Ripple's XRP: Navigating The ETF Landscape And SEC Scrutiny

Table of Contents

The SEC's Case Against Ripple and its Impact on XRP's Future

Understanding the SEC's Allegations:

The SEC's lawsuit alleges that XRP is an unregistered security, significantly impacting its trading and potential for mainstream adoption. This classification carries substantial weight, potentially altering how investors perceive and interact with the cryptocurrency.

- Key arguments of the SEC lawsuit: The SEC argues that Ripple sold XRP as an unregistered security through various unregistered offerings, violating federal securities laws. They claim XRP functioned as an investment contract, promising investors future profits based on Ripple's efforts.

- Implications of the SEC’s classification of XRP as a security: If the court rules in favor of the SEC, it could severely restrict XRP's trading, leading to delisting from major exchanges and hindering its accessibility to investors. This could also negatively impact Ripple's business operations and future development.

- Potential penalties and consequences for Ripple: Depending on the court's decision, Ripple could face substantial fines, and its executives could face individual penalties. The outcome could set a significant precedent for the broader cryptocurrency industry.

Ripple's Defense and Ongoing Legal Battles:

Ripple has vigorously defended itself against the SEC's allegations, employing various legal strategies. They argue that XRP is a currency, not a security, and that its sales did not constitute an investment contract.

- Key legal wins or setbacks for Ripple: The case has seen several significant developments, including expert testimony and the submission of various documents. The court's rulings on specific motions have influenced the market sentiment surrounding XRP. Closely monitoring these developments is crucial.

- Potential outcomes of the ongoing litigation and their impact on XRP’s price: The outcome of the SEC lawsuit will significantly influence XRP's price. A victory for Ripple could potentially boost its price considerably, while an SEC win could lead to a sharp decline.

The Ripple Case's Broader Implications for the Crypto Industry:

The SEC's case against Ripple has far-reaching implications for the entire cryptocurrency industry. The outcome will set a significant precedent for how other cryptocurrencies are regulated.

- How the Ripple case affects the regulatory clarity for the crypto industry: The case is testing the boundaries of securities law as it applies to cryptocurrencies. A clear ruling will provide much-needed guidance to other projects and exchanges.

- Potential impact on future crypto projects and their fundraising efforts: The outcome could influence how future crypto projects conduct their token sales and fundraising efforts, potentially leading to stricter compliance measures.

XRP and the ETF Landscape: Potential and Challenges

The Appeal of an XRP ETF:

The potential listing of XRP in an ETF is highly attractive to investors. An ETF provides several key benefits:

- Potential benefits for investors: Increased liquidity, lower trading costs, simplified investment processes, and increased accessibility to institutional investors.

- How an ETF would facilitate wider adoption of XRP: An ETF listing could lead to increased institutional investment, significantly boosting XRP's legitimacy and adoption.

Regulatory Hurdles to XRP ETF Approval:

Several regulatory hurdles stand in the way of XRP ETF approval. The SEC's stance on XRP as a potential security is a major obstacle.

- Specific SEC regulations that impact ETF applications: The SEC's scrutiny of XRP, along with other regulations concerning investment products and the prevention of market manipulation, will influence the approval process.

- Steps involved in the ETF approval process: An ETF application undergoes a rigorous review process, involving detailed documentation, market analysis, and SEC approval.

- Potential scenarios for ETF approval or rejection: Approval hinges heavily on the outcome of the SEC lawsuit and the SEC’s assessment of XRP’s regulatory status. Rejection could stem from concerns about market manipulation or XRP’s classification as a security.

Comparing XRP to other Cryptocurrencies in the ETF Context:

Comparing XRP to Bitcoin and Ethereum reveals key differences in their regulatory status and market position, influencing their respective ETF prospects.

- XRP's regulatory status compared to other cryptocurrencies: Bitcoin and Ethereum generally have more established regulatory landscapes, although they still face uncertainty.

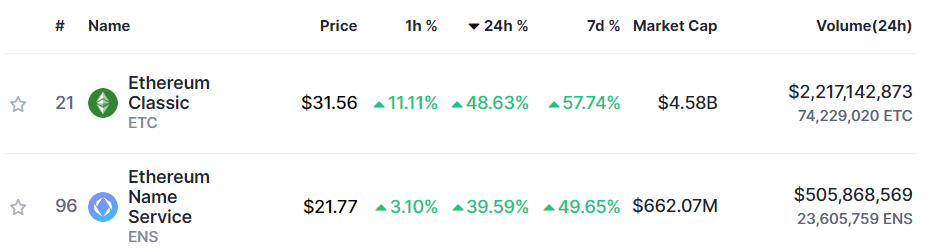

- Market capitalization and trading volume of XRP: While significant, XRP’s market capitalization and trading volume are smaller than Bitcoin and Ethereum, impacting its ETF appeal.

- Key factors influencing ETF listing decisions: Factors such as market capitalization, trading volume, regulatory clarity, and overall market stability influence ETF approval decisions.

Investing in XRP Amidst Uncertainty: Strategies and Considerations

Risk Assessment and Diversification:

Investing in XRP carries substantial risk due to its high volatility and regulatory uncertainty.

- High volatility of XRP: XRP's price has historically been highly volatile, susceptible to significant price swings.

- Risks associated with regulatory uncertainty: The ongoing SEC lawsuit creates significant uncertainty surrounding XRP's future.

- Strategies for mitigating investment risk: Diversification is crucial, spreading your investment across various asset classes to reduce overall portfolio risk.

Due Diligence and Research:

Before investing in XRP, thorough research is essential.

- Reliable sources for information: Consult reputable financial news sources, industry experts, and official documentation.

- Understanding the technology and market dynamics behind XRP: Understand the underlying technology, its use cases, and its competitive landscape.

Long-Term vs. Short-Term Investment Strategies:

Your investment strategy should align with your risk tolerance and financial goals.

- Advantages and disadvantages of long-term and short-term XRP investment strategies: Long-term strategies offer the potential for higher returns but involve greater risk, while short-term strategies offer lower risk but potentially lower returns.

- Potential return scenarios under different market conditions: Consider potential scenarios, including the positive and negative impacts of the SEC lawsuit and ETF approval or rejection.

Conclusion:

The future of XRP remains intertwined with the outcome of the SEC lawsuit and the potential for ETF approval. While regulatory uncertainty persists, the potential rewards of investing in XRP are considerable. Understanding the ongoing legal battles, the challenges of ETF listing, and the associated risks is crucial for informed investment decisions. By carefully considering the information presented, investors can navigate the complex landscape surrounding Ripple's XRP and make strategic choices aligned with their risk tolerance and financial goals. Continue to stay updated on the latest developments concerning Ripple’s XRP and the evolving regulatory environment to make well-informed investment decisions.

Featured Posts

-

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025 -

Rising Taiwan Dollar Implications For Economic Policy

May 08, 2025

Rising Taiwan Dollar Implications For Economic Policy

May 08, 2025 -

Zuckerbergs Leadership In A Trump Era America

May 08, 2025

Zuckerbergs Leadership In A Trump Era America

May 08, 2025 -

Bitcoin Mining Profits Surge Understanding This Weeks Increase

May 08, 2025

Bitcoin Mining Profits Surge Understanding This Weeks Increase

May 08, 2025 -

Boston Celtics Coach Provides Jayson Tatum Wrist Injury Update

May 08, 2025

Boston Celtics Coach Provides Jayson Tatum Wrist Injury Update

May 08, 2025