Rising Taiwan Dollar: Implications For Economic Policy

Table of Contents

Impact on Exports

A stronger TWD significantly impacts Taiwan's export-oriented economy.

Reduced Competitiveness

A rising Taiwan dollar makes Taiwanese exports more expensive in global markets, reducing their competitiveness. This leads to:

- Increased pricing pressure on manufacturers: Businesses face the difficult choice of absorbing higher costs, reducing profit margins, or passing the increased costs onto consumers, potentially losing market share.

- Potential loss of market share to competitors with weaker currencies: Countries with depreciating currencies gain a price advantage, making their products more attractive to international buyers. This necessitates a proactive response from Taiwanese businesses.

- Need for strategies to offset the impact of currency fluctuations: Businesses must develop strategies to mitigate the negative impacts of a strong TWD, including hedging strategies and diversification.

Diversification Strategies

To counter the challenges posed by a strong TWD, Taiwanese businesses need to adopt diversification strategies:

- Targeting new markets with higher demand for Taiwanese goods: Exploring new markets less sensitive to price fluctuations can help reduce reliance on existing export destinations.

- Developing higher value-added products to command premium prices: Focusing on innovation and producing high-quality, specialized goods can help offset higher prices. This requires significant investment in research and development (R&D).

- Investing in R&D to maintain technological edge: Maintaining a competitive advantage through technological innovation is crucial to command premium prices and reduce vulnerability to currency fluctuations.

Influence on Imports

The rising Taiwan dollar also significantly influences import dynamics.

Cheaper Imports

A stronger TWD makes imports cheaper, offering several potential benefits:

- Reduced costs for raw materials and intermediate goods: This can lower production costs for Taiwanese businesses, boosting their competitiveness in the long run.

- Increased consumer purchasing power: Lower import prices translate into lower consumer prices, increasing disposable income and stimulating domestic consumption.

- Potential for increased competition from foreign goods: Cheaper imports can intensify competition in the domestic market, potentially squeezing profit margins for local businesses.

Inflationary Pressures (or lack thereof)

While cheaper imports are generally beneficial, they can also create challenges:

- Impact on domestic producers and their pricing strategies: Domestic producers may struggle to compete with cheaper imports, potentially leading to reduced output or even business closures.

- Need for government policies to support domestic industries: Government intervention, such as targeted subsidies or other support measures, might be needed to protect domestic industries.

- Potential trade-offs between consumer benefits and domestic industry health: Policymakers face the complex task of balancing the benefits of cheaper imports for consumers with the need to support domestic industries.

Implications for Monetary Policy

The Central Bank of Taiwan (CBT) plays a crucial role in managing the impact of the rising TWD.

Central Bank Intervention

The CBT may intervene in the foreign exchange market to manage the TWD's appreciation, aiming to:

- Methods of intervention: This could involve buying foreign currencies to increase the supply of TWD or adjusting interest rates to influence capital flows.

- Challenges in managing currency movements effectively: Predicting and controlling currency movements is complex, and interventions can have unintended consequences.

- Balancing competing goals of inflation control, exchange rate stability and economic growth: The CBT must carefully weigh these competing objectives when formulating monetary policy.

Interest Rate Adjustments

Interest rate adjustments are another tool the CBT can utilize:

- Considerations for interest rate policy in the context of a rising TWD: Raising interest rates can attract foreign investment and increase demand for the TWD, but it can also slow down economic growth.

- Impact on domestic investment and economic activity: Interest rate changes have a significant impact on domestic investment and economic activity, requiring careful consideration.

- Potential trade-offs between exchange rate stability and economic growth: The CBT must balance the need for exchange rate stability with the need to support economic growth.

Impact on Foreign Investment

The strengthening TWD also impacts foreign investment flows into Taiwan.

Reduced Returns

A stronger TWD can reduce the returns for foreign investors, potentially affecting investment decisions:

- Impact on foreign direct investment (FDI): Companies may reconsider investments in Taiwan if returns are reduced due to currency appreciation.

- Attracting foreign investment despite currency appreciation: Taiwan needs to emphasize other competitive advantages beyond currency, such as skilled labor, robust infrastructure, and a stable political environment.

- Competitive advantage of Taiwan beyond currency alone: Highlighting these strengths is crucial for attracting foreign investment despite currency fluctuations.

Portfolio Investment

Portfolio investment flows are also sensitive to currency movements:

- Managing portfolio investment volatility: Fluctuations in portfolio investment can create instability, requiring careful management.

- Attracting long-term investors despite short-term currency movements: Focusing on long-term growth prospects can help attract investors who are less sensitive to short-term currency fluctuations.

- Building investor confidence in the Taiwanese economy: Maintaining a stable and predictable economic environment is crucial for building investor confidence.

Conclusion

The rising Taiwan dollar presents a complex interplay of challenges and opportunities for Taiwan's economy. Navigating this requires a nuanced approach to economic policy, balancing the needs of exporters, consumers, and foreign investors. Strategies for diversification, innovation, and strengthening domestic competitiveness are crucial. Continuous monitoring of the Taiwan dollar's movement and its impact on various sectors is essential for effective policymaking. Understanding the implications of the rising Taiwan dollar is paramount for long-term economic planning and ensuring sustainable and inclusive growth for Taiwan.

Featured Posts

-

The Hunger Games Directors Stephen King Horror Movie A 2025 Release

May 08, 2025

The Hunger Games Directors Stephen King Horror Movie A 2025 Release

May 08, 2025 -

Neymar Convocado Brasil Vs Argentina En El Monumental Por Eliminatorias

May 08, 2025

Neymar Convocado Brasil Vs Argentina En El Monumental Por Eliminatorias

May 08, 2025 -

Psl 10 Ticket Sales Begin Today

May 08, 2025

Psl 10 Ticket Sales Begin Today

May 08, 2025 -

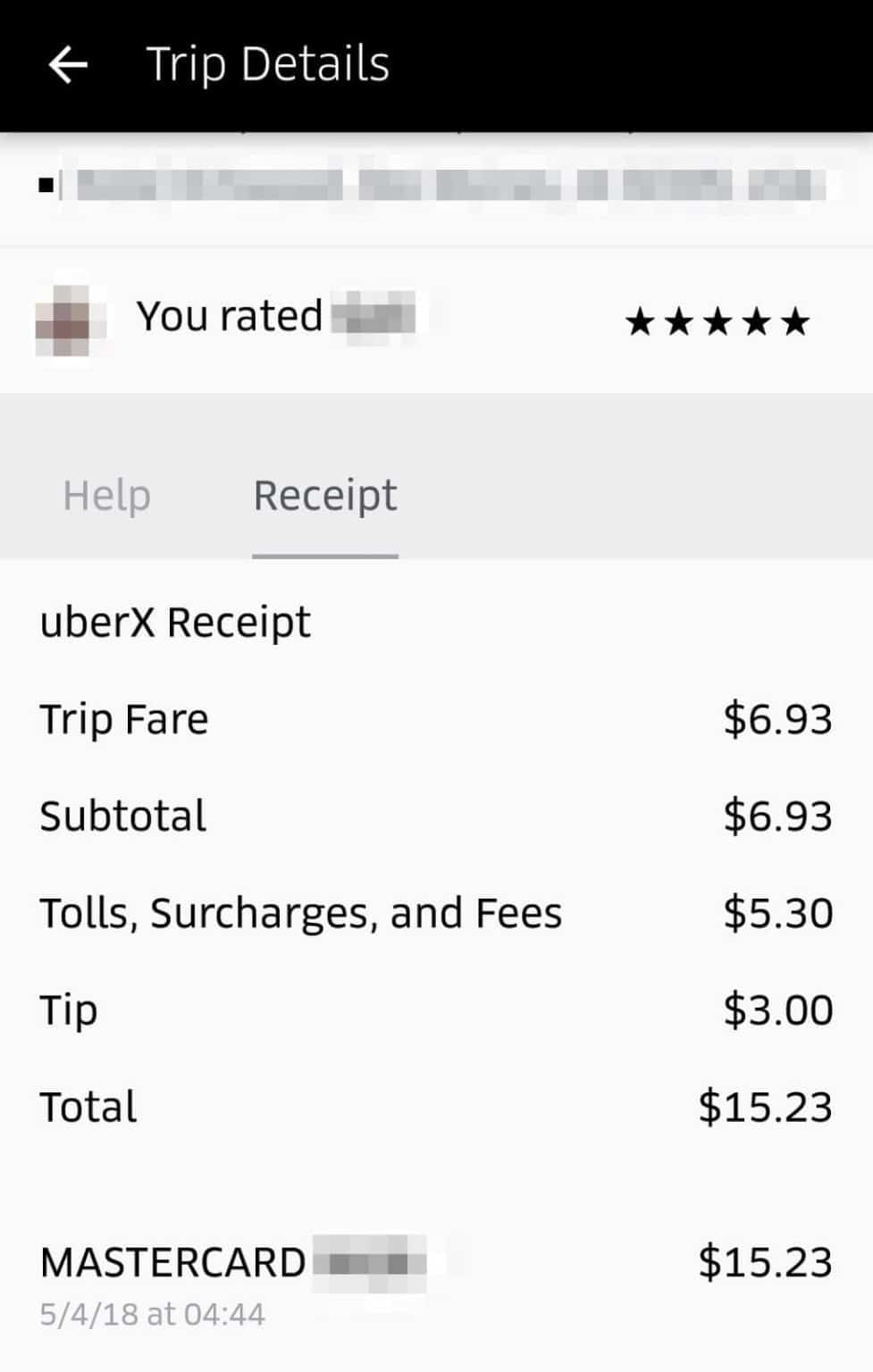

Kenya Welcomes Uber One All You Need To Know About The Membership

May 08, 2025

Kenya Welcomes Uber One All You Need To Know About The Membership

May 08, 2025 -

Ravens De Andre Hopkins Signing What It Means For The Offense

May 08, 2025

Ravens De Andre Hopkins Signing What It Means For The Offense

May 08, 2025