Top Crypto Narratives: Inspiring Tales Of Success And Failure

Table of Contents

Success Stories: Crypto Millionaires and Their Journeys

The crypto space boasts numerous success stories, illustrating the potential for massive returns for those who take calculated risks and understand the market.

Early Bitcoin Adopters:

Early adopters of Bitcoin, those who bought and held (hodl) during its nascent years, have witnessed incredible returns on their investments. Their crypto narratives often involve significant risk tolerance, patience, and a deep belief in the underlying technology.

- Examples: While specific early investors often remain anonymous, stories abound of individuals who acquired Bitcoin for pennies on the dollar and watched its value skyrocket.

- Strategies: These early investors employed strategies like early mining (creating new Bitcoin through computational power) and hodling (holding onto their Bitcoin despite market fluctuations).

- Importance of Timing and Risk Tolerance: Timing is everything in crypto. Early entry and the willingness to withstand significant short-term volatility were critical factors in their success. Bitcoin success stories are testaments to the power of long-term vision and risk management. These individuals understood the potential of this revolutionary technology and were willing to weather the storm.

Successful ICOs and Their Impact:

Initial Coin Offerings (ICOs) represent another avenue to success in the crypto world. While many ICOs have failed, some have delivered remarkable returns for early investors.

- Examples: While naming specific ICOs carries inherent risk given the volatility of the market, examples of projects that successfully raised funds and delivered on their promises highlight the importance of thorough due diligence.

- Success Factors: Successful ICOs typically feature innovative technologies, strong development teams, and effective marketing strategies. A compelling whitepaper outlining the project's vision and technology is also crucial.

- Risks and Due Diligence: Investing in ICOs is inherently risky. Thorough research, understanding the team's expertise, and evaluating the project's whitepaper are paramount to mitigating risk. Successful investors in successful ICOs understood this and approached their investments strategically.

The Rise of DeFi and Decentralized Finance Stars:

The Decentralized Finance (DeFi) space has emerged as a breeding ground for innovative projects and remarkable success stories.

- Examples: Various DeFi protocols have revolutionized lending, borrowing, and yield farming, creating opportunities for significant returns. Specific examples often highlight protocols that offered unique value propositions and successfully attracted users.

- Unique Value Propositions: DeFi protocols succeed by providing solutions to traditional finance problems, offering decentralized, transparent, and efficient services. DeFi success stories often demonstrate the power of community-driven projects.

- Risks of DeFi Projects: While offering immense potential, DeFi projects are subject to risks like smart contract vulnerabilities, oracle manipulation, and impermanent loss. Crypto lending and yield farming, while lucrative, demand careful consideration of these risks.

Cautionary Tales: Crypto Failures and Lessons Learned

While success stories abound, the crypto landscape is littered with cautionary tales emphasizing the importance of risk management and due diligence.

The Collapse of High-Profile Projects:

The crypto world has witnessed the spectacular collapse of several high-profile projects, highlighting the inherent risks associated with the industry.

- Examples: Numerous projects have failed due to various reasons, including scams, poor management, technological vulnerabilities, market manipulation, and regulatory issues. Analyzing these failures provides valuable insights into common pitfalls.

- Reasons for Failure: Understanding the causes of these failures – including fraudulent activities, unsustainable business models, and lack of transparency – is crucial for investors. Crypto failures serve as stark reminders of the inherent volatility of the market.

- Role of Scams: The cryptocurrency space, unfortunately, attracts scammers. Investors must be wary of projects promising unrealistic returns or lacking transparency. Crypto scams represent a significant threat, highlighting the importance of caution.

The Dangers of Speculation and FOMO:

Speculation and the fear of missing out (FOMO) are powerful forces driving impulsive decisions in the crypto market.

- Importance of Risk Management: Successful investors employ strategies like diversification, dollar-cost averaging, and setting stop-loss orders to mitigate risks. Understanding crypto risk management is paramount.

- Conducting Thorough Research: Investing in cryptocurrencies requires thorough research, including understanding the underlying technology, the team behind the project, and the market dynamics. Due diligence is non-negotiable.

- Psychological Factors: Emotional decision-making can lead to significant losses. Investors must remain disciplined and avoid impulsive trades driven by FOMO.

The Impact of Regulatory Uncertainty:

The evolving regulatory landscape poses significant challenges for the cryptocurrency industry.

- Regulatory Uncertainty: The lack of clear regulatory frameworks in many jurisdictions creates uncertainty, affecting the value and stability of crypto assets. Crypto regulation is a constantly evolving area.

- Staying Informed: Staying informed about regulatory developments and understanding their potential impact is crucial for navigating the crypto market. Crypto compliance is becoming increasingly important.

- Legal Risks: Investors should be aware of the legal risks associated with cryptocurrency investments and ensure compliance with applicable laws and regulations.

Conclusion:

The crypto narratives presented here offer valuable insights into the thrilling yet risky world of cryptocurrencies. Both the success stories and the cautionary tales underscore the importance of careful research, risk management, and a long-term perspective. Remember, the key to success in the crypto space lies in understanding both the immense potential rewards and the significant risks involved. Explore more compelling crypto narratives, understand the risks and rewards of investing in crypto, and learn from these crypto narratives to make informed decisions. Dive deeper into individual projects and invest wisely.

Featured Posts

-

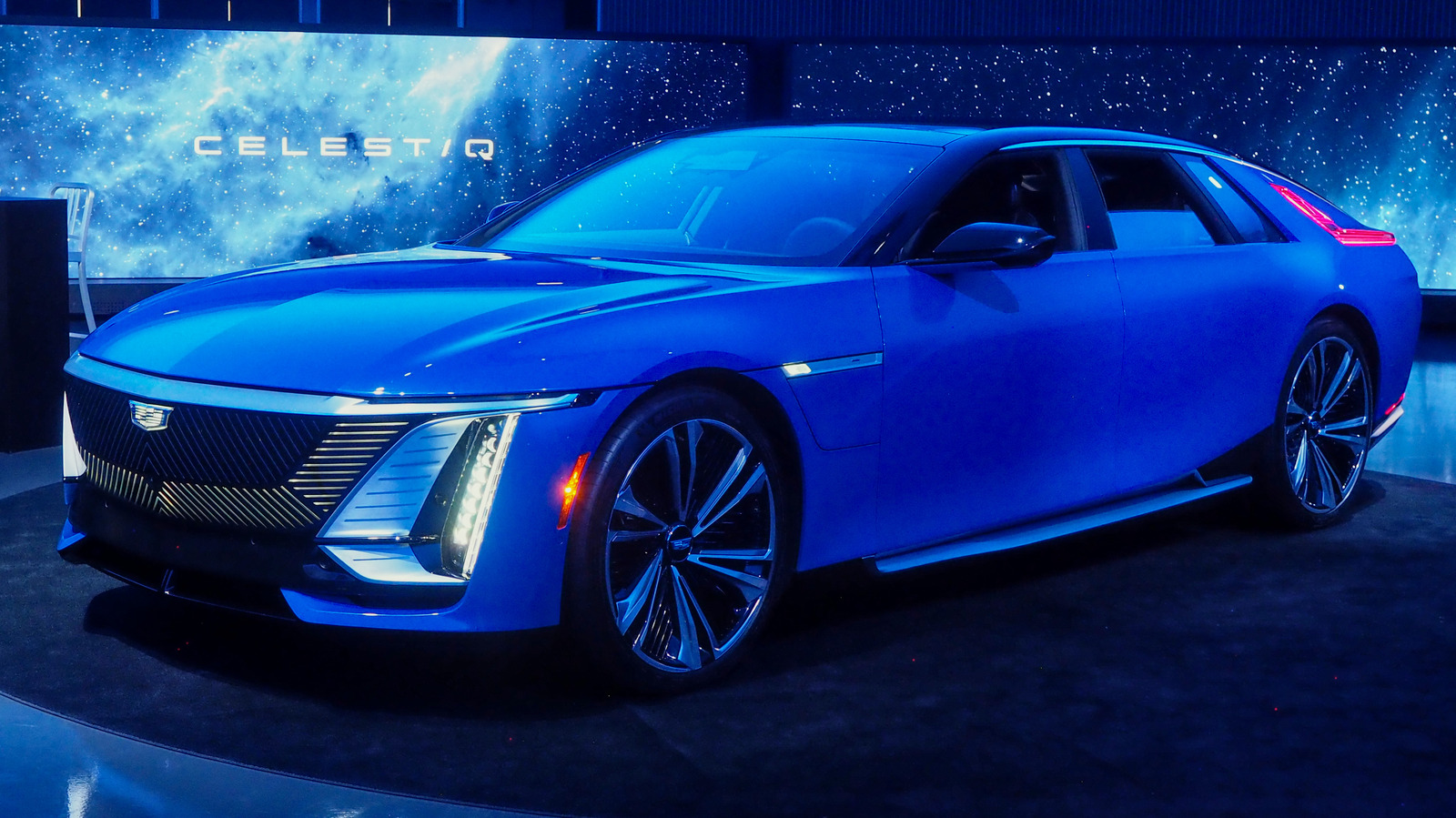

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025 -

Podcast Production Revolutionized Ais Role In Digesting Repetitive Scatological Documents

May 08, 2025

Podcast Production Revolutionized Ais Role In Digesting Repetitive Scatological Documents

May 08, 2025 -

Bitcoin In Gelecegi Guencel Durum Ve Uzun Vadeli Tahminler

May 08, 2025

Bitcoin In Gelecegi Guencel Durum Ve Uzun Vadeli Tahminler

May 08, 2025 -

Bitcoin Rally Imminent Analysts Chart Signals Bullish Trend May 6 2024

May 08, 2025

Bitcoin Rally Imminent Analysts Chart Signals Bullish Trend May 6 2024

May 08, 2025 -

Analiza E Ndermarrjes Se Psg Fitore Minimaliste Ne Pjesen E Pare

May 08, 2025

Analiza E Ndermarrjes Se Psg Fitore Minimaliste Ne Pjesen E Pare

May 08, 2025