Reliance Stock Soars: 10-Month High Following Earnings Announcement

Table of Contents

Stellar Earnings Announcement Fuels Reliance Stock Rally

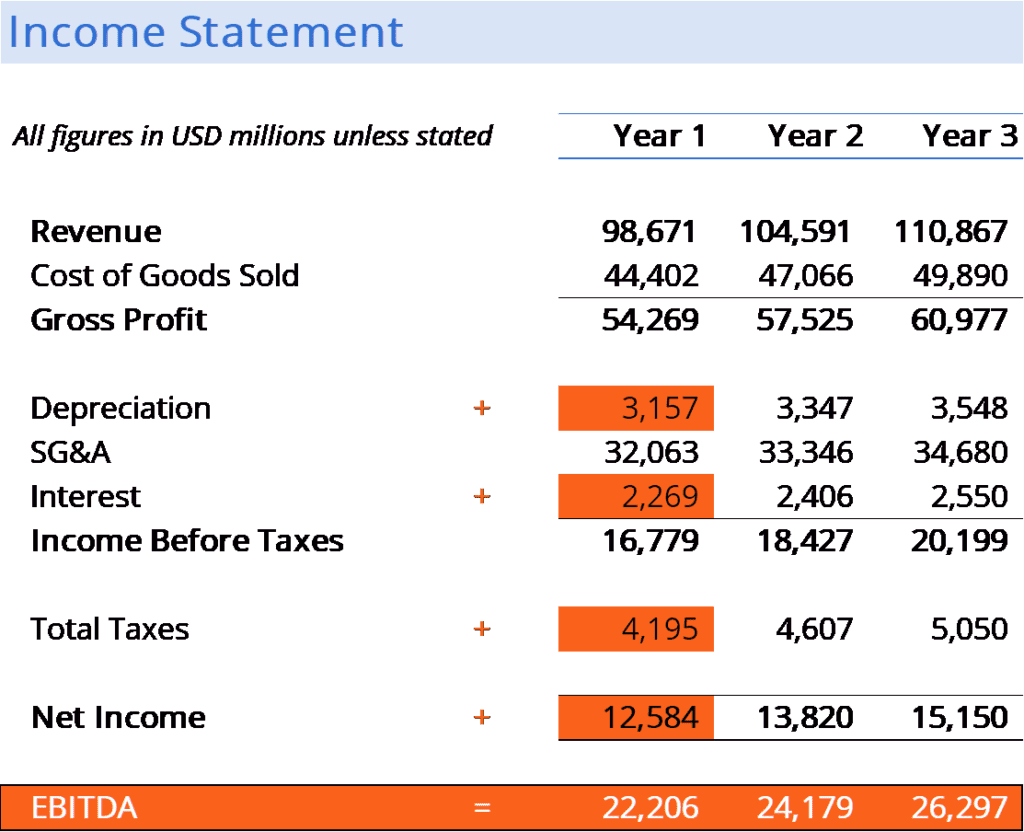

The recent earnings report from Reliance Industries provided a powerful catalyst for the surge in Reliance stock. The report showcased exceptionally strong financial performance across various sectors, exceeding analysts' predictions and fueling investor confidence. Key highlights include:

- Increased Revenue and Profits: Reliance Industries reported a substantial increase in both revenue and net profits compared to the same period last year, demonstrating robust financial health and growth. Specific figures (if available) should be included here, e.g., "Revenue increased by X% to reach ₹Y billion, while net profits soared by Z% to ₹W billion."

- Improved Margins: The company's improved operating margins indicate increased efficiency and better cost management, signifying a positive trend in profitability. Again, specific data would strengthen this point.

- Strong Growth in Key Sectors: Significant growth was observed in key sectors such as Jio (telecommunications) and Reliance Retail, showcasing the success of Reliance Industries' diversified business model. Details on subscriber growth for Jio and retail sales figures for Reliance Retail would be beneficial.

- Positive Future Outlook and Guidance: The management's positive outlook and guidance for future performance further bolstered investor confidence, contributing to the increased buying pressure observed in the market.

These impressive figures clearly demonstrate the strong financial performance underpinning the recent Reliance stock rally. The impressive earnings report, packed with data showcasing revenue growth and profitability, is the primary driver behind the current market excitement.

Investor Confidence Drives Reliance Stock Price Higher

The positive earnings announcement significantly impacted investor sentiment, leading to a considerable increase in buying pressure. The results exceeded market expectations, triggering a wave of optimism among investors. This is evident in:

- Increased Buying Pressure: The surge in trading volume indicates a significant influx of buyers eager to acquire Reliance stock at the current price, reflecting strong investor confidence.

- Analyst Ratings and Upgrades: Several leading financial analysts have upgraded their ratings for Reliance stock following the earnings announcement, further reinforcing the positive market sentiment. Mentioning specific analysts and their ratings would add credibility.

- Increased Investment: Specific examples of increased investment from institutional investors or mutual funds would be highly valuable here. Mentioning any significant investment strategies targeting Reliance stock can underscore the investor confidence.

The combination of exceeded expectations and positive analyst feedback created a perfect storm, driving up the demand for Reliance stock and propelling its price to a 10-month high.

Reliance Industries' Strategic Initiatives Contribute to Success

Reliance Industries' strategic initiatives have played a crucial role in its recent success. These strategic moves have diversified the company's revenue streams and positioned it for continued growth in a competitive market. Key initiatives contributing to the strong earnings include:

- Expansion into New Markets: Detail any recent market expansions undertaken by Reliance, either geographically or into new product/service categories.

- Technological Advancements: Highlight any significant technological advancements undertaken by the company, particularly within Jio and other tech-focused divisions. Mention investments in 5G technology, for example.

- Strategic Partnerships: Discuss any key partnerships or collaborations entered into by Reliance Industries, potentially highlighting synergies and collaborative efforts that have boosted performance.

These strategic initiatives have not only bolstered the current performance but also demonstrate a clear path for future growth, further strengthening investor confidence in Reliance stock.

Technical Analysis of Reliance Stock Price Movement

The recent surge in Reliance stock price is clearly visible on the stock chart, showcasing a significant breakout above previous resistance levels. While avoiding overly complex technical analysis, we can note that:

- 10-Month High: The stock has reached a 10-month high, marking a significant milestone in its price performance.

- Breakout from Resistance: The stock’s price has broken through key resistance levels, suggesting further upward momentum is possible. (Include visual aids like charts if possible)

- Increased Trading Volume: The increased trading volume accompanying the price increase reinforces the strength of the rally and the underlying buying pressure.

While past performance is not indicative of future results, the technical indicators suggest a positive short-term trend for Reliance stock.

Future Outlook for Reliance Stock

The future outlook for Reliance stock appears positive, driven by strong fundamentals and continued strategic initiatives. However, it is crucial to acknowledge potential risks and challenges:

- Growth Potential: The diversified business model and ongoing expansion plans suggest considerable growth potential in the long term.

- Market Risks: General market volatility and macroeconomic factors could impact the stock's performance.

- Competition: Competition within various sectors could present challenges to future growth.

A balanced approach is crucial. While the current trend is positive, external factors and competitive pressures need to be considered when predicting future performance.

Conclusion: Should You Invest in Reliance Stock Now?

The recent surge in Reliance stock to a 10-month high is a direct result of stellar earnings, positive investor sentiment, and smart strategic moves. The company's strong financial performance and positive future outlook are compelling factors. However, investing in any stock involves risk. Before making any investment decisions regarding Reliance stock investment, thorough research is crucial. Consider your personal risk tolerance and financial goals, and consult with a qualified financial advisor before investing. Conduct your own comprehensive analysis of Reliance Industries stock and related market conditions to make informed decisions about investing in Reliance stock.

Featured Posts

-

Anchor Brewing Companys Closure A Legacy Concludes After 127 Years

Apr 29, 2025

Anchor Brewing Companys Closure A Legacy Concludes After 127 Years

Apr 29, 2025 -

Willie Nelson Documentary Tops Austins Weekly News

Apr 29, 2025

Willie Nelson Documentary Tops Austins Weekly News

Apr 29, 2025 -

Fatal Boat Crash In Clearwater Florida Multiple Injuries Reported

Apr 29, 2025

Fatal Boat Crash In Clearwater Florida Multiple Injuries Reported

Apr 29, 2025 -

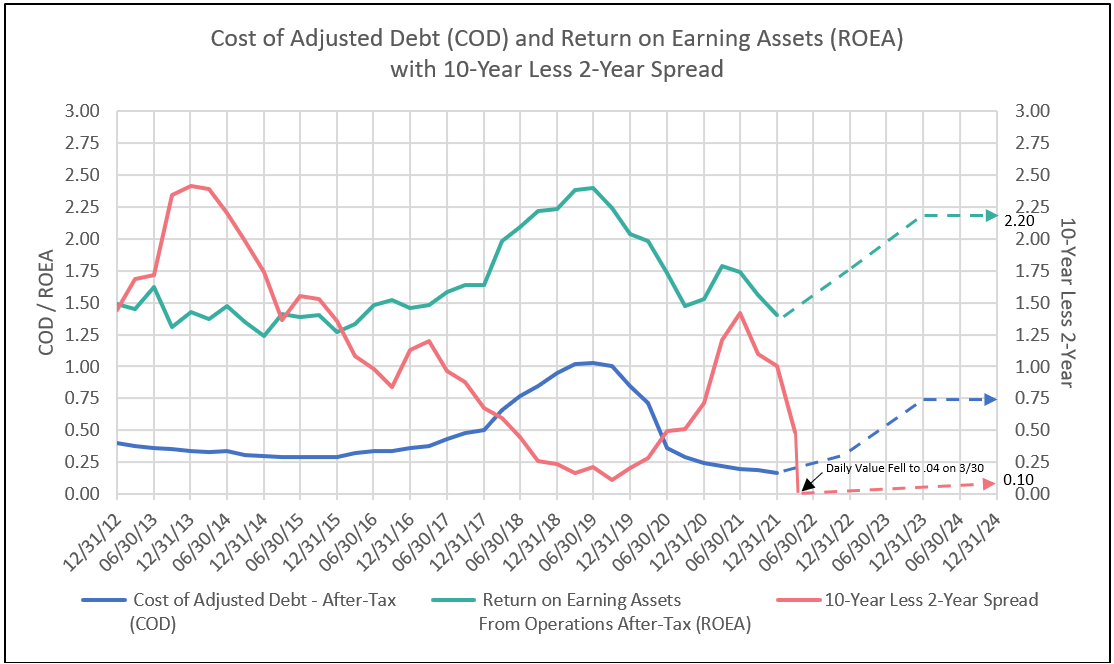

Post April 8th Treasury Market What We Discovered

Apr 29, 2025

Post April 8th Treasury Market What We Discovered

Apr 29, 2025 -

Recent X Debt Sale Financials Implications For The Companys Future

Apr 29, 2025

Recent X Debt Sale Financials Implications For The Companys Future

Apr 29, 2025

Latest Posts

-

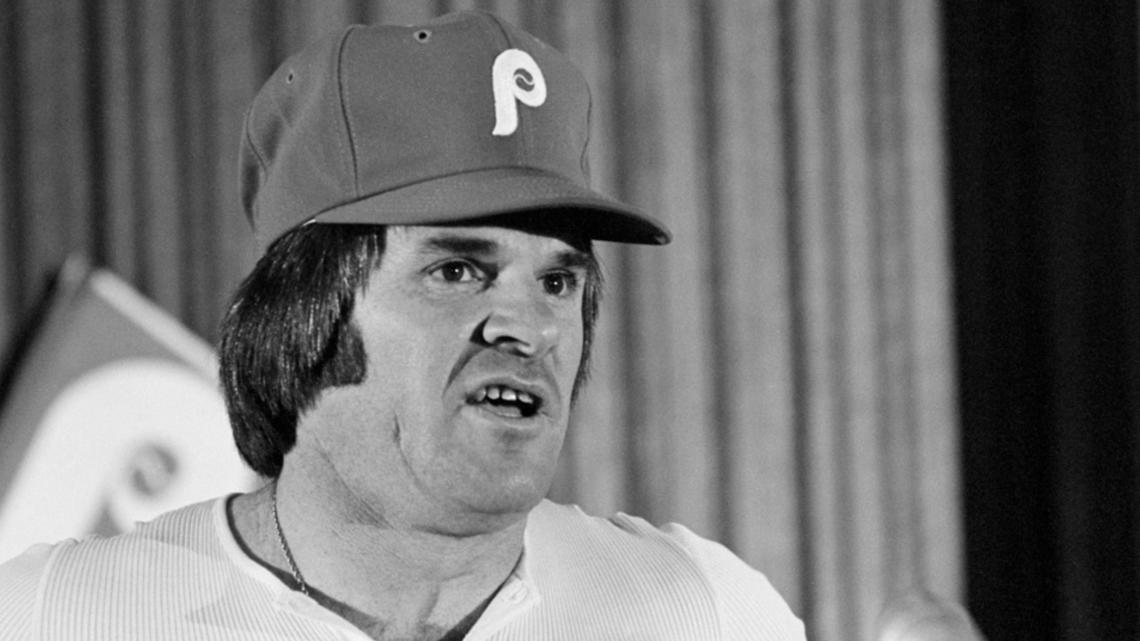

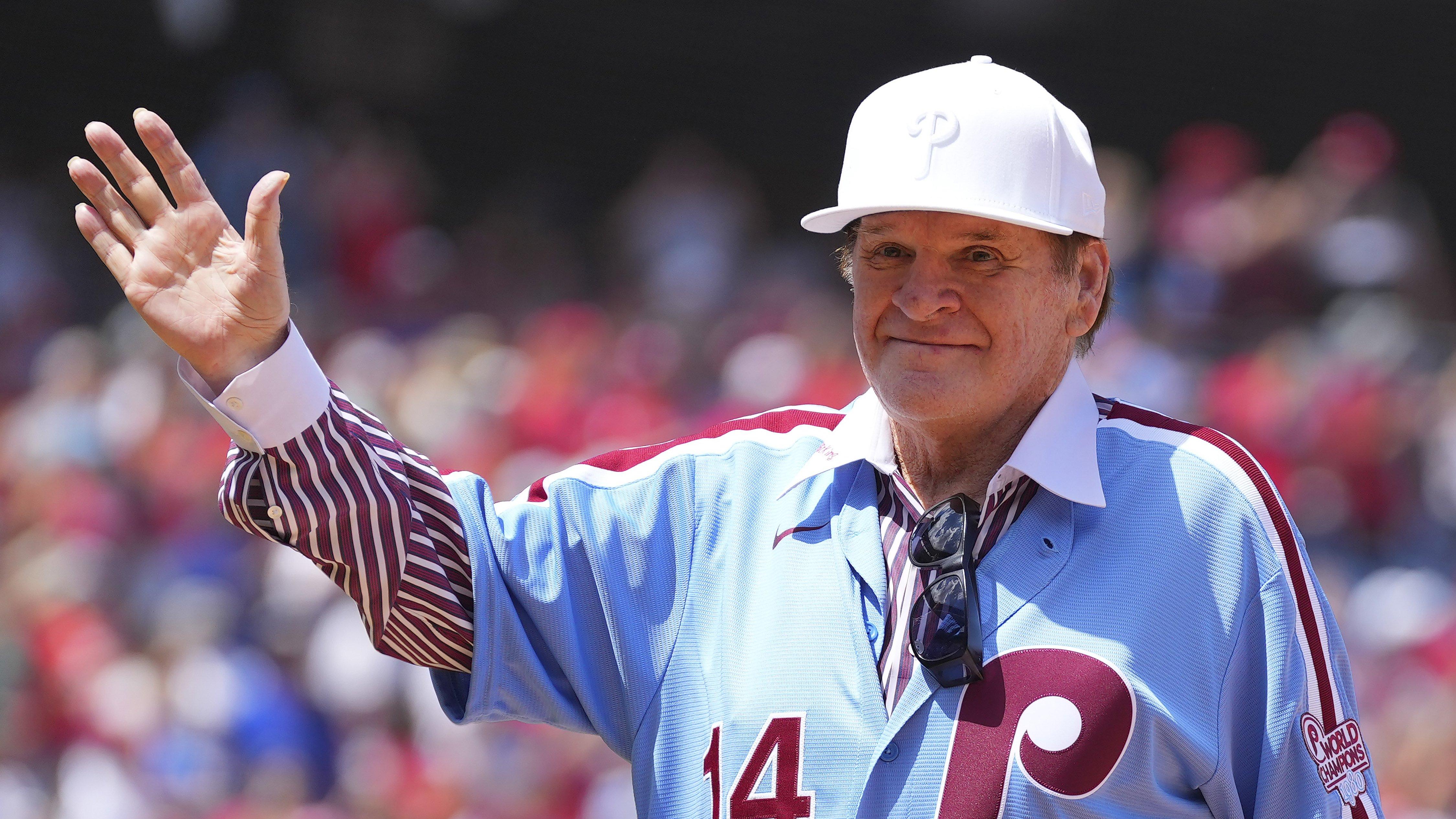

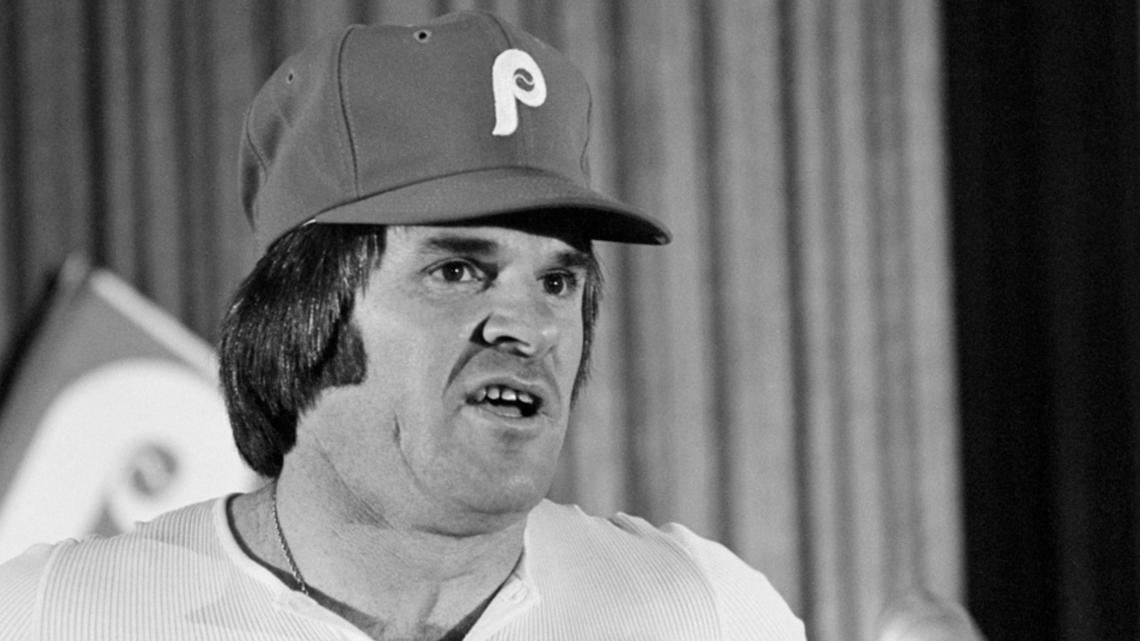

The Pete Rose Pardon Trumps Consideration And The Future Of Baseballs Betting Rules

Apr 29, 2025

The Pete Rose Pardon Trumps Consideration And The Future Of Baseballs Betting Rules

Apr 29, 2025 -

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025 -

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025 -

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025