The 10x Bitcoin Multiplier: Chart Analysis And Market Implications

Table of Contents

Identifying Potential 10x Bitcoin Multipliers Through Chart Analysis

Predicting a 10x Bitcoin multiplier isn't a guaranteed science, but utilizing robust chart analysis techniques can significantly improve your chances of identifying promising periods. Combining different indicators and understanding their limitations is key.

Understanding Key Technical Indicators

Technical analysis provides valuable insights into potential price movements. Several key indicators can signal potential Bitcoin price surges:

-

Relative Strength Index (RSI): An RSI reading below 30 often indicates an oversold condition, suggesting a potential bounce. However, it's crucial to consider the context; a prolonged oversold period might signal a continuing downtrend.

-

Moving Averages (MA): A "golden cross," where the short-term moving average (e.g., 50-day MA) crosses above the long-term moving average (e.g., 200-day MA), is often considered a bullish signal. Conversely, a "death cross" signals potential bearish pressure.

-

Moving Average Convergence Divergence (MACD): A bullish crossover (the MACD line crossing above the signal line) can indicate a potential upswing. However, the MACD should be used in conjunction with other indicators for confirmation.

-

Bollinger Bands: A squeeze, where the bands contract, followed by a breakout, can indicate a significant price move, either up or down. The direction of the breakout is crucial.

Limitations: Relying solely on technical indicators is risky. Market sentiment, news events, and macroeconomic factors can significantly influence Bitcoin's price, regardless of technical signals.

Recognizing Chart Patterns Predictive of Exponential Growth

Certain chart patterns can historically precede significant price rallies. Identifying these patterns requires experience and careful observation:

-

Inverse Head and Shoulders: This bullish reversal pattern indicates a potential end to a downtrend.

-

Cup and Handle: This pattern resembles a cup with a handle, suggesting a period of consolidation before a significant price increase.

-

Double Bottom: This pattern indicates a potential support level, suggesting a price reversal after a downturn.

-

Ascending Triangles: This pattern signals a period of consolidation with higher lows and equal highs, eventually leading to a breakout.

Examples: [Insert historical chart examples with annotations highlighting these patterns and the subsequent price increases. Clearly label each chart and provide context.]

Risk Factors: While these patterns can be predictive, they are not foolproof. False signals can occur, leading to inaccurate predictions.

Volume Confirmation: The Crucial Element

High volume accompanying bullish chart patterns is crucial for validation. A price increase with low volume is often a weak signal and may be easily reversed.

-

Volume Spikes Confirming Breakouts: A significant increase in trading volume during a breakout from a chart pattern reinforces the signal's strength.

-

Low-Volume Rallies Often Result in Pullbacks: Price increases without significant volume support are often unsustainable and prone to corrections.

-

Importance of Analyzing Volume on Different Timeframes: Analyzing volume across various timeframes (e.g., daily, weekly, monthly) provides a more holistic perspective.

Market Implications of a 10x Bitcoin Multiplier

A 10x Bitcoin multiplier would have profound implications for the cryptocurrency market and the broader global economy.

Impact on the Cryptocurrency Market

A massive Bitcoin price surge would likely trigger a ripple effect throughout the cryptocurrency market:

-

Altcoin Market Capitalization Increases: Increased investor interest in Bitcoin could spill over into altcoins, boosting their market capitalization.

-

Increased Media Coverage and Investor Interest: A 10x multiplier would likely attract significant media attention and further investment, potentially leading to increased mainstream adoption.

-

Potential for Regulatory Intervention: Such a dramatic price surge could prompt increased regulatory scrutiny and potential intervention from governments worldwide.

Macroeconomic Factors Influencing Bitcoin's Price

Macroeconomic factors play a crucial role in Bitcoin's price:

-

Inflationary Pressures Driving Bitcoin Adoption: High inflation can drive demand for Bitcoin as a hedge against inflation.

-

Impact of Interest Rate Hikes on Bitcoin Price: Interest rate hikes can impact Bitcoin's price negatively, as investors might shift to more traditional assets.

-

Geopolitical Instability and Bitcoin's Safe-Haven Appeal: During times of geopolitical uncertainty, Bitcoin's perceived status as a safe-haven asset might increase demand.

Risk Management Strategies for 10x Bitcoin Opportunities

Even with careful analysis, significant risks are involved in pursuing 10x Bitcoin opportunities:

-

Diversify Investments: Never put all your eggs in one basket. Diversify your portfolio across various asset classes to mitigate risks.

-

Risk Mitigation Strategies: Utilize stop-loss orders to limit potential losses, employ appropriate position sizing, and consider dollar-cost averaging to reduce risk.

-

Avoid FOMO: Fear of missing out can lead to impulsive decisions and significant losses. Maintain emotional discipline and stick to your trading plan.

Conclusion

Identifying potential 10x Bitcoin multipliers requires a multifaceted approach combining technical chart analysis, a deep understanding of macroeconomic factors, and disciplined risk management. By skillfully employing technical indicators, recognizing relevant chart patterns, confirming with volume analysis, and remaining aware of the broader economic context, investors can better position themselves to capitalize on potential opportunities. However, it's crucial to remember that no prediction is certain, and significant risk is inherent in cryptocurrency investing. Don't chase unrealistic returns; instead, employ a disciplined approach to potentially benefit from 10x Bitcoin multiplier opportunities. Start analyzing Bitcoin charts today and learn how to identify potential 10x Bitcoin multipliers!

Featured Posts

-

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Signals

May 08, 2025

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Signals

May 08, 2025 -

Uber Alleges Door Dash Engaged In Anti Competitive Practices A Deep Dive

May 08, 2025

Uber Alleges Door Dash Engaged In Anti Competitive Practices A Deep Dive

May 08, 2025 -

Cowherd On Tatum Celtics Game 1 Loss Prompts Strong Reaction

May 08, 2025

Cowherd On Tatum Celtics Game 1 Loss Prompts Strong Reaction

May 08, 2025 -

Spk Nin Aciklamasi Kripto Para Piyasalarinin Gelecegi

May 08, 2025

Spk Nin Aciklamasi Kripto Para Piyasalarinin Gelecegi

May 08, 2025 -

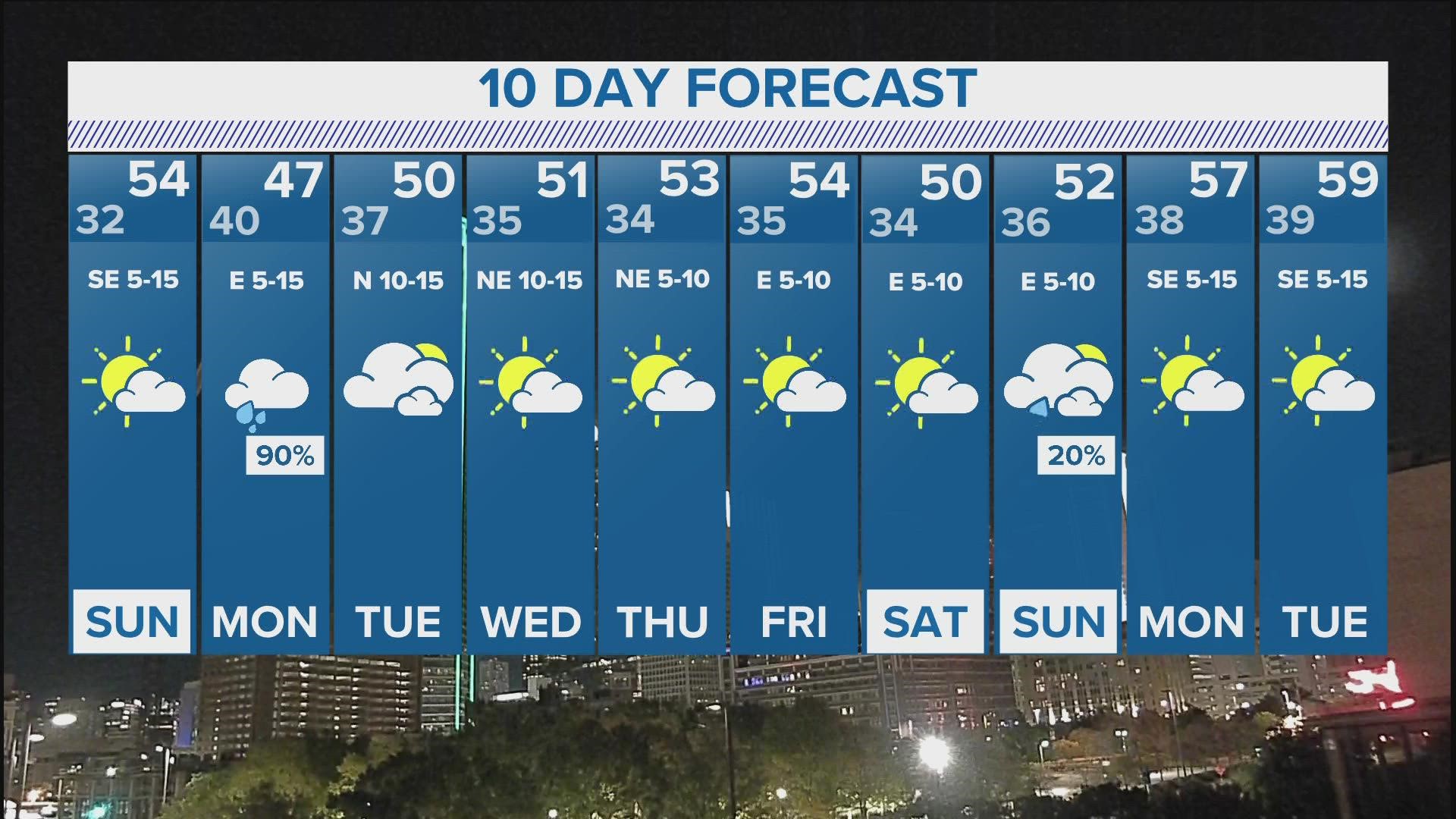

Lahore And Punjab Eid Ul Fitr Weather Forecast Next 48 Hours

May 08, 2025

Lahore And Punjab Eid Ul Fitr Weather Forecast Next 48 Hours

May 08, 2025