Ryanair's Growth Outlook: Tariff Wars And The Planned Share Buyback

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

The global economic climate, punctuated by escalating tariff wars, presents considerable headwinds for Ryanair's operations. Understanding these challenges is crucial to assessing Ryanair's growth outlook accurately.

Increased Fuel Costs

Fluctuating fuel prices, often exacerbated by international trade disputes, significantly impact Ryanair's operational costs and overall profitability. Fuel represents a substantial portion of the airline's expenses, making it highly vulnerable to price volatility.

- Hedging Strategies: Ryanair employs hedging strategies to mitigate some of the risk associated with fuel price volatility. However, the effectiveness of these strategies depends on market conditions and the accuracy of future price predictions. The success of these hedging strategies will be a key factor in determining Ryanair's fuel costs in the coming year.

- Fuel Efficiency Measures: To offset rising fuel costs, Ryanair continues to invest in fuel-efficient aircraft and operational procedures. Improving fuel efficiency is a critical aspect of managing operational costs and maintaining competitiveness within the aviation market. These efforts contribute directly to Ryanair's fuel cost management.

- Pass-Through of Costs: While Ryanair aims to absorb some of the increased fuel costs, there is potential for a pass-through of these costs to consumers through increased ticket prices. This, in turn, could affect passenger numbers and overall revenue, impacting Ryanair's growth outlook.

Disruptions to Supply Chains

Potential trade wars can severely disrupt the supply chains for aircraft parts and maintenance services. This disruption can lead to significant challenges for Ryanair's fleet operations and overall maintenance schedule.

- Potential Delays: Delays in receiving essential parts can lead to grounded aircraft, impacting operational efficiency and potentially leading to flight cancellations. This directly impacts Ryanair's ability to meet its scheduled flights and maintain its operational performance.

- Increased Maintenance Costs: Sourcing alternative parts or accelerating maintenance schedules to avoid potential delays can lead to significantly increased maintenance costs, further impacting profitability. The strategic management of these challenges is a vital aspect of Ryanair's operational planning.

- Alternative Sourcing Strategies: Ryanair may need to explore alternative sourcing strategies for aircraft parts and maintenance services to mitigate supply chain disruptions. The effectiveness of these alternative strategies will be a crucial element in maintaining the airline's fleet readiness.

Impact on Tourist Travel

Tariff wars can negatively affect global tourist travel, impacting the demand for air travel and directly influencing Ryanair's passenger numbers and revenue generation.

- Potential Decrease in Travel Demand: Increased prices for goods and services, potentially caused by tariffs, might dissuade tourists from traveling, leading to lower passenger numbers for Ryanair. Analyzing travel trends and adapting routes are key strategies to offset this potential impact.

- Changes in Route Profitability: Reduced passenger numbers could lead to changes in route profitability, requiring Ryanair to adjust its route network and pricing strategies. The agility to respond to these changing market dynamics is a critical aspect of Ryanair's overall strategy.

- Ryanair's Market Share: Competitors may also be affected, but the overall reduced travel demand means Ryanair’s market share could still be impacted, influencing its overall growth. Careful monitoring of competitor strategies and market share is essential.

Analyzing Ryanair's Planned Share Buyback

Ryanair's announcement of a share buyback program provides another key dimension to assessing its growth outlook. This program needs thorough analysis to understand its implications.

Financial Implications

The share buyback demonstrates Ryanair's financial health and how this program influences its financial position.

- Amount of the Buyback: The magnitude of the buyback indicates the company's confidence in its financial strength and future prospects. A larger buyback suggests greater confidence.

- Source of Funds: The source of funds used for the buyback (e.g., retained earnings, debt reduction) reveals important information about the company's financial management strategy. This will affect the company’s long-term financial stability.

- Impact on Debt Levels: The buyback's impact on debt levels will be important in understanding its long-term financial soundness and ability to weather potential economic downturns. A balanced approach to debt and equity is crucial for long-term financial health.

- Shareholder Returns: The buyback aims to increase shareholder returns by reducing the number of outstanding shares, potentially boosting earnings per share (EPS). This is a key indicator of success for the buyback strategy.

Investor Sentiment and Stock Price

The market's reaction to the share buyback announcement and its effect on Ryanair's stock price are crucial indicators of investor confidence.

- Investor Confidence: A positive market reaction signifies investor confidence in Ryanair's future performance and growth potential. This is a major positive for Ryanair's outlook.

- Impact on Stock Valuation: The share buyback can impact the stock valuation, potentially leading to increased stock prices, reflecting investor sentiment and expectations. The extent of this influence is vital for investors.

- Analyst Predictions: Analyst predictions and ratings following the buyback announcement provide valuable insights into the market's outlook on Ryanair's future performance. Monitoring these predictions provides valuable external perspectives.

Strategic Implications of the Buyback

The strategic rationale behind the share buyback needs careful examination – is this a display of confidence in future growth, or a signal of limited alternative investment opportunities?

- Alternative Uses of Capital: The decision to undertake a share buyback suggests that Ryanair has evaluated alternative uses of its capital and determined that returning capital to shareholders is the most optimal strategy.

- Potential for Future Acquisitions or Expansion: The buyback might indicate a pause in further acquisitions or expansion plans, pending further market developments. This provides crucial information about Ryanair's strategic priorities.

Conclusion

Ryanair's growth outlook is inextricably linked to the resolution of ongoing tariff wars and the effective execution of its share buyback program. While tariff wars pose significant challenges, particularly concerning fuel costs and supply chain vulnerabilities, Ryanair's strategic share buyback reflects confidence in its long-term trajectory. The impact of these intertwined factors on Ryanair's financial performance and stock price remains dynamic and requires continued observation. To stay abreast of the latest developments impacting Ryanair's growth outlook, consistent monitoring of financial news, analyst reports, and company announcements is essential. Analyzing Ryanair's future performance is crucial for investors to make informed decisions about their portfolios.

Featured Posts

-

Examining The Potential For A Resurgence Of American Factory Jobs

May 20, 2025

Examining The Potential For A Resurgence Of American Factory Jobs

May 20, 2025 -

Mia Deyteri Eykairia I Martha Antimetopizei Ta Tampoy Toy Gamoy

May 20, 2025

Mia Deyteri Eykairia I Martha Antimetopizei Ta Tampoy Toy Gamoy

May 20, 2025 -

4eme Pont D Abidjan Delais Cout Et Depenses Explications Claires

May 20, 2025

4eme Pont D Abidjan Delais Cout Et Depenses Explications Claires

May 20, 2025 -

Exploring The World Of Agatha Christies Poirot Novels Adaptations And Legacy

May 20, 2025

Exploring The World Of Agatha Christies Poirot Novels Adaptations And Legacy

May 20, 2025 -

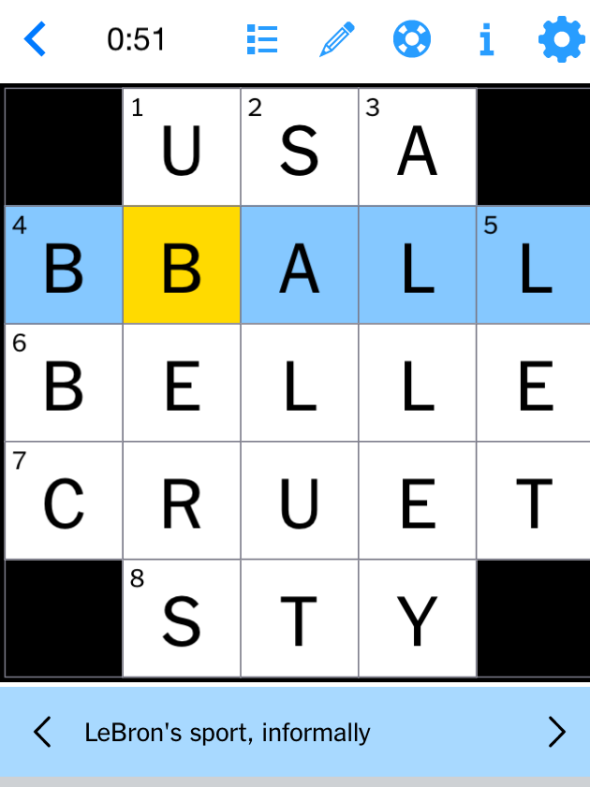

Solve The Nyt Mini Crossword April 2nd Answers

May 20, 2025

Solve The Nyt Mini Crossword April 2nd Answers

May 20, 2025

Latest Posts

-

Why Buy This Ai Quantum Computing Stock During A Dip

May 20, 2025

Why Buy This Ai Quantum Computing Stock During A Dip

May 20, 2025 -

Big Bear Ai Bbai A Deep Dive Into Penny Stock Investment

May 20, 2025

Big Bear Ai Bbai A Deep Dive Into Penny Stock Investment

May 20, 2025 -

1 Reason To Buy This Ai Quantum Computing Stock Now

May 20, 2025

1 Reason To Buy This Ai Quantum Computing Stock Now

May 20, 2025 -

Market Reaction To D Wave Quantum Qbts On Thursday Understanding The Downturn

May 20, 2025

Market Reaction To D Wave Quantum Qbts On Thursday Understanding The Downturn

May 20, 2025 -

Big Bear Ai Bbai Q1 Results Send Shares Down

May 20, 2025

Big Bear Ai Bbai Q1 Results Send Shares Down

May 20, 2025