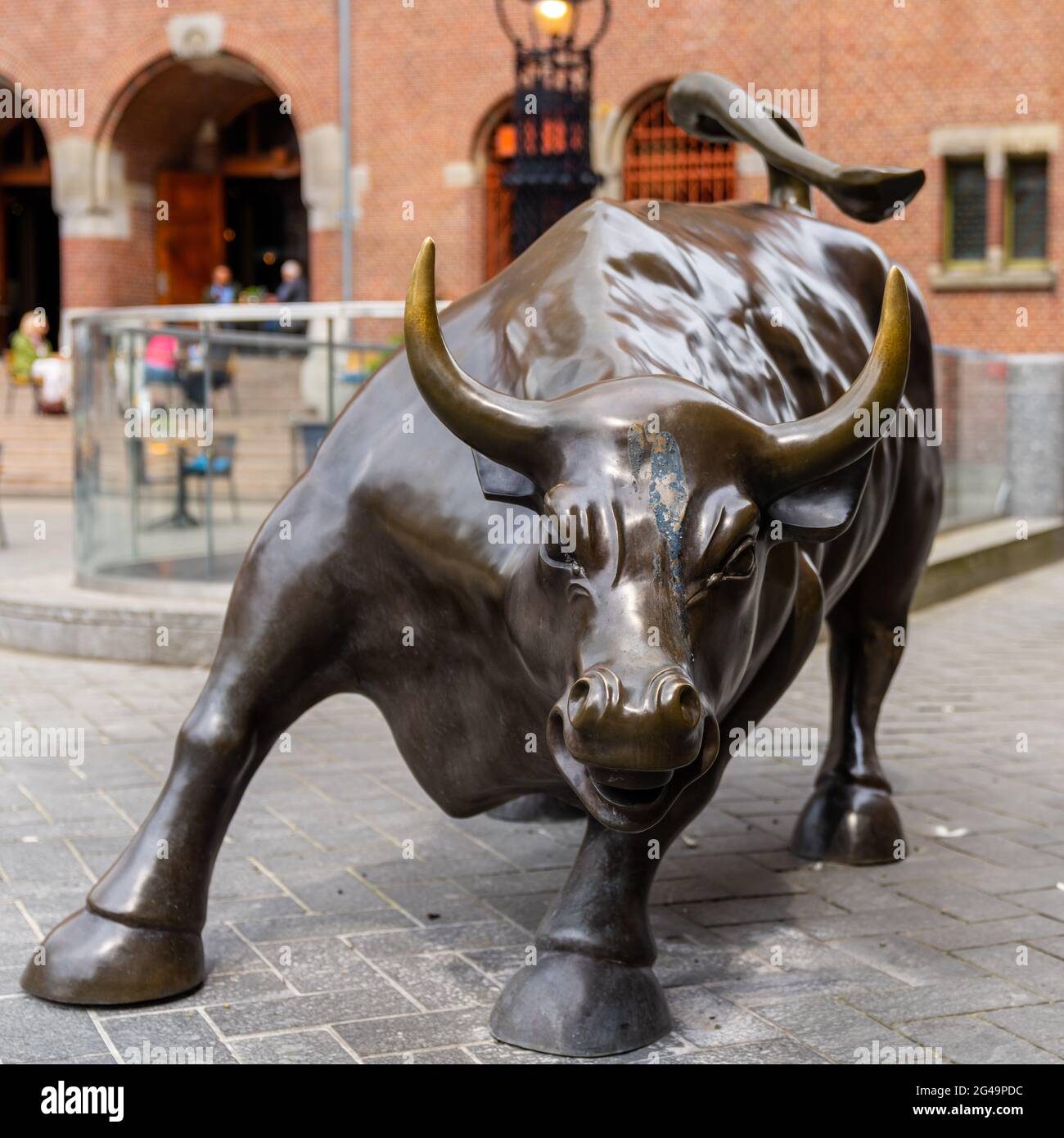

Sharp Decline On Amsterdam Stock Exchange: 11% Loss Since Wednesday's Open

Table of Contents

Identifying the Key Factors Contributing to the Amsterdam Stock Exchange Decline

The 11% loss on the Amsterdam Stock Exchange isn't an isolated event; it reflects a confluence of global and local factors impacting market sentiment and investor confidence.

Global Market Volatility and its Impact

Global economic uncertainty is a primary driver of the Amsterdam Stock Exchange decline. Rising inflation rates in many countries, aggressive interest rate hikes by central banks aiming to curb inflation, and persistent geopolitical tensions are creating a volatile environment for global markets. This uncertainty has led to a risk-off sentiment, causing investors to pull back from riskier assets, including those listed on the AEX.

-

Specific global events impacting the AEX decline:

- The ongoing war in Ukraine and its impact on energy prices.

- Increased inflation rates across Europe and the United States.

- Concerns about a potential global recession.

- Uncertainty surrounding future interest rate adjustments by the European Central Bank.

-

Data points: The S&P 500 experienced a similar downturn, falling by X%, while the FTSE 100 in London decreased by Y%. These correlated declines highlight the widespread impact of global economic uncertainty.

Specific Sectoral Weakness on the Amsterdam Stock Exchange

The decline hasn't affected all sectors equally. Certain sectors on the Amsterdam Stock Exchange have experienced disproportionately large losses.

-

Hardest-hit sectors: The energy sector, particularly companies reliant on volatile gas prices, has seen significant drops, alongside technology companies facing reduced investor appetite for growth stocks in this uncertain environment. The financial sector also shows signs of vulnerability due to rising interest rates impacting lending and profitability.

-

Examples of companies with sharp drops: [Insert examples of specific companies and the reasons behind their poor performance, e.g., Company X saw a 15% drop due to disappointing Q3 earnings, while Company Y suffered a 10% loss amidst concerns about supply chain disruptions].

-

Visual representation: [Insert a chart or graph visually representing the sectoral decline on the Amsterdam Stock Exchange].

Investor Sentiment and Market Psychology

Negative investor sentiment, characterized by fear, uncertainty, and doubt (FUD), has played a crucial role in amplifying the decline. Negative news coverage, fueled by the overall global market uncertainty and specific concerns about individual companies, further contributed to the sell-off. This created a self-reinforcing cycle of fear, leading to more selling and further depressing prices. Significant sell-offs by institutional investors also exacerbated the situation.

Analyzing the Short-Term and Long-Term Implications of the Decline

The sharp decline on the Amsterdam Stock Exchange has significant implications for investors and businesses alike, both in the short-term and the long-term.

Immediate Impact on Investors and Businesses

The immediate impact on individual investors is a decline in portfolio values. For businesses listed on the exchange, the consequences could include reduced access to funding, lower valuations making further investment or expansion more challenging, and potential difficulties in attracting new investors.

- Expert opinion: "[Quote from a financial analyst about the immediate impact on investors and businesses]".

Potential for Recovery and Future Outlook

While the current outlook is uncertain, several factors could potentially trigger a recovery. Government intervention, particularly fiscal stimulus measures or regulatory changes supporting specific sectors, could provide a boost. Positive economic news, such as easing inflation or signs of stronger-than-expected economic growth, could also improve investor sentiment.

- Long-term outlook: The long-term outlook for the Amsterdam Stock Exchange remains uncertain and will depend heavily on global economic developments and how effectively companies adapt to the challenges they are facing. It is crucial to monitor global economic indicators and company-specific news closely.

Strategies for Navigating the Amsterdam Stock Exchange Decline

Navigating this decline requires a strategic approach focusing on risk management and identifying potential opportunities.

Risk Management and Diversification

Diversifying investments across different asset classes and sectors is crucial to mitigate risk. Investors should adjust their investment strategies according to their risk tolerance. Hedging techniques and other risk management strategies can also be employed to protect portfolios from further losses.

Opportunities Amidst the Decline

While caution is always advised, the decline may present opportunities for investors willing to take calculated risks. Undervalued stocks may offer attractive entry points for long-term investors. However, thorough due diligence is essential before making any investment decisions. Seeking advice from a financial advisor is highly recommended.

Conclusion

The sharp decline on the Amsterdam Stock Exchange, a drop of 11% since Wednesday, is a result of a complex interplay of global market volatility, sectoral weaknesses, and negative investor sentiment. The short-term implications include losses for investors and challenges for businesses, while the long-term outlook remains uncertain. To effectively navigate this challenging period, investors should prioritize risk management, diversify their portfolios, and stay informed about Amsterdam Stock Exchange trends. Regularly monitor the Amsterdam Stock Exchange, consult reputable financial news sources, and seek professional financial advice to manage your investments effectively and understand the implications of the Amsterdam Stock Exchange decline.

Featured Posts

-

Escape To The Countryside A Step By Step Guide

May 24, 2025

Escape To The Countryside A Step By Step Guide

May 24, 2025 -

Serious M56 Motorway Incident Car Overturn And Casualty Care

May 24, 2025

Serious M56 Motorway Incident Car Overturn And Casualty Care

May 24, 2025 -

Cac 40 Weekly Performance Down Slightly But Stable Overall March 7 2025

May 24, 2025

Cac 40 Weekly Performance Down Slightly But Stable Overall March 7 2025

May 24, 2025 -

Wall Streets Comeback A Threat To The German Daxs Recent Success

May 24, 2025

Wall Streets Comeback A Threat To The German Daxs Recent Success

May 24, 2025 -

Avrupa Borsalarindaki Dalgalanmalar Yatirimcilar Icin Degerlendirme

May 24, 2025

Avrupa Borsalarindaki Dalgalanmalar Yatirimcilar Icin Degerlendirme

May 24, 2025

Latest Posts

-

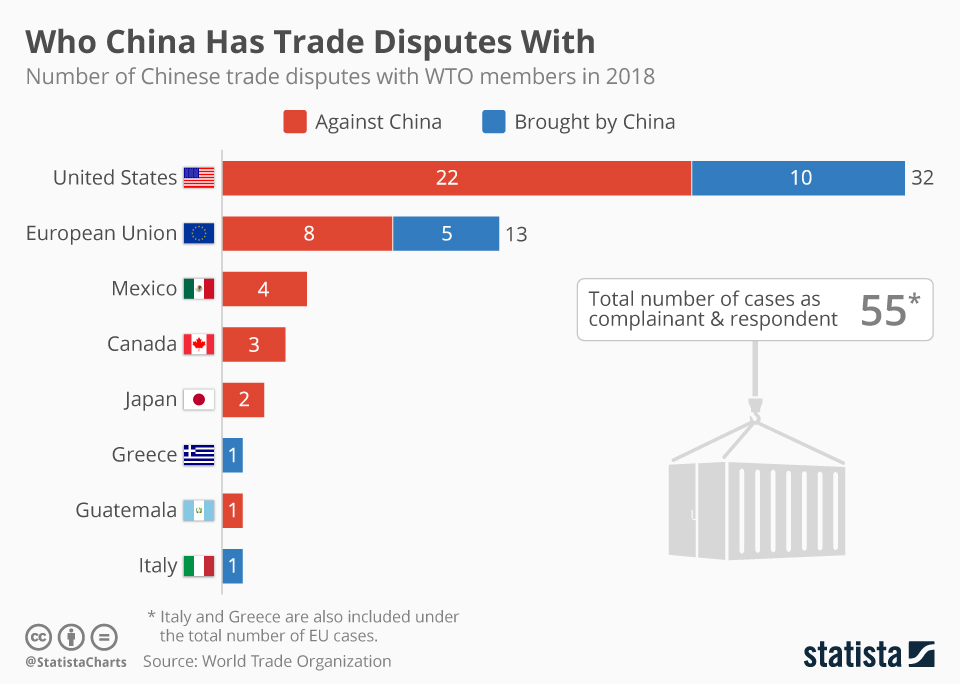

China And Us Trade Relations A Window Of Opportunity

May 24, 2025

China And Us Trade Relations A Window Of Opportunity

May 24, 2025 -

Open Ai Facing Ftc Investigation Exploring The Future Of Ai Accountability

May 24, 2025

Open Ai Facing Ftc Investigation Exploring The Future Of Ai Accountability

May 24, 2025 -

Us China Trade Soars Ahead Of Trade Truce

May 24, 2025

Us China Trade Soars Ahead Of Trade Truce

May 24, 2025 -

Is It Ethical To Bet On The Los Angeles Wildfires Exploring The Moral Implications

May 24, 2025

Is It Ethical To Bet On The Los Angeles Wildfires Exploring The Moral Implications

May 24, 2025 -

Lower Uk Inflation Eases Boe Rate Cut Pressure Boosting The Pound

May 24, 2025

Lower Uk Inflation Eases Boe Rate Cut Pressure Boosting The Pound

May 24, 2025