Retail Sales Surge Pushes Back Bank Of Canada Rate Cut

Table of Contents

Strong Retail Sales Figures Exceed Expectations

Analyzing the Data

The latest retail sales figures have significantly exceeded expectations, painting a picture of a more resilient Canadian economy than previously anticipated. Data released [insert date and source of data] revealed a [insert percentage]% increase in retail sales compared to the previous month and a [insert percentage]% increase year-over-year. This represents a substantial upward revision from previous forecasts.

- Specific retail sectors driving the growth: The automotive sector saw a particularly strong performance, with a [insert percentage]% increase, fueled by [mention specific factors like new car sales or used car market trends]. The clothing and apparel sector also experienced robust growth at [insert percentage]%, possibly driven by [mention seasonal factors or trends].

- Geographical distribution of the sales increase: The growth appears to be relatively widespread across the country, with [mention specific regions and their performance]. However, [mention any regions that underperformed and the potential reasons].

Keywords: Retail sales growth, economic indicators, Canadian economic data.

Factors Contributing to the Sales Boom

Several factors likely contributed to this unexpected sales boom:

- Increased consumer spending: Government stimulus measures implemented earlier this year may have played a role in boosting consumer confidence and disposable income, leading to increased spending. Improved labor market conditions also contributed to this trend.

- Inflationary pressures: While inflation remains a concern, the current rate hasn't significantly dampened consumer spending. In fact, some argue that consumers are preemptively purchasing goods in anticipation of further price increases.

- Seasonal factors: Certain seasonal factors, such as [mention specific seasonal events or periods affecting sales], may have contributed to the higher-than-expected figures.

Keywords: Consumer spending, inflation, consumer confidence, economic recovery.

Implications for Bank of Canada Monetary Policy

Delayed Rate Cut

The robust retail sales data significantly alters the outlook for the Bank of Canada's monetary policy. The unexpected strength of the economy makes a rate cut less likely in the near term. The Bank is likely to prioritize inflation control, given the current rate and its potential trajectory.

- The Bank of Canada's mandate: The central bank's primary mandate is to maintain price stability and full employment. The current data suggests that the inflation target may be at risk if interest rates are lowered further.

- Analysis of the current inflation rate: While inflation has shown signs of cooling, it remains above the Bank of Canada's target range. A rate cut could potentially exacerbate inflationary pressures.

- Alternative monetary policy options: Instead of a rate cut, the Bank of Canada may opt for other monetary policy tools, such as [mention potential alternative options, e.g., quantitative easing or forward guidance].

Keywords: Monetary policy, inflation control, interest rate decision, Bank of Canada mandate.

Uncertainty and Future Outlook

Despite the current positive economic indicators, several uncertainties remain:

- Potential risks and vulnerabilities: The Canadian economy is not without vulnerabilities. [Mention potential risks, e.g., global economic slowdown, housing market corrections].

- Impact of global economic conditions: Global economic uncertainty could significantly impact Canadian retail sales and overall economic growth. [Mention potential global factors that could influence the Canadian economy].

- Predictions and forecasts: Forecasting future retail sales and interest rate decisions remains challenging given the current economic landscape. Most analysts anticipate [mention current predictions for the future].

Keywords: Economic forecast, future interest rates, economic uncertainty, global economy.

Conclusion: Retail Sales Surge Impacts Bank of Canada's Rate Cut Decision – What's Next?

The unexpected surge in Canadian retail sales has significantly impacted the Bank of Canada's potential for a rate cut. While the strong economic performance is positive, the implications for inflation and future monetary policy decisions remain uncertain. The Bank will need to carefully weigh the risks and benefits before making any decisions about adjusting interest rates. The strength of retail sales underscores the resilience of the Canadian economy but also highlights the ongoing complexities of managing inflation and maintaining economic stability. Stay informed about future Bank of Canada announcements regarding interest rate decisions and follow the latest developments in Canadian retail sales to understand the evolving economic landscape. Keywords: Bank of Canada rate cut, retail sales forecast, Canadian economic outlook.

Featured Posts

-

Atletico Madrid Sevilla Yi 2 1 Yendi Mac Oezeti Ve Analizi

May 26, 2025

Atletico Madrid Sevilla Yi 2 1 Yendi Mac Oezeti Ve Analizi

May 26, 2025 -

Link Nonton Live Moto Gp Inggris Sprint Race Jam 20 00 Wib

May 26, 2025

Link Nonton Live Moto Gp Inggris Sprint Race Jam 20 00 Wib

May 26, 2025 -

Moto Gp Inggris 2025 Hasil Fp 1 Jadwal Lengkap Dan Cara Menonton Di Trans7

May 26, 2025

Moto Gp Inggris 2025 Hasil Fp 1 Jadwal Lengkap Dan Cara Menonton Di Trans7

May 26, 2025 -

Van Der Poel Triumphs Again Milan San Remo Victory

May 26, 2025

Van Der Poel Triumphs Again Milan San Remo Victory

May 26, 2025 -

Tennis Participation Report 25 Million Players Projected Nationwide In 2024

May 26, 2025

Tennis Participation Report 25 Million Players Projected Nationwide In 2024

May 26, 2025

Latest Posts

-

Broadcoms Extreme V Mware Price Increase At And T Highlights 1 050 Cost Jump

May 28, 2025

Broadcoms Extreme V Mware Price Increase At And T Highlights 1 050 Cost Jump

May 28, 2025 -

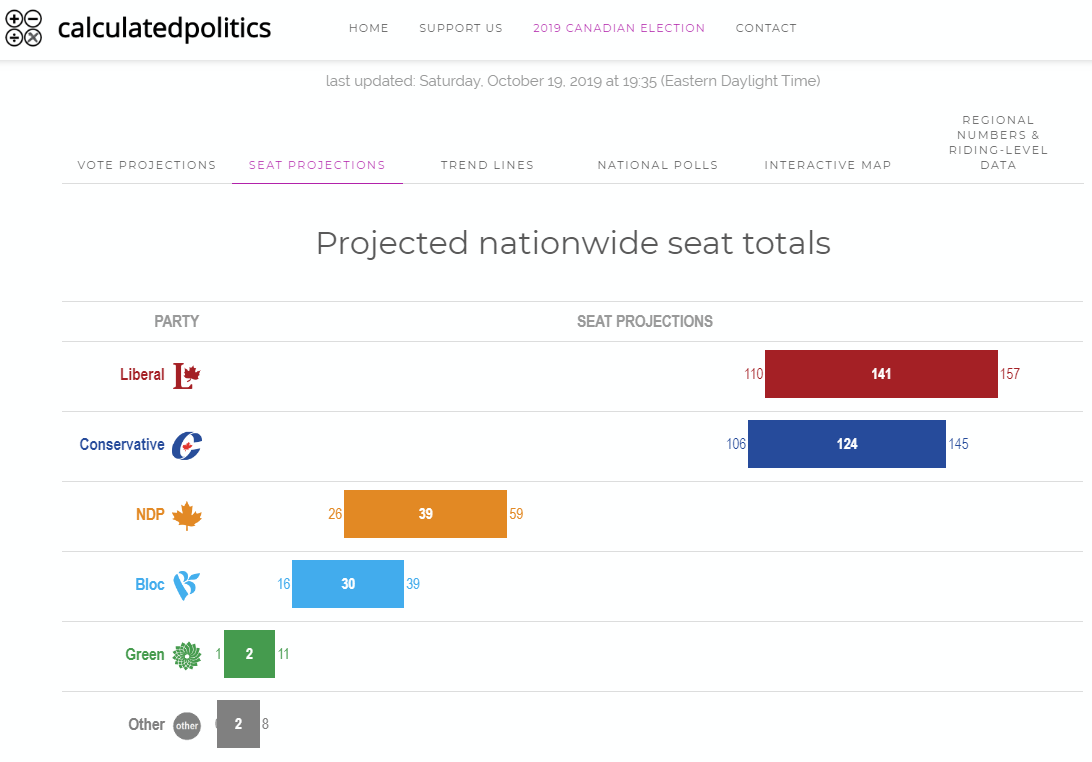

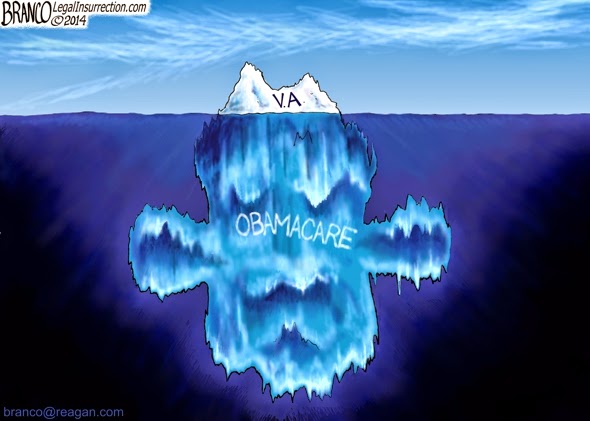

Is Canada Post Just The Tip Of The Iceberg Needed Overhauls Across Federal Institutions

May 28, 2025

Is Canada Post Just The Tip Of The Iceberg Needed Overhauls Across Federal Institutions

May 28, 2025 -

2 Defense Spending Target Ruttes Assessment Of Nato Progress

May 28, 2025

2 Defense Spending Target Ruttes Assessment Of Nato Progress

May 28, 2025 -

Oecd 2025 Forecast Canada To Avoid Recession But Growth Remains Stagnant

May 28, 2025

Oecd 2025 Forecast Canada To Avoid Recession But Growth Remains Stagnant

May 28, 2025 -

100 000 Job Cuts Predicted Td Bank Warns Of Imminent Recession

May 28, 2025

100 000 Job Cuts Predicted Td Bank Warns Of Imminent Recession

May 28, 2025