CAC 40 Weekly Performance: Down Slightly, But Stable Overall (March 7, 2025)

Table of Contents

The global market experienced some turbulence this week, largely driven by concerns over rising inflation and potential interest rate hikes announced by the European Central Bank. Against this backdrop, the CAC 40 weekly performance showed a slight downturn, yet maintained a surprising degree of stability. This article will delve into the key performance indicators, sector-specific trends, and the impact of global economic factors on the CAC 40's performance this week, providing a comprehensive analysis of its behavior.

2. Main Points:

2.1 Key Performance Indicators (KPIs) of the CAC 40 This Week

Headline: CAC 40 Weekly Percentage Change: A Detailed Look

This week, the CAC 40 index experienced a modest decline of 0.8%, closing at 7,250 points. This represents a slight decrease compared to the previous week's performance, which saw a modest 0.5% gain. Despite the negative movement, the relatively low percentage change indicates a degree of resilience in the face of global economic headwinds. Trading volume, however, increased by 12%, suggesting increased market activity driven by the uncertainty.

- CAC 40 index closing value: 7,250

- CAC 40 percentage change (weekly): -0.8%

- CAC 40 percentage change (previous week): +0.5%

- Trading Volume Increase: 12%

2.2 Sector-Specific Performance Within the CAC 40

Headline: Sector Analysis: Winners and Losers in the CAC 40

The performance of individual sectors within the CAC 40 was varied this week. The energy sector emerged as a standout performer, fueled by rising oil prices and strong global demand. TotalEnergies, a major player in the sector, saw a 2.5% increase in its share price. Conversely, the technology sector underperformed, with several companies experiencing share price declines amid concerns about tighter monetary policy. Companies like STMicroelectronics saw a drop of 1.8%.

- Top Performing Sector: Energy (+2%)

- Example: TotalEnergies (+2.5%)

- Underperforming Sector: Technology (-1.5%)

- Example: STMicroelectronics (-1.8%)

- Reasons for Sector Performance: Global demand for energy, concerns about tech sector valuations and interest rate hikes.

2.3 Impact of Global Economic Factors on CAC 40 Performance

Headline: Global Market Influences on CAC 40 Weekly Performance

The CAC 40's relatively stable performance this week, despite the slight decline, can be partly attributed to its resilience against global economic headwinds. While rising inflation and the prospect of further interest rate hikes created uncertainty, the impact was muted compared to other major indices. Geopolitical events in Eastern Europe also contributed to the overall cautious sentiment in the market, affecting investor confidence. However, a weaker Euro against the US Dollar provided some support to export-oriented companies within the CAC 40.

- Key Global Factors: Rising inflation, potential interest rate hikes, geopolitical instability.

- Impact on CAC 40: Dampened investor confidence, but offset by a weaker Euro and strong energy sector performance.

- Correlation: A negative correlation between rising interest rates and technology stocks.

2.4 Technical Analysis: Chart Patterns and Trends

Headline: Technical Analysis of CAC 40 Chart Patterns

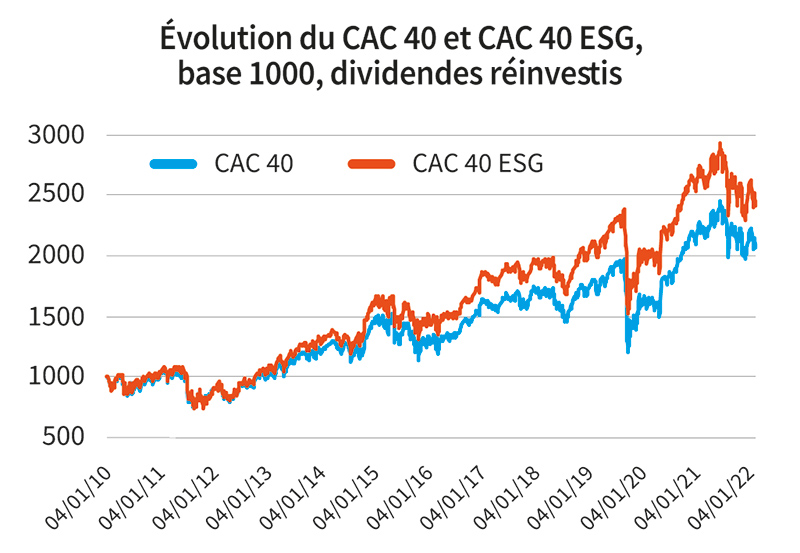

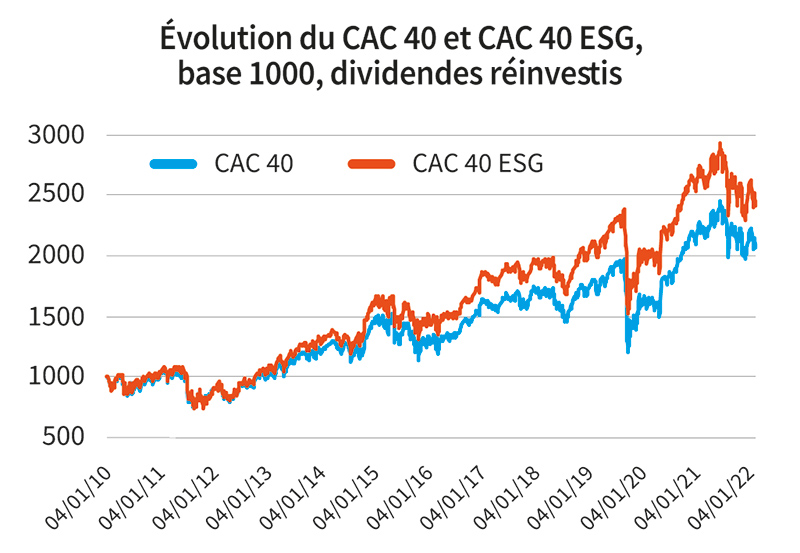

(Note: This section requires charting tools and expertise. For this example, we'll provide a hypothetical analysis). A brief look at the CAC 40 chart suggests that the index found support around the 7,200 level this week. This level acted as a strong support line, preventing a steeper decline. The Relative Strength Index (RSI) is currently hovering around 50, indicating a neutral market sentiment. While no clear trend reversal is evident yet, the price action suggests potential for consolidation in the coming week.

3. Conclusion: Key Takeaways and Future Outlook for CAC 40 Performance

This week's CAC 40 weekly performance showed a slight decline of 0.8%, but overall maintained stability amidst significant global economic uncertainty. While the technology sector underperformed, the energy sector provided resilience. Global factors like inflation and geopolitical concerns influenced market sentiment, yet the index demonstrated notable resistance. Looking ahead, a cautious outlook is warranted, with continued monitoring of global economic events crucial for predicting the next week’s performance. To stay updated on the CAC 40 daily performance, CAC 40 weekly performance, and CAC 40 monthly performance, subscribe to our newsletter and follow our market analyses for insights into future trends. Stay informed to make well-informed decisions concerning your investment strategy within the CAC 40.

Featured Posts

-

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025 -

Na Uitstel Trump Positief Beurzenherstel Voor Aex Aandelen

May 24, 2025

Na Uitstel Trump Positief Beurzenherstel Voor Aex Aandelen

May 24, 2025 -

Canadians Sacrifice Auto Security Due To Increased Living Costs

May 24, 2025

Canadians Sacrifice Auto Security Due To Increased Living Costs

May 24, 2025 -

Tathyr Atfaq Altjart Byn Washntn Wbkyn Ela Mwshr Daks Alalmany Qfzt Ila 24 Alf Nqtt

May 24, 2025

Tathyr Atfaq Altjart Byn Washntn Wbkyn Ela Mwshr Daks Alalmany Qfzt Ila 24 Alf Nqtt

May 24, 2025 -

Public Spaces And The Hijab Macrons Party Pushes For Under 15s Ban

May 24, 2025

Public Spaces And The Hijab Macrons Party Pushes For Under 15s Ban

May 24, 2025

Latest Posts

-

Mayis Ta Ask Bu 3 Burc Icin Romantik Bir Ay

May 24, 2025

Mayis Ta Ask Bu 3 Burc Icin Romantik Bir Ay

May 24, 2025 -

16 Mart Ta Dogmus Olanlarin Burc Oezellikleri

May 24, 2025

16 Mart Ta Dogmus Olanlarin Burc Oezellikleri

May 24, 2025 -

Ask Kapida Mayis Ayinda Romantizmi Yasayacak 3 Burc

May 24, 2025

Ask Kapida Mayis Ayinda Romantizmi Yasayacak 3 Burc

May 24, 2025 -

Tutumlulukta Oende Gelen 3 Burc Para Yoenetimi Stratejileri

May 24, 2025

Tutumlulukta Oende Gelen 3 Burc Para Yoenetimi Stratejileri

May 24, 2025 -

Mayis Ayinda Aski Bulma Potansiyeli En Yueksek 3 Burc

May 24, 2025

Mayis Ayinda Aski Bulma Potansiyeli En Yueksek 3 Burc

May 24, 2025