Market Reaction To D-Wave Quantum (QBTS) On Thursday: Understanding The Downturn

Table of Contents

Analyzing the Factors Contributing to QBTS Stock Decline

Several factors likely contributed to the decline in QBTS stock price on Thursday. Let's examine the key elements that influenced investor sentiment.

Disappointing Earnings Report

D-Wave Quantum's Thursday earnings report fell short of expectations, triggering a negative market reaction. The report revealed several key shortcomings that impacted investor confidence:

- Missed Revenue Targets: The company missed its projected revenue targets for the quarter, failing to meet analysts' consensus estimates. Specific figures detailing the shortfall should be included here (replace with actual data when available).

- Lower-than-Expected Guidance: The company's guidance for the upcoming quarter also disappointed investors, suggesting continued challenges in achieving revenue growth. Again, concrete numbers are needed here (replace with actual data when available).

- Increased Operating Expenses: Higher-than-anticipated operating expenses further dampened investor enthusiasm, indicating potential inefficiencies in the company's operations. (Replace with actual data when available).

Keywords: QBTS earnings, revenue, guidance, financial results, operating expenses.

Wider Market Sentiment and Sector Performance

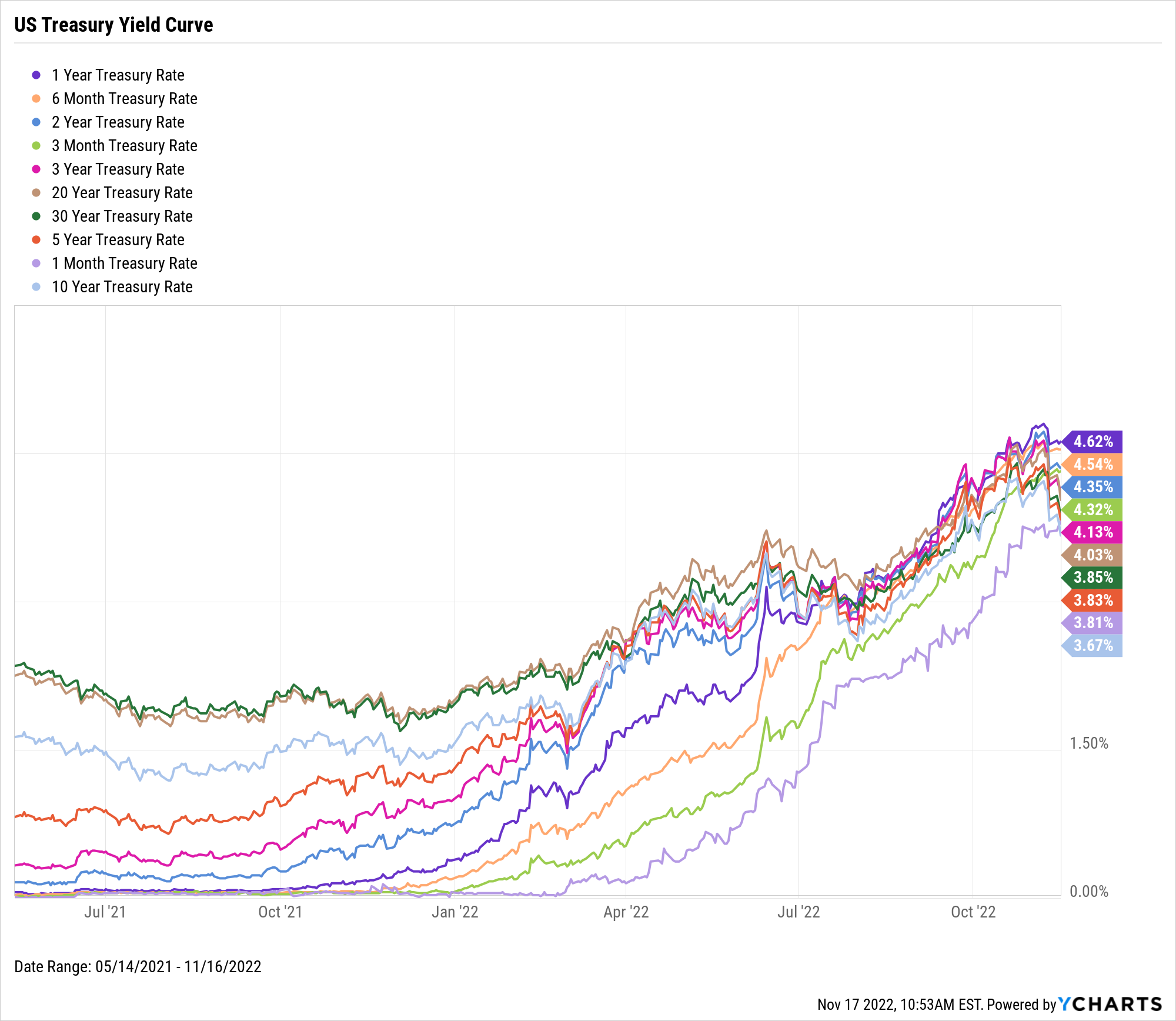

The overall market sentiment and the performance of the technology sector on Thursday also played a role in QBTS's downturn. A broader market sell-off, driven by [mention specific macroeconomic factors, e.g., rising interest rates, inflation concerns], could have exacerbated the negative impact of the earnings report. This created a negative environment for even well-performing stocks, let alone those already facing challenges like QBTS.

Keywords: market volatility, technology sector, macroeconomic factors, investor sentiment, market sell-off.

Competition in the Quantum Computing Space

The quantum computing industry is highly competitive, and D-Wave faces pressure from established tech giants and emerging startups. Recent announcements from competitors, such as [mention specific competitors and their announcements], might have further influenced investor perception of QBTS's market position and future prospects. The increasing pace of technological advancements in this field creates a dynamic and challenging environment.

Keywords: quantum computing competition, industry rivals, technological advancements, competitive landscape.

Analyst Ratings and Price Target Revisions

Following the disappointing earnings report, several analysts revised their ratings and price targets for QBTS. [Insert specific examples of analyst actions and quotes here, if available]. These negative revisions further contributed to the sell-off, reinforcing the bearish sentiment among investors.

Keywords: analyst ratings, price target, buy/sell recommendations, analyst revisions.

Impact on Investors and Future Outlook for QBTS

The stock drop has significant implications for investors, both in the short and long term.

Short-Term Implications

The immediate consequence of the QBTS stock price decline is substantial losses for investors who held the stock. The potential for further short-term volatility remains high, depending on future announcements and market conditions. Investors need to carefully assess their risk tolerance and consider diversification strategies.

Keywords: short-term investment, volatility, risk assessment, short-term losses.

Long-Term Growth Potential

Despite the recent setback, the long-term prospects for D-Wave Quantum and the quantum computing industry remain positive. The potential for groundbreaking technological breakthroughs and market expansion in the coming years offers significant opportunities for long-term investors. However, success hinges on D-Wave’s ability to overcome its current challenges, innovate effectively, and secure a strong market position.

Keywords: long-term investment, growth potential, future technology, market expansion, long-term prospects.

Conclusion: Understanding the QBTS Downturn and Next Steps

The D-Wave Quantum (QBTS) stock price decline on Thursday was a multifaceted event, driven by a disappointing earnings report, broader market conditions, competitive pressures, and negative analyst sentiment. Understanding these interconnected factors is crucial for investors. Remember that evaluating investments requires a thorough analysis of earnings reports, market conditions, and competitive landscapes. While the short-term outlook may appear uncertain, the long-term potential of the quantum computing sector remains significant. Stay informed about D-Wave Quantum (QBTS) and the quantum computing market by following relevant news and conducting your own research before making any investment decisions. Consider further investigation into D-Wave Quantum stock, performing your own QBTS analysis, and carefully assessing the risks before engaging in quantum computing investment.

Featured Posts

-

Miami Hedge Fund Executives Us Ban Accusations Of Lying To Immigration Officials

May 20, 2025

Miami Hedge Fund Executives Us Ban Accusations Of Lying To Immigration Officials

May 20, 2025 -

Former Aew Star Rey Fenix Debuts On Smack Down His Wwe Ring Name

May 20, 2025

Former Aew Star Rey Fenix Debuts On Smack Down His Wwe Ring Name

May 20, 2025 -

Kcrg Tv 9 10 Minnesota Twins Games On The Family Of Channels

May 20, 2025

Kcrg Tv 9 10 Minnesota Twins Games On The Family Of Channels

May 20, 2025 -

Sell America Moodys 30 Year Yield Hike To 5 And What It Means

May 20, 2025

Sell America Moodys 30 Year Yield Hike To 5 And What It Means

May 20, 2025 -

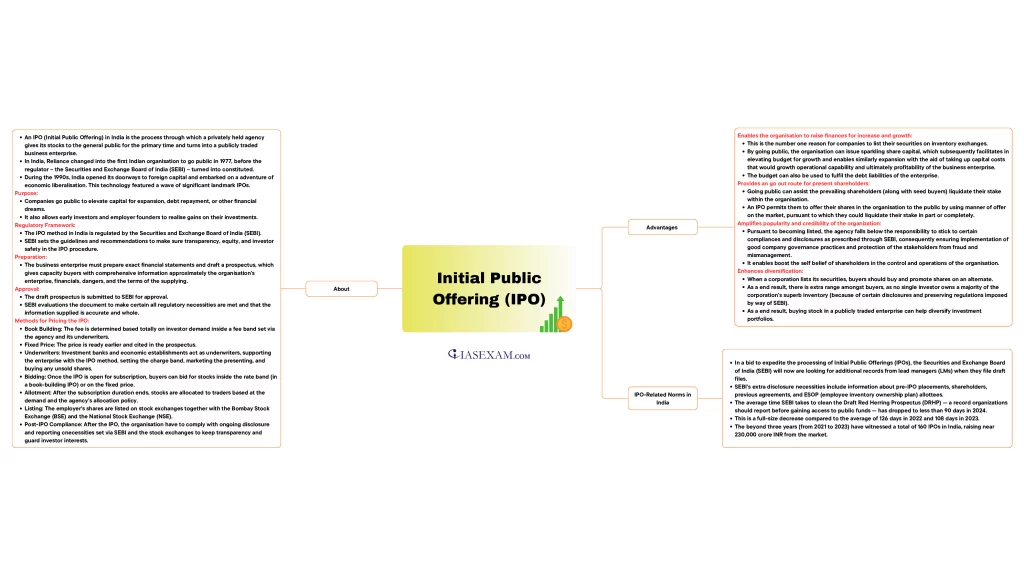

584 Million Dubai Holding Expands Reit Initial Public Offering

May 20, 2025

584 Million Dubai Holding Expands Reit Initial Public Offering

May 20, 2025

Latest Posts

-

Honest Review Young Playwrights Watercolor Themed Play

May 21, 2025

Honest Review Young Playwrights Watercolor Themed Play

May 21, 2025 -

A Realistic Look At A Young Playwrights Watercolor Inspired Script

May 21, 2025

A Realistic Look At A Young Playwrights Watercolor Inspired Script

May 21, 2025 -

Watercolor Script Review A Promising New Playwright

May 21, 2025

Watercolor Script Review A Promising New Playwright

May 21, 2025 -

Espns Insight Decisive Moves Shaping The Boston Bruins Future

May 21, 2025

Espns Insight Decisive Moves Shaping The Boston Bruins Future

May 21, 2025 -

Review Is This Young Playwrights Watercolor Script A Success

May 21, 2025

Review Is This Young Playwrights Watercolor Script A Success

May 21, 2025