Analysis: The Decline In Taiwanese Investment In US Bond ETFs

Table of Contents

Economic Factors Driving the Decline

Several key economic factors have contributed to the decline in Taiwanese investment in US Bond ETFs. These factors have collectively diminished the attractiveness of US bonds as a preferred investment vehicle for Taiwanese investors.

Impact of Rising US Interest Rates

The Federal Reserve's aggressive interest rate hikes have significantly impacted the appeal of US Bond ETFs. Higher interest rates directly translate to:

- Higher interest rates make alternative investments more appealing. Investors can now find better returns elsewhere, reducing demand for lower-yielding US bonds.

- Reduced demand for lower-yielding bonds. Existing bonds lose value as newer bonds offer superior yields. This creates a risk of capital losses for investors holding US Bond ETFs.

- Increased risk of capital losses. As interest rates rise, the market value of fixed-income securities typically falls.

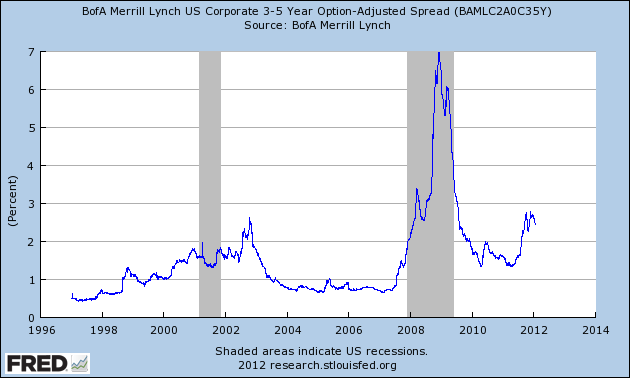

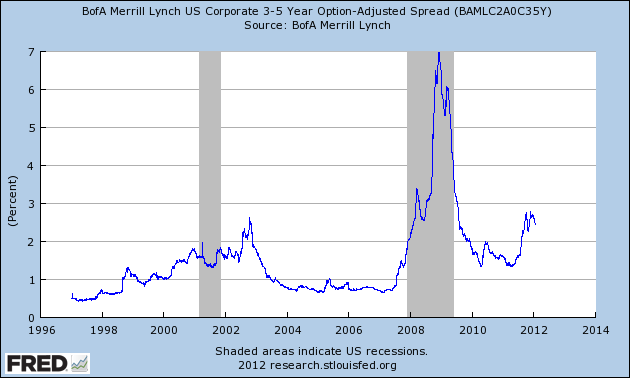

Data from the Federal Reserve shows a clear correlation between interest rate increases and the subsequent decrease in foreign investment in US treasury bonds, a significant component of many US Bond ETFs. This trend directly reflects the decreased attractiveness of these assets in a rising-rate environment.

Strengthening Taiwanese Dollar

The appreciation of the Taiwanese dollar against the US dollar has also played a role. The strengthening TWD makes US dollar-denominated assets less appealing because:

- Currency fluctuations impacting overall investment returns. When converting returns from US dollars back to Taiwanese dollars, the gains are diminished by the favorable exchange rate.

- Reduced incentive to invest in US dollar assets. The potential for currency losses offsets the potential gains from interest earned on the bonds.

- Diversification strategies in response to currency shifts. Investors might reallocate their portfolios to hedge against potential currency risks, seeking investments denominated in TWD or other currencies.

Exchange rate data from the Central Bank of the Republic of China (Taiwan) reveals a consistent strengthening of the TWD against the USD during the period of declining Taiwanese investment in US Bond ETFs, supporting this analysis.

Global Economic Uncertainty

Broader global economic uncertainties, including geopolitical tensions and persistent inflation, have increased investor risk aversion. This translates into:

- Risk aversion impacting investment in less stable assets. Investors are shifting away from perceived riskier assets, like US Bond ETFs, opting for more secure options.

- Increased preference for safer, more liquid investments. Cash and cash equivalents are seen as more attractive during periods of economic instability.

- Shifting investment strategies towards less volatile markets. Investors are looking for stable investments, potentially domestically, rather than taking on global risks.

Regulatory and Policy Changes

Regulatory and policy changes, both in Taiwan and the US, have also impacted investor sentiment and investment decisions.

Changes in Taiwanese Investment Regulations

New regulations or policies in Taiwan might influence outbound investment. These potential changes could include:

- New tax laws impacting investment returns. Changes in tax laws could reduce the after-tax returns on US Bond ETFs, making them less attractive.

- Restrictions on capital outflow. Increased restrictions on sending money overseas could directly limit the ability to invest in US assets.

- Changes in investment guidelines. Governmental guidelines or encouragement of domestic investment could divert capital away from foreign markets.

US Regulatory Scrutiny

Increased regulatory scrutiny in the US might also be impacting Taiwanese investors' confidence. This could include:

- Increased compliance costs. Navigating complex US regulations can be expensive and time-consuming.

- Fear of sanctions or penalties. Concerns about potential penalties for non-compliance could deter investment.

- Greater regulatory uncertainty. Changes in US regulations create uncertainty and can lead to risk aversion.

Shifting Investment Preferences

The decline in Taiwanese investment in US Bond ETFs might also reflect evolving investment preferences.

Diversification into other Asset Classes

Taiwanese investors might be diversifying into other asset classes offering potentially higher returns or perceived lower risk:

- Search for higher returns in alternative asset classes. Real estate, private equity, or emerging markets may be viewed as more promising avenues for growth.

- Reduced reliance on traditional bond investments. The pursuit of higher returns may be driving investors away from comparatively lower-yielding bonds.

- Exploring higher-growth, higher-risk opportunities. Investors may be willing to take on more risk to potentially achieve higher returns in other sectors.

Domestic Investment Opportunities

Increased domestic investment opportunities within Taiwan may be diverting capital away from overseas investments:

- Attractive domestic investment opportunities. Strong economic growth or government initiatives promoting infrastructure development can create attractive domestic investment prospects.

- Reduced need for overseas investment. Strong domestic markets can satisfy investment needs without the need for foreign investment.

- Focus on supporting the local economy. A shift towards domestic investment can be driven by a conscious effort to support the Taiwanese economy.

Conclusion: Understanding the Future of Taiwanese Investment in US Bond ETFs

The decline in Taiwanese investment in US Bond ETFs is a complex issue stemming from a confluence of factors. Rising US interest rates, a strengthening Taiwanese dollar, global economic uncertainty, regulatory changes, and shifting investment preferences have all played significant roles. Understanding these interwoven influences is crucial for predicting future trends. While the immediate future may show continued hesitation, shifts in interest rates or global economic stability could reverse this trend. The attractiveness of US Bond ETFs for Taiwanese investors will likely depend on future economic and regulatory developments.

Stay updated on the latest trends in Taiwanese investment in US Bond ETFs by following financial news and regularly reviewing market data. Understanding these dynamics is crucial for informed investment decisions.

Featured Posts

-

Etf

May 08, 2025

Etf

May 08, 2025 -

New Dwp Rules How Universal Credit Claim Verification Will Change

May 08, 2025

New Dwp Rules How Universal Credit Claim Verification Will Change

May 08, 2025 -

Dwp To Axe Two Benefits Final Payments Approaching

May 08, 2025

Dwp To Axe Two Benefits Final Payments Approaching

May 08, 2025 -

Buguen Bitcoin Fiyat Degisim Ve Gelecek Tahminleri

May 08, 2025

Buguen Bitcoin Fiyat Degisim Ve Gelecek Tahminleri

May 08, 2025 -

Star Wars Yavin 4 Return A Behind The Scenes Look At The Delayed Sequel

May 08, 2025

Star Wars Yavin 4 Return A Behind The Scenes Look At The Delayed Sequel

May 08, 2025