Market Analysis: Dow Futures, Gold Prices, And Impact Of Tariffs And Fed Policy

Table of Contents

Understanding market dynamics is crucial for investors. This market analysis explores the interconnectedness of Dow Futures, gold prices, and the significant influence of tariffs and Federal Reserve (Fed) policy. We'll delve into the current trends and explore how these factors impact investment strategies, providing you with a comprehensive overview to improve your trading decisions.

H2: Dow Futures: Tracking the US Economy

Dow Futures contracts are a powerful tool for gauging investor sentiment towards the US economy. Their price movements offer valuable insights into future market performance.

H3: Sensitivity to Economic Indicators: Dow Futures contracts are highly sensitive to a variety of key economic indicators. Fluctuations are often driven by:

- GDP growth reports: Strong GDP growth generally leads to increased optimism and higher Dow Futures prices. Conversely, weak growth can trigger declines.

- Employment data (non-farm payrolls): Positive employment numbers, indicating a healthy labor market, often support higher Dow Futures. Conversely, job losses tend to put downward pressure on prices.

- Inflation reports (CPI, PPI): Inflation reports are closely scrutinized. Moderate inflation is generally positive, while high inflation can trigger concerns about Fed intervention and potentially lower Dow Futures.

- Corporate earnings announcements: Strong corporate earnings reports boost investor confidence and usually result in higher Dow Futures. Disappointing earnings, on the other hand, can lead to sell-offs.

H3: Impact of Fed Policy on Dow Futures: The Federal Reserve's actions significantly influence Dow Futures.

- Interest rate hikes: Interest rate hikes generally increase borrowing costs for businesses, potentially slowing economic growth and impacting Dow Futures negatively.

- Quantitative easing (QE): QE, a monetary policy tool involving injecting liquidity into the market, usually supports higher Dow Futures.

- Forward guidance: The Fed's communication about future monetary policy, also known as forward guidance, can heavily influence investor expectations and Dow Futures trading.

H3: Analyzing Dow Futures Charts and Technical Indicators: Technical analysis is invaluable when trading Dow Futures. Tools like:

- Moving averages: Identify trends and potential support/resistance levels.

- RSI (Relative Strength Index): Measures the momentum of price changes, helping identify overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Identifies changes in momentum, providing potential buy/sell signals.

H2: Gold Prices: A Safe Haven Asset

Gold is a popular investment, often acting as a hedge against various economic and geopolitical uncertainties.

H3: Gold as a Hedge Against Inflation and Uncertainty: Investors often turn to gold during times of:

- High inflation: Gold's value tends to increase during inflationary periods as it maintains its purchasing power, unlike fiat currencies.

- Geopolitical instability: During times of global uncertainty, investors flock to gold as a safe haven asset, driving up demand and prices.

- Economic recession fears: Gold often serves as a safe haven during periods of economic slowdown or recession.

H3: Impact of Dollar Strength on Gold Prices: Gold is priced in US dollars, so the dollar's strength impacts its price inversely.

- Strong dollar: A stronger dollar makes gold more expensive for holders of other currencies, leading to reduced demand and lower gold prices.

- Weak dollar: A weaker dollar makes gold more affordable internationally, increasing demand and potentially driving gold prices higher.

H3: Influence of Interest Rates on Gold Prices: Interest rates also influence gold's price.

- Higher interest rates: Higher rates make alternative investments like bonds more attractive, potentially reducing demand for non-yielding gold.

- Lower interest rates: Lower rates can make gold more appealing relative to other investments.

H2: Impact of Tariffs and Trade Wars

Tariffs and trade wars create significant uncertainty in the markets and affect both Dow Futures and gold prices.

H3: Tariffs and their Ripple Effects on Markets: The imposition of tariffs can have far-reaching consequences:

- Increased costs: Tariffs increase the cost of imported goods, leading to higher prices for consumers and reduced purchasing power.

- Supply chain disruptions: Trade wars disrupt global supply chains, impacting production and potentially leading to shortages.

- Reduced corporate profits: Tariffs can negatively affect corporate profits, reducing investor confidence.

H3: Market Reactions to Trade Negotiations: Trade negotiations and announcements strongly influence market sentiment.

- Positive outcomes: Positive developments in trade talks typically lead to increased market confidence and higher Dow Futures.

- Negative outcomes: Negative news often triggers sell-offs in both stocks and potentially boosts safe-haven demand for gold.

H3: Geopolitical Risks and their Impact: Geopolitical events and escalating tensions worldwide often affect market stability.

- Increased uncertainty: Geopolitical uncertainty frequently increases gold's appeal as a safe-haven asset, driving up its price.

- Market volatility: Geopolitical risks frequently lead to greater market volatility in both Dow Futures and other asset classes.

H2: Integrating Market Analysis for Informed Decisions

Effective investment strategies require a holistic approach that considers multiple factors.

H3: Combining Fundamental and Technical Analysis: Successful market analysis integrates both fundamental and technical analysis.

- Fundamental analysis: Examines macroeconomic indicators (GDP, inflation, interest rates), company performance, and industry trends.

- Technical analysis: Analyzes price charts, trading volume, and technical indicators to identify trends and potential trading opportunities.

H3: Diversification and Risk Management Strategies: Diversification is crucial to mitigate risk:

- Asset allocation: Distribute investments across different asset classes (stocks, bonds, commodities like gold) to reduce exposure to any single market.

- Risk tolerance: Understand your risk tolerance and adjust your investment strategy accordingly.

- Stop-loss orders: Use stop-loss orders to limit potential losses on your investments.

H3: Staying Informed and Adapting to Market Changes: The market is dynamic, so continuous monitoring is essential.

- Economic news: Stay updated on major economic news releases.

- Policy changes: Follow central bank announcements and government policies.

- Market trends: Continuously monitor market trends and adjust your strategy as needed.

Conclusion:

This market analysis demonstrates the complex relationship between Dow Futures, gold prices, tariffs, and Fed policy. Understanding these interconnected factors is crucial for effective investing. By analyzing economic indicators, monitoring market trends, employing diversified strategies, and implementing robust risk management, investors can navigate the complexities of the market more successfully. Remember to conduct thorough research and, if needed, seek advice from a qualified financial advisor before making any investment decisions. Continue your journey into effective market analysis by exploring further resources and deepening your understanding of these key market indicators.

Featured Posts

-

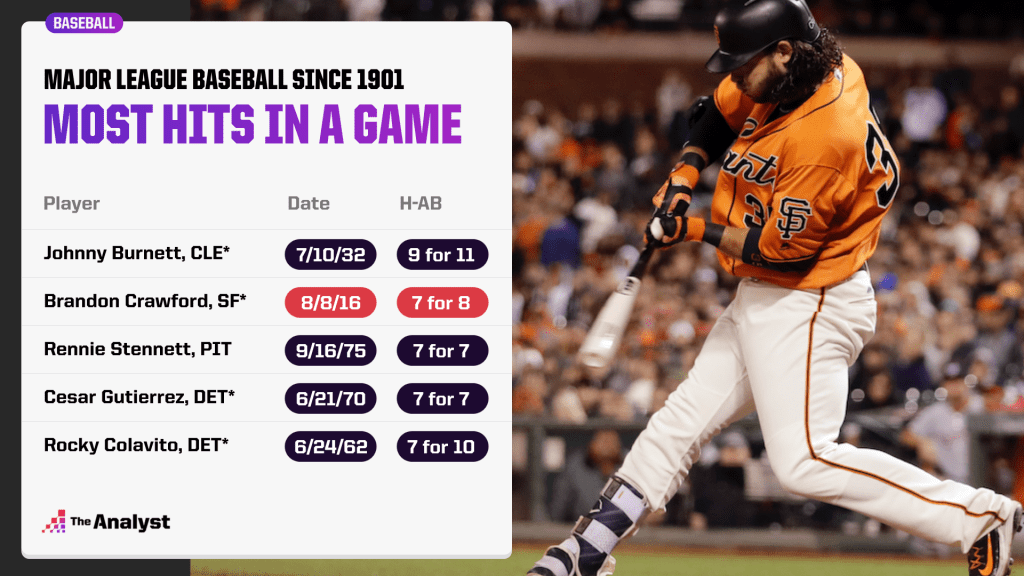

Brewers Record Breaking 9 Steal Game 6 Bases Stolen In The First Inning

Apr 23, 2025

Brewers Record Breaking 9 Steal Game 6 Bases Stolen In The First Inning

Apr 23, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

Apr 23, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

Apr 23, 2025 -

Ser Sbykt Dhhb 10 Jramat Alywm Alathnyn 17 Fbrayr 2025 Fy Swq Alsaght

Apr 23, 2025

Ser Sbykt Dhhb 10 Jramat Alywm Alathnyn 17 Fbrayr 2025 Fy Swq Alsaght

Apr 23, 2025 -

Yankees Smash Team Record With 9 Home Runs Judges Trio Leads The Charge 2025

Apr 23, 2025

Yankees Smash Team Record With 9 Home Runs Judges Trio Leads The Charge 2025

Apr 23, 2025 -

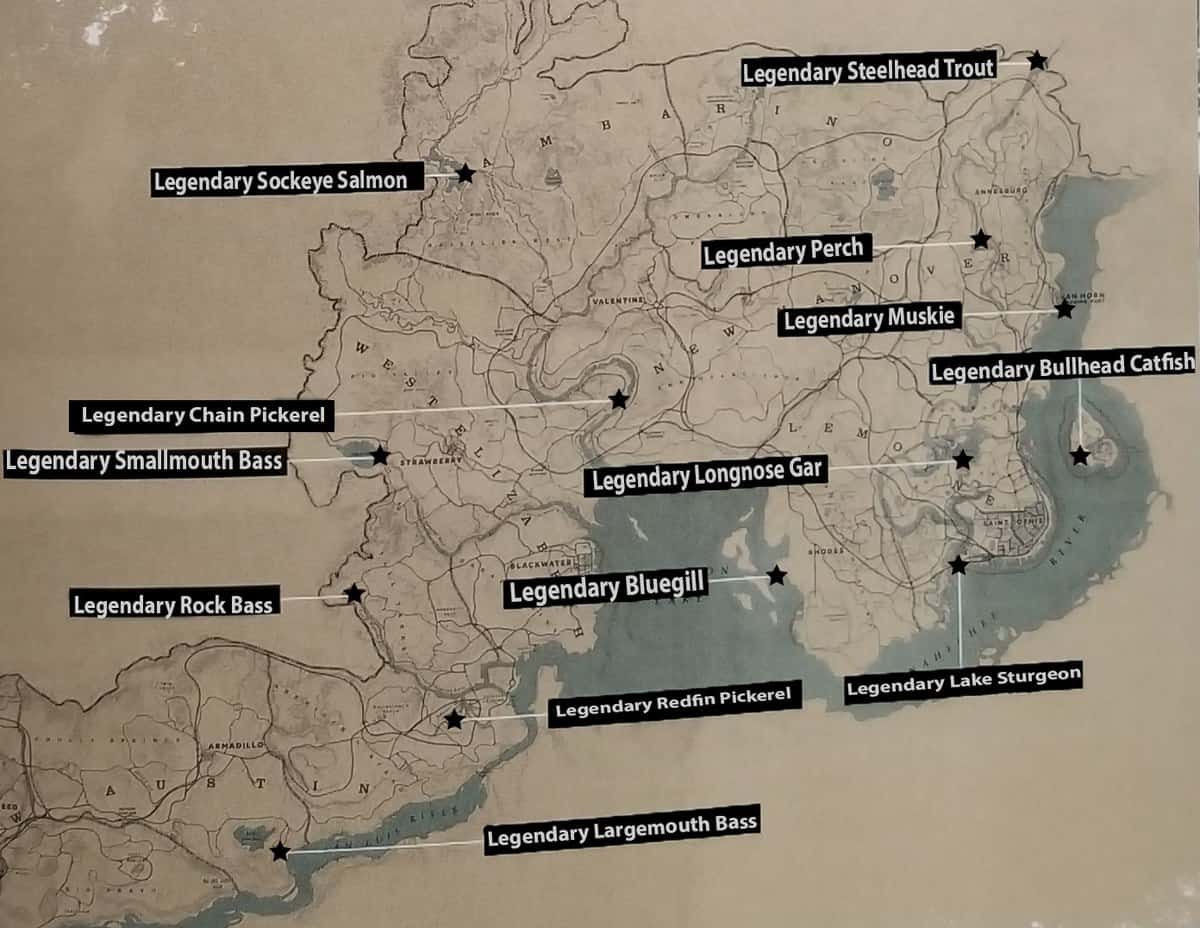

The Countrys Top New Business Locations A Comprehensive Map

Apr 23, 2025

The Countrys Top New Business Locations A Comprehensive Map

Apr 23, 2025