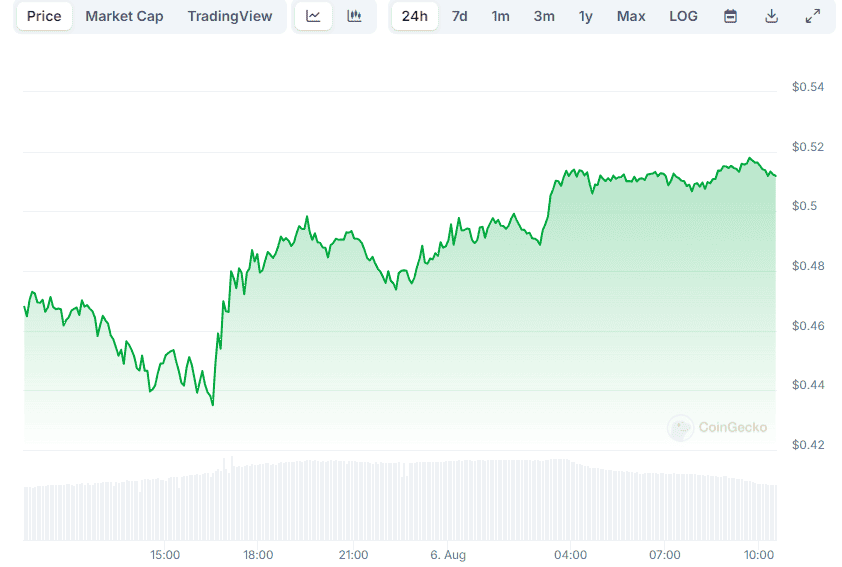

XRP Price Recovery Falters: Derivatives Market Holds Back

Table of Contents

The Ripple Effect: SEC Lawsuit and Market Sentiment

The ongoing SEC lawsuit against Ripple Labs, the creator of XRP, remains a dominant force shaping market sentiment and XRP price volatility. The uncertainty surrounding the legal outcome continues to suppress investor confidence, creating a climate of fear, uncertainty, and doubt (FUD) that impacts XRP trading significantly.

- Uncertainty surrounding the legal outcome continues to suppress investor confidence. A definitive resolution is needed to unlock substantial, sustained growth.

- Positive court rulings are followed by temporary price increases, but sustained growth is lacking. These rallies are often short-lived as the underlying uncertainty persists.

- Negative news or delays can trigger significant price drops. The market reacts swiftly and dramatically to any negative development, highlighting the sensitivity of XRP's price to legal developments.

This inherent uncertainty fuels speculative trading, particularly within the derivatives market, where traders bet on price movements rather than holding XRP for its long-term value. This speculative activity can amplify short-term price fluctuations, making it difficult to achieve a steady XRP price recovery.

Derivatives Market Dynamics: Short Selling and Open Interest

A key aspect hindering the XRP price recovery is the significant short selling activity in the XRP derivatives market. Short selling involves borrowing XRP, selling it at the current price, and hoping to buy it back later at a lower price to profit from the difference.

- High open interest in XRP short positions indicates significant bearish sentiment. This suggests that a large number of traders are betting against XRP's price increase.

- Short sellers profit from price declines, creating downward pressure on the price. Their actions directly contribute to the difficulty in achieving a sustained price recovery.

- Liquidations of short positions can cause temporary price spikes, but the underlying bearish pressure remains. While these liquidations can lead to short-term upward movements, they are often followed by renewed downward pressure as short sellers re-enter the market.

Open interest, a key indicator in derivatives markets, refers to the total number of outstanding contracts that have not been settled. High open interest in XRP short positions signals a substantial bearish bet against the token, further hindering the potential for an XRP price recovery.

Leveraged Trading and Amplified Volatility

Leveraged trading in XRP derivatives magnifies both potential gains and losses, exacerbating the volatility already present in the market. Traders use borrowed funds to amplify their positions, significantly increasing their potential profits but also their risk.

- High leverage increases the risk of forced liquidations, which can exacerbate price swings. When prices move against a leveraged trader, they may be forced to sell their assets to meet margin calls, leading to a cascade effect that further depresses the price.

- Margin calls can lead to cascading liquidations, further depressing the price. This chain reaction can create significant downward pressure on the XRP price.

- This volatility discourages long-term investment and contributes to the lack of sustained price recovery. The unpredictable price swings make it difficult for long-term investors to feel confident in holding XRP.

This amplified volatility, driven by leveraged trading, contributes to the overall instability in the XRP market and is a major obstacle to a sustained XRP price recovery.

The Role of Futures Contracts in Price Suppression

Futures contracts, a type of derivative, play a significant role in influencing the XRP price. These contracts allow traders to agree to buy or sell XRP at a future date at a predetermined price.

- Analyzing the pricing of XRP futures contracts relative to the spot price is crucial. A negative futures basis, where the futures price is below the spot price, is a strong indicator of bearish sentiment.

- A negative futures basis (futures price below spot price) reflects bearish sentiment. This suggests that the market anticipates a further decline in the XRP price.

- This impacts overall market perception and investor behavior. A negative futures basis can discourage new investment and encourage further selling pressure.

Alternative Factors Affecting XRP Price

While the derivatives market plays a significant role, other factors influence the XRP price:

- Adoption rate of XRP in the payments industry: Wider adoption could drive demand and price.

- Regulatory developments globally affecting cryptocurrencies: Clearer regulatory frameworks could increase investor confidence.

- Overall cryptocurrency market trends: The broader crypto market significantly impacts XRP's price.

Conclusion

While positive developments in the SEC lawsuit offer glimmers of hope for an XRP price recovery, the current state of the XRP derivatives market significantly impedes sustained growth. High short interest, leveraged trading, a potentially negative futures basis, and amplified volatility all contribute to a bearish outlook and price instability. Other factors, such as adoption and global regulation, further complicate the situation.

Call to Action: Understanding the complexities of the derivatives market is crucial for navigating the volatility surrounding XRP. Stay informed about the latest developments in the SEC lawsuit and the XRP derivatives market to make informed decisions regarding your XRP investments. Monitor the XRP price recovery closely and adjust your strategy accordingly. Analyzing open interest and futures contracts can provide valuable insights into market sentiment and potential future price movements. A keen understanding of the interplay between the Ripple lawsuit and derivatives market dynamics is essential for successful XRP investment.

Featured Posts

-

Yankees 2000 Season A Diary Entry Comeback Attempt Fails 500 Record

May 07, 2025

Yankees 2000 Season A Diary Entry Comeback Attempt Fails 500 Record

May 07, 2025 -

Mobleys Impact Cavaliers Achieve Franchise Record 16 Game Winning Streak

May 07, 2025

Mobleys Impact Cavaliers Achieve Franchise Record 16 Game Winning Streak

May 07, 2025 -

Izrazanje Sozalja Besede Tolazbe Za Zalujoce

May 07, 2025

Izrazanje Sozalja Besede Tolazbe Za Zalujoce

May 07, 2025 -

High Stock Market Valuations A Bof A Analysts Reassuring View

May 07, 2025

High Stock Market Valuations A Bof A Analysts Reassuring View

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special The Biggest Wins And Biggest Losses

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special The Biggest Wins And Biggest Losses

May 07, 2025

Latest Posts

-

Thunders Leadership Dynamic Kenrich Williams Perspective

May 08, 2025

Thunders Leadership Dynamic Kenrich Williams Perspective

May 08, 2025 -

Williams Reveals Unsung Leadership In The Thunder Organization

May 08, 2025

Williams Reveals Unsung Leadership In The Thunder Organization

May 08, 2025 -

Okc Thunder Leadership Williams Highlights A Standout Player

May 08, 2025

Okc Thunder Leadership Williams Highlights A Standout Player

May 08, 2025 -

Okc Thunders Heated Exchange With National Media Outlets

May 08, 2025

Okc Thunders Heated Exchange With National Media Outlets

May 08, 2025 -

Kenrich Williams Names The Thunders Top Leader

May 08, 2025

Kenrich Williams Names The Thunders Top Leader

May 08, 2025