Understanding The Financial Strain: Trump's Tariffs And The Canadian Consumer

Table of Contents

Increased Prices on Imported Goods

The most immediate effect of Trump's tariffs was a direct increase in the prices of imported goods from the US. This wasn't limited to luxury items; everyday consumer goods felt the impact.

The Direct Impact of Tariffs

Tariffs, essentially taxes on imports, directly increased the cost of goods at the border. This increase was then passed on to Canadian consumers.

- Examples: The price of steel and aluminum, key components in many manufactured goods, rose sharply. This led to higher prices for automobiles, appliances (refrigerators, washing machines), and construction materials.

- Percentage Increases: While precise figures vary by product, many goods saw price increases ranging from 5% to 25%, significantly impacting household budgets. Data from Statistics Canada provides detailed information on inflation rates during this period. (Link to relevant Statistics Canada data would be inserted here).

- Impact on Inflation: The increased cost of imported goods contributed to a noticeable rise in Canada's inflation rate, eroding consumer purchasing power.

Ripple Effect on Domestic Prices

The impact extended beyond directly imported goods. Increased prices on imported inputs affected domestically produced goods as well.

- Examples: Canadian manufacturers relying on imported steel and aluminum saw their production costs increase, leading to higher prices for their finished products. This ripple effect impacted everything from furniture to building supplies.

- Supply Chain Disruption: The tariffs disrupted established supply chains, forcing businesses to find more expensive alternatives or reduce production, further impacting prices.

- Impact on Small Businesses: Small businesses, with less financial flexibility, were particularly vulnerable to these price increases, facing challenges in maintaining profitability and competitiveness.

Impact on Specific Sectors

Several key Canadian sectors felt the brunt of Trump's tariffs. The interconnected nature of the North American economy meant that the impact rippled through various industries.

The Automotive Industry

The Canadian automotive sector, deeply integrated with the US, suffered significantly.

- Specific Challenges: Canadian automakers faced increased costs for parts and materials, impacting their competitiveness in the global market. This led to production cutbacks and job losses.

- Job Losses: The increased costs and reduced competitiveness resulted in job losses across the automotive manufacturing and supply chain.

- Government Intervention: The Canadian government implemented various support measures to mitigate the impact on the industry, including financial aid and trade negotiations.

Agriculture and Food Production

Canadian farmers and food producers also faced challenges, with significant effects on both exports to the US and imports from the US.

- Specific Agricultural Products Affected: Products like dairy, pork, and softwood lumber were particularly impacted by retaliatory tariffs imposed by the US.

- Trade Disputes: The imposition of tariffs escalated trade disputes between the two countries, leading to uncertainty and market volatility for Canadian agricultural producers.

- Impact on Canadian Consumers' Food Prices: Increased costs for producers translated into higher food prices for Canadian consumers, particularly for those goods subject to tariffs or retaliatory tariffs.

The Lumber Industry

The Canadian lumber industry, a major exporter to the US, was severely impacted by the tariffs imposed on Canadian lumber exports.

- Tariffs Imposed on Canadian Lumber: Significant tariffs were imposed, leading to reduced demand for Canadian lumber in the US market.

- Impact on Jobs and the Economy: This resulted in job losses in the lumber industry and related sectors across Canada, negatively impacting local economies.

- Long-Term Implications: The long-term effects on the Canadian lumber industry included reduced investment and a shift in market focus away from the US.

Long-Term Economic Consequences

The impact of Trump's tariffs extended beyond immediate price increases, creating significant long-term economic consequences for Canada.

Weakened Canadian Dollar

The tariffs contributed to a weakening of the Canadian dollar against the US dollar.

- Correlation between Tariffs and Exchange Rates: The economic uncertainty created by the trade disputes and the increased costs for Canadian businesses contributed to the weakening of the Canadian dollar.

- Impact on Canadian Purchasing Power: A weaker dollar made imports even more expensive, further squeezing consumer spending power and increasing the financial strain on Canadian households.

Reduced Consumer Spending

Increased prices and economic uncertainty led to a decrease in consumer spending.

- Statistical Data Showing Decreased Consumer Confidence: Indices tracking consumer confidence showed a decline during this period, indicating reduced willingness to spend. (Link to relevant economic data would be inserted here).

- Impact on Retail Sales: Retail sales figures reflected the reduced consumer spending, signaling a slowdown in economic growth.

Government Response and Mitigation Strategies

The Canadian government responded to the economic challenges with various initiatives.

- Government Aid Packages: The government provided financial aid and support programs to affected businesses and sectors to mitigate job losses and economic disruption.

- Trade Negotiations: Canada engaged in intensive trade negotiations to resolve trade disputes and reduce or eliminate tariffs.

- Long-Term Economic Planning: The experience highlighted the need for long-term economic planning to diversify trade relationships and reduce reliance on a single major trading partner.

Conclusion

Trump's tariffs created a significant financial strain on Canadian consumers, leading to increased prices on a wide range of goods, impacting various sectors, and weakening the Canadian dollar. The lasting effects on the automotive, agricultural, and lumber industries, coupled with reduced consumer spending, underscored the vulnerability of the Canadian economy to trade disruptions. This highlights the importance of understanding the complex interplay between international trade policies and their direct impact on personal finances. Continue your research into understanding the financial strain of trade wars and how they affect consumers by exploring resources from the Bank of Canada and Statistics Canada. Stay informed about future trade negotiations to better understand and mitigate the potential financial strain of future tariffs on Canadian consumers.

Featured Posts

-

Spartak Vs Rostov Itogi Matcha 23 Go Tura Rpl

Apr 23, 2025

Spartak Vs Rostov Itogi Matcha 23 Go Tura Rpl

Apr 23, 2025 -

Ahdth Asear Sbykt Dhhb 10 Jramat Fy Swq Alsaght 17 Fbrayr 2025

Apr 23, 2025

Ahdth Asear Sbykt Dhhb 10 Jramat Fy Swq Alsaght 17 Fbrayr 2025

Apr 23, 2025 -

Good Morning Business 24 02 Tous Les Sujets

Apr 23, 2025

Good Morning Business 24 02 Tous Les Sujets

Apr 23, 2025 -

Kak Pravilno Postitsya V Chistiy Ponedelnik I Ves Velikiy Post 2025

Apr 23, 2025

Kak Pravilno Postitsya V Chistiy Ponedelnik I Ves Velikiy Post 2025

Apr 23, 2025 -

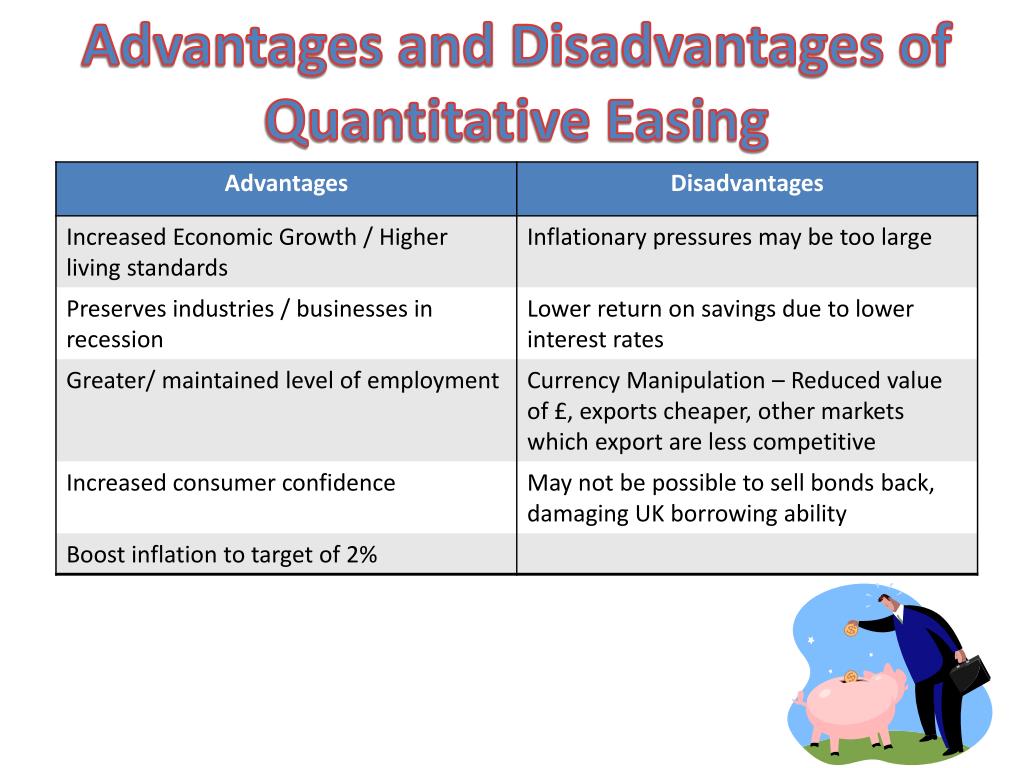

Quantitative Easing Greene Suggests A Revised Boe Strategy For Future Economic Crises

Apr 23, 2025

Quantitative Easing Greene Suggests A Revised Boe Strategy For Future Economic Crises

Apr 23, 2025