100,000 Job Cuts Predicted: TD Bank Warns Of Imminent Recession

Table of Contents

TD Bank's Recession Prediction: The Details

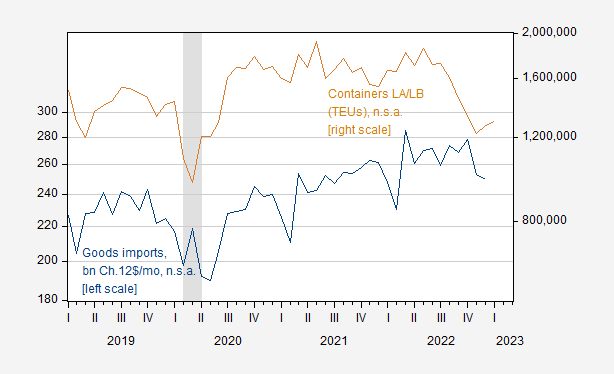

TD Bank's prediction of 100,000 job cuts isn't based on speculation; it's rooted in a careful analysis of several key economic indicators. While the exact number may be debated, the underlying message is clear: a significant economic downturn is looming. The bank's forecast points towards widespread job losses across various sectors, impacting not only large corporations but also small businesses and the self-employed. The reasoning behind their prediction centers on several crucial factors:

- Soaring Inflation: Persistently high inflation rates are eroding consumer purchasing power, leading to decreased consumer spending and impacting business profitability.

- Aggressive Interest Rate Hikes: The Federal Reserve's efforts to curb inflation through aggressive interest rate hikes are slowing economic growth and increasing borrowing costs, making it harder for businesses to invest and expand.

- Weakening Consumer Confidence: A decline in consumer confidence suggests a reduced willingness to spend, further dampening economic activity and increasing the risk of layoffs.

- Global Economic Uncertainty: Geopolitical instability and global supply chain disruptions are adding to the overall economic uncertainty, contributing to the pessimistic outlook.

Unfortunately, a direct link to the original TD Bank report isn't publicly available at this time; however, multiple reputable news sources have reported on the prediction, confirming its significance.

Impact on the Job Market: Sectors at Risk

The predicted 100,000 job cuts will not be evenly distributed across all sectors. Some industries are expected to be hit harder than others. The tech sector, already grappling with layoffs and hiring freezes, is particularly vulnerable. The financial sector, facing increased regulatory scrutiny and reduced profitability, is also at risk. Manufacturing, reliant on consumer spending and global trade, could experience significant job losses.

- Tech Layoffs: Major tech companies have already announced significant layoffs, setting the stage for further job losses in the sector.

- Financial Sector Contraction: Banks and financial institutions are bracing for a potential slowdown, leading to hiring freezes and potential layoffs.

- Manufacturing Slowdown: Decreased consumer demand and global supply chain issues are impacting manufacturing output and employment.

The potential consequences of widespread job losses are far-reaching: increased unemployment rates, decreased consumer confidence, and potential social unrest. The ripple effects of these job cuts could significantly impact the overall economic health.

Economic Implications: Beyond Job Losses

The economic consequences of an imminent recession extend far beyond the 100,000 job cuts predicted by TD Bank. We can expect a domino effect impacting various aspects of the economy:

- Reduced Economic Growth: Widespread job losses will lead to a significant decrease in consumer spending, directly impacting overall economic growth.

- Increased Poverty Rates: Job losses will likely exacerbate existing inequalities and contribute to a rise in poverty rates.

- Housing Market Impact: A potential recession could lead to a decline in housing prices and increased mortgage defaults.

- Government Intervention: Governments may implement fiscal stimulus packages or other interventions to mitigate the impact of the recession. The effectiveness and timing of such measures remain uncertain.

Preparing for a Recession: Practical Advice

Preparing for a potential recession is crucial, both for individuals and businesses. Proactive steps can significantly mitigate the negative impact of an economic downturn.

For Individuals:

- Create a Budget: Track your income and expenses to identify areas where you can cut back.

- Build an Emergency Fund: Aim to have 3-6 months of living expenses saved in an easily accessible account.

- Review Your Debt: Consider consolidating high-interest debt or exploring options for debt management.

- Diversify Investments: Spread your investments across different asset classes to minimize risk.

- Update Your Resume: Being prepared for a job search can significantly reduce stress if layoffs occur.

For Businesses:

- Review Cash Flow: Monitor your cash flow closely and ensure you have sufficient working capital.

- Cut Unnecessary Expenses: Identify and eliminate non-essential expenses to conserve resources.

- Explore Funding Options: Explore various funding options to ensure you have the resources to navigate the downturn.

- Develop a Contingency Plan: Develop a comprehensive plan to address potential challenges and maintain business continuity.

Useful resources from government agencies offering financial assistance can be found online by searching "[Your Country] government financial assistance".

Alternative Perspectives and Criticisms

While TD Bank's prediction of 100,000 job cuts is alarming, it's essential to consider alternative perspectives. Some economists argue that the situation isn't as dire as TD Bank suggests, citing potential factors that could mitigate the impact of a recession. These counterarguments often highlight the resilience of the U.S. economy and the potential for a “soft landing.” Others believe that the job loss prediction might be overly pessimistic.

- Counterarguments: Some economists believe inflation is peaking and interest rate hikes are less severe than anticipated.

- Differing Opinions: Other financial institutions may offer less pessimistic forecasts, emphasizing the adaptability of the economy.

Maintaining a balanced perspective and considering multiple viewpoints is crucial for understanding the potential economic landscape and making informed decisions.

Conclusion

TD Bank's prediction of 100,000 job cuts and the looming threat of an imminent recession underscores the need for proactive preparation. The potential impact on the job market and the broader economy is significant. Understanding the implications of TD Bank's 100,000 job cut prediction and preparing for a potential imminent recession is crucial. Take action today to safeguard your financial future. Don’t wait until the recession hits; start preparing now to recession-proof your career and finances. The information presented here should be considered for informational purposes and professional advice should be sought before making any financial decisions.

Featured Posts

-

Italian Open Jannik Sinners Unexpected Meeting With Pope Leo Xiv

May 28, 2025

Italian Open Jannik Sinners Unexpected Meeting With Pope Leo Xiv

May 28, 2025 -

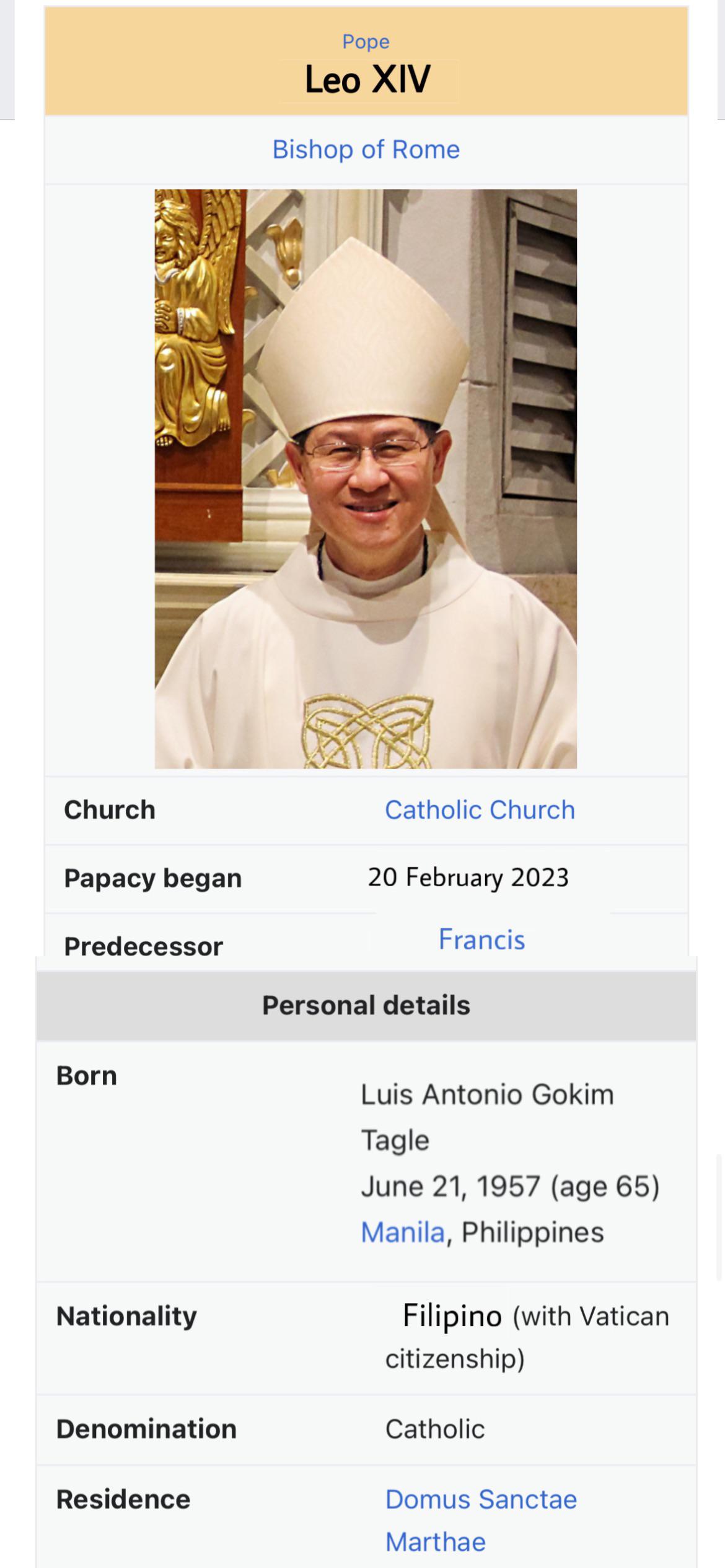

Aprils Rainfall A Look At The Data So Far

May 28, 2025

Aprils Rainfall A Look At The Data So Far

May 28, 2025 -

Bandung Hujan Pukul 1 Siang Prakiraan Cuaca Besok 22 4 Jawa Barat

May 28, 2025

Bandung Hujan Pukul 1 Siang Prakiraan Cuaca Besok 22 4 Jawa Barat

May 28, 2025 -

Doce Atletas Espanoles Incluyendo A Ana Peleteiro Competiran En El Mundial De Atletismo Indoor De Nanjing

May 28, 2025

Doce Atletas Espanoles Incluyendo A Ana Peleteiro Competiran En El Mundial De Atletismo Indoor De Nanjing

May 28, 2025 -

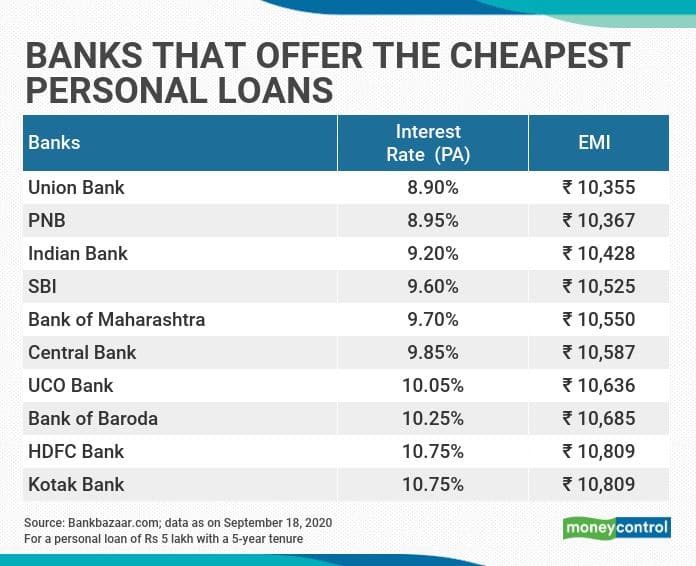

Personal Loan Rates Today How To Secure The Lowest Apr

May 28, 2025

Personal Loan Rates Today How To Secure The Lowest Apr

May 28, 2025