Significant Losses In Amsterdam: Stock Market Falls 7% On Trade War Fears

Table of Contents

Causes of the Amsterdam Stock Market Decline

The sharp decline in the Amsterdam Stock Market is a multifaceted issue stemming from a confluence of factors, primarily driven by the escalating global trade war and subsequent shifts in investor sentiment.

Impact of Global Trade War

The ongoing trade war has cast a long shadow over global markets, and Amsterdam is feeling the effects acutely. Concerns center around potential tariffs on key Dutch exports, particularly agricultural products and high-tech goods. The uncertainty surrounding future trade agreements creates a chilling effect on investment and business confidence.

- Increased uncertainty among investors: The unpredictable nature of trade policies makes long-term investment planning extremely difficult, leading to hesitation and a reluctance to commit capital.

- Decreased consumer and business confidence: Fear of higher prices and reduced purchasing power due to tariffs impacts consumer spending, while businesses postpone investments due to uncertainty about future profitability.

- Potential for reduced exports from the Netherlands: Tariffs imposed by trading partners directly reduce the demand for Dutch goods, impacting export-oriented businesses and potentially leading to job losses.

- Impact on specific sectors: Sectors heavily reliant on international trade, such as technology, agriculture, and manufacturing, are particularly vulnerable. For example, the semiconductor industry, a significant player in the Amsterdam Stock Exchange, faces disruptions in global supply chains.

Investor Sentiment and Market Volatility

Beyond the concrete impact of trade policies, investor psychology played a significant role in the market's sharp decline. Fear and uncertainty fueled panic selling, amplifying the initial downturn.

- Panic selling triggered by negative news: Negative headlines and reports about escalating trade tensions triggered a wave of selling, exacerbating the market's decline.

- Impact of algorithmic trading: High-frequency algorithmic trading strategies, designed to react instantly to market movements, may have amplified the volatility and contributed to the speed of the downturn.

- Influence of international market trends: The Amsterdam Stock Exchange is not an isolated entity; negative trends in other major global markets further fueled the sell-off.

- Withdrawal of foreign investments: Concerns about the stability of the Dutch economy prompted some foreign investors to withdraw their funds, contributing to the decline.

Sectors Most Affected by the Stock Market Fall

The impact of the market fall wasn't evenly distributed. Certain sectors within the Amsterdam Stock Exchange experienced far greater losses than others.

- Technology: Companies in the technology sector, many reliant on global supply chains and international sales, were hit particularly hard.

- Finance: Financial institutions face reduced investment activity and increased uncertainty, impacting their profitability and stock prices.

- Export-oriented industries: Companies heavily reliant on exports suffered significantly due to the potential for reduced demand and increased trade barriers.

Examples of specific companies significantly affected would need to be added here based on real-time data. This section would then include details of individual stock performance, impacts on valuations, and potential job losses within those specific sectors.

Economic Implications for the Netherlands

The 7% drop in the Amsterdam Stock Market has significant implications for the Dutch economy, both in the short-term and long-term.

- GDP growth projections: The decline will likely lead to a downward revision of GDP growth projections for the Netherlands.

- Impact on employment: Reduced business investment and potential export declines could result in job losses across various sectors.

- Government response and potential intervention: The Dutch government may need to intervene to mitigate the economic impact, potentially through fiscal stimulus measures or other policy adjustments.

- Consumer spending and its anticipated impact: Reduced consumer confidence could lead to decreased spending, further impacting economic growth.

Future Outlook and Investor Advice

While the current situation is concerning, it's crucial to maintain a balanced perspective. The market is inherently volatile, and historical data suggests periods of decline are often followed by recovery.

- Analysis of potential market rebounds: A careful analysis of underlying economic fundamentals and global trade developments will be crucial to assess the potential for market recovery.

- Risk management strategies for investors: Investors should adopt a cautious approach, diversifying their portfolios to mitigate potential losses.

- Recommendations for diversification of portfolios: Diversifying across different asset classes and geographic regions is a key strategy to minimize risk.

- Importance of long-term investment strategies: Focusing on long-term investment goals rather than reacting to short-term market fluctuations is essential.

Conclusion

The 7% drop in the Amsterdam Stock Market highlights the severe impact of global trade uncertainties on even stable economies. The decline reflects investor anxieties, market volatility, and significant consequences for specific sectors within the Dutch economy. The situation calls for careful risk management and a long-term perspective for investors.

Call to Action: Stay informed about the evolving situation surrounding the Amsterdam Stock Market and global trade developments to make informed investment decisions. Monitor [link to relevant financial news source] for updates on the Amsterdam Stock Market and the broader global financial landscape. Understanding the factors driving significant losses in Amsterdam is crucial for effective financial planning.

Featured Posts

-

Revealed 2026 Porsche Cayenne Ev In Spy Photos

May 24, 2025

Revealed 2026 Porsche Cayenne Ev In Spy Photos

May 24, 2025 -

Former French Pm Disagrees With Macrons Decisions

May 24, 2025

Former French Pm Disagrees With Macrons Decisions

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Performance And Analysis

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Performance And Analysis

May 24, 2025 -

Ezt A Porsche 911 Est 80 Millio Forintert Tuningoltak

May 24, 2025

Ezt A Porsche 911 Est 80 Millio Forintert Tuningoltak

May 24, 2025 -

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 24, 2025

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 24, 2025

Latest Posts

-

Ohio Train Derailment Lingering Chemical Contamination In Nearby Structures

May 24, 2025

Ohio Train Derailment Lingering Chemical Contamination In Nearby Structures

May 24, 2025 -

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 24, 2025

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 24, 2025 -

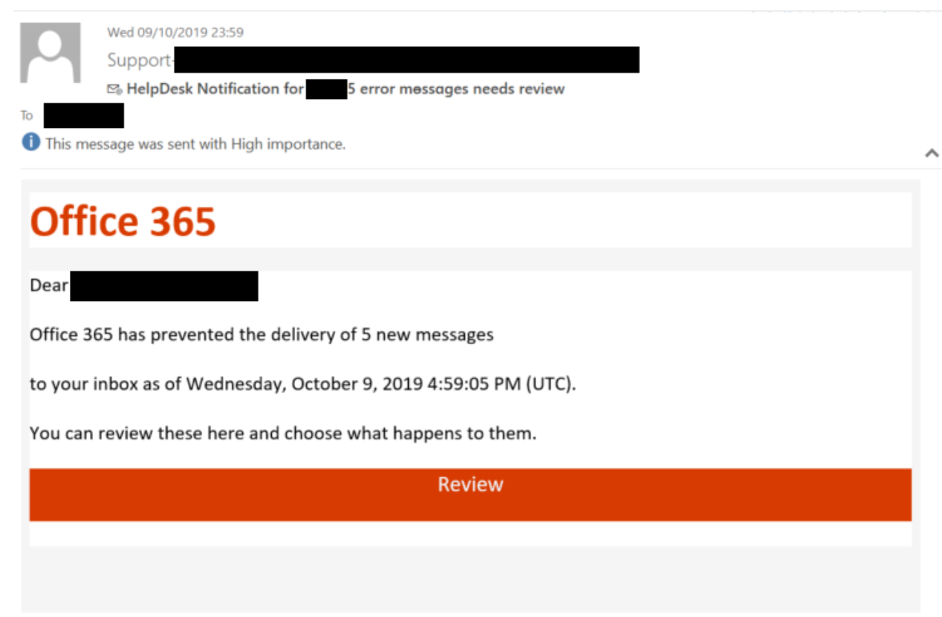

High Profile Office365 Accounts Compromised Millions Stolen

May 24, 2025

High Profile Office365 Accounts Compromised Millions Stolen

May 24, 2025 -

Fbi Investigation Large Scale Office365 Data Breach And Theft

May 24, 2025

Fbi Investigation Large Scale Office365 Data Breach And Theft

May 24, 2025 -

Office365 Security Flaw Leads To Millions In Losses For Executives

May 24, 2025

Office365 Security Flaw Leads To Millions In Losses For Executives

May 24, 2025