Should I Invest In XRP (Ripple) At Its Current Price?

Table of Contents

XRP, the cryptocurrency associated with Ripple Labs, has experienced significant price volatility, leaving many investors wondering: should I invest in XRP at its current price? This comprehensive guide analyzes the current market conditions, legal landscape, and future potential of XRP to help you make an informed investment decision. We'll delve into the factors influencing XRP's price and offer insights into whether investing in XRP now is a wise move.

XRP's Current Market Position and Price Analysis

Current Price and Recent Trends

Analyzing XRP's recent price movements is crucial. (Insert chart showing XRP price over the past few months here). As of [Date], XRP is trading at $[Current Price]. Recent trends have shown [Describe recent trends – e.g., a period of consolidation, a bullish surge, or a bearish downturn].

- Factors Affecting Price: News events, such as regulatory updates or partnerships, significantly impact XRP's price. Positive news often leads to price increases, while negative news can trigger sell-offs.

- Comparison to Other Cryptocurrencies: Comparing XRP's performance to other major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) provides valuable context. [Insert chart comparing XRP to BTC and ETH here]. XRP's price often correlates with the overall cryptocurrency market, but it can also exhibit independent movements based on specific news or events.

- Technical and Fundamental Analysis: Both technical analysis (chart patterns, indicators) and fundamental analysis (Ripple's business model, adoption rate) are essential for a comprehensive assessment of XRP's value. Technical analysis helps predict short-term price movements, while fundamental analysis provides insights into long-term potential.

Market Capitalization and Trading Volume

XRP's market capitalization and trading volume are critical indicators of its overall market strength and liquidity. [Insert data on XRP's market cap and trading volume here].

- Market Cap Comparison: Comparing XRP's market capitalization to other cryptocurrencies helps determine its relative size and influence within the market.

- High Trading Volume Significance: High trading volume often indicates strong investor interest and liquidity, making it easier to buy and sell XRP.

- Risks of Low Liquidity: Low liquidity can lead to significant price swings and make it difficult to buy or sell large quantities of XRP without impacting the price.

Ripple's Legal Battle and its Impact on XRP

The SEC Lawsuit and its Potential Outcomes

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and investor sentiment. The SEC alleges that XRP is an unregistered security.

- Potential Scenarios: Several potential outcomes exist: Ripple could win the case, the SEC could win, or a settlement could be reached.

- Impact on XRP's Price: Each scenario will likely have a different impact on XRP's price. A Ripple victory could lead to a significant price surge, while an SEC victory could result in a substantial price drop. A settlement could lead to a more moderate price adjustment.

- Legal Uncertainty and Investor Confidence: The ongoing legal uncertainty creates significant risk for investors. The lack of clarity surrounding the SEC lawsuit makes it difficult to predict XRP's future price.

Regulatory Uncertainty and its Effect on XRP Investment

The regulatory landscape for cryptocurrencies is constantly evolving, and this uncertainty affects XRP's investment potential.

- Regulatory Developments: Different countries are taking varying approaches to regulating cryptocurrencies, creating a complex and fragmented regulatory environment.

- Regulatory Clarity and Investor Sentiment: Regulatory clarity is crucial for investor confidence. Clear rules and regulations reduce risk and uncertainty, potentially attracting more investment.

- Risks of Regulatory Challenges: Investing in a cryptocurrency facing regulatory challenges carries substantial risk. The outcome of regulatory actions could significantly impact XRP's value and future.

XRP's Potential and Future Outlook

RippleNet Adoption and its Impact on XRP's Value

RippleNet, Ripple's payment network, plays a significant role in XRP's value proposition. The wider adoption of RippleNet could increase demand for XRP.

- Examples of RippleNet Use: [Provide examples of businesses and financial institutions using RippleNet].

- Potential for Increased Adoption: Increased adoption of RippleNet could lead to greater demand for XRP, potentially driving its price higher.

- RippleNet and XRP Utility: RippleNet's functionality relies on XRP for transactions, providing XRP with real-world utility.

Long-Term Projections and Investment Strategies

Predicting the long-term price of XRP is inherently challenging and speculative. However, analyzing various factors can help to formulate potential scenarios.

- Price Scenarios and Probabilities (with disclaimers): [Present potential price scenarios with appropriate disclaimers emphasizing the speculative nature of such projections].

- Diversification as Risk Management: Diversifying your investment portfolio across multiple assets is a crucial risk management strategy. Don't put all your eggs in one basket.

- Individual Risk Tolerance: Investing in XRP involves risk. Only invest an amount you can afford to lose and ensure your investment aligns with your overall risk tolerance.

Conclusion

Investing in XRP (Ripple) requires careful consideration of its current market position, the ongoing legal battle with the SEC, regulatory uncertainty, and the potential for future growth through RippleNet adoption. Remember that the cryptocurrency market is highly volatile, and investing in XRP or any cryptocurrency carries significant risk.

Call to Action: Before making any investment decisions regarding XRP, conduct thorough research, understand the risks involved, and consider consulting with a qualified financial advisor. This information is for educational purposes only and does not constitute financial advice. Make your own informed decision about whether to invest in XRP at its current price.

Featured Posts

-

Ongoing Nuclear Litigation Cases Trends And Implications

May 01, 2025

Ongoing Nuclear Litigation Cases Trends And Implications

May 01, 2025 -

125 Murid Asnaf Sibu Terima Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 01, 2025

125 Murid Asnaf Sibu Terima Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 01, 2025 -

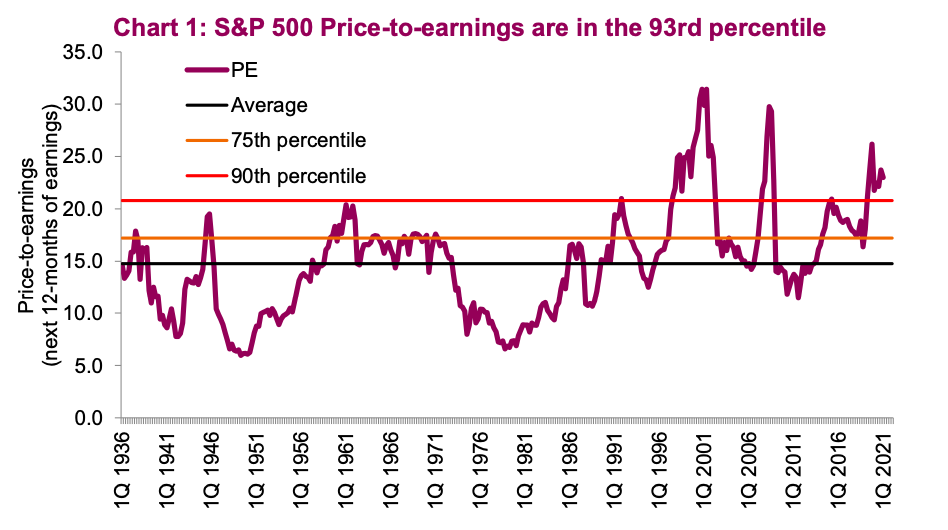

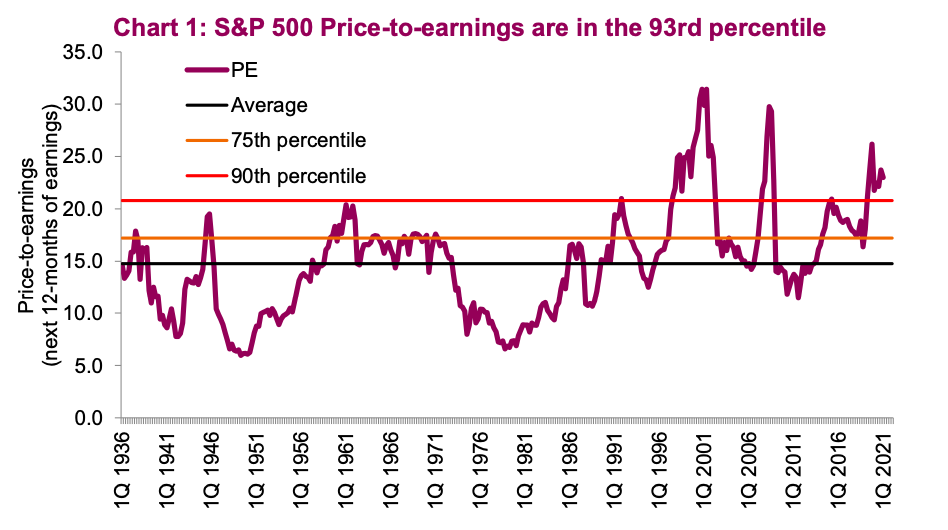

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025 -

Cette Boulangerie Normande Offre Son Poids En Chocolat Au Premier Bebe De L Annee

May 01, 2025

Cette Boulangerie Normande Offre Son Poids En Chocolat Au Premier Bebe De L Annee

May 01, 2025 -

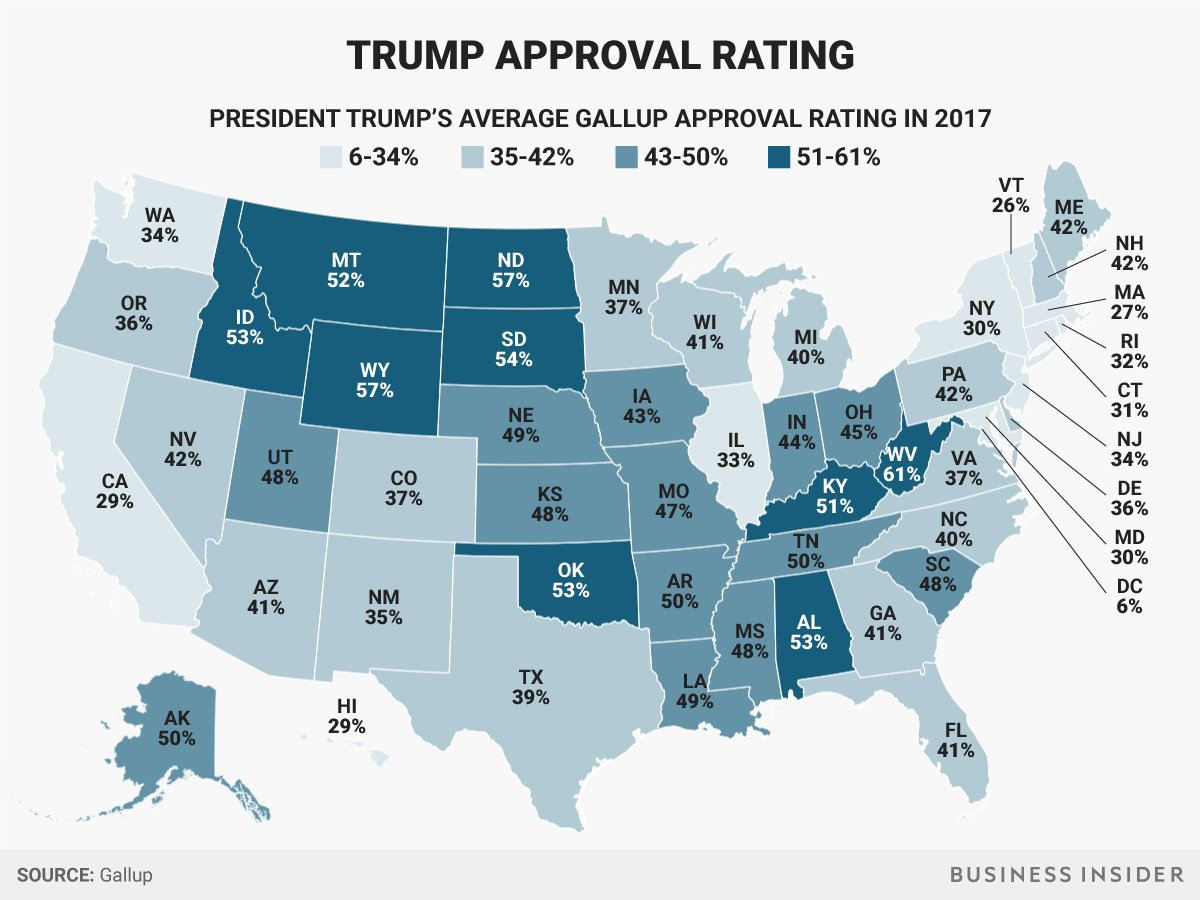

Trumps Approval Rating Plummets A 39 Low After 100 Days

May 01, 2025

Trumps Approval Rating Plummets A 39 Low After 100 Days

May 01, 2025

Latest Posts

-

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025 -

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025 -

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025