Privatizing Student Loans: Analyzing Trump's Hints And Potential Impacts

Table of Contents

Trump's Hints and Proposals Regarding Student Loan Privatization

Examining Public Statements and Policy Proposals

During the Trump administration, while no concrete plan for full-scale student loan privatization emerged, several statements and policy proposals hinted at a shift towards greater private sector involvement in student loan management and reform. These suggestions often appeared alongside broader discussions of student loan debt relief and higher education reform.

- 2016 Campaign: Trump's campaign rhetoric included discussions of reforming the student loan system, though specifics regarding privatization were scarce. The focus was more on reducing the cost of higher education.

- Proposed Budget Cuts: The Trump administration's proposed budgets included cuts to various education programs, potentially paving the way for increased reliance on private lenders to fill the funding gap.

- Emphasis on Market-Based Solutions: The administration frequently emphasized market-based solutions to address economic challenges, potentially suggesting a preference for private sector involvement in managing student loans. (Source needed – cite relevant news articles or government documents here)

The political climate at the time, characterized by a desire to reduce government spending and increase private sector efficiency, likely influenced these suggestions. The administration aimed to address the growing student loan debt crisis but often favored solutions emphasizing market forces over direct government intervention.

Comparing Trump's Approach to Previous Administrations

Trump's approach to student loan reform differed significantly from previous administrations. While previous presidents had focused on expanding government programs aimed at making college more affordable (like Pell Grants), Trump's focus seemed to lean towards empowering the private sector to address the problem.

- Obama Administration: Focused on expanding income-driven repayment plans and student loan forgiveness programs.

- Bush Administration: Implemented reforms like the College Cost Reduction and Access Act, but largely maintained the existing government-backed loan system.

The key difference lies in the preferred method of tackling the problem: government intervention versus market-driven solutions. The economic conditions and political priorities differed markedly between these administrations, significantly shaping their approaches to student loan reform.

Potential Positive Impacts of Student Loan Privatization

Increased Efficiency and Innovation

Proponents of student loan privatization argue that private entities could manage loans more efficiently than the government. This argument often rests on claims of superior operational efficiency and the potential for technological innovation.

- Streamlined Processes: Private companies might implement more streamlined processes for loan application, disbursement, and repayment.

- Technological Advancements: Private lenders could leverage technology to personalize repayment plans and offer more user-friendly online tools.

- Personalized Repayment Options: Private lenders may be more flexible in tailoring repayment plans to individual borrowers' financial situations.

However, this argument overlooks potential challenges like the need for robust regulatory oversight to prevent exploitation and ensure equitable access.

Competition and Lower Interest Rates (Potential)

Another argument suggests that competition among private lenders could drive down interest rates for borrowers. This is based on the principle of competitive markets, where increased competition typically leads to lower prices.

- Increased Choice for Borrowers: Competition among lenders might give borrowers more options and more favorable loan terms.

- Market Efficiency: The free market theoretically allocates resources more efficiently, leading to optimal pricing.

However, this relies on a truly competitive market with strong consumer protection regulations. Without safeguards, the possibility of increased interest rates and predatory lending practices significantly undermines this optimistic outlook.

Potential Negative Impacts of Student Loan Privatization

Increased Costs and Predatory Lending

A major concern surrounding student loan privatization is the potential for increased costs and predatory lending practices. Private lenders, driven by profit motives, might charge higher interest rates and fees than the government.

- Higher Interest Rates and Fees: Private lenders may charge significantly higher interest rates and fees compared to government-backed loans, increasing the overall cost of borrowing.

- Predatory Lending Tactics: The history of the subprime mortgage crisis demonstrates the potential for predatory lending practices targeting vulnerable borrowers.

Robust consumer protection regulations and strong regulatory oversight are crucial to mitigating these risks.

Reduced Access to Loans and Increased Inequality

Privatization could potentially reduce access to loans, particularly for low-income borrowers and students from underrepresented groups.

- Credit Score Requirements: Private lenders often rely on credit scores, potentially excluding those with limited or no credit history.

- Higher Barriers to Entry: More stringent lending criteria could create significant barriers to entry for students from disadvantaged backgrounds.

This would exacerbate existing inequalities in higher education access, leading to a less equitable system.

Political and Ethical Concerns

Privatizing student loans raises significant political and ethical concerns. The influence of powerful private lenders on policy decisions and the potential for conflicts of interest are paramount.

- Lobbying and Political Influence: Private lenders may exert undue political influence, shaping policies to favor their interests.

- Lack of Transparency and Accountability: Private companies are not subject to the same level of public scrutiny as government agencies, potentially leading to a lack of transparency and accountability.

Conclusion: Weighing the Pros and Cons of Privatizing Student Loans

The debate surrounding student loan privatization is complex, with valid arguments on both sides. While privatization could potentially increase efficiency and (theoretically) lower interest rates through competition, the risks are substantial. The potential for increased costs, reduced access to loans, and ethical concerns associated with profit-driven loan management cannot be ignored. The Trump administration’s hints towards increased private sector involvement, while not resulting in full privatization, highlighted the ongoing tension between market-based solutions and the need for equitable access to higher education. The significant impact of student loan debt on individuals and the economy necessitates careful consideration of any policy shifts in this area.

Stay informed about the ongoing debate surrounding student loan privatization and its potential impact on your future. Engage in informed discussions about student loan reform, student debt relief, and higher education affordability to help shape a more just and accessible system for all.

Featured Posts

-

Rfk Jr S Hhs An Exclusive Look At The Potential End Of Routine Covid 19 Vaccination For Children And Pregnant Women

May 17, 2025

Rfk Jr S Hhs An Exclusive Look At The Potential End Of Routine Covid 19 Vaccination For Children And Pregnant Women

May 17, 2025 -

The Auto Industrys Standoff Dealers Vs Electric Vehicle Regulations

May 17, 2025

The Auto Industrys Standoff Dealers Vs Electric Vehicle Regulations

May 17, 2025 -

Analyzing Principal Financial Group Pfg Key Insights From 13 Analysts

May 17, 2025

Analyzing Principal Financial Group Pfg Key Insights From 13 Analysts

May 17, 2025 -

Is Josh Hart The Knicks Draymond Green Analyzing His Contributions

May 17, 2025

Is Josh Hart The Knicks Draymond Green Analyzing His Contributions

May 17, 2025 -

How Immigration Agents Investigated Columbia University For Harboring Undocumented Immigrants

May 17, 2025

How Immigration Agents Investigated Columbia University For Harboring Undocumented Immigrants

May 17, 2025

Latest Posts

-

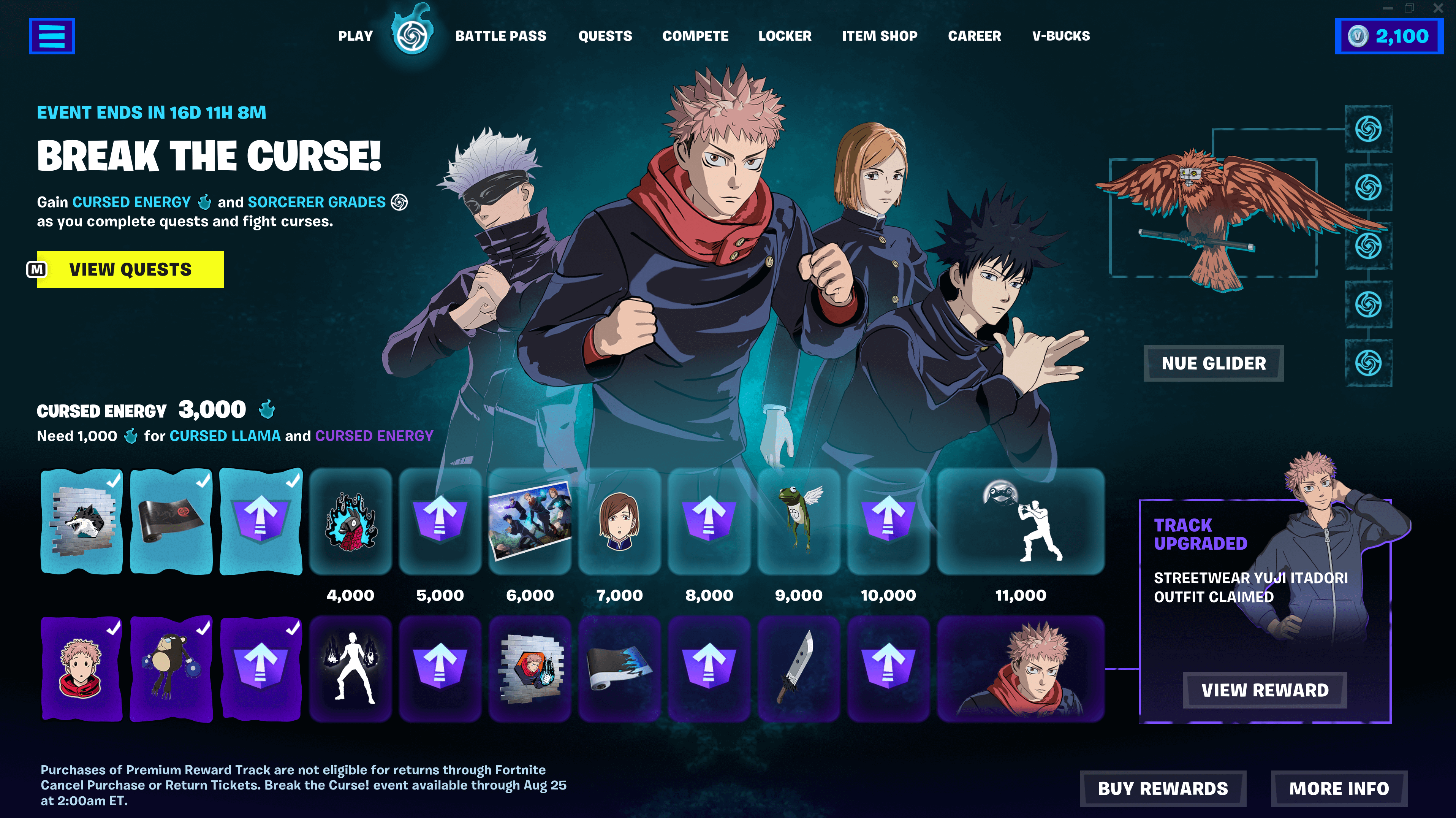

Fortnite Item Shop The Return Of Highly Demanded Skins 1000 Days

May 17, 2025

Fortnite Item Shop The Return Of Highly Demanded Skins 1000 Days

May 17, 2025 -

Fortnite Item Shop 1000 Day Old Skins Return

May 17, 2025

Fortnite Item Shop 1000 Day Old Skins Return

May 17, 2025 -

Examining Ubers Stock Its Potential During A Recession

May 17, 2025

Examining Ubers Stock Its Potential During A Recession

May 17, 2025 -

Uber Stock And Recessions What Analysts Are Saying

May 17, 2025

Uber Stock And Recessions What Analysts Are Saying

May 17, 2025 -

Investors Guide Understanding Uber Stocks Recessionary Behavior

May 17, 2025

Investors Guide Understanding Uber Stocks Recessionary Behavior

May 17, 2025