Refinance Federal Student Loans: When It Makes Sense

Table of Contents

Understanding Your Current Federal Student Loan Situation

Before considering refinancing federal student loans, you need a clear picture of your current financial situation. This involves assessing several key aspects of your existing loans.

Assessing Your Interest Rates

The core reason many people refinance is to secure a lower interest rate. Compare your current federal student loan interest rates to those offered by private lenders. Are you paying significantly more than you could be? A substantial difference could translate into significant savings over the life of your loan.

- Check your loan servicer's website: Find your interest rate and loan terms. This is your baseline for comparison.

- Research current refinance rates: Many online lenders offer tools to compare rates. Input your loan details to see potential savings.

- Fixed vs. Variable Rates: Understand the difference. Fixed rates offer stability, while variable rates can fluctuate, potentially leading to higher payments.

Evaluating Your Credit Score

Your credit score is a crucial factor in determining your eligibility for refinancing and the interest rate you'll receive. A higher credit score typically translates to better loan terms.

- Check your credit report: Review your credit report for errors that could be lowering your score. Dispute any inaccuracies.

- Improve your credit score: Before applying, work on improving your credit score through responsible financial habits. This could significantly impact your eligibility and interest rate.

- Credit score impact: Understand how your credit score influences your loan options and the interest rate you qualify for. A higher score typically unlocks lower rates.

Analyzing Your Monthly Payments and Loan Term

Consider your current monthly payments and loan term. Are your payments manageable? Could a lower monthly payment or shorter loan term help you achieve your financial goals faster?

- Calculate your current monthly payment: This helps you compare it to potential payments with refinancing.

- Explore repayment options: Private lenders offer various repayment options, including shorter or longer terms. Evaluate the trade-offs.

- Impact of loan term: A shorter term means higher monthly payments but lower total interest paid. A longer term lowers monthly payments but increases total interest.

Benefits of Refinancing Federal Student Loans

Refinancing your federal student loans can offer several key advantages, primarily focused on cost savings and simplified repayment.

Lower Interest Rates

This is the primary draw for most borrowers. Lower interest rates mean substantial savings over the life of your loan, potentially thousands of dollars.

- Use online calculators: Many refinance lenders offer calculators to estimate potential savings based on your loan details and the new interest rate.

- Long-term financial plan: Factor the potential savings into your long-term financial plan. This can free up money for other goals.

Simplified Payment Structure

Consolidating multiple federal student loans into a single private loan simplifies repayment.

- Easier tracking: Managing one payment instead of several is much easier to track and manage.

- Single monthly payment: This eliminates the hassle of juggling multiple due dates and payments.

Shorter Loan Term

While this increases monthly payments, a shorter loan term significantly reduces the total interest paid.

- Trade-off analysis: Weigh the higher monthly payments against the long-term savings from reduced interest.

- Financial capacity: Ensure you have the financial capacity to handle potentially higher monthly payments.

Drawbacks of Refinancing Federal Student Loans

While refinancing offers potential benefits, there are also significant drawbacks to consider.

Loss of Federal Loan Benefits

This is a critical consideration. Refinancing federal student loans means losing access to federal protections and benefits.

- Income-driven repayment plans: These plans adjust payments based on your income, offering crucial flexibility.

- Loan forgiveness programs: Certain professions might qualify for loan forgiveness programs, which are lost upon refinancing.

- Deferment and forbearance options: These options offer temporary relief from payments during financial hardship, and they are lost with refinancing.

Risk of Higher Interest Rates (if credit score deteriorates)

Your credit score significantly impacts your interest rate. If your credit score drops after refinancing, you could end up with a higher interest rate than before.

- Maintain good credit: Maintain a strong credit score to minimize this risk. Responsible financial behavior is key.

- Creditworthiness: Assess your creditworthiness before refinancing. If it’s weak, it might be best to improve it before applying.

Prepayment Penalties (Rare but Possible)

Though uncommon, some lenders may impose prepayment penalties if you pay off your loan early.

- Review loan terms: Carefully review the loan agreement for any prepayment penalties.

- Transparent lenders: Choose lenders with transparent and favorable terms.

Conclusion

Refinancing federal student loans can be a powerful tool to save money and simplify your financial life, but it's a decision that shouldn't be taken lightly. Carefully weigh the benefits of lower interest rates and simplified payments against the potential loss of federal loan benefits. By carefully evaluating your current financial situation and understanding the risks and rewards, you can determine if refinancing your federal student loans is the right choice for you. Before you make a decision, thoroughly research different lenders and compare their rates and terms. Remember to prioritize your financial well-being and make an informed choice about refinancing your federal student loans. Start exploring your options today and see if refinancing your federal student loans makes sense for your financial future.

Featured Posts

-

Fountain City Classic Scholarship A Midday Interview Guide

May 17, 2025

Fountain City Classic Scholarship A Midday Interview Guide

May 17, 2025 -

Federal Student Loan Refinancing A Complete Guide

May 17, 2025

Federal Student Loan Refinancing A Complete Guide

May 17, 2025 -

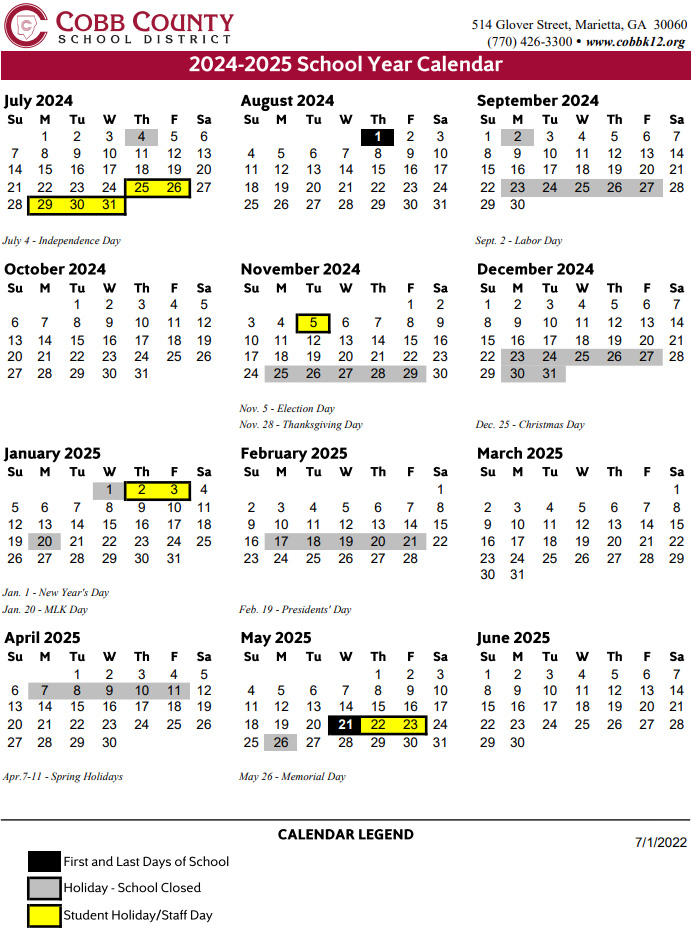

2024 25 High School Confidential Week 26 Highlights

May 17, 2025

2024 25 High School Confidential Week 26 Highlights

May 17, 2025 -

Deepfake Detection Foiled Cybersecurity Experts Clever Strategy

May 17, 2025

Deepfake Detection Foiled Cybersecurity Experts Clever Strategy

May 17, 2025 -

Simplified Surface Portfolio Analyzing Microsofts Latest Move

May 17, 2025

Simplified Surface Portfolio Analyzing Microsofts Latest Move

May 17, 2025

Latest Posts

-

Epic Games Sued Allegations Of Large Scale Deceptive Practices In Fortnite

May 17, 2025

Epic Games Sued Allegations Of Large Scale Deceptive Practices In Fortnite

May 17, 2025 -

Fortnite The Latest Icon Skin Addition

May 17, 2025

Fortnite The Latest Icon Skin Addition

May 17, 2025 -

Fortnites Item Shop A New Feature To Help Players

May 17, 2025

Fortnites Item Shop A New Feature To Help Players

May 17, 2025 -

Fortnite Cowboy Bebop Collaboration How To Get The Freebies

May 17, 2025

Fortnite Cowboy Bebop Collaboration How To Get The Freebies

May 17, 2025 -

Leaked Fortnite Icon Skin First Look And Speculation

May 17, 2025

Leaked Fortnite Icon Skin First Look And Speculation

May 17, 2025