Recent X Debt Sale Financials: Implications For The Company's Future

Table of Contents

Understanding the Corporate Debt Sale

Acme Corporation's recent debt sale involved the issuance of $500 million in 10-year corporate bonds. This represents a significant fundraising effort for the company.

- Type of Debt: Senior unsecured notes, offering a fixed interest rate of 6% payable semi-annually. The maturity date is set for 2034.

- Amount Raised: $500 million, a substantial increase compared to their previous bond issuance of $300 million in 2021. This signifies a considerable expansion in their debt financing strategy.

- Buyers: The bonds were primarily purchased by institutional investors, including several large pension funds and mutual fund companies. This indicates a degree of confidence in Acme's long-term prospects within the investment community. A smaller portion was allocated to high-net-worth retail investors.

- Purpose: Acme explicitly stated that the proceeds from the debt sale will be used to fund a major expansion into new markets and to accelerate research and development for their next-generation product line. This aggressive growth strategy is a key factor in interpreting these corporate debt sale financials.

- Keywords: corporate debt, debt financing, debt issuance, bond sale, loan sale, corporate bonds, senior unsecured notes

Financial Implications of the Debt Sale

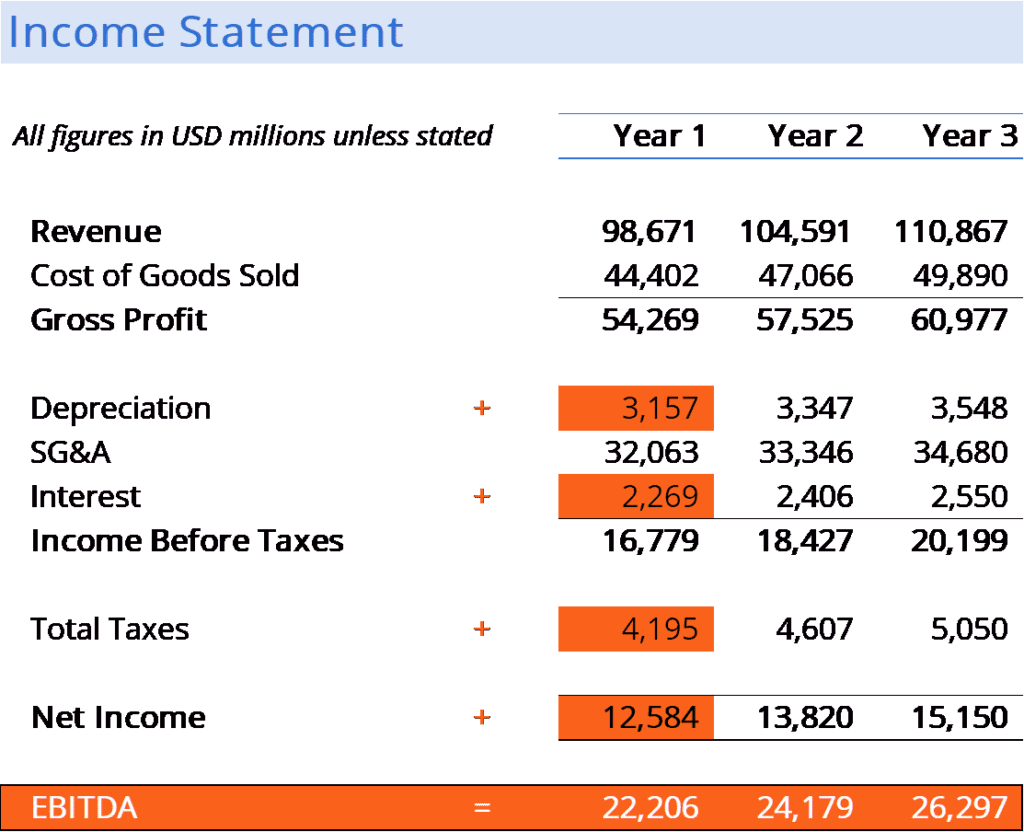

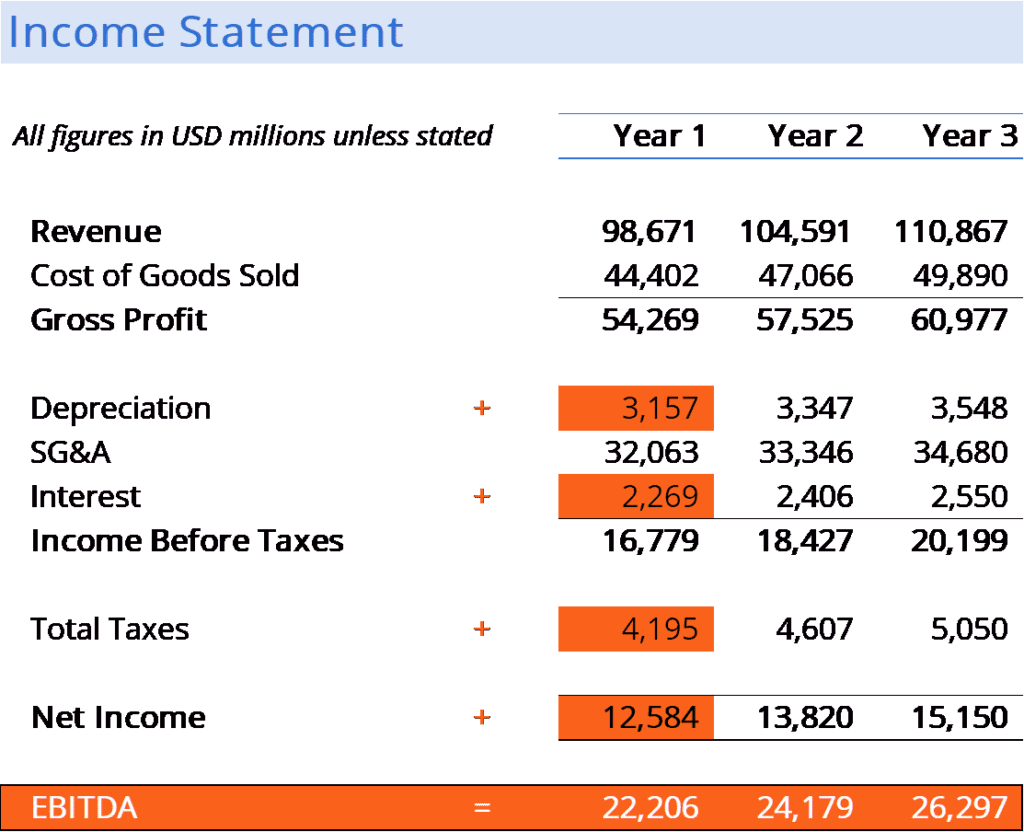

The successful corporate debt sale has had a measurable impact on Acme's financial standing. Let's analyze some key areas:

- Impact on Debt-to-Equity Ratio: The additional debt will likely increase Acme's debt-to-equity ratio, potentially impacting its credit rating. Further analysis of the company's balance sheet is needed to determine the precise extent of this change. Existing credit ratings from agencies like Moody's and S&P will need to be monitored closely.

- Effect on Interest Expense: The 6% interest rate on the new bonds will significantly increase Acme's annual interest expense. This will reduce short-term profits, requiring careful management of operating costs to maintain profitability.

- Changes in Cash Flow: The immediate impact is a considerable increase in cash reserves. This enhanced liquidity will be crucial for funding their expansion plans. However, the long-term impact on cash flow needs to consider the increased interest payments and repayments of principal at maturity.

- Potential for Future Financing: The success of this debt sale could pave the way for future capital raises, demonstrating investor confidence and improving their ability to secure favorable terms in future debt issuances.

- Keywords: financial leverage, debt-to-equity ratio, interest expense, cash flow, credit rating, profitability, financial health, liquidity

Implications for the Company's Future Strategy

The $500 million raised opens exciting possibilities but also presents challenges for Acme's future.

- Investment Plans: The company plans to invest heavily in expanding into the Asian market and in research and development for its next generation of sustainable energy products. Success depends on effectively managing these investments.

- Risk Management: The increased debt burden exposes Acme to greater risk, particularly during economic downturns. Effective risk management strategies are crucial to mitigating potential financial vulnerabilities.

- Shareholder Value: The potential impact on shareholder value is complex. While the expansion plans could generate significant future growth, the increased debt and interest expense may initially pressure profitability and stock prices in the short term. Careful monitoring of stock price movements is necessary.

- Competitive Landscape: The increased financial flexibility will allow Acme to aggressively compete in the expanding sustainable energy market. This may lead to increased market share but also invite stronger competition from established players.

- Keywords: investment strategy, risk management, shareholder value, competitive advantage, strategic planning, future growth, sustainable energy

Conclusion: Assessing the Long-Term Outlook Based on Corporate Debt Sale Financials

Acme Corporation's recent corporate debt sale presents a mixed bag. The significant capital injection provides the resources for ambitious growth plans, but also increases financial leverage and interest expenses. Careful management of these risks, combined with successful execution of their expansion strategies, will be crucial in determining the long-term success of this fundraising initiative. The impact on shareholder value remains to be seen, and close monitoring of financial performance and stock price movements is warranted. To stay abreast of the ongoing developments and gain deeper insights into the implications of this and other corporate debt sales, continue following financial news and analysis. Understanding corporate debt sale implications is crucial for informed investment decisions.

Featured Posts

-

Seven Tech Titans 2 5 Trillion Market Value Plunge

Apr 29, 2025

Seven Tech Titans 2 5 Trillion Market Value Plunge

Apr 29, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Malfunction

Apr 29, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Malfunction

Apr 29, 2025 -

Get Tickets Now Willie Nelsons Texas 4th Of July Picnic

Apr 29, 2025

Get Tickets Now Willie Nelsons Texas 4th Of July Picnic

Apr 29, 2025 -

Los Angeles Wildfires A Reflection Of Our Changing Relationship With Risk And Gambling

Apr 29, 2025

Los Angeles Wildfires A Reflection Of Our Changing Relationship With Risk And Gambling

Apr 29, 2025 -

Severe Weather Pummels Louisville Snow Tornadoes And Devastating Floods In 2025

Apr 29, 2025

Severe Weather Pummels Louisville Snow Tornadoes And Devastating Floods In 2025

Apr 29, 2025

Latest Posts

-

Prosecutorial Misconduct Allegations In Cardinal Trial Gain Momentum With New Evidence

Apr 29, 2025

Prosecutorial Misconduct Allegations In Cardinal Trial Gain Momentum With New Evidence

Apr 29, 2025 -

New Developments Bolster Cardinal Beccius Appeal

Apr 29, 2025

New Developments Bolster Cardinal Beccius Appeal

Apr 29, 2025 -

Cardinal Becciu Seeks Retrial Based On New Evidence

Apr 29, 2025

Cardinal Becciu Seeks Retrial Based On New Evidence

Apr 29, 2025 -

Becciu Trial Fresh Evidence Casts Doubt On Conviction

Apr 29, 2025

Becciu Trial Fresh Evidence Casts Doubt On Conviction

Apr 29, 2025 -

London Real Estate Fraud British Court Ruling Against Vatican

Apr 29, 2025

London Real Estate Fraud British Court Ruling Against Vatican

Apr 29, 2025