Understanding Bitcoin's Golden Cross: Market Predictions And Analysis

Table of Contents

What is the Bitcoin Golden Cross?

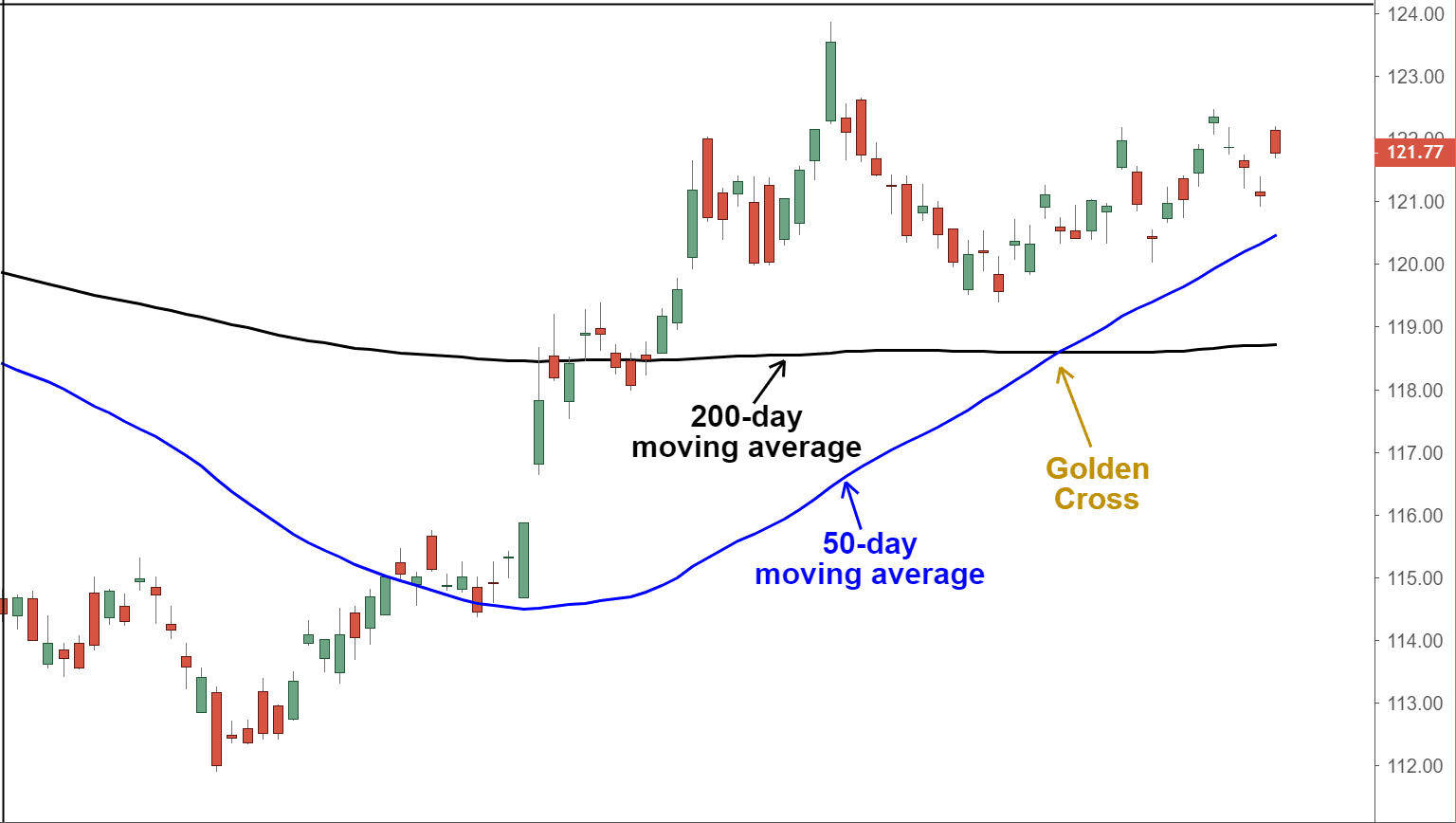

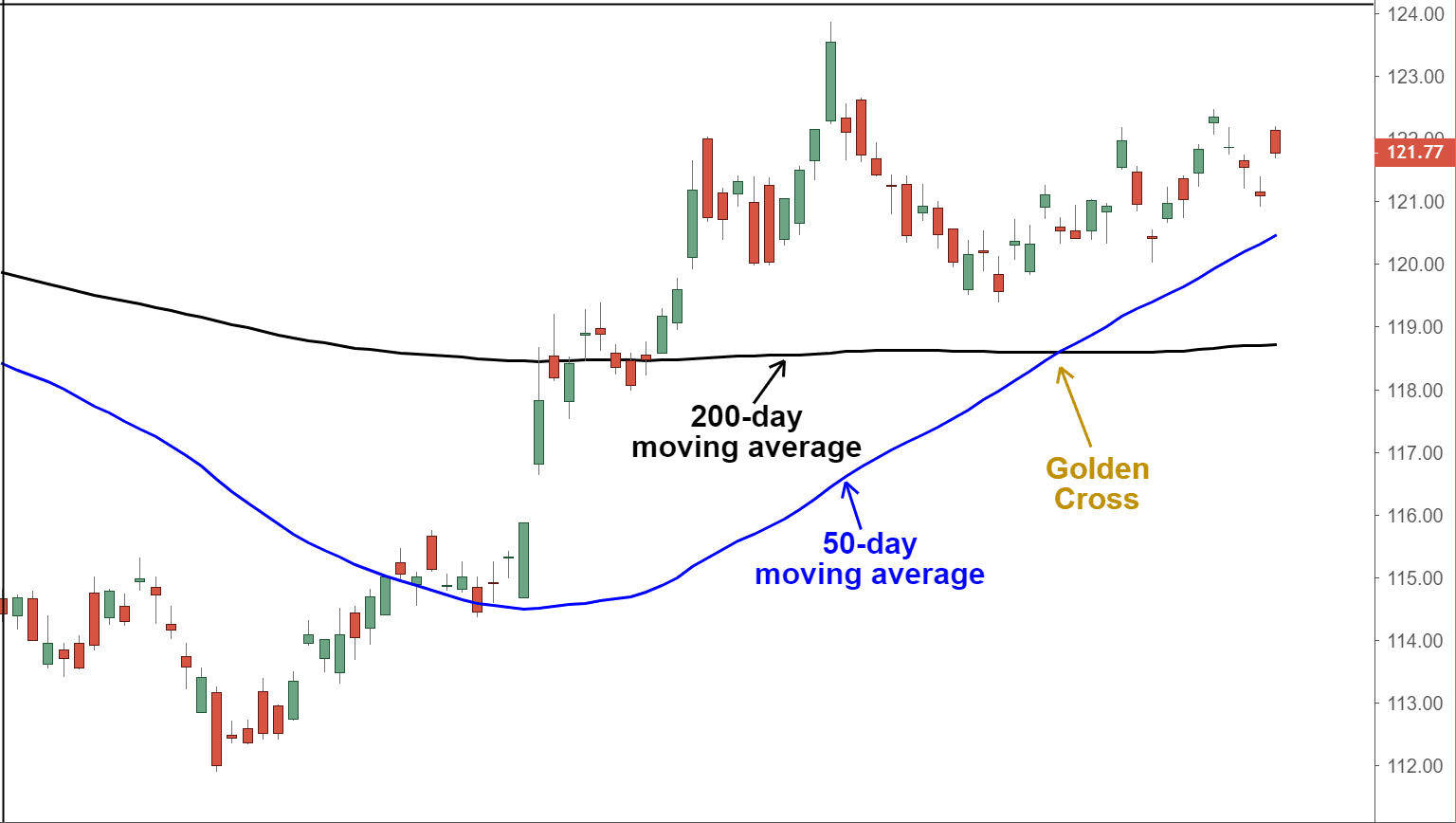

The Bitcoin Golden Cross is a bullish technical indicator formed when the 50-day moving average (MA) crosses above the 200-day MA on a Bitcoin price chart. This crossover suggests a potential shift from a bearish to a bullish trend. Think of it as a visual representation of increasing buying pressure overcoming selling pressure.

Moving Averages Explained:

Moving averages smooth out price fluctuations, providing a clearer picture of the underlying trend. The 50-day MA represents short-term price momentum, while the 200-day MA represents long-term price momentum. They are calculated by averaging the closing prices of Bitcoin over the respective periods (50 days and 200 days). Many charting platforms automatically calculate these MAs.

Identifying a Golden Cross:

Identifying a Golden Cross is straightforward. Look for the point on your Bitcoin price chart where the 50-day MA line crosses above the 200-day MA line.

- Example: Imagine Bitcoin's 50-day MA is $28,000 and its 200-day MA is $27,000. If the 50-day MA rises above $27,000, crossing the 200-day MA, a Golden Cross is confirmed.

- Different chart types, such as candlestick charts and line charts, can all be used to identify a Golden Cross. Candlestick charts offer more detailed price information, allowing for a more precise identification of the crossover.

Historical Performance of the Bitcoin Golden Cross

Analyzing past Bitcoin Golden Cross events provides valuable insights, although it's crucial to remember that past performance is not indicative of future results.

- Past Occurrences: Examining historical BTC price charts reveals several instances of Golden Crosses. While many have been followed by price increases, it's not always a guaranteed outcome.

- [Insert chart showing price action before and after a past Golden Cross event here]

- Duration and Magnitude: The duration and magnitude of price increases following Golden Crosses have varied significantly. Some have resulted in short-lived rallies, while others have marked the beginning of substantial bull markets.

- [Insert chart showing price action for multiple past Golden Cross events here, comparing duration and magnitude]

- Limitations: It’s vital to acknowledge that the Golden Cross isn’t a foolproof predictor. There have been instances where the signal was not followed by significant price appreciation, highlighting the need to consider other factors.

Case Studies: Analyzing specific instances, such as the Golden Crosses of [Year] and [Year], showcases how market conditions and other factors influenced the outcome. For example, during [Year]'s Golden Cross, the overall market sentiment was highly bullish, amplifying the effect of the indicator, while in [Year], external economic factors played a more significant role.

Factors Influencing the Bitcoin Golden Cross's Predictive Power

The predictive power of the Bitcoin Golden Cross is not absolute; several factors can influence its effectiveness.

- Market Sentiment: The overall market sentiment, often gauged by the Crypto Fear & Greed Index or social media analysis, plays a crucial role. A highly bullish sentiment can amplify the positive impact of the Golden Cross.

- Macroeconomic Factors: Broader economic events such as inflation, interest rates, and government regulations significantly impact Bitcoin's price, irrespective of technical indicators. Negative macroeconomic news can negate the bullish signal of a Golden Cross.

- Bitcoin Adoption and Network Growth: Increasing Bitcoin adoption by institutions, network upgrades, and technological advancements can either strengthen or weaken the signal. Positive developments in these areas tend to bolster the Golden Cross's predictive power.

- These factors can interact in complex ways. A Golden Cross occurring during a period of strong institutional investment and positive regulatory developments is likely to have a more significant impact than one occurring during a time of uncertainty and regulatory crackdown.

Trading Strategies and Risk Management around the Bitcoin Golden Cross

The Bitcoin Golden Cross shouldn't be the sole basis for trading decisions. Instead, it should be incorporated into a broader trading strategy.

Conservative Approach: A cautious approach involves waiting for confirmation signals, such as increased trading volume or positive price action after the crossover. Entry points could be set slightly above the recent high after the crossover. Stop-loss orders should be implemented to limit potential losses.

Aggressive Approach: A more aggressive approach might involve entering a long position immediately upon confirmation of the Golden Cross. However, this carries significantly higher risk.

Risk Management Techniques:

-

Stop-loss orders: Essential for limiting losses. Place stop-loss orders below the 200-day MA or at a level that aligns with your risk tolerance.

-

Position sizing: Never invest more than you can afford to lose.

-

Diversification: Spread your investments across different assets to reduce risk.

-

Thorough research is vital before using the Golden Cross as a trading signal. Never rely solely on this indicator; consider combining it with fundamental analysis and other technical indicators.

-

Your risk tolerance and investment goals should always guide your trading strategy.

Conclusion

Understanding the Bitcoin Golden Cross is a valuable tool for navigating the cryptocurrency market. It offers a potential indicator of bullish trends, but it is not a guarantee of future price increases. Its effectiveness is significantly influenced by market sentiment, macroeconomic factors, and the broader adoption of Bitcoin. Successful Bitcoin trading requires a holistic approach, combining technical analysis, such as the Golden Cross, with fundamental analysis and careful risk management.

Continue your research and make informed decisions in the dynamic world of Bitcoin. Learn more about moving averages, other technical indicators like the Death Cross (the opposite of the Golden Cross), and fundamental analysis to enhance your understanding of Bitcoin price movements. Understanding the Bitcoin Golden Cross is only one piece of the puzzle; continue your research and make informed decisions in the dynamic world of Bitcoin.

Featured Posts

-

Thunder Face Stiff Memphis Test Crucial Upcoming Game

May 08, 2025

Thunder Face Stiff Memphis Test Crucial Upcoming Game

May 08, 2025 -

Nereden Izlenir Lyon Psg Canli Mac Yayini

May 08, 2025

Nereden Izlenir Lyon Psg Canli Mac Yayini

May 08, 2025 -

Xrp Rally Analysis Of The Us Presidents Article On Trumps Ripple Connection

May 08, 2025

Xrp Rally Analysis Of The Us Presidents Article On Trumps Ripple Connection

May 08, 2025 -

Grbovic Psg O Prelaznoj Vladi Svi Predlozi Na Stolu

May 08, 2025

Grbovic Psg O Prelaznoj Vladi Svi Predlozi Na Stolu

May 08, 2025 -

Los Angeles Angels Baseball Your 2025 Guide To Cable Free Streaming

May 08, 2025

Los Angeles Angels Baseball Your 2025 Guide To Cable Free Streaming

May 08, 2025