Ripple Vs SEC: XRP Price Action And The Potential For A US ETF Approval

Table of Contents

The Ripple vs SEC Lawsuit: A Deep Dive

At the heart of the matter lies the SEC's claim that Ripple's sale of XRP constituted an unregistered securities offering, violating federal securities laws. The SEC argues that XRP functions as an investment contract, promising investors a profit based on Ripple's efforts. This is a crucial distinction, as securities require registration with the SEC before being offered to the public.

Ripple, on the other hand, vehemently denies these allegations. Their defense centers on the argument that XRP is a decentralized digital asset, operating independently of Ripple's actions and not meeting the Howey Test definition of a security. They contend that XRP is primarily used as a functional currency within a decentralized ecosystem.

Key Dates and Rulings:

- 2020: The SEC files its lawsuit against Ripple.

- 2022: A partial summary judgment favors Ripple on certain aspects of the case, impacting the classification of XRP sales to institutional investors.

- July 2023: Judge Analisa Torres issues a final ruling on the case, concluding that programmatic sales of XRP were not securities, and that sales to institutional investors constituted securities.

The potential outcomes range from a complete dismissal of the SEC's case to significant fines and restrictions on Ripple's operations. The implications for crypto regulation and the future of XRP are profound. Related keywords: Ripple lawsuit, SEC lawsuit, XRP lawsuit, crypto regulation, securities law.

XRP Price Action and Market Sentiment

XRP's price has been highly sensitive to developments in the Ripple vs SEC lawsuit. Major legal announcements have frequently triggered significant price swings. Positive news tends to boost investor confidence, leading to price increases, while negative news can cause sharp drops.

Historical Price Fluctuations:

- Pre-lawsuit: XRP enjoyed periods of substantial growth.

- During the lawsuit: XRP experienced significant volatility, often plummeting on negative news and recovering on positive developments.

- Post-partial summary judgment: Initial price movements suggested a mixed reaction from the market, reflecting both positive and negative interpretations of the ruling.

Market sentiment plays a crucial role. Investor confidence and fear surrounding regulatory uncertainty significantly impact trading volumes and price fluctuations. Related keywords: XRP price prediction, XRP price chart, XRP market cap, cryptocurrency trading, crypto investment.

Impact on Institutional Investors and Trading Volumes

The legal uncertainty surrounding XRP significantly impacted institutional investment. Many large firms hesitated to invest heavily due to the risk of regulatory action. This hesitancy translated into lower trading volumes on major crypto exchanges compared to other assets with clearer regulatory pathways.

However, a resolution to the lawsuit, regardless of the outcome, could unlock significant potential for increased institutional adoption. Clarity on XRP's regulatory status could encourage institutional investors to re-evaluate their exposure to the asset. This could lead to substantial increases in trading volume and market liquidity. Related keywords: institutional investors, crypto exchanges, trading volume, market liquidity.

The Potential for US XRP ETF Approval

The approval of a US XRP ETF hinges significantly on the outcome of the Ripple vs SEC lawsuit. A favorable ruling for Ripple could pave the way for ETF applications, while an unfavorable ruling might significantly delay or even prevent approval. The SEC's stance on XRP's classification as a security will be a primary determinant.

Potential Impacts of an XRP ETF:

- Increased liquidity and accessibility: An ETF would make XRP more accessible to a wider range of investors.

- Price stability: Increased trading volume through an ETF could potentially lead to greater price stability.

- Market capitalization growth: Increased investment could boost XRP's market capitalization.

However, potential drawbacks include increased regulatory scrutiny and the possibility of market manipulation. A comparison with the path of Bitcoin ETF approvals provides valuable context and insight. Related keywords: XRP ETF, Bitcoin ETF, cryptocurrency ETF, SEC ETF approval, exchange-traded fund.

The Broader Implications for Crypto Regulation in the US

The Ripple vs SEC case has far-reaching implications for the entire US cryptocurrency landscape. The outcome will set a precedent for how the SEC approaches the classification of other crypto assets. It will influence the regulatory clarity (or lack thereof) for other projects and shape future regulatory frameworks. The decision will also have implications for investor protection and market stability, impacting the development of a robust and transparent crypto market in the US. Related keywords: crypto regulation, US crypto regulations, regulatory clarity, crypto legal framework.

Conclusion: Ripple vs SEC: Understanding the Future of XRP

The Ripple vs SEC lawsuit has undeniably shaped XRP's price action and its trajectory. The outcome will profoundly impact not only XRP's future but also the broader landscape of crypto regulation in the US. While predicting XRP's price with certainty remains impossible, understanding the nuances of the case and its potential implications is crucial for informed investment decisions. Continue researching the "Ripple vs SEC" case and its impact on XRP price and potential ETF approval. Make informed decisions regarding your investment in XRP, considering both its potential and inherent risks.

Featured Posts

-

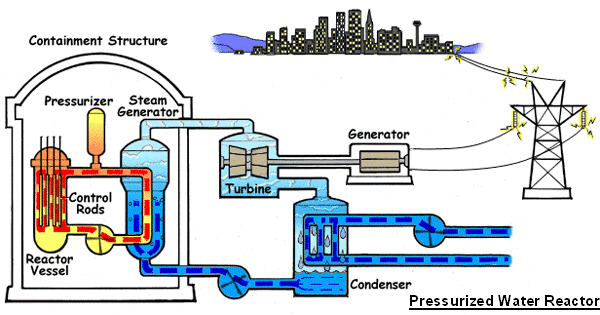

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025 -

Veteran Actress Priscilla Pointer Passes Away At Age 100

May 01, 2025

Veteran Actress Priscilla Pointer Passes Away At Age 100

May 01, 2025 -

Dragons Den Preparing Your Pitch For Success

May 01, 2025

Dragons Den Preparing Your Pitch For Success

May 01, 2025 -

Rambo First Blood Director Ted Kotcheff Dies At 94

May 01, 2025

Rambo First Blood Director Ted Kotcheff Dies At 94

May 01, 2025 -

Xrp Rally Us Presidents Article On Trump And Ripple Sends Xrp Higher

May 01, 2025

Xrp Rally Us Presidents Article On Trump And Ripple Sends Xrp Higher

May 01, 2025

Latest Posts

-

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025 -

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

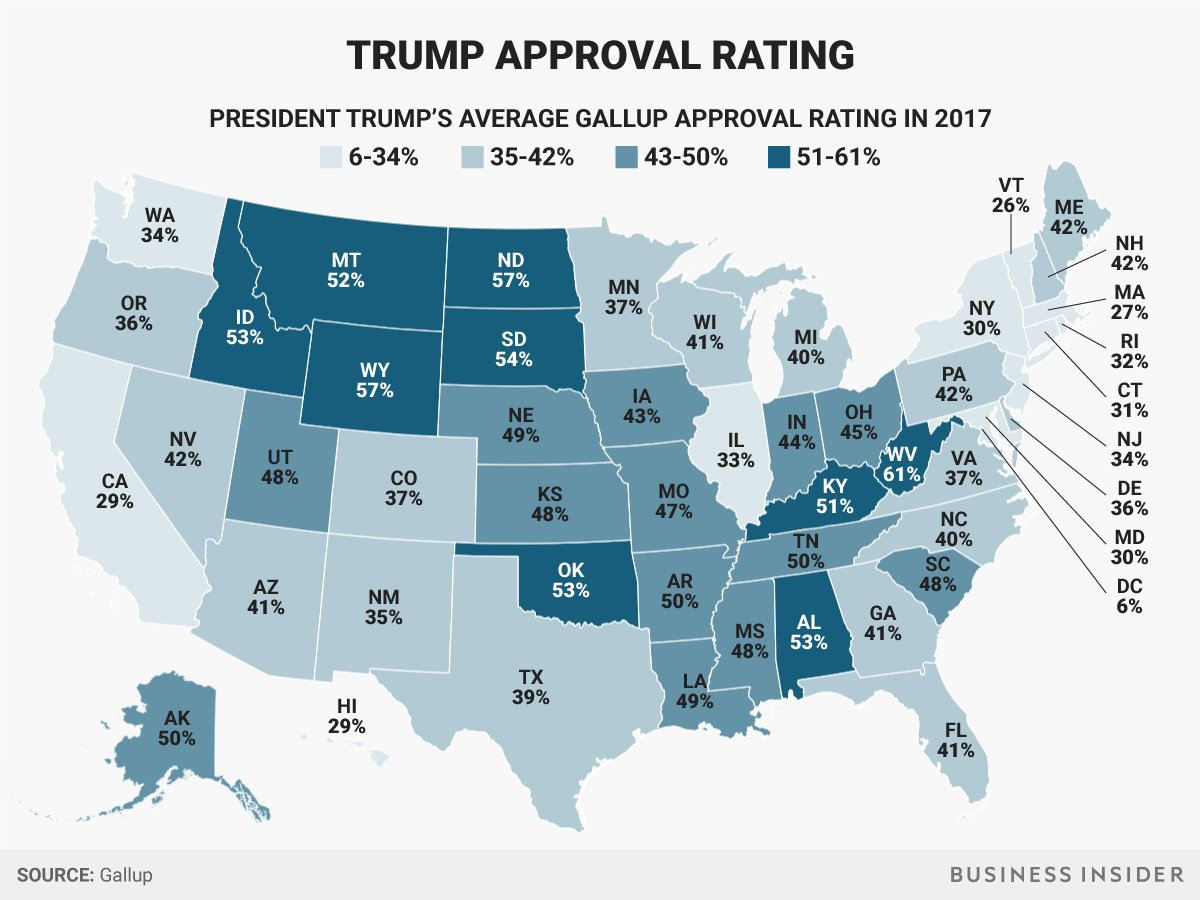

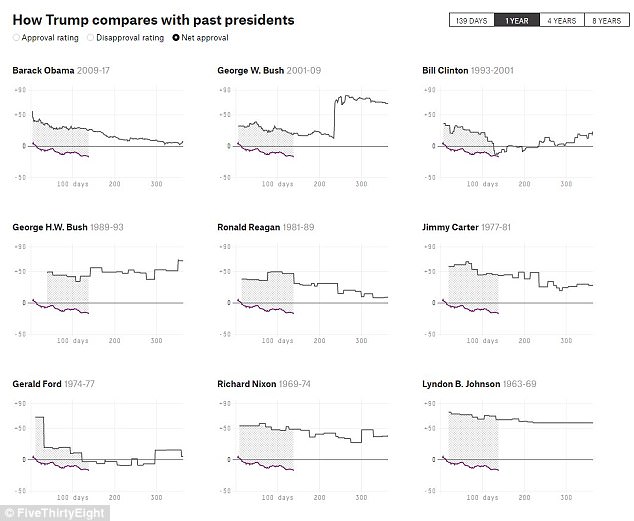

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025 -

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025