Should You Invest In This Hot New SPAC Stock? A Detailed Analysis

Table of Contents

Understanding SPACs and Their Investment Appeal

SPACs, often called "blank-check companies," are publicly traded companies with no specific business operations. Their sole purpose is to raise capital through an initial public offering (IPO) to acquire a private company. This acquisition takes the private company public without undergoing a traditional IPO process. The allure of SPAC investments lies primarily in two key areas: the potential for high returns and access to pre-IPO opportunities. Investing in a successful SPAC can yield substantial profits if the target company performs well after the merger. Furthermore, SPACs offer investors the chance to gain exposure to promising companies that might not otherwise be accessible.

- Lower barriers to entry: Compared to traditional IPOs, accessing SPAC investments can be relatively easier, broadening participation.

- Portfolio diversification: SPACs can offer diversification benefits, adding a unique element to an investment portfolio.

- Early access to promising companies: Investors gain exposure to companies potentially poised for significant growth before they are widely known.

However, it's crucial to acknowledge the inherent risks. Before a merger is announced, investors typically have limited financial information about the target company, making it challenging to perform comprehensive due diligence. This lack of transparency increases the uncertainty surrounding the investment.

Analyzing the Specific SPAC Stock in Question

To illustrate the analytical process, let's assume we are considering a hypothetical, "hot" SPAC – let's call it "Acme Acquisition Corp." A thorough analysis needs to cover several crucial aspects.

The Target Company and its Potential

Let's assume Acme Acquisition Corp. is targeting "InnovateTech," a company developing cutting-edge AI-powered software for the healthcare industry. Analyzing InnovateTech requires assessing:

- Industry and Business Model: The healthcare AI market is rapidly expanding, presenting significant growth potential for InnovateTech. Their business model revolves around providing subscription-based software solutions to hospitals and clinics.

- Financials: While pre-merger financial details might be limited, available information suggests strong revenue growth and a path to profitability within the next two years. Debt levels appear manageable.

- Market size and growth potential: The global market for AI in healthcare is projected to grow exponentially over the next decade.

- Management team experience and expertise: InnovateTech boasts a seasoned management team with a proven track record in the technology and healthcare sectors.

- Intellectual property and competitive advantages: InnovateTech holds several key patents related to its core technology, giving them a competitive edge.

The SPAC Sponsor and Management Team

The reputation and track record of the SPAC sponsor and management team are vital. A successful sponsor suggests a higher likelihood of a well-managed acquisition process. We need to investigate:

- Past successes and failures: Has this SPAC sponsor successfully completed previous mergers? What were the outcomes?

- Conflicts of interest: Any potential conflicts of interest should be carefully examined to ensure transparency and investor protection.

- Alignment of incentives: Are the sponsor's incentives aligned with those of the investors?

Valuation and Potential Returns

Determining a fair valuation for the SPAC requires comparing it to similar companies and performing a thorough financial analysis:

- Discounted cash flow analysis: Projecting future cash flows and discounting them back to present value to estimate the intrinsic value of InnovateTech.

- Comparable company analysis: Comparing InnovateTech's valuation multiples (e.g., price-to-earnings ratio) to similar publicly traded companies.

- Sensitivity analysis: Testing different growth scenarios to understand the potential range of returns under various conditions.

Assessing the Risks Involved in SPAC Investments

Beyond the inherent risks discussed earlier, several additional factors warrant careful consideration:

- Risk of dilution: Future equity offerings could dilute existing shareholders' ownership and reduce the value of their investment.

- Limited historical data: The lack of a long operating history makes assessing long-term performance challenging.

- Regulatory uncertainty: Changes in regulations related to SPACs could impact the value of the investment.

- Deal failure: The merger might not be completed, resulting in the return of the initial investment, often with a small interest payment.

Due Diligence and Investment Strategy

Thorough due diligence is paramount before investing in any SPAC. This should involve:

- Carefully reading the SPAC's offering documents: This includes the prospectus and any other relevant disclosures.

- Independently researching the target company: Go beyond the information provided by the SPAC sponsor and verify facts.

- Seeking professional financial advice: Consider consulting a financial advisor to discuss the suitability of the investment for your risk profile.

A diversified investment approach is recommended. Avoid over-concentrating your portfolio in a single SPAC, even if it appears highly promising.

Conclusion

Investing in a "hot" SPAC stock like Acme Acquisition Corp. presents both opportunities and significant risks. While the potential for high returns is alluring, the lack of transparency and inherent uncertainties necessitate a cautious approach. Thorough due diligence, careful assessment of the target company's financials and the SPAC sponsor's track record, and a diversified investment strategy are crucial before committing funds. Weighing the potential for high returns against the inherent risks is crucial before making any decision about this or any other SPAC stock. Conduct your own thorough research and consider consulting a financial professional before making any investment in a SPAC. Remember, investing in SPACs involves significant risk.

Featured Posts

-

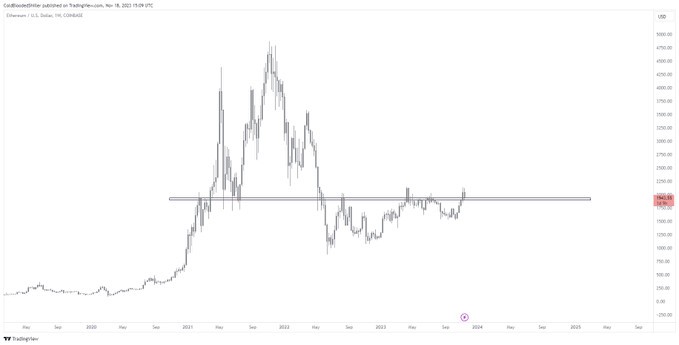

Analyzing The Ethereum Weekly Chart Buy Signal Spotted

May 08, 2025

Analyzing The Ethereum Weekly Chart Buy Signal Spotted

May 08, 2025 -

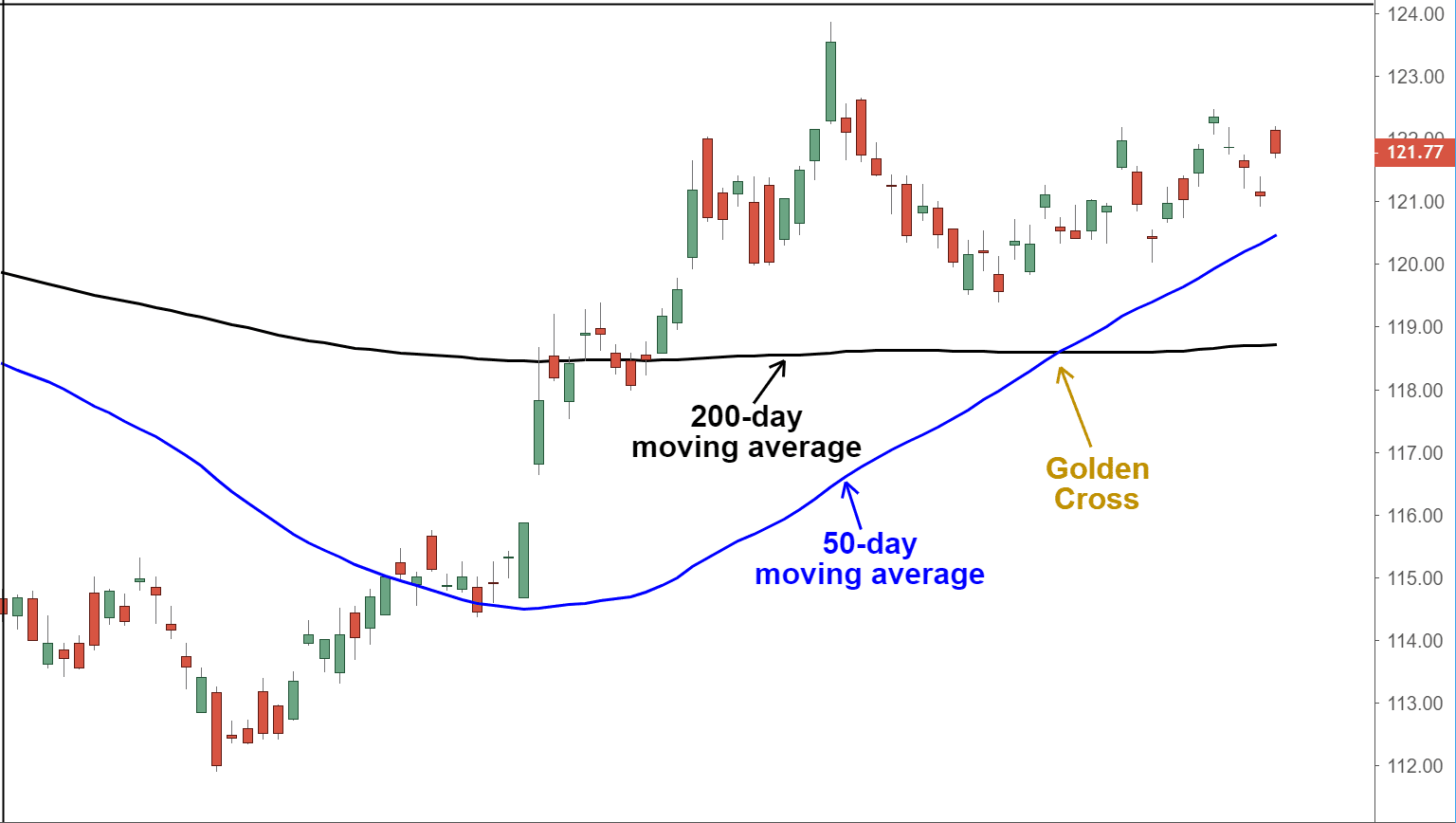

Understanding Bitcoins Golden Cross Market Predictions And Analysis

May 08, 2025

Understanding Bitcoins Golden Cross Market Predictions And Analysis

May 08, 2025 -

Singapores Dbs On Climate Change A Call For Gradual Reform Of Top Polluters

May 08, 2025

Singapores Dbs On Climate Change A Call For Gradual Reform Of Top Polluters

May 08, 2025 -

Analyzing The Risks Of Investing In An Xrp Etf Supply And Demand Dynamics

May 08, 2025

Analyzing The Risks Of Investing In An Xrp Etf Supply And Demand Dynamics

May 08, 2025 -

Voice Assistant Development Revolutionized Open Ais 2024 Showcase

May 08, 2025

Voice Assistant Development Revolutionized Open Ais 2024 Showcase

May 08, 2025