Post-April 8th Treasury Market: What We Discovered

Table of Contents

Increased Volatility and Market Uncertainty After the Debt Ceiling Debate

The debt ceiling debate cast a long shadow over the Treasury market, fueling significant uncertainty and volatility. The mere possibility of a U.S. default triggered a dramatic flight to safety, initially suppressing yields on short-term Treasury securities. However, once a deal (however last-minute) was reached, a wave of risk-on sentiment swept through the market, resulting in sharp fluctuations in Treasury yields.

-

Sharp fluctuations in Treasury yields: Following the resolution of the debt ceiling crisis, we witnessed dramatic swings in yields across the maturity spectrum. For instance, 2-year Treasury yields saw a [Insert percentage]% increase/decrease, while 10-year yields experienced a [Insert percentage]% change. These fluctuations highlight the market's sensitivity to political risk and the ongoing uncertainty surrounding future fiscal policy.

-

Increased investor anxiety and risk aversion: The proximity to a potential default heightened investor anxiety, leading to a period of heightened risk aversion. Investors sought safety in the most liquid and low-risk assets, driving significant demand for short-term Treasury bills.

-

Impact on short-term versus long-term Treasury securities: Short-term Treasury yields experienced more pronounced volatility compared to their long-term counterparts, reflecting the market's immediate concern about near-term debt servicing capabilities.

-

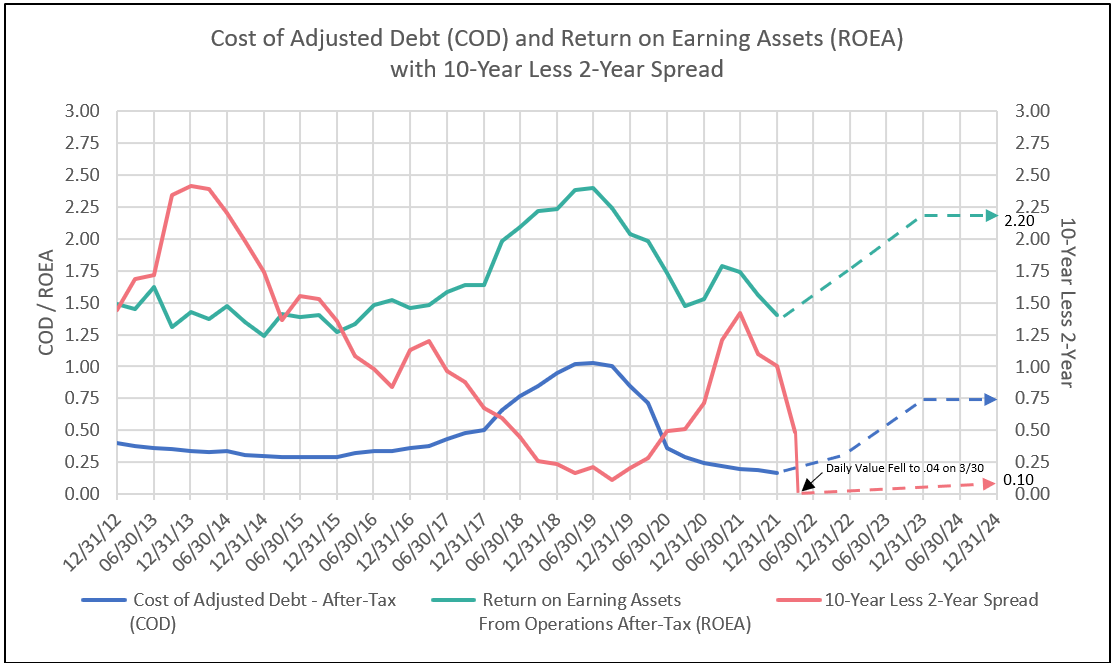

Specific yield changes and their significance: The significant jump/drop in [specific Treasury yield, e.g., 10-year Treasury yield] indicated a shift in market expectations regarding future interest rate hikes/cuts by the Federal Reserve. [Insert chart/graph illustrating volatility].

Shifting Investor Sentiment and Risk Appetite in the Post-April 8th Treasury Market

The period following April 8th witnessed a pronounced shift in investor behavior. Initially marked by a flight to safety, the market gradually transitioned towards a more risk-on attitude as the debt ceiling crisis was averted. This dynamic impacted the demand for various Treasury maturities.

-

Flight to safety or increased risk-taking?: The initial reaction was a clear flight to safety, with investors flocking to short-term Treasuries. However, as confidence returned, we saw a gradual shift towards riskier assets, leading to a decrease in demand for longer-term Treasuries.

-

Changes in demand for different Treasury maturities: The demand for short-term Treasuries surged initially, reflecting the heightened uncertainty surrounding the near-term fiscal outlook. Longer-term Treasuries, however, experienced reduced demand as investors sought higher returns elsewhere.

-

Impact of Federal Reserve policy announcements: Federal Reserve announcements regarding monetary policy played a crucial role in shaping investor sentiment and risk appetite. Any hint of a more dovish/hawkish stance significantly impacted Treasury yields and overall market dynamics.

-

Specific investor actions and their consequences: For example, [mention specific actions, e.g., large-scale selling/buying of specific Treasury securities] led to [mention consequences, e.g., a significant increase/decrease in specific yields].

Implications for Interest Rates and Monetary Policy in the Post-April 8th Environment

The events surrounding the debt ceiling debate have had profound implications for interest rates and the Federal Reserve's monetary policy decisions. The increased market volatility and uncertainty added a layer of complexity to the already challenging task of navigating inflation and economic growth.

-

Impact on borrowing costs for businesses and consumers: The fluctuations in Treasury yields directly influenced borrowing costs for businesses and consumers, potentially impacting investment decisions and consumer spending.

-

Potential adjustments to the Federal Reserve's monetary policy tools: The Federal Reserve may need to adjust its monetary policy tools, such as interest rate hikes or quantitative easing, in response to the market's reaction to the debt ceiling crisis.

-

Predictions for future interest rate movements: Based on the post-April 8th market data, analysts predict [mention specific predictions about future interest rate movements and their rationale].

-

Link to economic growth forecasts: The market turmoil could potentially hinder economic growth through increased borrowing costs and reduced investor confidence.

Analyzing the Long-Term Effects on the Treasury Market's Stability

The near-miss default raises serious questions about the long-term stability and functionality of the Treasury market. The episode underscores the need for structural reforms to prevent future crises and mitigate the risks associated with political brinkmanship.

-

Potential for increased market fragility: The events of April 8th highlighted the potential for increased market fragility, with even the slightest hint of a potential default triggering significant market disruptions.

-

Need for policy adjustments to mitigate future risks: Policymakers must explore mechanisms to reduce the risk of future debt ceiling crises, including exploring options for automatic debt ceiling increases or alternative budgetary processes.

-

Examination of the impact on the overall financial system: The ramifications extend beyond the Treasury market itself, impacting confidence in the entire U.S. financial system and its role in the global economy.

-

Discussion of potential future debt ceiling crises and their anticipated effects: Failure to address the underlying issues could lead to more frequent and severe market disruptions in the future, with potentially significant consequences for the global economy.

Conclusion: Understanding the Post-April 8th Treasury Market for Informed Decisions

The Post-April 8th Treasury Market has proven to be significantly more volatile and unpredictable than before. We've seen dramatic shifts in Treasury yields, investor sentiment, and expectations for interest rates. The long-term implications for market stability and the broader economy remain uncertain but highlight the urgent need for policy adjustments to prevent future crises. To make informed investment decisions in this evolving landscape, stay informed about ongoing developments and seek professional advice. Understanding the complexities of the Post-April 8th Treasury Market is crucial for navigating the risks and opportunities that lie ahead. Consult with a financial professional to develop a personalized strategy for managing your investments within this dynamic environment.

Featured Posts

-

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025 -

Gambling On Calamity Examining The Los Angeles Wildfire Betting Phenomenon

Apr 29, 2025

Gambling On Calamity Examining The Los Angeles Wildfire Betting Phenomenon

Apr 29, 2025 -

Millions Lost Office365 Executive Email Accounts Targeted In Major Data Breach

Apr 29, 2025

Millions Lost Office365 Executive Email Accounts Targeted In Major Data Breach

Apr 29, 2025 -

Technical Issue Forces Blue Origin To Postpone Rocket Launch

Apr 29, 2025

Technical Issue Forces Blue Origin To Postpone Rocket Launch

Apr 29, 2025 -

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 29, 2025

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 29, 2025

Latest Posts

-

How River Road Construction Affects Louisvilles Restaurant Scene

Apr 29, 2025

How River Road Construction Affects Louisvilles Restaurant Scene

Apr 29, 2025 -

Impact Of River Road Construction On Louisville Restaurants

Apr 29, 2025

Impact Of River Road Construction On Louisville Restaurants

Apr 29, 2025 -

Louisville Eateries Face Decline Due To River Road Project

Apr 29, 2025

Louisville Eateries Face Decline Due To River Road Project

Apr 29, 2025 -

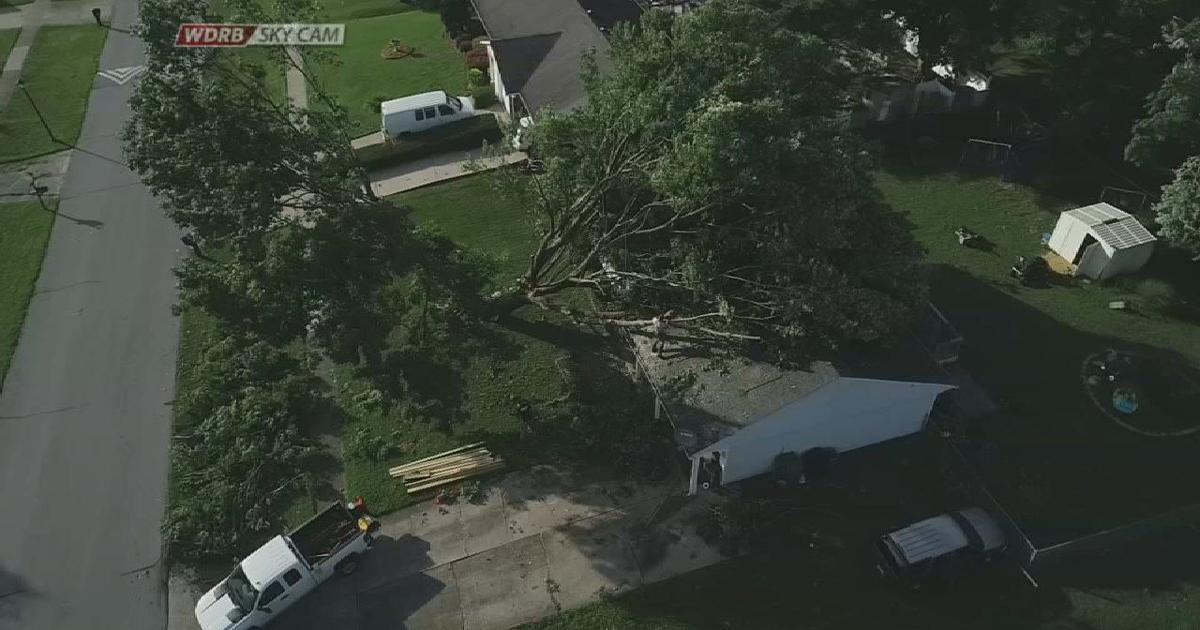

Severe Weather Cleanup Louisville Accepting Debris Removal Requests

Apr 29, 2025

Severe Weather Cleanup Louisville Accepting Debris Removal Requests

Apr 29, 2025 -

Louisville Opens Storm Debris Removal Request System

Apr 29, 2025

Louisville Opens Storm Debris Removal Request System

Apr 29, 2025