Should You Invest In XRP (Ripple) In 2024? A Prudent Approach

Table of Contents

Understanding the XRP Ripple Ecosystem and its Technology

Ripple's technology centers around its namesake, RippleNet, a real-time gross settlement system (RTGS) designed to facilitate cross-border payments. Unlike many cryptocurrencies that rely on blockchain technology, Ripple uses a unique consensus mechanism that allows for faster and cheaper transactions. This efficiency is a key differentiator, making it attractive to financial institutions seeking to streamline international money transfers.

-

Faster and Cheaper Transactions: XRP's role is crucial in facilitating these faster and cheaper transactions. It acts as a bridge currency, enabling near-instantaneous settlements between different currencies and reducing reliance on traditional banking infrastructure.

-

RippleNet Adoption: Many financial institutions globally have adopted RippleNet, signifying a growing acceptance of Ripple's technology within the traditional finance sector. This institutional adoption is a significant factor potentially driving XRP's value.

-

Scalability and Energy Efficiency: Compared to Bitcoin or Ethereum, XRP boasts superior scalability and energy efficiency. Its transaction processing speed and lower energy consumption are key advantages in a world increasingly concerned about sustainability. This energy-efficient crypto offers a compelling alternative to other, more energy-intensive cryptocurrencies.

-

Use Cases Beyond Payments: While primarily known for cross-border payments, XRP's technology is also being explored for other applications, including supply chain management and micropayments. These expanding use cases could further enhance its long-term value proposition.

The SEC Lawsuit and its Potential Impact on XRP Price

The ongoing SEC (Securities and Exchange Commission) lawsuit against Ripple Labs is a major factor influencing XRP's price. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this case will significantly impact XRP's future.

-

Arguments Presented: The SEC argues that XRP sales constituted an unregistered securities offering, while Ripple counters that XRP is a digital currency used for payments and not a security. The legal arguments are complex and hinge on the definition of a "security."

-

Impact of a Ruling: A positive ruling for Ripple could lead to a significant surge in XRP's price, as the regulatory uncertainty would be removed. Conversely, an unfavorable ruling could result in a substantial price drop and potentially even delisting from some exchanges.

-

Expert Opinions and Market Predictions: Expert opinions are divided, with some predicting a positive outcome for Ripple and others expressing caution. Market predictions for XRP's price post-lawsuit vary widely, reflecting the considerable uncertainty surrounding the case.

-

Uncertainty and Investor Sentiment: The uncertainty surrounding the lawsuit significantly impacts investor sentiment. Many investors are hesitant to invest heavily in XRP until the legal matter is resolved. This regulatory uncertainty is a key risk factor for potential XRP investors.

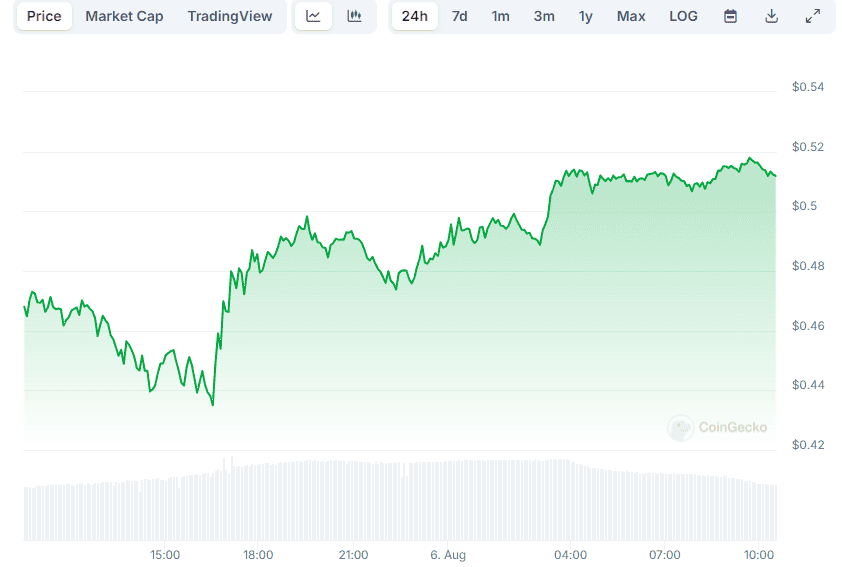

Market Analysis and Price Predictions for XRP in 2024

Predicting the price of any cryptocurrency, including XRP, is inherently speculative. However, analyzing current market trends and considering various scenarios can offer a more informed perspective on potential price movements in 2024.

-

Influencing Factors: Several factors will influence XRP's price, including the outcome of the SEC lawsuit, the rate of RippleNet adoption, overall cryptocurrency market sentiment, and broader macroeconomic conditions.

-

Price Prediction Models: Various price prediction models exist, each with its own set of assumptions. Some models are based on technical analysis of price charts, while others incorporate fundamental factors such as adoption rates and regulatory developments.

-

Risks and Opportunities: Investing in XRP presents both substantial risks and potential opportunities. The high volatility of the cryptocurrency market is a significant risk, while the potential for substantial gains if the SEC lawsuit is resolved favorably presents a significant opportunity.

-

Visualizing Predictions: Charts and graphs illustrating different price scenarios based on various assumptions can help visualize the potential range of XRP's price in 2024. These visuals provide a helpful tool for understanding the potential for both gains and losses.

Diversification and Risk Management in Your XRP Investment Strategy

Investing in cryptocurrencies, including XRP, carries inherent risks. Diversification and risk management are crucial for mitigating these risks and protecting your investment.

-

Diversification: Diversifying your portfolio across different asset classes (including stocks, bonds, and other cryptocurrencies) is essential to reduce the impact of potential losses in any single asset. An XRP portfolio should be part of a broader strategy.

-

Suggested Portfolio: A diversified portfolio might include a small allocation to XRP alongside other cryptocurrencies like Bitcoin and Ethereum, as well as traditional investments.

-

Risk Tolerance: Your risk tolerance should inform your investment decisions. If you're risk-averse, you should limit your XRP investment to a small percentage of your overall portfolio.

-

Realistic Goals and Expectations: Set realistic investment goals and manage your expectations. Cryptocurrency investments are highly volatile, and losses are possible.

Conclusion

Investing in XRP in 2024 presents both exciting opportunities and significant risks. The ongoing SEC lawsuit casts a shadow of uncertainty, but the underlying technology and potential adoption by financial institutions offer a counterpoint. A prudent approach involves thorough research, understanding the inherent risks, and diversifying your investment portfolio. Before making any investment decisions regarding XRP, conduct your own due diligence and consider consulting a financial advisor. Remember, only invest what you can afford to lose. Ultimately, the decision of whether or not to invest in XRP is a personal one, requiring a careful assessment of your own risk tolerance and financial goals. Make informed choices regarding your XRP investment and consider all aspects before committing your capital.

Featured Posts

-

The Red Heels And Ring Rihannas Post Engagement Style

May 07, 2025

The Red Heels And Ring Rihannas Post Engagement Style

May 07, 2025 -

The Enduring Success Of Lewis Capaldis New Album

May 07, 2025

The Enduring Success Of Lewis Capaldis New Album

May 07, 2025 -

Royal Air Maroc Flight Cancellations Brussels Strikes Impact

May 07, 2025

Royal Air Maroc Flight Cancellations Brussels Strikes Impact

May 07, 2025 -

Learning From History Why The Warriors Shouldnt Fear A Blowout

May 07, 2025

Learning From History Why The Warriors Shouldnt Fear A Blowout

May 07, 2025 -

Xrp Price Recovery Falters Derivatives Market Holds Back

May 07, 2025

Xrp Price Recovery Falters Derivatives Market Holds Back

May 07, 2025

Latest Posts

-

Epic Crypto Stories From Humble Beginnings To Billion Dollar Empires

May 08, 2025

Epic Crypto Stories From Humble Beginnings To Billion Dollar Empires

May 08, 2025 -

Top Crypto Narratives Inspiring Tales Of Success And Failure

May 08, 2025

Top Crypto Narratives Inspiring Tales Of Success And Failure

May 08, 2025 -

The Greatest Crypto Stories Of All Time

May 08, 2025

The Greatest Crypto Stories Of All Time

May 08, 2025 -

New Superman Sneak Peek Kryptos Unexpected Attack

May 08, 2025

New Superman Sneak Peek Kryptos Unexpected Attack

May 08, 2025 -

These Are The Best Crypto Stories Ever Told

May 08, 2025

These Are The Best Crypto Stories Ever Told

May 08, 2025