Retail Sales Slump: Could The Bank Of Canada Reverse Rate Hikes?

Table of Contents

The Current State of Retail Sales in Canada

Statistics Canada's recent reports paint a concerning picture. Canadian retail sales have declined for [insert number] consecutive months, indicating a substantial contraction in consumer spending. This isn't solely attributable to interest rate hikes; other factors significantly contribute to this retail sales slump.

- Soaring Inflation: High inflation rates erode purchasing power, forcing consumers to cut back on discretionary spending.

- Weakening Consumer Confidence: Uncertainty about the future economic outlook leads to decreased consumer confidence, impacting spending habits.

- Lingering Supply Chain Issues: Although easing, lingering supply chain disruptions continue to impact the availability and pricing of goods.

Specific sectors are feeling the pinch more acutely:

- Apparel Retail: Sales in clothing stores have seen a particularly sharp decline, reflecting decreased consumer spending on non-essential items.

- Furniture and Home Furnishings: Higher interest rates have increased mortgage payments, leading to reduced spending on large-ticket items like furniture.

- Electronics Retail: Consumers are delaying purchases of electronics and appliances due to financial constraints and uncertainty.

These factors paint a complex picture of the challenges facing Canadian retailers, highlighting the need for a multi-pronged approach to address the retail sales slump.

The Bank of Canada's Rate Hike Strategy and its Impact

The Bank of Canada's recent interest rate hikes are part of a broader strategy to combat inflation. By increasing borrowing costs, the central bank aims to cool down the economy and curb inflationary pressures. However, this monetary tightening has had a significant impact on retail sales:

- Reduced Borrowing: Higher interest rates make borrowing more expensive, discouraging consumers from taking on debt for purchases.

- Increased Mortgage Payments: Rising interest rates significantly increase mortgage payments, leaving less disposable income for other spending.

- Decreased Consumer Confidence: The prospect of continued rate hikes contributes to uncertainty and decreased consumer confidence, further dampening spending.

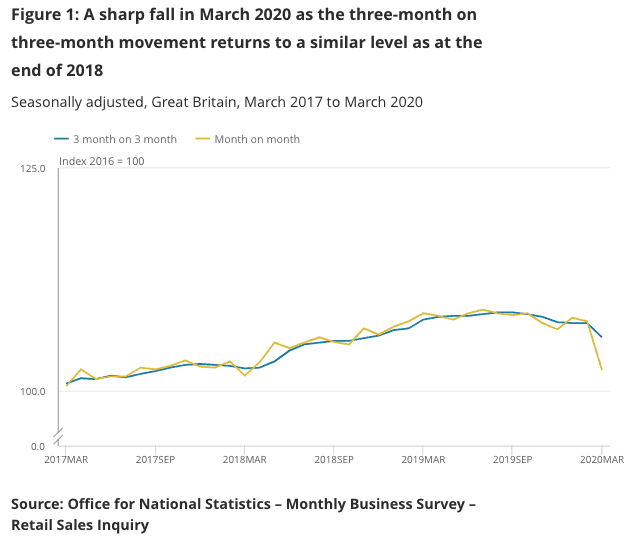

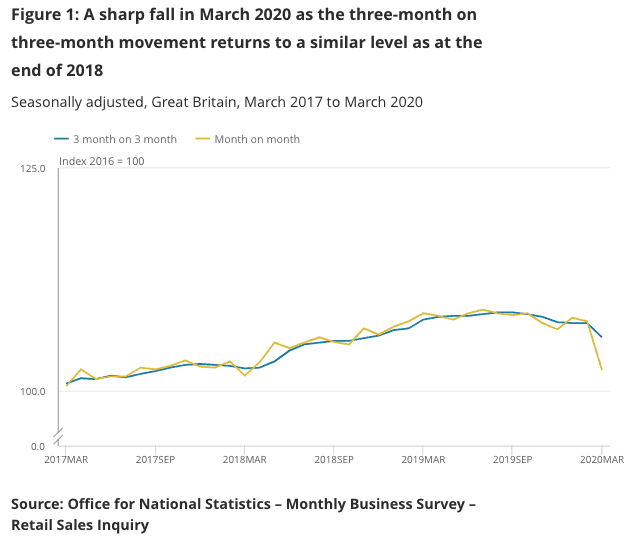

The timeline of rate hikes and their effect on key economic indicators demonstrates a clear correlation between monetary tightening and the retail sales slump. [Insert timeline data and economic indicator correlations here, citing sources like the Bank of Canada website]. The Bank of Canada's inflation-targeting mandate clearly prioritizes price stability, but the knock-on effect on consumer spending and the retail sector needs careful consideration.

Analyzing the Potential of a Rate Reversal

The question of whether the Bank of Canada should reverse its rate hikes to stimulate retail sales is complex and contentious.

Arguments for Reversal: Proponents argue that reversing rate hikes could boost consumer confidence, increase borrowing, and stimulate economic activity, potentially easing the retail sales slump.

Arguments Against Reversal: Opponents warn that reversing course could reignite inflationary pressures, undermining the Bank's efforts to achieve price stability and potentially leading to greater economic instability in the long run.

The political pressures on the Bank of Canada are immense. The government faces pressure to address the retail sales slump and protect jobs, potentially influencing the central bank's decision-making process. Weighing the economic and political considerations is crucial in determining the optimal course of action. The potential benefits must be carefully weighed against the potential risks of increased inflation.

- Pros of Reversal: Potential boost to consumer spending and economic growth.

- Cons of Reversal: Risk of increased inflation and potential economic instability.

Alternative Measures to Stimulate Retail Sales

While reversing interest rate hikes is a significant consideration, alternative measures could also stimulate retail sales without necessarily fueling inflation. The government could explore:

- Targeted Tax Cuts: Tax cuts focused on low- and middle-income earners could boost disposable income and stimulate consumer spending.

- Infrastructure Spending: Increased government investment in infrastructure projects could create jobs and stimulate economic activity, indirectly benefiting the retail sector.

The effectiveness and potential drawbacks of each measure need careful evaluation. Tax cuts might not be equally effective across all consumer segments, and infrastructure spending takes time to yield results. A balanced approach considering various fiscal policy tools is essential for a sustainable retail recovery.

- Example 1: A temporary reduction in sales tax on essential goods could provide immediate relief to consumers.

- Example 2: Investments in public transportation infrastructure could indirectly boost spending in related sectors.

Conclusion: Navigating the Retail Sales Slump and the Bank of Canada's Next Move

The relationship between the retail sales slump and the Bank of Canada's interest rate policy is intricate. While higher interest rates aim to control inflation, they also have a significant dampening effect on consumer spending and retail activity. Reversing rate hikes presents a dilemma, potentially reigniting inflation while offering a potential short-term boost to the retail sector. Alternative measures, such as targeted fiscal policies, offer a more nuanced approach, requiring careful consideration of their effectiveness and potential drawbacks. Navigating this complex situation requires a balanced strategy that addresses both inflation and the needs of the retail sector.

Stay informed about the Bank of Canada's decisions and their impact on the retail sales slump and the broader Canadian economy. Follow reputable economic news sources and participate in the discussion. Share your thoughts and perspectives on this critical issue and help shape the conversation on how to best address the ongoing retail sales slump in Canada.

Featured Posts

-

Rodons Strong Performance Early Runs Prevent Yankees Sweep

Apr 28, 2025

Rodons Strong Performance Early Runs Prevent Yankees Sweep

Apr 28, 2025 -

Long Lasting Power A Deep Dive Into Kuxius Solid State Power Bank Technology

Apr 28, 2025

Long Lasting Power A Deep Dive Into Kuxius Solid State Power Bank Technology

Apr 28, 2025 -

Teslas Rise Leads Tech Giants To Lift Us Stock Market

Apr 28, 2025

Teslas Rise Leads Tech Giants To Lift Us Stock Market

Apr 28, 2025 -

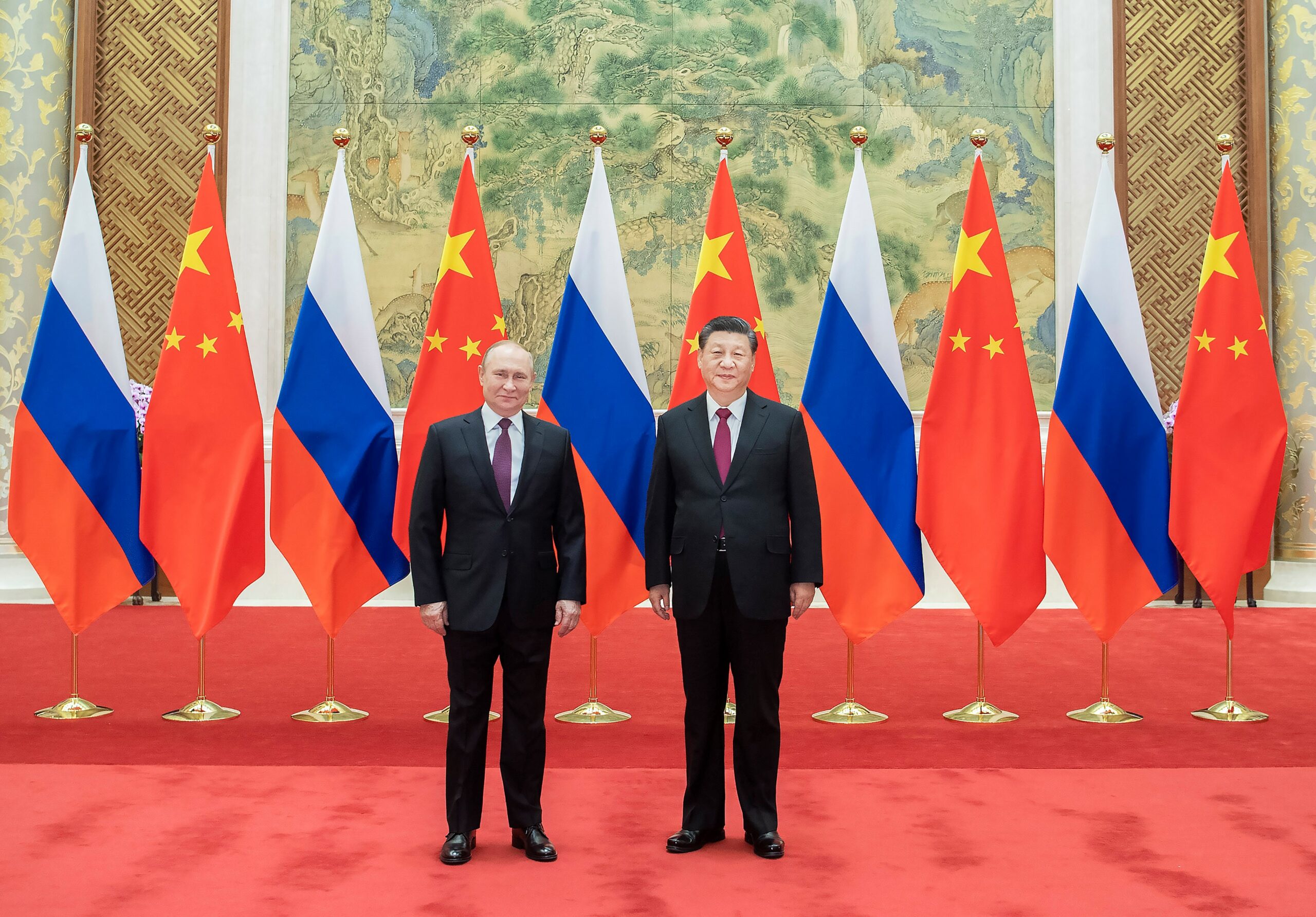

Trumps Time Interview Focus On Canada China Relations And Presidential Term Limits

Apr 28, 2025

Trumps Time Interview Focus On Canada China Relations And Presidential Term Limits

Apr 28, 2025 -

The Reach Of Trumps Campus Policies Far Reaching Consequences For Colleges And Universities

Apr 28, 2025

The Reach Of Trumps Campus Policies Far Reaching Consequences For Colleges And Universities

Apr 28, 2025

Latest Posts

-

Game 1 Lineup Coras Subtle Red Sox Adjustments For Doubleheader

Apr 28, 2025

Game 1 Lineup Coras Subtle Red Sox Adjustments For Doubleheader

Apr 28, 2025 -

Red Sox Doubleheader Lineup Changes Under Coras Management

Apr 28, 2025

Red Sox Doubleheader Lineup Changes Under Coras Management

Apr 28, 2025 -

Coras Lineup Decisions Red Sox Game 1 Doubleheader

Apr 28, 2025

Coras Lineup Decisions Red Sox Game 1 Doubleheader

Apr 28, 2025 -

Boston Red Sox Doubleheader Coras Game 1 Lineup Changes

Apr 28, 2025

Boston Red Sox Doubleheader Coras Game 1 Lineup Changes

Apr 28, 2025 -

Slight Lineup Shift Coras Approach To Red Sox Doubleheader

Apr 28, 2025

Slight Lineup Shift Coras Approach To Red Sox Doubleheader

Apr 28, 2025