OECD 2025 Forecast: Canada To Avoid Recession, But Growth Remains Stagnant

Table of Contents

Reasons Behind Canada's Stagnant Growth

The OECD 2025 forecast attributes Canada's stagnant growth to a confluence of factors impacting Canadian economic growth. These interconnected challenges create a complex scenario requiring careful consideration of government policy and private sector adaptation.

-

Persistent Inflation Impacting Consumer Spending and Investment: High inflation continues to erode purchasing power, reducing consumer spending and dampening business investment. The OECD report indicates that inflation remains stubbornly above the Bank of Canada's target, significantly affecting consumer confidence and discretionary spending. This translates to reduced demand for goods and services across various sectors.

-

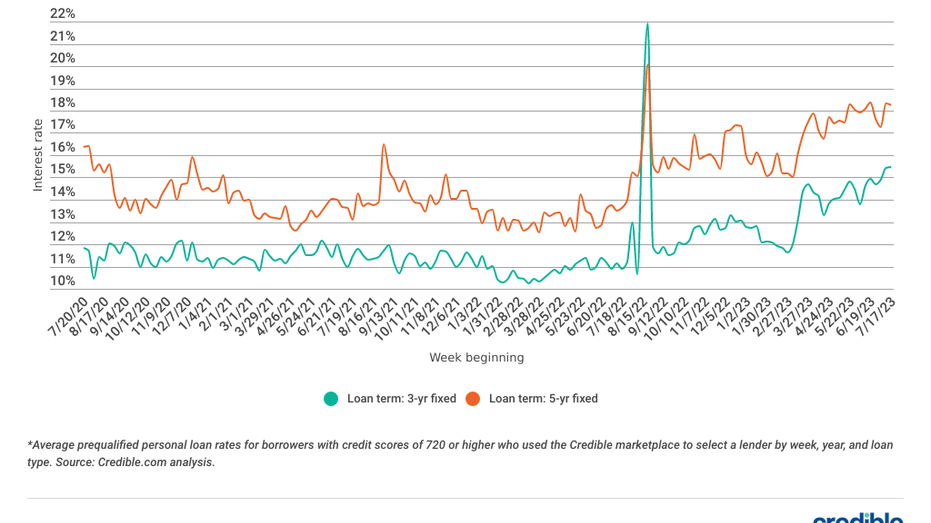

High Interest Rates Dampening Economic Activity: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, have inadvertently slowed down economic activity. Higher borrowing costs make it more expensive for businesses to invest and expand, while consumers face increased mortgage payments and reduced borrowing capacity. This leads to decreased investment in new projects and a general slowdown in economic expansion.

-

Global Economic Slowdown Impacting Canadian Exports: The global economic slowdown is impacting Canada's export-oriented industries. Reduced demand from major trading partners, coupled with increased global uncertainty, is putting pressure on Canadian businesses reliant on international markets. This is particularly relevant for sectors such as manufacturing and resource extraction.

-

Cooling Housing Market Affecting Construction and Related Sectors: The cooling Canadian housing market, after a period of significant growth, is impacting the construction sector and related industries. Decreased housing starts and lower real estate transactions are leading to job losses and reduced economic activity within this crucial segment of the Canadian economy. This ripple effect extends to related industries such as furniture, appliances, and home improvement.

-

Uncertainty Surrounding Global Supply Chains: Persistent disruptions to global supply chains, exacerbated by geopolitical instability, continue to add uncertainty to the Canadian economic outlook. Businesses face challenges in sourcing materials and managing production, leading to increased costs and potential delays. This uncertainty makes long-term planning difficult for businesses of all sizes.

Sectors Most Affected by Stagnant Growth

The OECD 2025 forecast highlights several sectors particularly vulnerable to the projected stagnant growth. Understanding these impacts is critical for businesses and policymakers alike.

-

Potential Job Growth Slowdown in Certain Sectors: The projected slow growth translates to a potential slowdown in job creation across various sectors. Industries heavily reliant on consumer spending, such as retail and hospitality, may experience reduced hiring or even job losses. The Canadian job market is expected to face increased competition for fewer available positions.

-

Impact on the Housing Market and Construction: The cooling housing market will continue to impact the construction industry, potentially leading to job losses and reduced investment in new projects. The ripple effect will be felt throughout the broader economy, impacting related industries and potentially increasing unemployment in the Canadian construction sector.

-

Challenges for the Manufacturing Sector Due to Global Economic Uncertainty: Canada's manufacturing sector faces significant challenges due to the global economic slowdown and increased uncertainty. Reduced demand for exports, supply chain disruptions, and increased input costs are putting pressure on manufacturers' profitability and competitiveness. This could lead to plant closures and job losses within this key sector.

-

Pressure on the Service Sector Due to Reduced Consumer Spending: The service sector, which accounts for a significant portion of the Canadian economy, is likely to face pressure due to reduced consumer spending resulting from high inflation and interest rates. Businesses offering non-essential services may experience declining revenues, impacting profitability and job security. This pressure is particularly evident within hospitality, tourism, and retail services.

Government Response and Policy Implications

The OECD 2025 forecast necessitates a careful assessment of current government policies and potential adjustments to stimulate economic growth. Both fiscal and monetary policies will play critical roles in navigating this period of stagnant growth.

-

Potential Government Measures to Stimulate Economic Growth: The Canadian government may consider implementing fiscal measures to stimulate economic growth, such as targeted tax cuts or increased infrastructure spending. These initiatives aim to boost consumer spending and business investment, thereby counteracting the negative impacts of inflation and high-interest rates.

-

The Role of the Bank of Canada in Managing Interest Rates: The Bank of Canada’s role in managing interest rates will be pivotal in navigating the economic challenges. While interest rate hikes are designed to curb inflation, the central bank must carefully balance the need to control inflation with the potential negative impacts on economic growth and employment. Striking this balance is crucial for economic stability.

-

Analysis of the Current Fiscal Policy and its Effectiveness: A thorough review of current fiscal policies is necessary to assess their effectiveness in addressing the challenges outlined in the OECD forecast. Identifying areas for improvement and potential adjustments is critical for optimizing resource allocation and promoting sustainable economic growth.

-

Discussion on Potential Future Policy Changes: Based on the OECD forecast, the Canadian government may need to adjust its economic policies. This could involve reconsidering fiscal stimulus packages, re-evaluating regulatory frameworks, or exploring innovative solutions to address the specific challenges faced by different sectors.

Conclusion

The OECD 2025 forecast for Canada indicates a mixed outlook: a recession is avoided, but stagnant growth remains a significant concern. Persistent inflation, high interest rates, a global economic slowdown, a cooling housing market, and global supply chain uncertainty all contribute to this projected sluggish growth. Sectors such as manufacturing, construction, and services are expected to experience the most significant challenges. The Canadian government's response, particularly concerning fiscal and monetary policies, will play a critical role in shaping the economic landscape in the coming years. Careful policy adjustments and proactive measures will be crucial in mitigating the negative impacts of stagnant growth and fostering a more resilient Canadian economy.

Call to Action: Stay informed about the evolving Canadian economic landscape and the impact of the OECD 2025 forecast. Follow [Your Website/Source] for continued updates and in-depth analysis of the Canadian economy and future OECD forecasts. Learn more about navigating the challenges of stagnant growth and preparing your business for the economic climate ahead.

Featured Posts

-

Everything You Need To Know About Finance Loans Application Process Interest Rates And More

May 28, 2025

Everything You Need To Know About Finance Loans Application Process Interest Rates And More

May 28, 2025 -

Urgent Appeal Lotto Officials Locate E1 Million Jackpot Winner

May 28, 2025

Urgent Appeal Lotto Officials Locate E1 Million Jackpot Winner

May 28, 2025 -

Roof Collapse In Tucson Firefighters Avoid Serious Injury

May 28, 2025

Roof Collapse In Tucson Firefighters Avoid Serious Injury

May 28, 2025 -

Climate Whiplash Assessing The Risks To Urban Environments

May 28, 2025

Climate Whiplash Assessing The Risks To Urban Environments

May 28, 2025 -

Undefeated In Rome The Champions Unwavering Drive

May 28, 2025

Undefeated In Rome The Champions Unwavering Drive

May 28, 2025