Federal Student Loan Refinancing: A Complete Guide

Table of Contents

Understanding Federal Student Loan Refinancing

What is Federal Student Loan Refinancing?

Federal student loan refinancing involves replacing your existing federal student loans with a new private loan. This is a key distinction: you're moving from a federal loan, backed by the government, to a private loan, issued by a private lender. This process simplifies your repayment by consolidating multiple loans into a single monthly payment. However, it's crucial to understand that this transition means you'll lose the protections and benefits afforded by federal loan programs.

- Loss of federal benefits: This includes income-driven repayment plans (IDR), deferment options for times of financial hardship, and forbearance, which allows temporary suspension of payments.

- Potential for lower interest rates: Private lenders may offer lower interest rates than your current federal loans, leading to significant savings over the life of the loan.

- Simplification of multiple loan payments: Refinancing combines multiple loans into one, making budgeting and repayment easier.

Who Should Consider Refinancing?

Refinancing federal student loans is most beneficial for borrowers with a solid financial foundation. It's generally not recommended for those struggling financially or facing potential job instability.

- Individuals with a stable financial situation: A consistent income and good credit history are essential for securing favorable loan terms.

- Those with high interest rates on their existing loans: If your current interest rates are significantly high, refinancing could lead to considerable savings.

- Borrowers seeking to simplify their loan repayment process: Consolidating multiple loans into one simplifies budgeting and streamlines payments.

What are the Benefits of Refinancing?

The primary advantages of refinancing federal student loans center around cost savings and convenience.

- Reduced monthly payments: Lower interest rates often translate to lower monthly payments, making it easier to manage your budget.

- Potential for significant long-term savings on interest: Over the loan's lifespan, even small interest rate reductions can result in substantial savings.

- Simplified repayment process with a single lender: Dealing with one lender instead of multiple simplifies communication and administration.

The Refinancing Process: A Step-by-Step Guide

Checking Your Credit Score

Your credit score is a crucial factor in determining the interest rate you'll receive. A higher credit score typically qualifies you for better terms.

- Tips for improving credit score before applying: Pay down existing debts, maintain a good payment history, and avoid opening new lines of credit before applying.

- Checking your credit report for errors: Ensure your credit report is accurate; inaccuracies can negatively impact your score.

Comparing Lenders and Rates

Shopping around for the best rates is critical. Don't settle for the first offer you receive.

- Using online comparison tools: Several websites offer tools to compare rates and terms from different lenders.

- Checking lender reviews and ratings: Research lenders' reputations and read reviews from other borrowers.

- Understanding APR (Annual Percentage Rate): The APR reflects the total cost of the loan, including interest and fees. Compare APRs, not just interest rates.

Applying for Refinancing

The application process typically involves providing documentation and completing an application form.

- Required documents: You'll likely need proof of income, employment history, and possibly tax returns.

- Typical processing times: Processing times vary among lenders, but you can expect a decision within a few weeks.

- Understanding loan terms and conditions: Carefully review the loan agreement before signing to ensure you understand all terms and fees.

Potential Drawbacks and Considerations

Loss of Federal Benefits

This is a significant consideration. Refinancing means losing the safety net offered by federal student loan programs.

- Specific federal benefits lost upon refinancing: This includes income-driven repayment plans (IDR), deferment, and forbearance.

- Potential implications for borrowers facing financial hardship: Without these protections, you could face more difficulty managing payments during financial setbacks.

Risk Assessment

Private loans carry inherent risks that federal loans don't.

- Understanding the terms of the loan agreement: Carefully read and understand all terms, including interest rates, fees, and repayment schedules.

- Potential impact of changes in interest rates: Be aware of whether your interest rate is fixed or variable. Variable rates can increase over time.

- Evaluating fees and charges: Compare fees charged by different lenders; some may have higher fees than others.

Conclusion

Federal student loan refinancing can offer significant benefits, such as lower monthly payments and reduced overall interest costs. However, it's crucial to carefully weigh the advantages against the potential loss of federal protections. Before refinancing your federal student loans, thoroughly research different lenders, compare rates and terms, and ensure you understand the implications of switching to a private loan. Take control of your student loan debt today – explore your federal student loan refinancing options and make an informed decision that aligns with your financial goals. Consider your individual financial situation and explore all available options before making a decision regarding student loan refinancing. Don't hesitate to seek professional financial advice if needed.

Featured Posts

-

May 16 Oil Market Report News And Price Analysis

May 17, 2025

May 16 Oil Market Report News And Price Analysis

May 17, 2025 -

Leading Australian Crypto Casino Sites Your 2025 Guide

May 17, 2025

Leading Australian Crypto Casino Sites Your 2025 Guide

May 17, 2025 -

Wga And Sag Aftra Strike What It Means For Hollywood

May 17, 2025

Wga And Sag Aftra Strike What It Means For Hollywood

May 17, 2025 -

Mariners Vs Tigers Mlb Game Predictions Odds And Expert Betting Tips

May 17, 2025

Mariners Vs Tigers Mlb Game Predictions Odds And Expert Betting Tips

May 17, 2025 -

Angel Reeses Post Chicago Sky Game Statement A Full Breakdown

May 17, 2025

Angel Reeses Post Chicago Sky Game Statement A Full Breakdown

May 17, 2025

Latest Posts

-

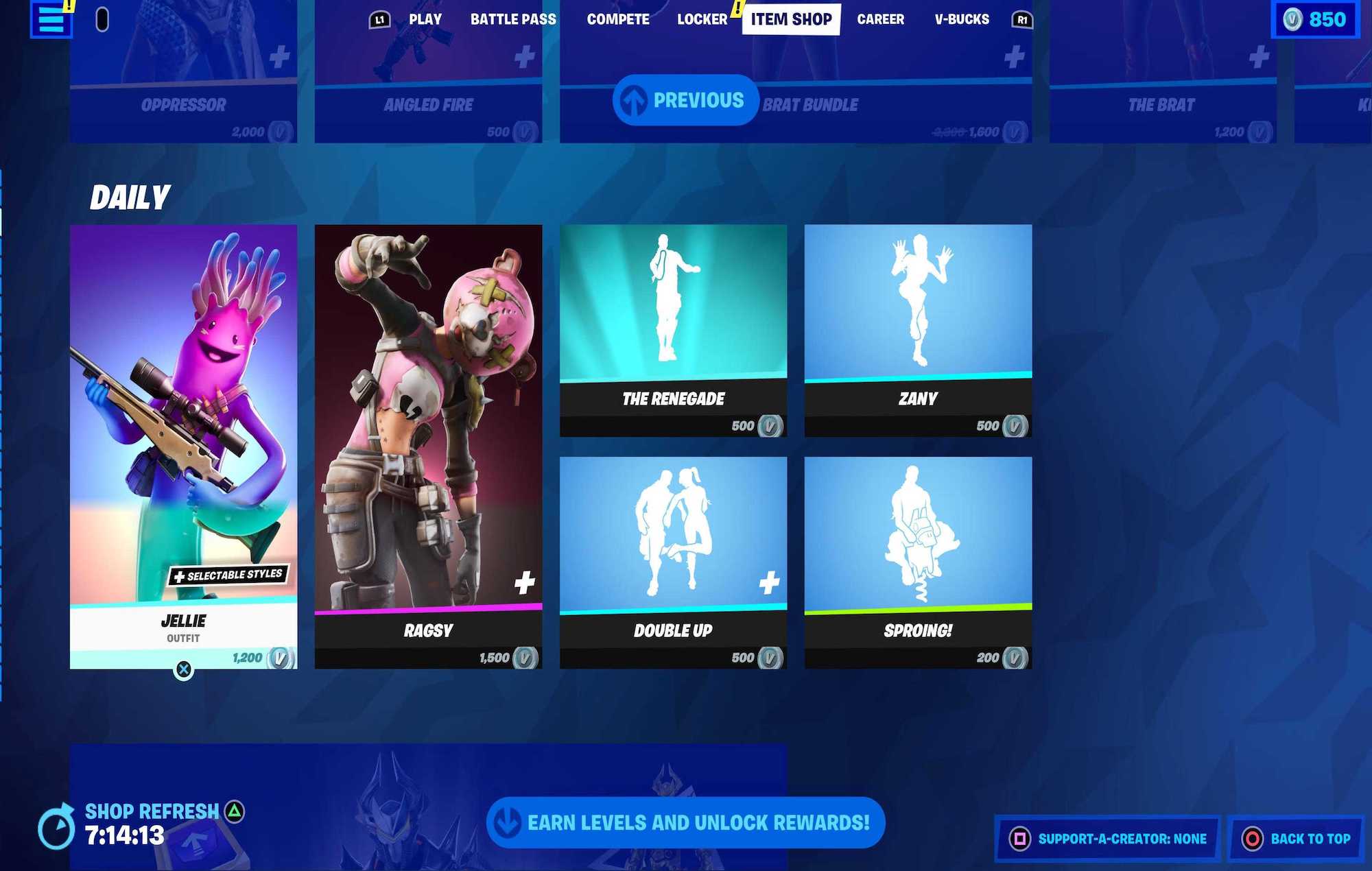

Leaked Fortnite Icon Skin First Look And Speculation

May 17, 2025

Leaked Fortnite Icon Skin First Look And Speculation

May 17, 2025 -

Fortnite Item Shop Enhanced A Helpful New Feature Explained

May 17, 2025

Fortnite Item Shop Enhanced A Helpful New Feature Explained

May 17, 2025 -

Fortnite Icon Series A New Skin Joins The Battle

May 17, 2025

Fortnite Icon Series A New Skin Joins The Battle

May 17, 2025 -

Improved Navigation Fortnite Item Shop Adds Player Friendly Feature

May 17, 2025

Improved Navigation Fortnite Item Shop Adds Player Friendly Feature

May 17, 2025 -

Fortnites Cosmetic Market A Refund And Its Possible Impact

May 17, 2025

Fortnites Cosmetic Market A Refund And Its Possible Impact

May 17, 2025