XRP (Ripple) Price Analysis: Buy Or Sell Below $3?

Table of Contents

H2: Current Market Conditions and Technical Analysis

H3: XRP Price History and Recent Trends

XRP's price history is a rollercoaster ride. From its all-time high, it has experienced substantial corrections, influenced by various factors, including the ongoing SEC lawsuit. Analyzing past price performance is crucial for understanding potential future movements.

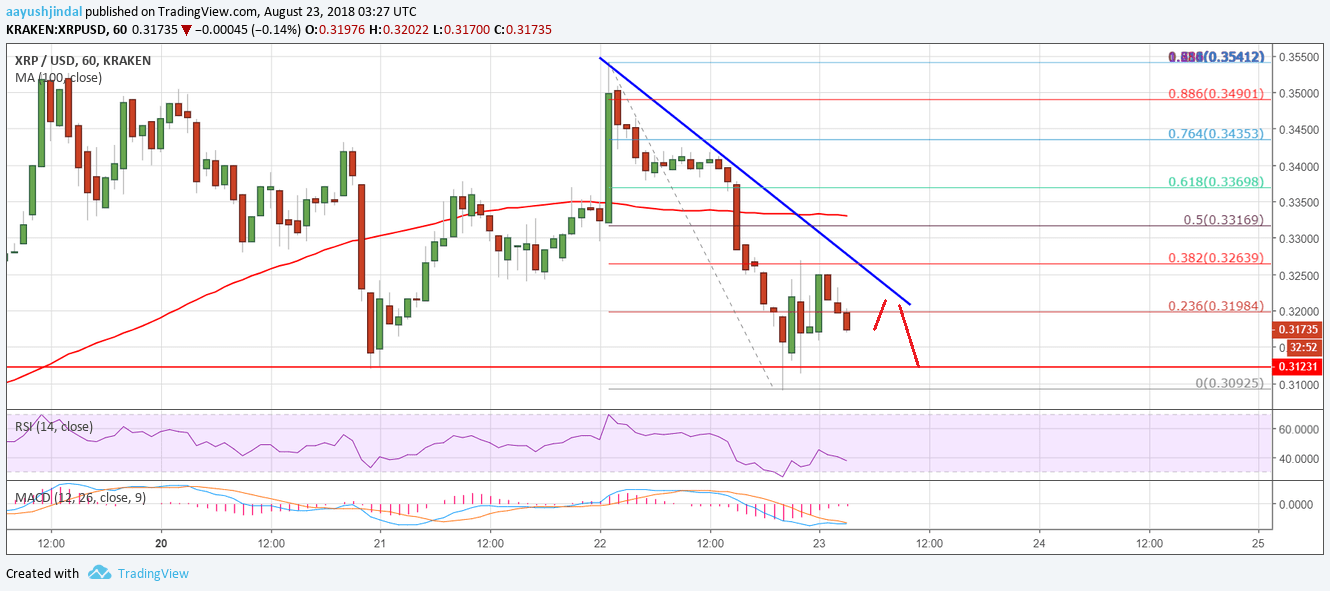

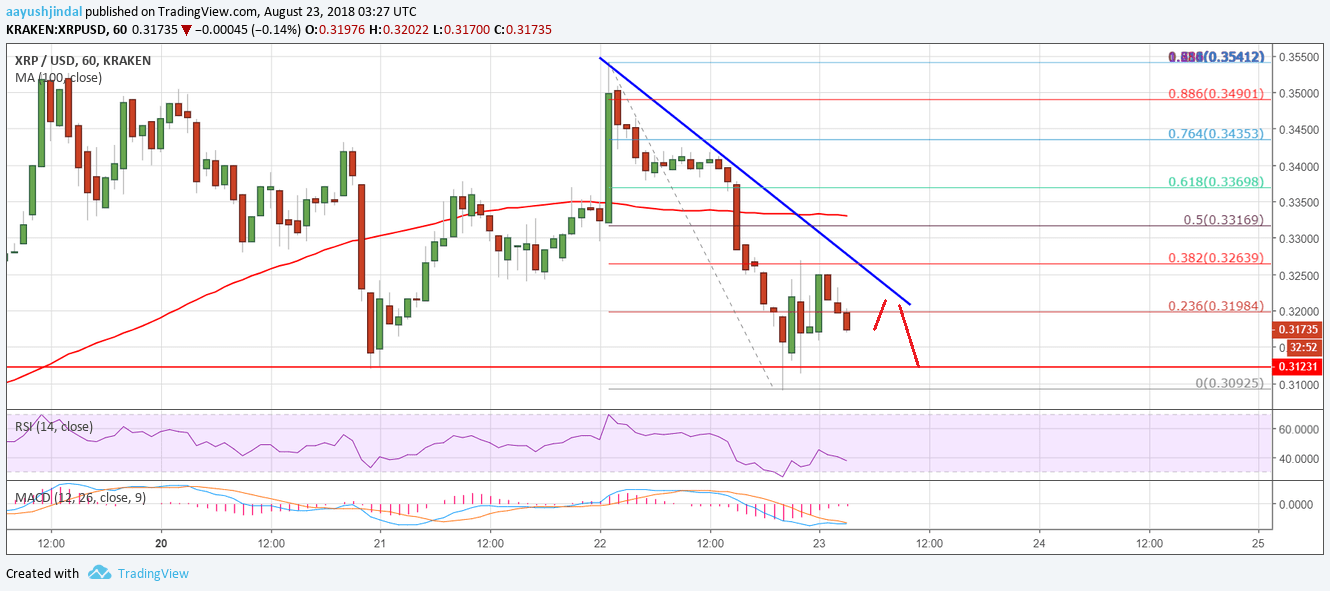

- Key Price Support and Resistance Levels: Identifying historical support and resistance levels can provide insights into potential price reversals or breakouts. For example, the $0.50 level has historically acted as strong support, while the $1.00 and $1.50 levels have presented significant resistance.

- Recent Price Action: The recent price action of XRP needs careful scrutiny. Has it been primarily bullish, indicating potential upward momentum, or bearish, suggesting further price declines? Observing candlestick patterns and volume can offer valuable clues.

- Trading Indicators: Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can provide additional signals. For example, an RSI above 70 suggests overbought conditions, potentially indicating a price correction, while an RSI below 30 suggests oversold conditions, potentially indicating a price reversal. Analyzing these indicators in conjunction with price action offers a more comprehensive view.

H3: Impact of the SEC Lawsuit

The SEC lawsuit against Ripple Labs significantly impacts XRP's price. The uncertainty surrounding the outcome creates volatility.

- Potential Outcomes and Their Effects: A favorable ruling could significantly boost XRP's price, while an unfavorable ruling could lead to further declines. Different legal experts offer varying predictions, creating uncertainty in the market.

- Expert Opinions and Legal Analyses: Following legal developments and expert opinions on the lawsuit's potential outcomes is essential. Understanding the nuances of the legal arguments can help in assessing the potential impact on XRP's price.

- Investor Sentiment: Investor sentiment surrounding the lawsuit is crucial. Negative sentiment can drive down the price, while positive news could trigger price increases. Monitoring social media and news coverage provides insights into investor sentiment.

H3: Overall Market Sentiment and Crypto Market Trends

XRP's price is also affected by broader cryptocurrency market trends.

- Bitcoin's Influence: Bitcoin's price movements often influence altcoins like XRP. A bullish Bitcoin market usually benefits XRP, while a bearish Bitcoin market often negatively affects XRP.

- General Investor Confidence: Overall investor confidence in the cryptocurrency market plays a crucial role. Periods of high investor confidence often lead to higher XRP prices, while periods of low confidence can cause price declines.

- News Events Affecting the Crypto Market: Significant news events, such as regulatory changes or technological advancements, can influence the entire cryptocurrency market, including XRP's price.

H2: Fundamental Analysis of Ripple and XRP

H3: Ripple's Technology and Adoption

Ripple's underlying technology and its adoption by financial institutions are critical factors in assessing XRP's long-term value.

- RippleNet and Partnerships: RippleNet, Ripple's payment network, facilitates cross-border payments, and its partnerships with major banks and payment providers are key drivers of XRP's adoption.

- XRP's Role in Cross-Border Payments: XRP's role in facilitating faster and cheaper cross-border transactions is a significant advantage.

- New Developments and Partnerships: Monitoring Ripple's new partnerships and technological advancements can provide insights into future growth potential.

H3: Ripple's Business Model and Future Prospects

Ripple's business model, financial health, and future growth potential are also vital considerations.

- Revenue Streams and Profitability: Analyzing Ripple's revenue streams and profitability is essential to understanding its financial strength and sustainability.

- Competitive Advantages and Disadvantages: Assessing Ripple's competitive advantages and disadvantages in the payments industry provides a comprehensive view of its long-term prospects.

- Potential Future Projects and Expansions: Understanding Ripple's future plans and potential expansions can help in predicting its long-term growth.

H2: Predicting Future XRP Price and Investment Strategies

H3: Price Predictions from Analysts

Several analysts and research firms offer XRP price predictions, but it's vital to treat them cautiously.

- Range of Predictions and Justifications: Different analysts provide varying predictions, often based on different methodologies and assumptions. Understanding the justifications behind these predictions is critical.

- Sources of Predictions: Evaluating the credibility and track record of the analysts offering predictions is essential.

- Limitations of Price Predictions: Price predictions are inherently uncertain and should not be the sole basis for investment decisions.

H3: Risk Assessment and Investment Recommendations

Investing in XRP carries significant risks. A thorough risk assessment is essential before making any investment decisions.

- Potential Upside and Downside Risks: Understanding the potential upside and downside risks associated with XRP is crucial for managing your investment.

- Risk Management Strategies: Employing risk management strategies, such as diversification and dollar-cost averaging, can help mitigate potential losses.

- Buy/Sell/Hold Recommendations: Investment recommendations should depend on your risk tolerance and investment goals. A conservative investor might prefer a "hold" or "sell" strategy, while a more aggressive investor might opt for a "buy" strategy, but always with appropriate risk management.

3. Conclusion:

The decision to buy or sell XRP below $3 involves many factors. While XRP shows potential, thorough research and risk assessment are crucial. Consider your risk tolerance, investment goals, and carefully analyze the information presented before making any decisions. This analysis is for informational purposes only and does not constitute financial advice. Do your own research before buying or selling XRP (Ripple).

Featured Posts

-

Inflation Bites How One Womans Pregnancy Craving Created A Chocolate Market Crisis

May 01, 2025

Inflation Bites How One Womans Pregnancy Craving Created A Chocolate Market Crisis

May 01, 2025 -

Investing In Xrp Ripple In 2024 A Price Analysis Below 3

May 01, 2025

Investing In Xrp Ripple In 2024 A Price Analysis Below 3

May 01, 2025 -

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 01, 2025

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 01, 2025 -

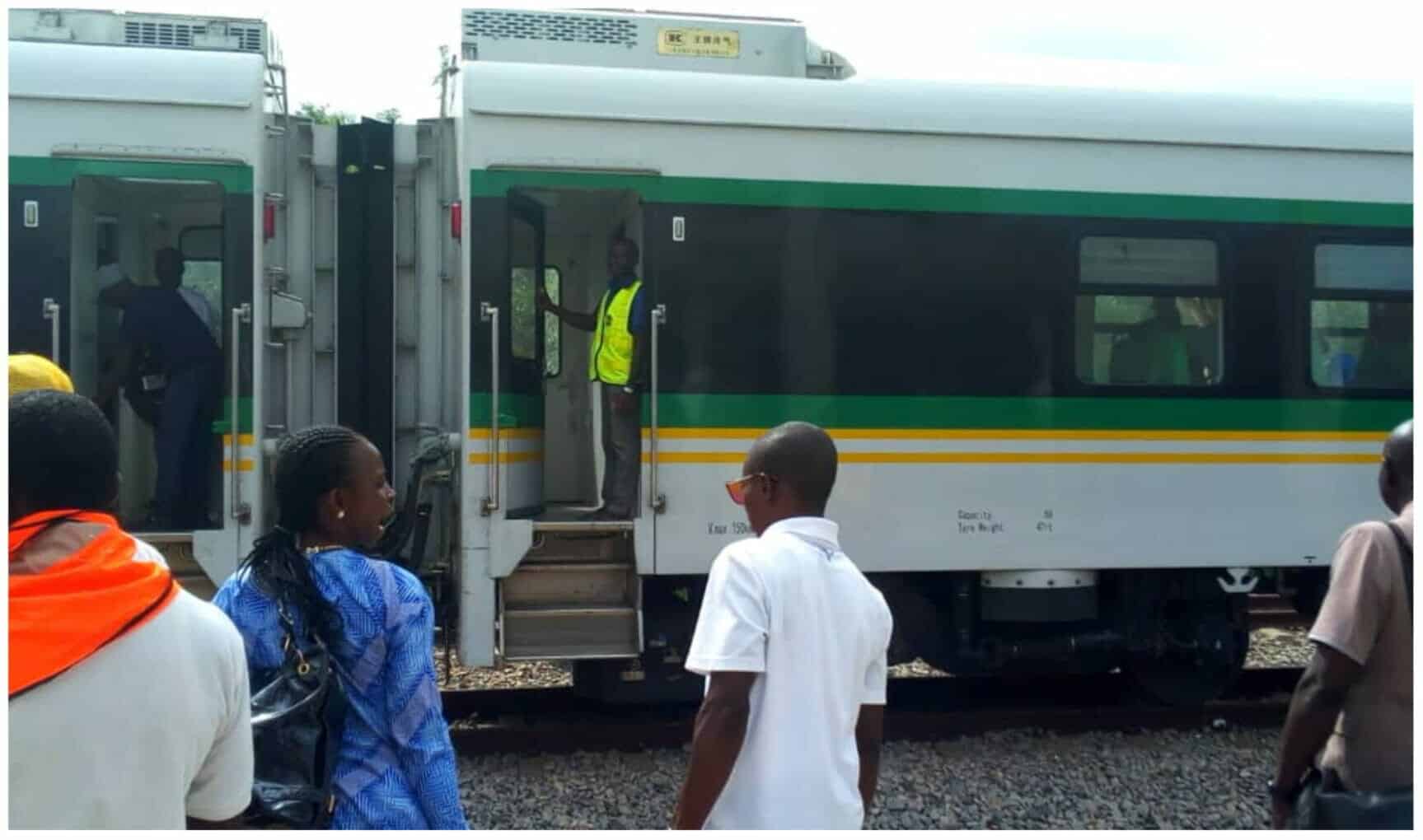

Technical Failure Grounds Train Stranding Passengers In Kogi State

May 01, 2025

Technical Failure Grounds Train Stranding Passengers In Kogi State

May 01, 2025 -

Melding Gaslucht In Roden Vals Alarm

May 01, 2025

Melding Gaslucht In Roden Vals Alarm

May 01, 2025

Latest Posts

-

Americas Favorite Cruise Lines Reviews And Recommendations

May 01, 2025

Americas Favorite Cruise Lines Reviews And Recommendations

May 01, 2025 -

Than Trong Khi Rot Von Nhan Dien Va Tranh Rui Ro Dau Tu Vao Cong Ty Ma

May 01, 2025

Than Trong Khi Rot Von Nhan Dien Va Tranh Rui Ro Dau Tu Vao Cong Ty Ma

May 01, 2025 -

Choosing The Right Cruise Line A Comparison Of Top Us Operators

May 01, 2025

Choosing The Right Cruise Line A Comparison Of Top Us Operators

May 01, 2025 -

Phap Ly Va Rui Ro Khi Dau Tu Vao Doanh Nghiep Bi Nghi Van Lua Dao

May 01, 2025

Phap Ly Va Rui Ro Khi Dau Tu Vao Doanh Nghiep Bi Nghi Van Lua Dao

May 01, 2025 -

Nguy Co Mat Trang Khi Gop Von Vao Cong Ty Co Tien Su Lua Dao

May 01, 2025

Nguy Co Mat Trang Khi Gop Von Vao Cong Ty Co Tien Su Lua Dao

May 01, 2025