South Africa, Tanzania Talks Could End Farm Import Ban

Table of Contents

The Impact of Tanzania's Farm Import Ban on South Africa

Tanzania's farm import ban has dealt a substantial blow to South African agricultural exports, creating significant economic repercussions. The ban directly affects a range of products crucial to South Africa's agricultural economy.

-

Specific Products Affected: The restrictions encompass a wide variety of agricultural products, including fresh fruits (apples, oranges, grapes), vegetables (potatoes, onions, tomatoes), and processed foods. The impact extends beyond raw produce to include value-added products, hindering South Africa's ability to capitalize on the lucrative processed food market in Tanzania.

-

Quantifiable Financial Losses: Precise figures are difficult to obtain, but estimates suggest substantial financial losses for South African farmers and exporters. The ban has led to reduced production, increased storage costs, and spoiled goods, resulting in significant losses of revenue and impacting farm profitability. This decline in exports contributes to a widening trade deficit between the two nations.

-

Impact on Employment and Rural Livelihoods: The consequences extend beyond financial losses. Thousands of jobs in South Africa's agricultural sector, particularly in rural communities, are directly or indirectly affected. Farmers, farmworkers, and related industries are facing hardship due to the reduced export market.

-

Effect on South Africa's Trade Balance with Tanzania: The import ban has negatively impacted South Africa's trade balance with Tanzania. Reduced agricultural exports lead to a trade imbalance, highlighting the need for a resolution that benefits both economies. The disruption to trade flows affects not just the agricultural sector but ripples through interconnected industries.

Reasons Behind Tanzania's Import Ban and Potential for Resolution

Tanzania's import ban stems from a combination of factors aiming to support its domestic agricultural sector.

-

Tanzania's Stated Reasons: The Tanzanian government has publicly cited the need to protect its local farmers and ensure national food security as the primary reasons for the ban. The argument centers on fostering self-sufficiency and reducing reliance on imports.

-

Political and Economic Factors: Underlying these stated reasons are complex political and economic factors. Protectionist policies aimed at shielding domestic farmers from competition play a significant role. Furthermore, the desire for import substitution—replacing imported goods with domestically produced ones—underpins the ban.

-

Ongoing Discussions and Potential Compromises: The current bilateral talks between South Africa and Tanzania are focusing on finding mutually acceptable solutions. Potential compromises could involve phased lifting of the ban, establishing quality control measures for imported goods, or negotiating preferential trade agreements.

-

Past Attempts and International Involvement: Previous attempts to resolve the issue have met with limited success. The involvement of regional trade organizations and international bodies could facilitate a compromise and provide a framework for sustainable agricultural trade. The ongoing discussions provide hope for a more collaborative approach.

Potential Economic Benefits of Lifting the Farm Import Ban

Lifting the farm import ban promises significant economic benefits for both South Africa and Tanzania.

-

Increased South African Exports to Tanzania: A resolution would unlock substantial export opportunities for South African farmers, leading to increased trade volume and revenue. This renewed access to the Tanzanian market offers a significant boost to South Africa’s agricultural sector.

-

Projected Economic Growth: Increased trade flows would stimulate economic growth in both countries. The enhanced trade relationship would lead to increased investment, job creation, and a more robust agricultural sector in both nations.

-

Investment and Joint Venture Opportunities: Lifting the ban could foster investment opportunities and facilitate the establishment of joint ventures between South African and Tanzanian companies in the agricultural sector. This collaboration could lead to technological advancements and improved agricultural practices.

-

Regional Integration and Mutual Benefits: The removal of trade barriers would foster closer economic ties and regional integration within the Southern African Development Community (SADC). This collaborative approach would lead to a win-win situation, promoting economic growth and stability across the region. This shared prosperity model is crucial for sustained economic development within the region.

Conclusion

The ongoing South Africa, Tanzania talks hold the potential to resolve a significant trade barrier, unlocking substantial economic benefits for both nations. A successful resolution of the farm import ban would signal a new era of agricultural trade cooperation, fostering increased economic growth, job creation, and regional integration. The potential for enhanced food security and mutual prosperity through increased agricultural trade is substantial. Staying updated on the progress of these crucial bilateral talks is essential for all stakeholders in the agricultural sector. Continue to follow developments regarding the South Africa, Tanzania farm import ban discussions for updates on this vital issue.

Featured Posts

-

Mc Cook Jeweler Supports Nfl Players Fresh Starts

Apr 27, 2025

Mc Cook Jeweler Supports Nfl Players Fresh Starts

Apr 27, 2025 -

Ariana Grandes Dramatic Hair And Tattoo Changes A Professionals Insight

Apr 27, 2025

Ariana Grandes Dramatic Hair And Tattoo Changes A Professionals Insight

Apr 27, 2025 -

Film News Juliette Binoche Named Cannes Jury President

Apr 27, 2025

Film News Juliette Binoche Named Cannes Jury President

Apr 27, 2025 -

Best Free Movies And Tv Shows To Watch On Kanopy Right Now

Apr 27, 2025

Best Free Movies And Tv Shows To Watch On Kanopy Right Now

Apr 27, 2025 -

The China Factor Analyzing The Struggles Of Bmw Porsche And The Broader Automotive Landscape

Apr 27, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And The Broader Automotive Landscape

Apr 27, 2025

Latest Posts

-

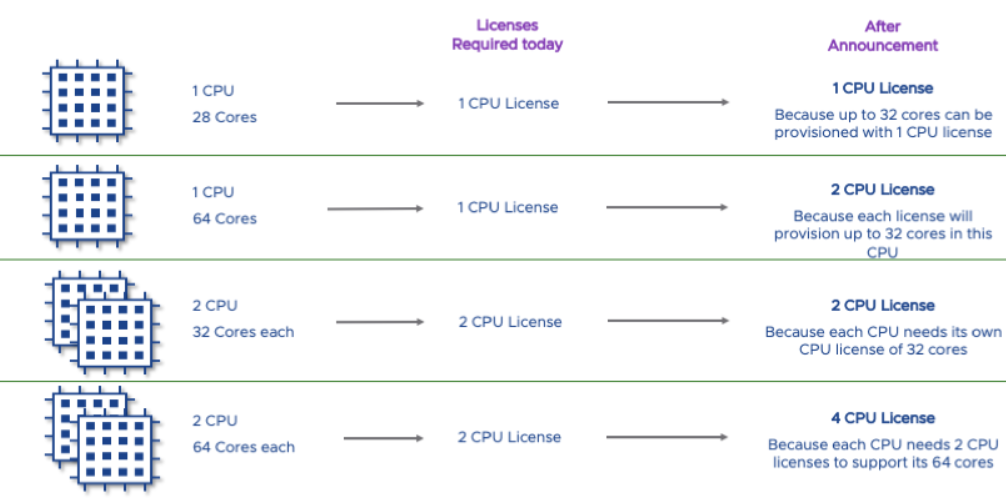

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025 -

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025 -

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025 -

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025