Should You Invest In D-Wave Quantum Inc. (QBTS)?

Table of Contents

D-Wave's Technology and Market Position

D-Wave Quantum Inc., trading under the stock ticker symbol QBTS, is a leader in the development and deployment of quantum computing systems. Unlike many competitors focusing on gate-based quantum computing, D-Wave utilizes a unique approach: quantum annealing. This method excels at solving specific types of optimization problems, offering potential advantages in areas like logistics, materials science, and financial modeling. While not a general-purpose quantum computer like some aspire to build, D-Wave's technology is already finding real-world applications.

- Strengths of D-Wave's technology: Mature technology, existing customer base, demonstrated real-world applications.

- Weaknesses of D-Wave's technology: Limited to specific types of problems, not as versatile as gate-based quantum computers.

- Key competitors in the quantum computing space: IBM, Google, IonQ, Rigetti Computing.

- Market potential for D-Wave's technology: Significant growth potential as quantum computing solutions become more prevalent across various industries. The quantum computing investment market is ripe for disruption, and D-Wave aims to be a key player.

Financial Performance and Investment Risks

Analyzing QBTS's financial performance is crucial for any potential investor. While D-Wave boasts a strong position in the quantum computing market, its financial statements reveal the realities of a young, rapidly evolving company. Revenue growth might be slow relative to the hype, and profitability may remain elusive for some time. The quantum computing sector itself is extremely volatile, meaning QBTS stock is subject to significant price swings.

- Key financial metrics for QBTS: Closely monitor revenue growth, operating expenses, and any debt incurred. Look at the quantum computing investment landscape to better understand the industry's current financial health.

- Potential risks of investing in QBTS: Market risk (overall market downturns), financial risk (potential for losses), technological risk (competition and technological obsolescence).

- Historical stock performance of QBTS: Analyze past performance but remember that past performance is not indicative of future results.

Future Growth Prospects and Potential Returns

D-Wave's future growth hinges on several factors. Their strategy involves expanding their customer base, developing new applications for their technology, and continuing to advance their quantum annealing capabilities. The long-term potential is significant, given the projected exponential growth of the quantum computing market. However, realizing this potential requires successfully navigating intense competition and delivering on ambitious technological advancements. A quantum computing investment in QBTS should be carefully weighted.

- Projected growth of the quantum computing market: Market research predicts substantial growth, but the actual rate of adoption and market penetration remains uncertain.

- D-Wave's potential to capture market share: D-Wave needs to maintain its technological edge and continue securing partnerships to capture a significant market share.

- Factors that could affect QBTS's future performance: Technological breakthroughs by competitors, economic downturns, regulatory changes.

Alternative Quantum Computing Investments

While D-Wave presents an interesting opportunity in the quantum computing investment space, it's essential to consider alternatives. Companies like IBM, Google, and IonQ are pursuing different approaches to quantum computing, each with its own strengths and weaknesses. IBM and Google, for instance, are focusing on gate-based quantum computing, targeting a broader range of applications but facing different challenges related to scalability and error correction. IonQ, like D-Wave, has a focus on a specific type of quantum computing hardware, but with a different approach than quantum annealing. Comparing their investment prospects requires careful examination of their respective business models and risk profiles within the quantum computing investment space.

- Brief profiles of key competitors: Research the technologies, market positions, and financial performance of key competitors.

- Comparison of investment risks and potential returns: Weigh the risks and potential rewards of investing in D-Wave versus its competitors.

Conclusion: Should You Invest in D-Wave Quantum Inc. (QBTS)?

Investing in D-Wave Quantum Inc. (QBTS) presents both exciting opportunities and significant risks. While D-Wave holds a strong position in the quantum annealing market and shows promise for solving specific types of optimization problems, the company faces intense competition and the inherent volatility of a young, rapidly evolving sector within the quantum computing investment space. Before making any investment decisions related to D-Wave Quantum (QBTS) or other quantum computing stocks, be sure to conduct thorough due diligence and consult with a financial advisor. Remember to consider your own risk tolerance and diversify your portfolio appropriately. Further research into QBTS financials and industry trends related to quantum computing investment is highly recommended.

Featured Posts

-

Kritichno Vazhlivi Telekanali Ukrayini Rishennya Minkulturi Schodo 1 1 Inter Stb Ta Inshikh

May 21, 2025

Kritichno Vazhlivi Telekanali Ukrayini Rishennya Minkulturi Schodo 1 1 Inter Stb Ta Inshikh

May 21, 2025 -

La Salud De Javier Baez Clave Para Su Productividad En El Beisbol

May 21, 2025

La Salud De Javier Baez Clave Para Su Productividad En El Beisbol

May 21, 2025 -

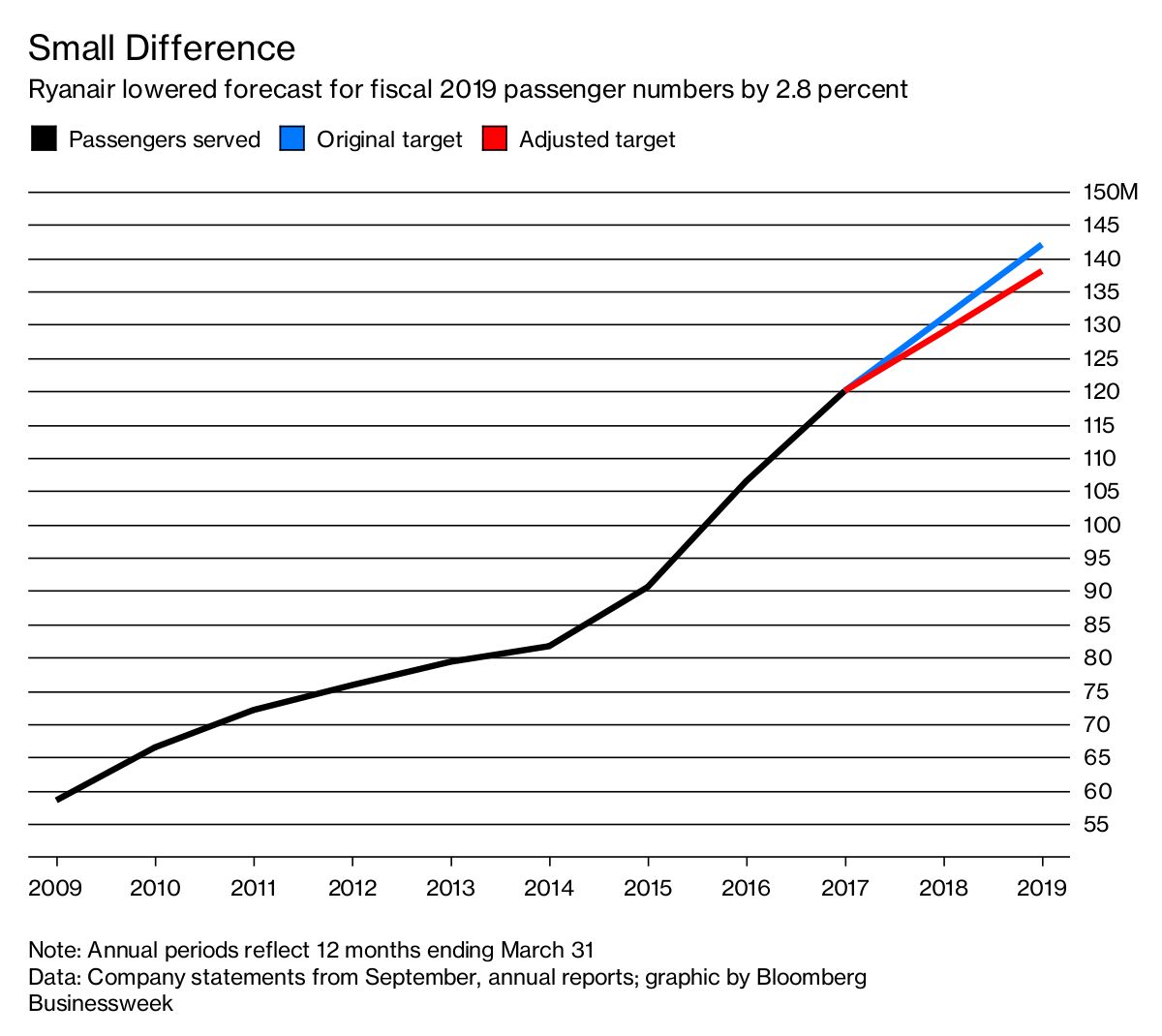

Ryanairs Growth Outlook Dampened By Tariff Wars Buyback Plan Unveiled

May 21, 2025

Ryanairs Growth Outlook Dampened By Tariff Wars Buyback Plan Unveiled

May 21, 2025 -

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025 -

Uncovering The Countrys Next Business Powerhouses A Location Guide

May 21, 2025

Uncovering The Countrys Next Business Powerhouses A Location Guide

May 21, 2025

Latest Posts

-

Naybilshi Finansovi Kompaniyi Ukrayini U 2024 Rotsi Dokhodi Ta Analiz Rinku

May 22, 2025

Naybilshi Finansovi Kompaniyi Ukrayini U 2024 Rotsi Dokhodi Ta Analiz Rinku

May 22, 2025 -

Finansoviy Reyting 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 22, 2025

Finansoviy Reyting 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 22, 2025 -

Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus Analiz Lideriv Finansovogo Rinku Ukrayini Za 2024 Rik

May 22, 2025

Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus Analiz Lideriv Finansovogo Rinku Ukrayini Za 2024 Rik

May 22, 2025 -

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025 -

Ings 2024 Annual Report Key Highlights From Form 20 F

May 22, 2025

Ings 2024 Annual Report Key Highlights From Form 20 F

May 22, 2025