Analyzing The Ethereum Weekly Chart: Buy Signal Spotted?

Table of Contents

Keywords: Ethereum weekly chart, Ethereum price prediction, Ethereum buy signal, ETH chart analysis, cryptocurrency analysis, Ethereum trading, buy Ethereum, ETH price, Ethereum investment

The cryptocurrency market is constantly fluctuating, making it crucial for investors to stay informed. Analyzing the Ethereum weekly chart is a vital step for anyone considering buying Ethereum (ETH) or managing their existing holdings. This analysis explores potential buy signals, key indicators, and crucial risk factors to help you make informed decisions. Let's dive into the current state of the ETH market and uncover potential opportunities.

Current Ethereum Price and Market Sentiment

At the time of writing, Ethereum is trading at [Insert Current ETH Price]. The overall market sentiment appears to be [Insert Current Market Sentiment - e.g., cautiously bullish]. While recent price action has shown [Describe recent price movements - e.g., some volatility and consolidation], the long-term outlook remains a topic of discussion among analysts.

- Recent News Impacting ETH Price: Recent developments, such as the progress of Ethereum 2.0, advancements in decentralized finance (DeFi) applications built on Ethereum, and regulatory updates concerning cryptocurrencies in various jurisdictions, have all influenced the price. Positive news tends to drive price up, while negative news can cause temporary dips.

- Trading Volume and Market Capitalization: The current trading volume is [Insert Current Trading Volume], indicating [Interpret the volume – e.g., moderate activity or high volatility]. The market capitalization of Ethereum is currently [Insert Current Market Cap], placing it as the [Insert Ranking - e.g., second-largest] cryptocurrency by market cap.

- Significant Price Movements: The past few weeks have seen [Describe recent price swings – e.g., a significant price correction followed by a period of consolidation]. This highlights the inherent volatility of the cryptocurrency market.

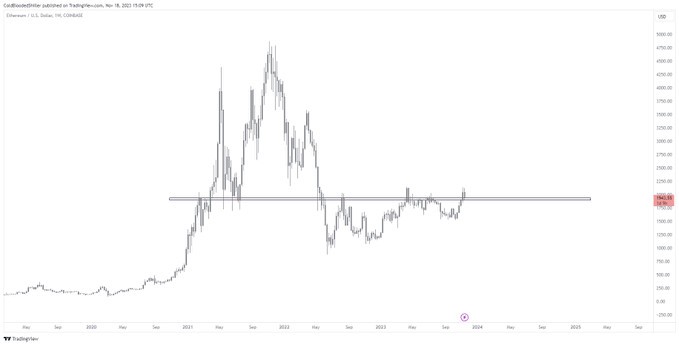

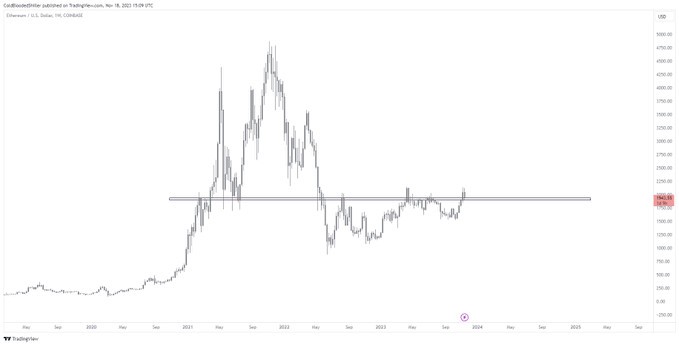

Key Technical Indicators on the Ethereum Weekly Chart

Analyzing the Ethereum weekly chart using various technical indicators provides a holistic view of potential price movements. Let's examine some key indicators:

- Moving Averages (MA): The 50-day MA and the 200-day MA are crucial indicators. Currently, the [Insert Relationship between MAs - e.g., 50-day MA is crossing above the 200-day MA, suggesting a bullish signal (golden cross)]. This is a classic bullish indicator often considered a strong buy signal for long-term investors. (Include a chart showing the MAs)

- Relative Strength Index (RSI): The RSI currently stands at [Insert Current RSI Value]. A reading below 30 generally suggests oversold conditions, while a reading above 70 suggests overbought conditions. [Interpret the current RSI value and its implications]. (Include a chart showing the RSI)

- Moving Average Convergence Divergence (MACD): The MACD is currently [Describe the current MACD status - e.g., showing a bullish crossover]. This indicator can confirm or contradict the signals provided by other indicators like moving averages. (Include a chart showing the MACD)

- Support and Resistance Levels: Significant support levels are observed around [Insert Support Levels], while resistance is found around [Insert Resistance Levels]. These levels often represent key psychological barriers for price action. A break above resistance could signal a significant bullish move.

The confluence of these indicators provides a stronger signal for potential trading decisions. For example, a golden cross (50-day MA crossing above 200-day MA), combined with an RSI above 50 and a bullish MACD, points toward a strong bullish trend.

Identifying Potential Buy Signals on the Ethereum Weekly Chart

Several chart patterns suggest potential buy signals. These should be used in conjunction with technical indicators for a more robust analysis.

- Bullish Engulfing Candle: A bullish engulfing candle, where a large green candle completely engulfs the previous red candle, indicates a potential shift in momentum from bearish to bullish. (Include a chart example). This pattern requires confirmation from other indicators before initiating a trade.

- Double Bottom: A double bottom pattern, characterized by two consecutive lows followed by a significant price increase, can suggest a reversal from a downtrend. (Include a chart example). The neckline of this pattern acts as a key support and breakout level.

- Risk Management: Any trade based on chart patterns involves risks. Always use stop-loss orders to limit potential losses and take-profit targets to lock in profits.

Analyzing Support and Resistance Levels

Support levels, such as [Insert Support Levels], act as price floors, where buying pressure often outweighs selling pressure. Resistance levels, such as [Insert Resistance Levels], act as price ceilings, where selling pressure often dominates. Breaks above resistance levels can signal strong bullish momentum, while breaks below support levels can signal bearish pressure. These levels are critical for defining entry and exit strategies.

Potential Risks and Considerations

Investing in cryptocurrencies, including Ethereum, involves significant risk.

- Market Volatility: The cryptocurrency market is notoriously volatile, subject to sudden and dramatic price swings. Prices can fluctuate significantly within short periods, leading to potential substantial losses.

- Diversification: It's crucial to diversify your investment portfolio to mitigate risk. Don't put all your eggs in one basket.

- Regulatory Changes: Regulatory changes and government actions can significantly impact the cryptocurrency market. Stay informed about relevant regulations in your jurisdiction.

Conclusion

Our analysis of the Ethereum weekly chart reveals [Summarize key findings – e.g., several potential buy signals supported by a confluence of technical indicators, including a potential golden cross and bullish engulfing candles]. While these indicators suggest a potential upward trend, it’s crucial to remember that this is not financial advice. The cryptocurrency market remains volatile, and prices can change rapidly. Always conduct your own thorough research and consider your own risk tolerance before making any investment decisions.

Call to Action: Stay updated on the latest Ethereum price movements and continue to analyze the Ethereum weekly chart to make informed decisions about your Ethereum investment strategy. Remember to always do your own research before investing in any cryptocurrency.

Featured Posts

-

Celtics Nets Game Jayson Tatum Injury Update And Playing Status

May 08, 2025

Celtics Nets Game Jayson Tatum Injury Update And Playing Status

May 08, 2025 -

Crypto Whales Target New Xrp 5880 Potential Gains

May 08, 2025

Crypto Whales Target New Xrp 5880 Potential Gains

May 08, 2025 -

New Uber Kenya Initiative Customer Cashback And Increased Earnings For Drivers And Couriers

May 08, 2025

New Uber Kenya Initiative Customer Cashback And Increased Earnings For Drivers And Couriers

May 08, 2025 -

Why Is Xrp Rising Examining Trumps Potential Role In Ripples Price Increase

May 08, 2025

Why Is Xrp Rising Examining Trumps Potential Role In Ripples Price Increase

May 08, 2025 -

New Dwp Rules How Universal Credit Claim Verification Will Change

May 08, 2025

New Dwp Rules How Universal Credit Claim Verification Will Change

May 08, 2025