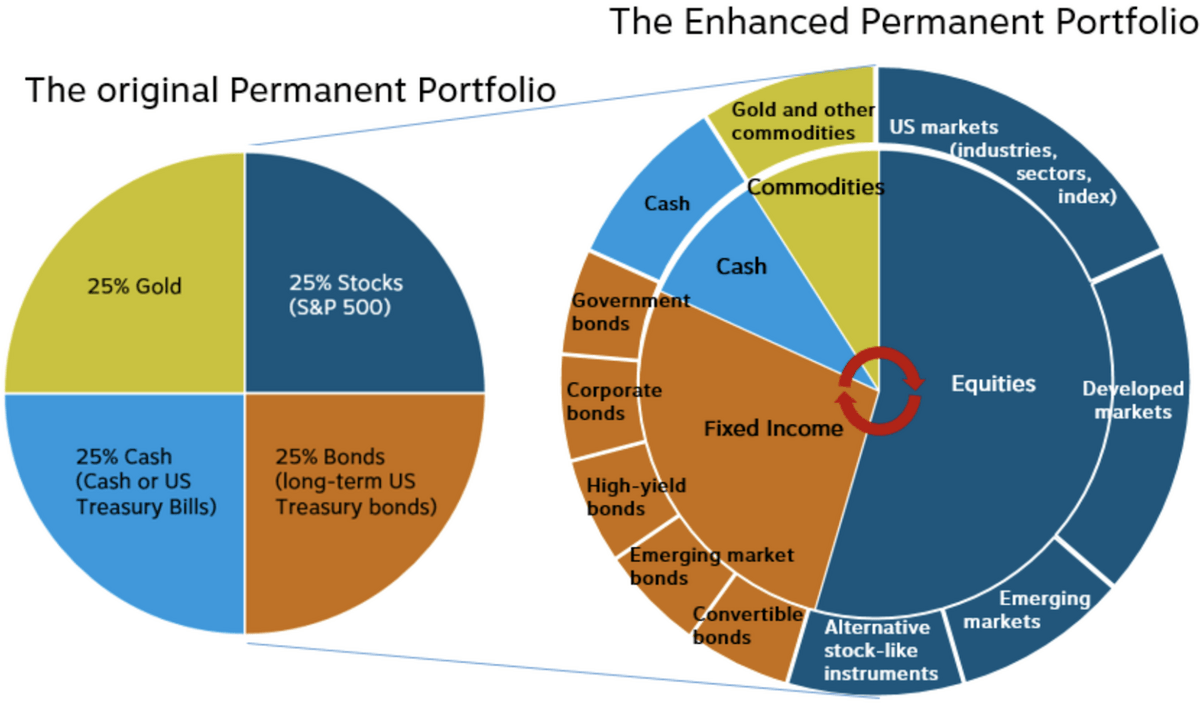

- Diversification Strategies: BlackRock ETFs span a broad range of asset classes, sectors, and geographies. This allows investors to build highly diversified portfolios, mitigating risk.

- Index Tracking: A core strength lies in their precise tracking of indices, ensuring ETFs closely mirror the performance of their underlying benchmarks.

Deconstructing Billionaire Investment Strategies with BlackRock ETFs

Billionaire investors frequently utilize BlackRock ETFs as a cornerstone of their diversified portfolios. Their strategies often emphasize risk management, long-term growth, and value investing.

Diversification and Risk Management

BlackRock ETFs facilitate sophisticated diversification strategies crucial for mitigating risk.

- Asset Allocation: Billionaire investors leverage BlackRock ETFs to achieve optimal asset allocation across various asset classes, including stocks, bonds, and potentially commodities, depending on their risk tolerance and investment goals.

- Rebalancing: Regular rebalancing of portfolios, using BlackRock ETFs, helps maintain the desired asset allocation and capitalize on market fluctuations. This ensures the portfolio aligns with the long-term investment plan.

Long-Term Growth and Value Investing

BlackRock ETFs play a significant role in achieving long-term growth and value investing objectives.

- Index Funds: BlackRock's index funds, like IVV, provide broad market exposure, allowing investors to participate in the long-term growth of the overall market.

- Sector-Specific ETFs: For targeted exposure, BlackRock offers sector-specific ETFs allowing investors to capitalize on specific industry trends or themes. These can be part of a larger, diversified strategy.

- Long-Term Wealth Creation: The combination of diversification and low-cost index tracking through BlackRock ETFs is a potent tool for long-term wealth creation, a key focus for high-net-worth individuals.

BlackRock ETF Projections for 2025: Opportunities and Challenges

Predicting the future is inherently uncertain, but analyzing current trends offers valuable insights into the potential performance and challenges facing BlackRock ETFs by 2025.

Market Trends and Predictions

Several factors could significantly impact BlackRock ETF performance in 2025.

- Market Growth: Continued, though potentially fluctuating, global economic growth is expected, which could positively impact equity-based BlackRock ETFs.

- Interest Rates: Interest rate movements will influence the performance of bond ETFs. Rising rates can negatively impact bond prices, while falling rates could have the opposite effect.

- Inflation: Inflationary pressures can erode purchasing power and impact the returns of various asset classes, requiring careful portfolio adjustments.

- Geopolitical Events: Unpredictable geopolitical events can create both opportunities and risks for BlackRock ETFs, depending on their exposure to affected regions or sectors.

Technological Advancements and their Influence

Technological advancements will likely reshape the ETF landscape.

- AI and Algorithmic Trading: The increasing use of AI and algorithmic trading may lead to increased market efficiency and potentially impact BlackRock's active management strategies.

- Blockchain Technology: Blockchain's potential to improve ETF transparency and efficiency could benefit investors and streamline operations for providers like BlackRock.

Potential Risks and Mitigation Strategies

Investing in BlackRock ETFs, like any investment, carries inherent risks.

- Market Volatility: Market fluctuations can impact the value of ETFs, particularly those focused on equities.

- Inflation Risk: Unexpected inflation can erode the real return on investments, affecting both stocks and bonds.

- Geopolitical Risks: Global events can significantly influence market performance.

- Mitigation Strategies: Diversification across asset classes and geographies, alongside a well-defined risk tolerance, are essential mitigation strategies.

Conclusion: Investing in Your Future with BlackRock ETFs

BlackRock ETFs have emerged as powerful tools for investors seeking diversification, long-term growth, and exposure to a wide range of asset classes. Billionaire investors leverage these ETFs as part of a robust investment strategy, demonstrating their effectiveness in managing risk and building wealth. While projections for 2025 suggest continued growth, understanding potential risks and implementing effective mitigation strategies is crucial. Explore BlackRock's ETF offerings today and learn more about billionaire investment strategies using BlackRock ETFs. Start building your portfolio with BlackRock ETFs for 2025 and beyond.

Featured Posts

-

3 Month Warning Dwp Halts Benefits For 355 000 Claimants

May 08, 2025

3 Month Warning Dwp Halts Benefits For 355 000 Claimants

May 08, 2025 -

Istori Ska Pobeda Segeda Nad Pariz Sent Zhermen U L Sh

May 08, 2025

Istori Ska Pobeda Segeda Nad Pariz Sent Zhermen U L Sh

May 08, 2025 -

Star Wars Yavin 4 Return A Behind The Scenes Look At The Delayed Sequel

May 08, 2025

Star Wars Yavin 4 Return A Behind The Scenes Look At The Delayed Sequel

May 08, 2025 -

Saving Private Ryan How Improvisation Created An Iconic Scene

May 08, 2025

Saving Private Ryan How Improvisation Created An Iconic Scene

May 08, 2025 -

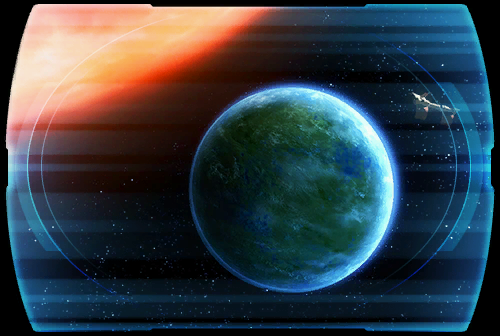

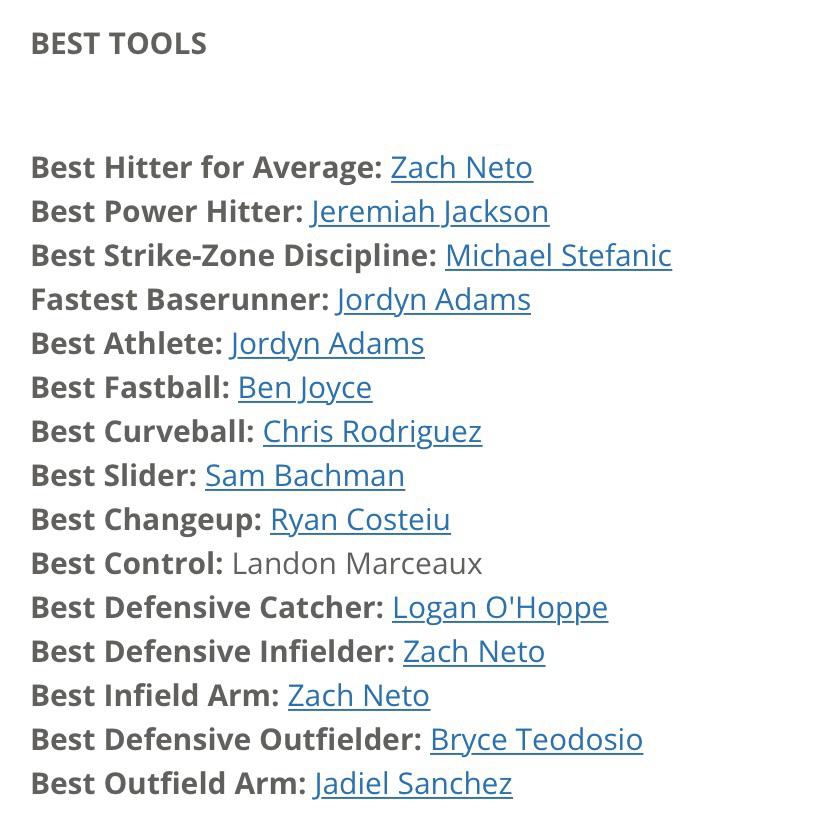

Angels Farm System Ranked Poorly By Baseball Experts

May 08, 2025

Angels Farm System Ranked Poorly By Baseball Experts

May 08, 2025