Tesla's Rise Leads Tech Giants To Lift US Stock Market

Table of Contents

Tesla's Impact on the Tech Sector

Tesla's influence extends far beyond its automotive sector. Its advancements in battery technology, artificial intelligence (AI), and renewable energy are reshaping multiple industries. The company's innovations aren't just selling cars; they are driving growth and investment across the tech landscape.

- Increased investment in EV-related companies: Tesla's success has attracted significant investment in the electric vehicle (EV) supply chain, boosting companies involved in battery production, charging infrastructure, and related technologies. This influx of capital fuels innovation and accelerates the transition to sustainable transportation.

- Growth in demand for rare earth minerals and related materials: The burgeoning demand for EVs necessitates a surge in the mining and processing of rare earth minerals crucial for battery production. This increased demand stimulates related industries and creates new economic opportunities.

- Stimulation of innovation in autonomous driving and related software: Tesla's pioneering work in autonomous driving technology has spurred intense competition and accelerated innovation within the field of AI and software development for self-driving cars. This competition benefits consumers through improved safety and technology advancements.

- Positive spillover effects on the broader tech ecosystem: The overall success of Tesla boosts investor confidence in the tech sector, encouraging investment in other innovative companies and technologies, creating a positive feedback loop for the entire ecosystem.

The Ripple Effect on Other Tech Giants

Tesla's stellar performance isn't just benefiting itself; it's positively influencing the valuation and performance of other tech companies. Companies involved in battery production, like Panasonic, and those focused on charging infrastructure, see their stock prices rise alongside Tesla's success.

- Increased investor confidence in the tech sector as a whole: Tesla's success story reinforces the belief that disruptive innovation can yield significant returns, boosting investor confidence in the tech sector as a whole. This leads to increased investment in other tech ventures.

- Positive market sentiment leading to increased valuations for other tech stocks: The positive sentiment surrounding Tesla spills over to other tech companies, leading to increased valuations and a more buoyant market overall. This creates a snowball effect, increasing market capitalization for related companies.

- Increased competition and innovation within the tech industry: Tesla's success has spurred increased competition within the EV and related tech sectors, driving innovation and improving product offerings for consumers. This competitive landscape results in better products at more affordable prices.

- Positive media coverage impacting the perception of the tech sector: The extensive positive media coverage surrounding Tesla's achievements enhances the overall perception of the tech sector, attracting talent and investment. This positive public perception is crucial to long-term growth.

Economic Factors Contributing to the Market Lift

While Tesla's intrinsic value is a key driver, broader economic factors also amplify its positive influence on the US stock market.

- Low interest rates making investments more attractive: Low interest rates encourage investment in higher-growth sectors like technology, further boosting Tesla's positive impact on the market. This makes investment in riskier but potentially more rewarding sectors like technology more appealing.

- Positive investor sentiment driven by overall market performance: Positive market sentiment, driven by factors such as overall economic growth, further enhances the impact of Tesla's success. This positive environment amplifies the positive influence of Tesla.

- Growing demand for electric vehicles and renewable energy solutions: The growing global demand for sustainable solutions increases the demand for Tesla's products and services, contributing to its market success and influence. This global demand also affects related industries.

- Government incentives and policies supporting the EV industry: Government policies supporting the transition to electric vehicles and renewable energy further bolster Tesla's position and its positive influence on the market. These supportive policies create a fertile environment for growth.

Potential Risks and Future Outlook

Despite the impressive positive trends, several factors could impact Tesla's continued positive influence on the market.

- Geopolitical risks and supply chain disruptions: Geopolitical instability and supply chain disruptions could negatively impact Tesla's production and sales, affecting its stock price and influence on the market. This highlights the importance of diversification and risk management.

- Competition from established and emerging automakers: Increased competition from established and emerging automakers could put pressure on Tesla's market share and profitability. This competition keeps Tesla innovative and responsive to the market.

- Potential regulatory changes impacting the EV industry: Changes in government regulations or policies could also impact Tesla's operations and profitability. Regulatory uncertainty is a risk factor that investors should carefully consider.

- Fluctuations in the price of raw materials: Fluctuations in the price of raw materials used in EV production, such as lithium and cobalt, could affect Tesla's profitability and market valuation. This is a risk inherent in many industries that rely on commodity pricing.

Conclusion: Tesla's Continued Influence on the US Stock Market

Tesla's remarkable success has undeniably had a significant positive impact on the US stock market and the broader tech sector. Its influence ripples through the ecosystem, boosting investor confidence, driving innovation, and stimulating growth across related industries. While potential risks exist, Tesla's continued evolution and the growing demand for electric vehicles and renewable energy solutions suggest its positive influence will likely persist. Stay informed about the continued evolution of Tesla and its impact on the US stock market. Follow our updates on the latest developments in Tesla's stock performance and its influence on the tech giants that are shaping our future.

Featured Posts

-

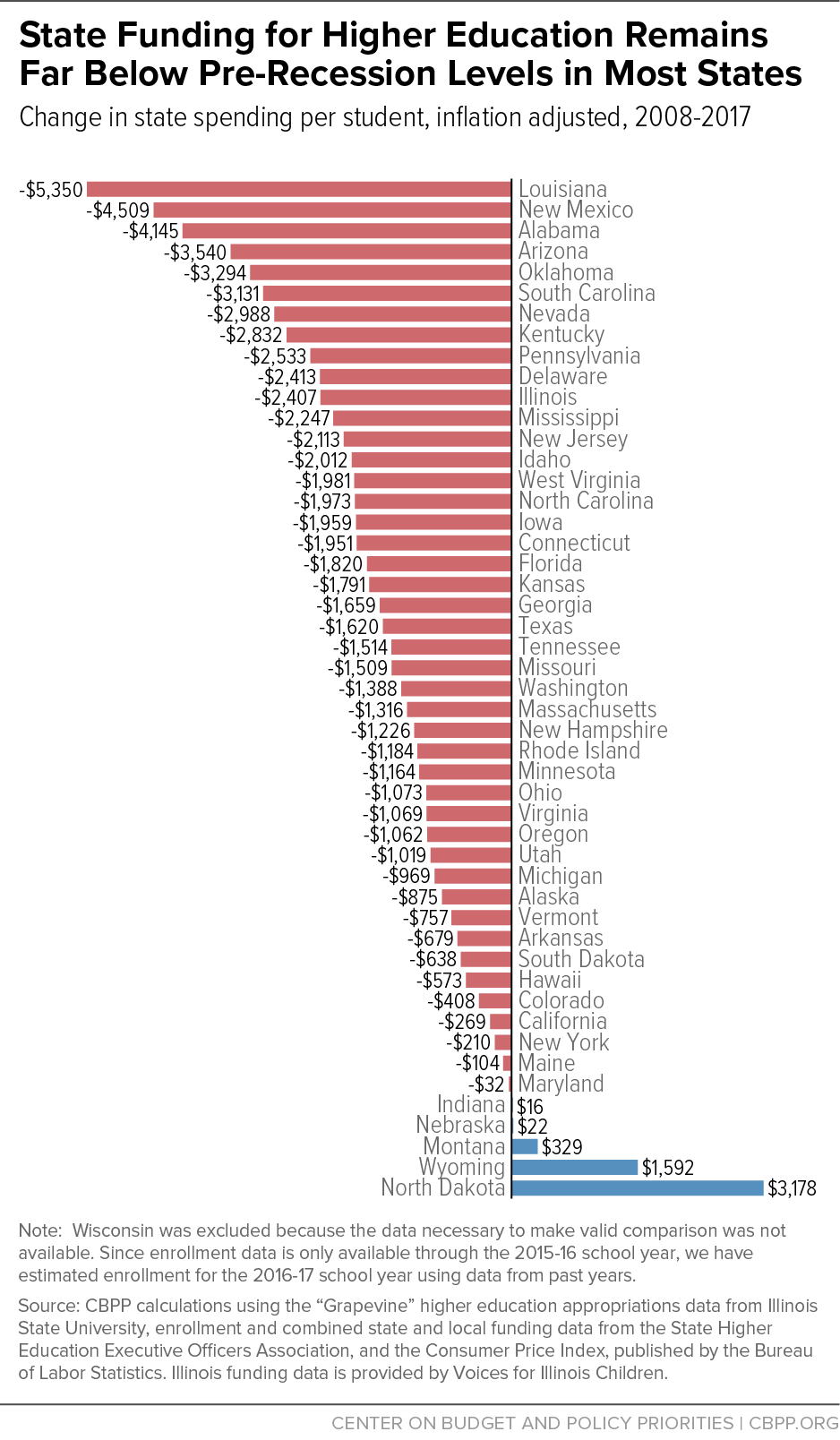

Trump Administrations Impact On Higher Education A Nationwide Analysis

Apr 28, 2025

Trump Administrations Impact On Higher Education A Nationwide Analysis

Apr 28, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Tell All This Fall

Apr 28, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Tell All This Fall

Apr 28, 2025 -

Teslas Rise Leads Tech Giants To Lift Us Stock Market

Apr 28, 2025

Teslas Rise Leads Tech Giants To Lift Us Stock Market

Apr 28, 2025 -

Post Oval Office Confrontation Trump And Zelensky Meet At Popes Funeral

Apr 28, 2025

Post Oval Office Confrontation Trump And Zelensky Meet At Popes Funeral

Apr 28, 2025 -

Early Bats And Rodons Pitching Secure Yankees Victory

Apr 28, 2025

Early Bats And Rodons Pitching Secure Yankees Victory

Apr 28, 2025

Latest Posts

-

Red Sox Lineup Overhaul Outfielders Return Impacts Casas Position

Apr 28, 2025

Red Sox Lineup Overhaul Outfielders Return Impacts Casas Position

Apr 28, 2025 -

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Year

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Year

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025 -

This Red Sox Outfielder Poised For A Duran Like Breakout

Apr 28, 2025

This Red Sox Outfielder Poised For A Duran Like Breakout

Apr 28, 2025 -

The End Of An Era Orioles Hit Streak Ends At 160 Games

Apr 28, 2025

The End Of An Era Orioles Hit Streak Ends At 160 Games

Apr 28, 2025