President Trump Renews Criticism Of Fed Chair Jerome Powell

Table of Contents

Trump's Key Criticisms of Jerome Powell and the Federal Reserve

President Trump's dissatisfaction with Chairman Powell stems from several key areas, each impacting the nation's economic trajectory and investor confidence.

Interest Rate Hikes and Economic Slowdown

Trump consistently criticizes Powell's interest rate hikes, arguing they stifle economic growth and jeopardize his chances of re-election.

- Specific examples: Trump has frequently tweeted and stated in public addresses his disapproval of rate increases, calling them "crazy" and detrimental to the economy. He has specifically cited instances where rate hikes coincided with slowing economic indicators.

- Economic arguments: Trump's argument rests on the idea that higher interest rates increase borrowing costs for businesses and consumers, reducing investment and spending, thus slowing economic growth. Conversely, proponents of the Fed's policies argue that controlled interest rate hikes are necessary to prevent runaway inflation and maintain long-term economic stability.

- Impact on business confidence: The uncertainty generated by Trump's public criticism of the Fed's actions can negatively impact business confidence and investment decisions. Businesses may delay investments or postpone expansion plans due to this uncertainty, further impacting economic growth.

Allegations of Political Bias

Trump has repeatedly accused Powell of being politically motivated, suggesting that the Fed Chair is deliberately undermining the administration's economic policies.

- Evidence (or lack thereof): While Trump has made these allegations, concrete evidence of political bias on Powell's part remains elusive. Critics argue that such accusations undermine the independence of the Federal Reserve.

- Importance of Fed independence: The Federal Reserve's independence from political pressure is a cornerstone of its effectiveness. Political interference could lead to short-sighted monetary policies driven by electoral considerations rather than sound economic principles.

- Historical context: Throughout history, the relationship between Presidents and the Federal Reserve has been complex, with periods of cooperation and conflict. However, the frequency and intensity of Trump's criticism are unprecedented.

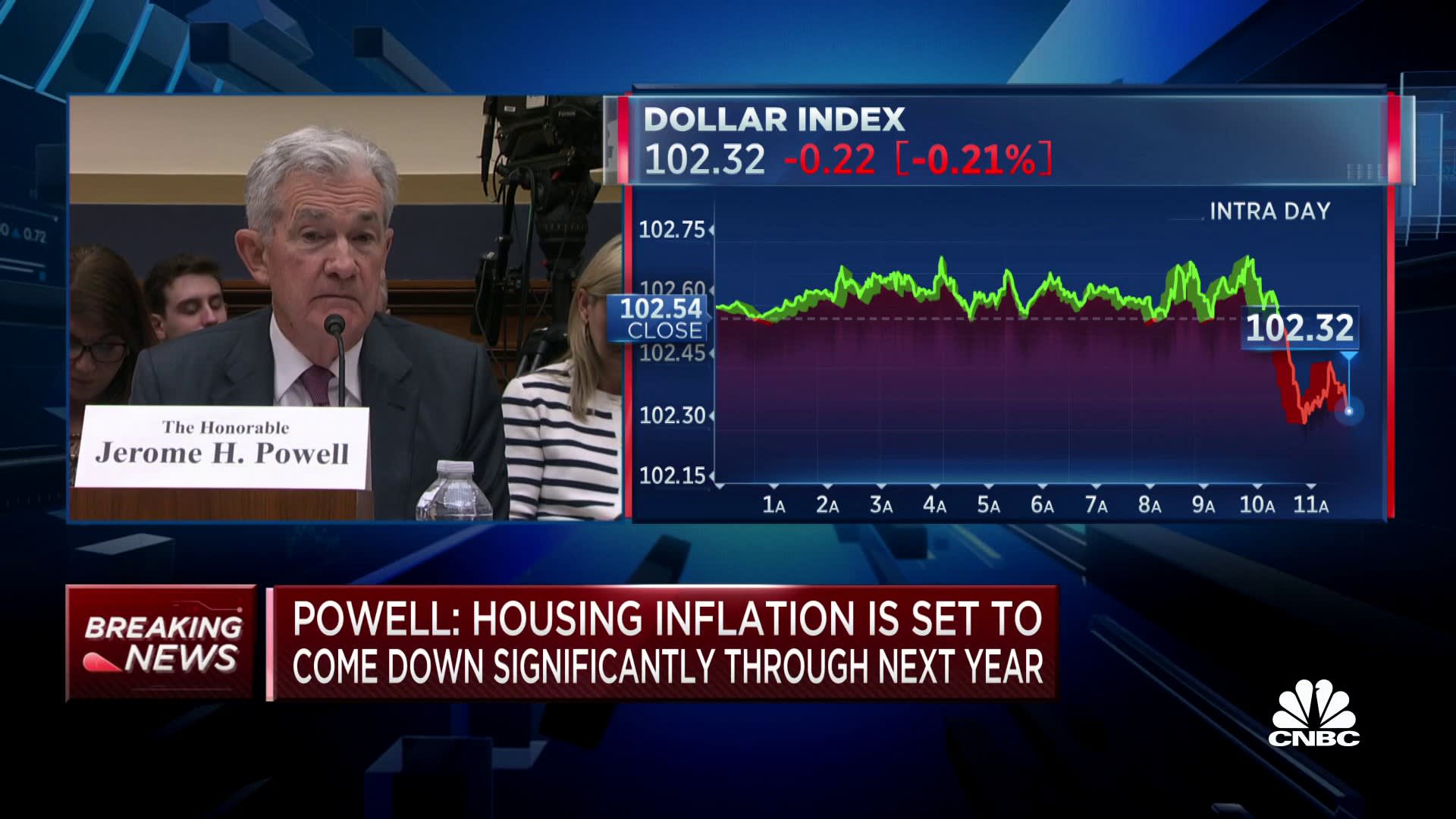

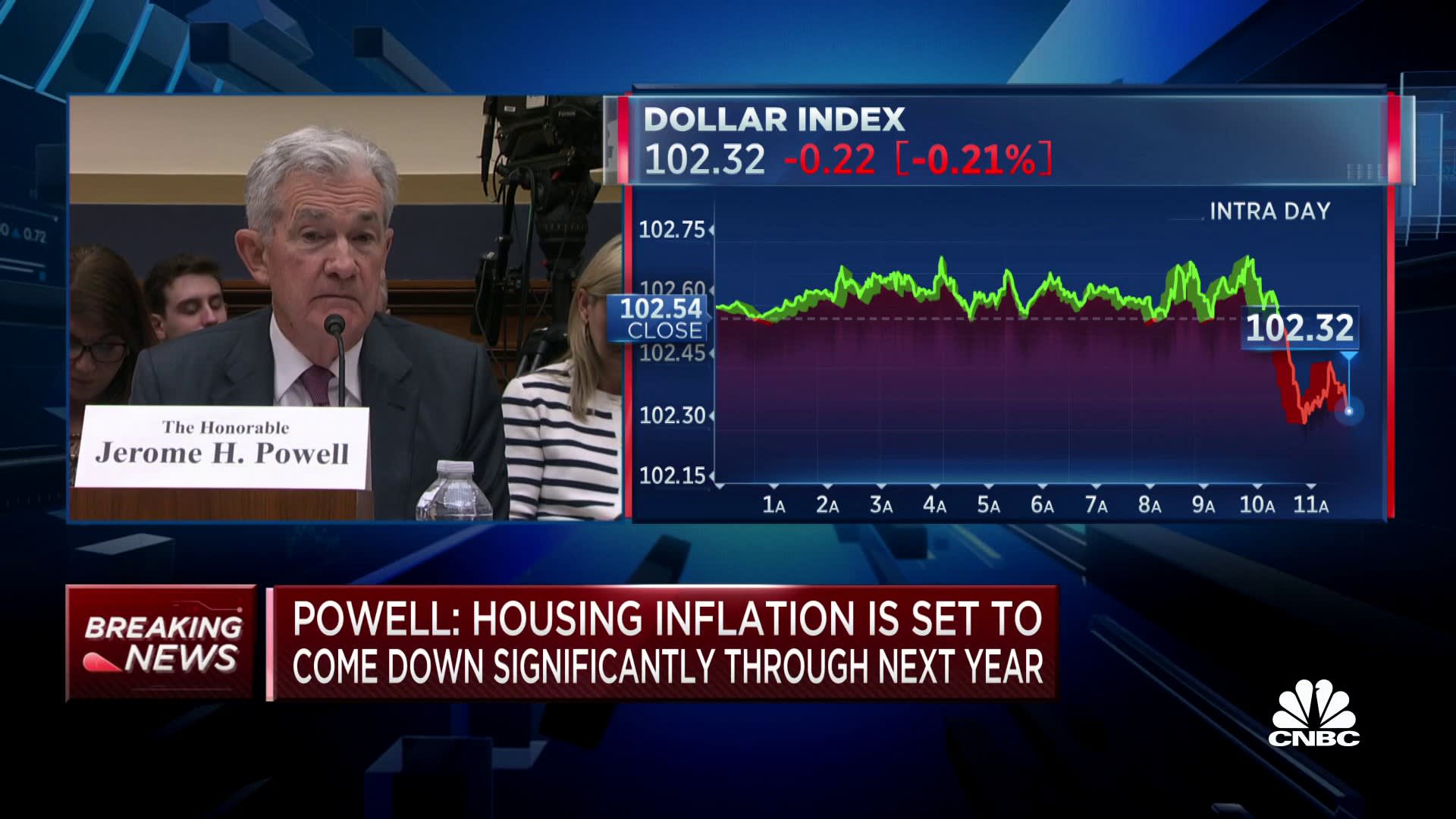

Impact on the Stock Market and Currency

Trump's criticism of Powell and the Fed significantly impacts market volatility and investor sentiment.

- Market fluctuations: Trump's public pronouncements on the Fed have historically been followed by noticeable market fluctuations, with the stock market often experiencing declines after his criticisms.

- Confidence in the Fed: Investor confidence in the Federal Reserve is directly linked to market stability. When the Fed's independence is questioned, it can lead to uncertainty and increased market volatility.

- Impact on the US dollar: The US dollar's value can be affected by concerns about the Fed's independence and its ability to effectively manage monetary policy. Uncertainty in this area can lead to fluctuations in the dollar's exchange rate and affect international trade.

Powell's Response and the Fed's Stance

Despite facing intense pressure, Jerome Powell has consistently defended the Fed's independence and its monetary policy decisions.

Maintaining Independence

Powell has repeatedly emphasized the Fed's commitment to its mandate of price stability and maximum employment, while maintaining its independence from political influence.

- Public statements: Powell has publicly defended the Fed's actions, emphasizing its focus on long-term economic stability, not short-term political gains. He has reiterated the importance of the Fed's independence in carrying out its responsibilities.

- Legal and institutional frameworks: The Federal Reserve Act provides a framework for the Fed's independence, limiting direct political control over monetary policy decisions.

- Consequences of undermining independence: Undermining the Fed's independence could lead to unpredictable and potentially harmful monetary policies, eroding confidence in the US dollar and the stability of the financial system.

Justification of Monetary Policy Decisions

The Federal Reserve's monetary policy decisions are based on a complex analysis of various economic indicators.

- Economic indicators: The Fed closely monitors inflation, unemployment rates, economic growth, and other key metrics to inform its decisions.

- Balancing growth and inflation: The Fed faces the challenge of balancing economic growth with controlling inflation. Raising interest rates too aggressively can stifle growth, while raising them too slowly can lead to higher inflation.

- Diverse perspectives: There is considerable debate among economists regarding the effectiveness of the Fed's policies. Different schools of thought advocate for various approaches to monetary policy, highlighting the complexity of the issue.

Conclusion

President Trump's ongoing criticism of Fed Chair Jerome Powell highlights a crucial tension between the executive branch and an independent central bank. While Trump advocates for policies he believes will stimulate short-term economic growth, Powell and the Fed prioritize long-term stability and the avoidance of actions that could lead to destabilizing inflation. The consequences of this conflict extend beyond immediate economic impacts, raising significant questions about the appropriate balance of power and the paramount importance of preserving the Fed's independence for the health of the US economy.

Call to Action: Stay informed about the ongoing developments in this crucial political and economic conflict by regularly checking back for updates on the relationship between President Trump and Federal Reserve Chair Jerome Powell. Understanding the nuances of this dynamic is essential for anyone seeking to navigate the complexities of the current economic climate and the future of US monetary policy.

Featured Posts

-

Jan 6 Committee Witness Cassidy Hutchinson To Publish Memoir

Apr 23, 2025

Jan 6 Committee Witness Cassidy Hutchinson To Publish Memoir

Apr 23, 2025 -

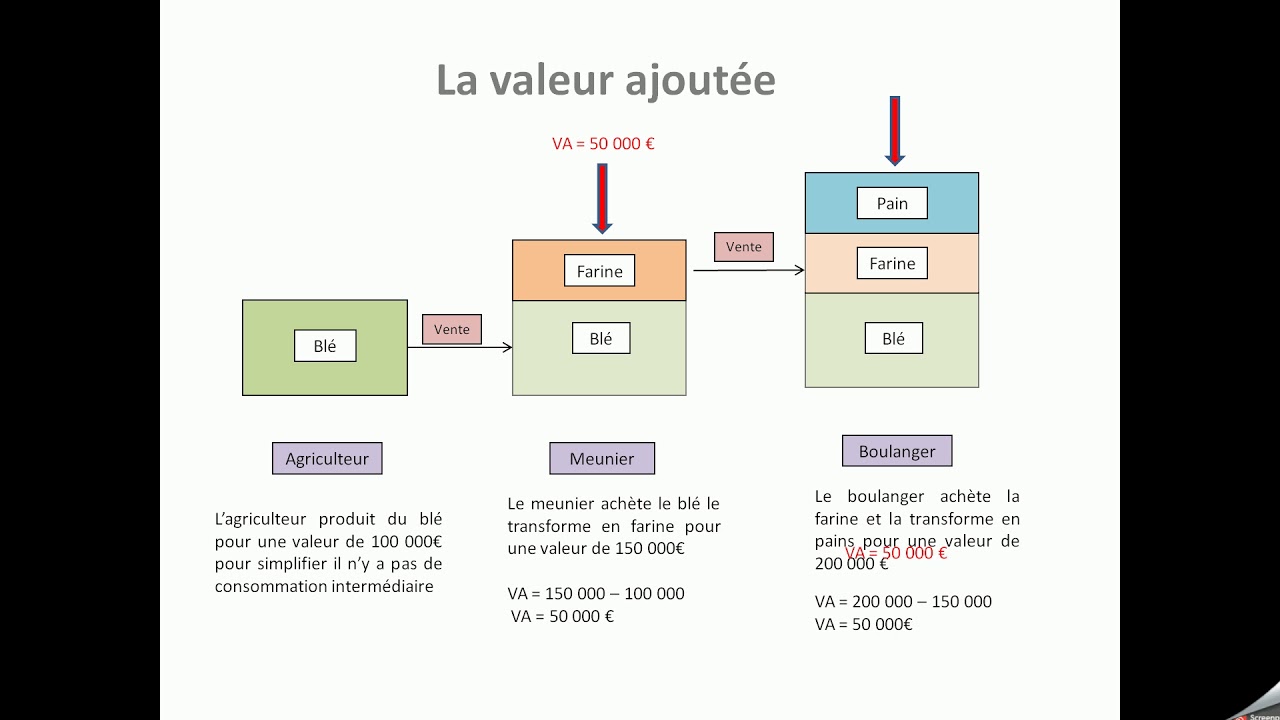

Valeur Ajoutee D Infotel Un Succes Client Le 17 Fevrier

Apr 23, 2025

Valeur Ajoutee D Infotel Un Succes Client Le 17 Fevrier

Apr 23, 2025 -

2569

Apr 23, 2025

2569

Apr 23, 2025 -

Understanding The Financial Strain Trumps Tariffs And The Canadian Consumer

Apr 23, 2025

Understanding The Financial Strain Trumps Tariffs And The Canadian Consumer

Apr 23, 2025 -

Market Analysis Dow Futures Gold Prices And Impact Of Tariffs And Fed Policy

Apr 23, 2025

Market Analysis Dow Futures Gold Prices And Impact Of Tariffs And Fed Policy

Apr 23, 2025