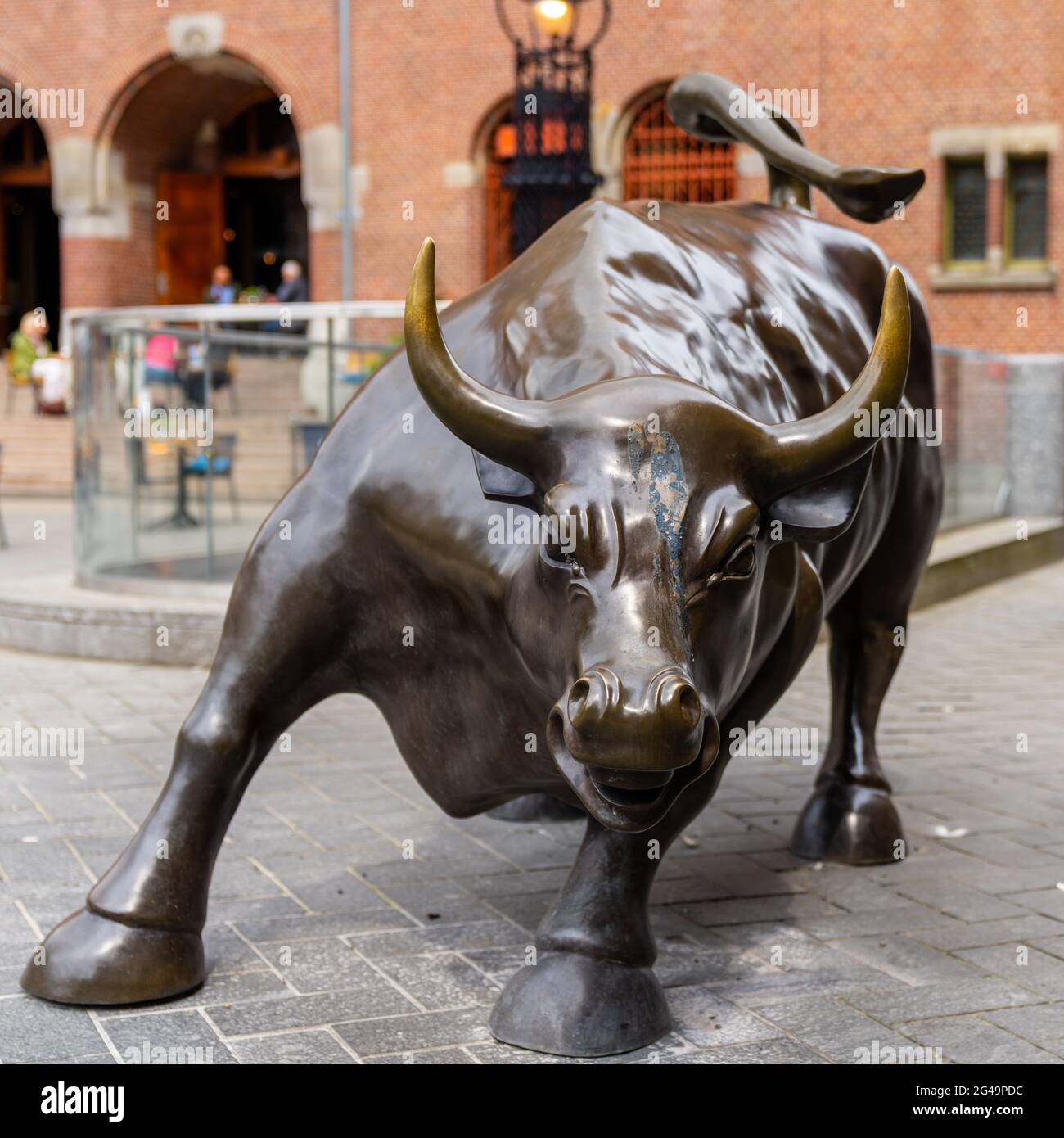

US-China Trade Soars Ahead Of Trade Truce

Table of Contents

Factors Contributing to the Surge in US-China Trade

Several interconnected factors have contributed to the remarkable increase in US-China trade.

Increased Demand for Chinese Goods

The US market continues to exhibit strong demand for various Chinese goods. Import figures for electronics, consumer goods, and various manufactured products show consistent growth. This demand stems from several sources:

- Price Competitiveness: Many Chinese-manufactured goods remain significantly cheaper than comparable products from other nations, making them attractive to US consumers and businesses.

- Supply Chain Integration: Decades of deeply integrated supply chains make it difficult for US businesses to quickly shift sourcing away from China, even amidst trade tensions.

- Specialized Production: China holds a dominant position in the production of certain specialized goods, making it an irreplaceable supplier for many US companies.

US Businesses Stockpiling Goods Before Potential Tariff Increases

Anticipating the possibility that a trade truce might fail to materialize, many US businesses have engaged in strategic stockpiling of goods sourced from China. This proactive measure aims to mitigate the impact of potential future tariff increases.

- Industries Most Affected: Industries heavily reliant on Chinese imports, such as electronics, apparel, and furniture, are most likely to engage in stockpiling.

- Short-Term Impact: This stockpiling artificially inflates short-term trade figures, making it difficult to assess the true underlying strength of US-China trade.

Easing of Certain Trade Restrictions (if applicable)

While significant barriers remain, any minor, even temporary, relaxations of trade restrictions between the two countries would likely contribute to increased trade volumes. For example, (insert specific example here if applicable, e.g., a temporary suspension of certain tariffs on specific goods). Analyzing these temporary adjustments provides crucial insights into the sensitivity of trade flows to policy changes.

Implications of the Trade Surge for the US and China

The recent surge in US-China trade has significant implications for both economies.

Impact on the US Economy

Increased imports from China contribute to the US trade deficit. This has potential ramifications for:

- US Businesses: Increased competition from cheaper Chinese imports could pressure some US businesses, particularly those in manufacturing.

- US Consumers: While consumers benefit from lower prices on many goods, reliance on imports could expose vulnerabilities in the US supply chain.

- Inflation and Employment: The effect on inflation and employment is complex and depends on several interacting factors including the nature of the imported goods, domestic production capacity and consumer spending patterns.

Impact on the Chinese Economy

The increased exports to the US significantly boost China's economic growth. This has implications for:

- Chinese Economic Growth: Export-oriented industries in China benefit significantly from increased demand from the US.

- Chinese Employment: Jobs in manufacturing and related sectors in China experience a positive impact.

- Geopolitical Implications: The trade relationship significantly influences China’s global economic standing and its relationship with other nations.

Uncertainty Surrounding the Potential Trade Truce

The future trajectory of US-China trade remains uncertain, largely dependent on the outcome of ongoing negotiations.

Negotiation Status and Potential Outcomes

Several scenarios are possible:

- Full Agreement: A comprehensive trade agreement could lead to sustained growth in trade, with both countries benefiting.

- Partial Agreement: A partial agreement addressing specific issues might yield limited benefits, leaving many aspects of the trade relationship unresolved.

- Failure to Reach an Agreement: A failure to reach an agreement could result in renewed escalation of trade tensions, potentially leading to further restrictions and a decline in trade.

Long-Term Outlook for US-China Trade

The long-term outlook for US-China trade is highly complex. The potential for a trade truce is but one factor; other crucial aspects include:

- Technological Competition: The intense technological rivalry between the two nations could lead to trade restrictions in strategically important sectors.

- Geopolitical Tensions: Broader geopolitical factors will continue to influence the trade relationship.

Conclusion: Navigating the Future of US-China Trade

The recent surge in US-China trade, despite ongoing tensions, highlights the complexities of this crucial economic relationship. The factors driving this increase—from sustained demand for Chinese goods to strategic stockpiling—have significant implications for both countries. However, the uncertainty surrounding a potential trade truce casts a long shadow on the future. Stay tuned for further updates on the evolving US-China trade landscape as this dynamic relationship continues to shape the global economic future. Continue monitoring this crucial relationship as it shapes the global economic future. Understanding the nuances of US-China trade relations is crucial for navigating the complexities of the global marketplace.

Featured Posts

-

Police Helicopter Pursuit High Speed Refueling And Texting

May 24, 2025

Police Helicopter Pursuit High Speed Refueling And Texting

May 24, 2025 -

Jazda Porsche Cayenne Gts Coupe Subiektywna Ocena

May 24, 2025

Jazda Porsche Cayenne Gts Coupe Subiektywna Ocena

May 24, 2025 -

Sharp Decline On Amsterdam Stock Exchange 11 Loss Since Wednesdays Open

May 24, 2025

Sharp Decline On Amsterdam Stock Exchange 11 Loss Since Wednesdays Open

May 24, 2025 -

Nisan Da Mali Sans Zenginlesmeye Hazirlanan Burclar

May 24, 2025

Nisan Da Mali Sans Zenginlesmeye Hazirlanan Burclar

May 24, 2025 -

The Sean Penn Dylan Farrow Woody Allen Controversy Examining The Claims

May 24, 2025

The Sean Penn Dylan Farrow Woody Allen Controversy Examining The Claims

May 24, 2025

Latest Posts

-

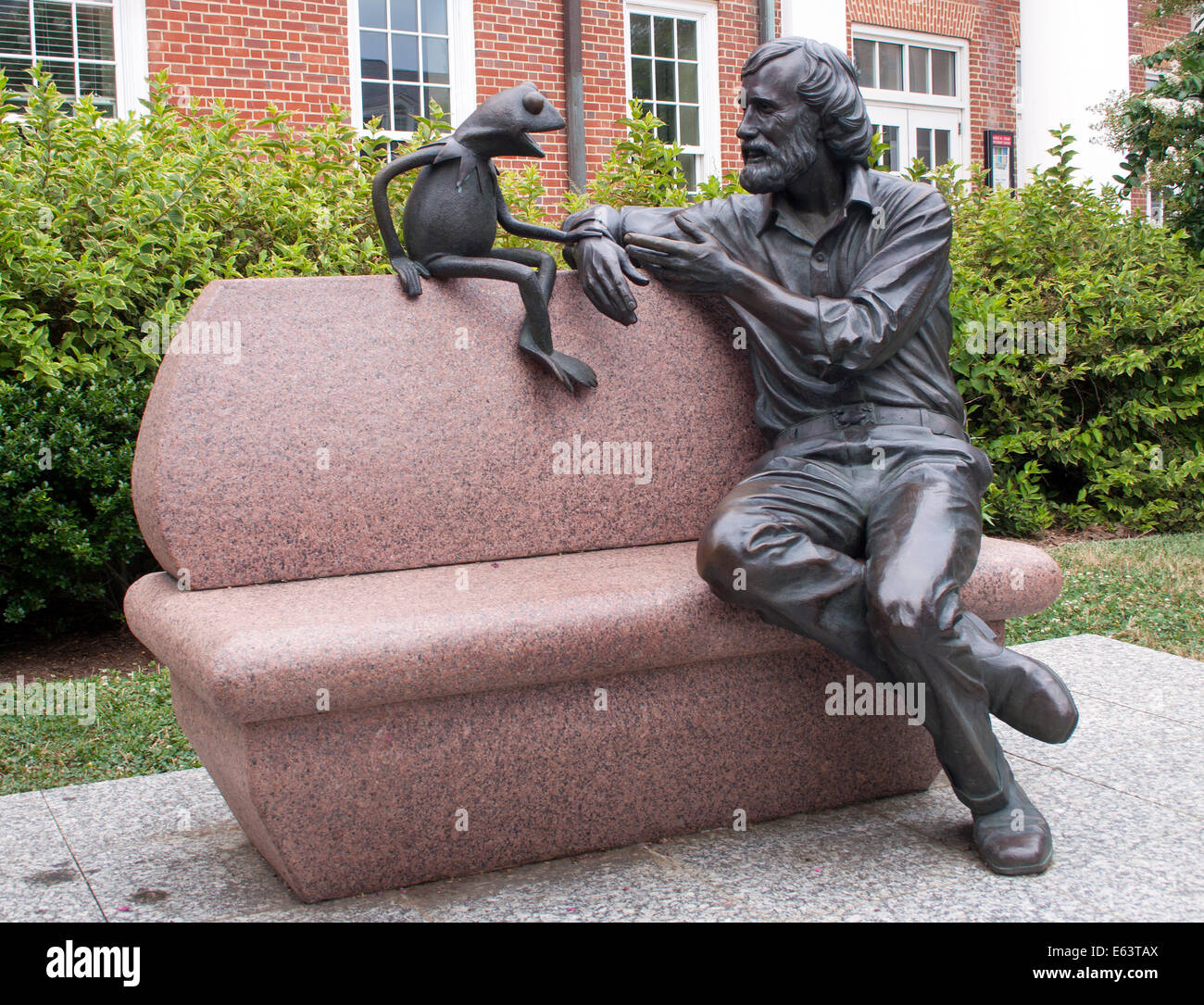

University Of Marylands 2024 Commencement Kermit The Frog To Speak

May 24, 2025

University Of Marylands 2024 Commencement Kermit The Frog To Speak

May 24, 2025 -

Kermit The Frog To Address University Of Maryland Graduates

May 24, 2025

Kermit The Frog To Address University Of Maryland Graduates

May 24, 2025 -

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025 -

Kermit The Frogs University Of Maryland Commencement Speech 2025

May 24, 2025

Kermit The Frogs University Of Maryland Commencement Speech 2025

May 24, 2025 -

Confirmed Kermit The Frog To Speak At University Of Maryland Graduation 2025

May 24, 2025

Confirmed Kermit The Frog To Speak At University Of Maryland Graduation 2025

May 24, 2025