SEC Approval Of XRP ETFs: A Potential $800 Million Market Influx

Table of Contents

Understanding the XRP ETF Landscape

An XRP ETF (Exchange-Traded Fund) is an investment vehicle that tracks the price of XRP, Ripple's native cryptocurrency. Unlike directly owning XRP, which involves managing a digital wallet and navigating the complexities of cryptocurrency exchanges, an XRP ETF offers a more accessible and regulated investment option for investors. This is because ETFs trade on major stock exchanges, providing liquidity and ease of access similar to traditional stocks.

However, the path to XRP ETF approval has been fraught with regulatory hurdles. The SEC, the primary regulatory body for securities in the United States, has historically been cautious about approving cryptocurrency-based ETFs due to concerns about market manipulation, price volatility, and investor protection. Several asset management firms are actively pursuing XRP ETF applications, hoping to capitalize on the potential demand. Key players involved include [insert names of relevant firms here if known, otherwise remove this sentence]. The current status of these applications is [insert current status of applications]. The success of these applications will hinge on the SEC's assessment of XRP's regulatory status and the overall maturity of the cryptocurrency market.

- Advantages of XRP ETFs: Simplified investment process, regulatory oversight, enhanced liquidity, diversification benefits.

- Regulatory Hurdles: SEC scrutiny, concerns about market manipulation, potential for price volatility, classification of XRP as a security.

- Key Players: [List key players involved in pushing for XRP ETF approval if known].

The Potential $800 Million Market Influx: A Deep Dive

The projected $800 million market influx is a conservative estimate based on several assumptions. This figure is derived from [explain the methodology used to calculate the $800 million figure. Be transparent about the assumptions made. For example: "analyzing the potential AUM (Assets Under Management) of several proposed XRP ETFs based on the AUM of similar Bitcoin ETFs and assuming a conservative uptake rate"]. This potential influx is expected to come from both institutional and retail investors.

- Institutional Investors: Hedge funds, pension funds, and other large financial institutions might see XRP ETFs as a way to diversify their portfolios and gain exposure to the cryptocurrency market in a regulated manner.

- Retail Investors: Individual investors who previously found it difficult to invest in XRP directly will now have a simpler and more accessible route through ETFs.

- Influencing Factors: Market conditions (bull or bear market), investor sentiment towards XRP and cryptocurrencies in general, SEC's final decision on ETF applications, and general macroeconomic factors all play critical roles.

Impact on XRP Price and Market Volatility

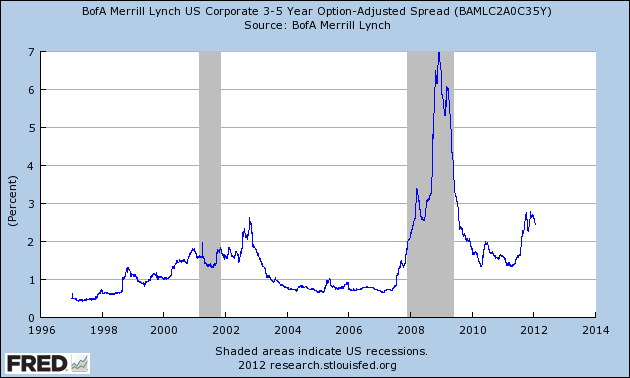

SEC approval of XRP ETFs would likely lead to a significant surge in XRP's price. Increased demand from ETF inflows, coupled with increased trading volume and liquidity, would put upward pressure on the price. However, this also increases the potential for increased market volatility. Sudden price swings, both upward and downward, are highly probable in the short term following approval. The potential for price manipulation or speculation, while always present in the cryptocurrency market, might be amplified by the influx of new investment.

- Price Prediction: While predicting the exact price movement is impossible, a significant price increase is expected. [Insert any relevant price predictions from reputable sources, properly attributed, or remove this bullet point if no reliable predictions are available].

- Volatility: Expect increased volatility in the short term, potentially leading to significant price swings. Long-term price stability would depend on market adoption and regulatory developments.

- Trading Volume and Liquidity: Increased trading volume would result in enhanced liquidity, making it easier for investors to buy and sell XRP.

Comparison to Other Crypto ETFs and Market Trends

The potential impact of an XRP ETF should be compared to the impact of other approved or pending cryptocurrency ETFs, such as Bitcoin ETFs. While Bitcoin ETFs have already seen some success, XRP's unique features and regulatory landscape present distinct opportunities and challenges. The overall impact depends on various factors, including the overall market sentiment towards cryptocurrencies and the regulatory environment.

- Bitcoin ETF Comparison: Compare and contrast the potential impact of an XRP ETF with existing or future Bitcoin ETFs. Discuss differences in market capitalization, regulatory status, and investor sentiment.

- Market Trends: Analyze broader market trends in cryptocurrency investment, regulatory developments globally, and the evolving landscape of digital asset investment.

Conclusion: Investing in the Future of XRP: The SEC Approval and Beyond

The potential SEC approval of XRP ETFs represents a watershed moment for the cryptocurrency market. The projected $800 million market influx highlights the significant potential for growth and investment opportunities. However, investors must approach this with a balanced perspective, acknowledging the inherent risks associated with cryptocurrency investments. Increased volatility and the potential for price manipulation are real considerations.

Investing in XRP or related investment vehicles should only be done after thorough research and understanding of the associated risks. Consider diversifying your portfolio and consulting with a financial advisor before making any investment decisions. Stay informed about XRP ETF developments and adapt your cryptocurrency investment strategies accordingly. Consider exploring reputable sources for informed XRP ETF investing and responsible investing in the cryptocurrency market.

Featured Posts

-

Analysis The Decline In Taiwanese Investment In Us Bond Etfs

May 08, 2025

Analysis The Decline In Taiwanese Investment In Us Bond Etfs

May 08, 2025 -

Unscripted Moments In Saving Private Ryan Impact And Legacy

May 08, 2025

Unscripted Moments In Saving Private Ryan Impact And Legacy

May 08, 2025 -

Copa Libertadores Grupo C Pronostico Liga De Quito Flamengo Fecha 3

May 08, 2025

Copa Libertadores Grupo C Pronostico Liga De Quito Flamengo Fecha 3

May 08, 2025 -

Amazon Primes Collection Of The Most Intense War Movies A Ranked List

May 08, 2025

Amazon Primes Collection Of The Most Intense War Movies A Ranked List

May 08, 2025 -

The 10x Bitcoin Multiplier Chart Analysis And Market Implications

May 08, 2025

The 10x Bitcoin Multiplier Chart Analysis And Market Implications

May 08, 2025