Tesla's Rise Lifts US Stocks: Tech Giants Power Market Growth

Table of Contents

Tesla's Impact on the EV Sector and Beyond

Tesla's influence extends far beyond its own impressive market capitalization. Its success story is rewriting the narrative for the entire automotive and technology landscape.

Dominance in the Electric Vehicle Market

Tesla's innovative technology, aggressive expansion, and strong brand recognition have solidified its position as a market leader in EVs. This isn't just about selling cars; it's about shaping the future of transportation. This dominance directly influences investor sentiment towards the entire EV sector, attracting significant investment in related companies.

- Increased demand for EV charging infrastructure: The proliferation of Tesla vehicles necessitates a robust charging network, leading to investment in charging station companies and related infrastructure projects.

- Growth of battery technology companies: The demand for high-performance batteries fuels innovation and investment in battery technology companies, crucial for the continued growth of the EV market.

- Development of autonomous driving solutions: Tesla's advancements in Autopilot and Full Self-Driving capabilities drive investment and development in autonomous driving technologies, a key differentiator in the EV space.

Tesla's Influence on the broader Tech Sector

Tesla's success isn't just about electric cars; it's a testament to the power of disruptive innovation in the tech industry. This success boosts investor confidence in other tech companies, particularly those focusing on similar technological advancements.

- Increased investment in AI startups: Tesla's heavy reliance on artificial intelligence for autonomous driving and other features fuels investment in AI startups developing similar technologies.

- Growth of renewable energy stocks: Tesla's involvement in solar energy and energy storage solutions through its Powerwall and solar roof products boosts investor interest in renewable energy companies.

- Rising valuations of software companies involved in automotive technology: The increasing importance of software in modern vehicles drives investment in software companies developing automotive technology, further contributing to the overall growth of tech stocks.

The Ripple Effect on US Stock Market Performance

Tesla's performance isn't contained within its own sector; its success creates a ripple effect across the entire US stock market.

Increased Investor Confidence

Tesla's strong financial results and consistent growth have noticeably increased overall investor confidence in the US stock market. This positive sentiment isn't limited to the tech sector; it spills over to other industries, fostering broader market growth.

- Higher stock valuations across various sectors: The positive sentiment associated with Tesla's success often lifts valuations across various sectors, not just those directly related to EVs or technology.

- Increased trading volume: The excitement surrounding Tesla often increases overall trading volume in the stock market, indicating higher levels of investor activity.

- Influx of new investments into the US market: Tesla's success story can attract international investment into the US stock market, bolstering overall market liquidity.

Impact on Related Industries

Tesla's growth story positively impacts numerous related industries, creating a multiplier effect that further boosts overall market performance.

- Increased demand for raw materials: The production of electric vehicles requires significant quantities of raw materials like lithium, cobalt, and nickel, boosting the mining and materials sectors.

- Growth in renewable energy production: The increasing demand for electric vehicles and Tesla's own involvement in renewable energy drive significant growth in the renewable energy production sector.

- Advancements in battery technology: The race to improve battery technology, driven in part by Tesla's innovation, fuels further advancements and investment in this crucial sector.

Analyzing the Future of Tesla and its Impact on US Stocks

While Tesla's past success is undeniable, understanding its future potential and associated risks is crucial for investors.

Sustained Growth Potential

Tesla's continued innovation, expansion into new markets (like China and Europe), and the growing global demand for EVs suggest a strong potential for sustained growth. This growth is likely to continue positively impacting the broader US stock market.

- Expansion into new vehicle segments (trucks, SUVs): Tesla's expansion beyond its initial sedan and roadster models into trucks and SUVs broadens its market reach and potential for growth.

- Development of new battery technologies: Ongoing research and development into new battery technologies promise further improvements in range, charging time, and cost-effectiveness, driving sales growth.

- Global expansion plans: Tesla's continued expansion into new global markets opens up vast growth opportunities, increasing its overall market share and influence.

Potential Risks and Challenges

Despite the positive outlook, potential challenges remain that investors must consider.

- Competition from established automakers: Established automakers are rapidly increasing their EV offerings, creating growing competition for Tesla.

- Potential for production delays: Manufacturing and supply chain issues can impact production targets and negatively affect stock performance.

- Fluctuating raw material prices: Volatility in the prices of raw materials needed for EV production can impact profitability and stock prices.

Conclusion

Tesla's remarkable ascent has undeniably impacted the US stock market, boosting not only the EV sector but also broader tech stocks and investor confidence. The company's continued innovation and market dominance suggest a positive outlook for the future, although careful consideration of potential risks remains vital. To stay ahead of the curve in understanding the dynamic relationship between Tesla and the US stock market, continue to monitor market trends, company performance, and industry developments. Understanding the impact of Tesla's rise on the US stock market is crucial for investors seeking to maximize returns in this evolving landscape.

Featured Posts

-

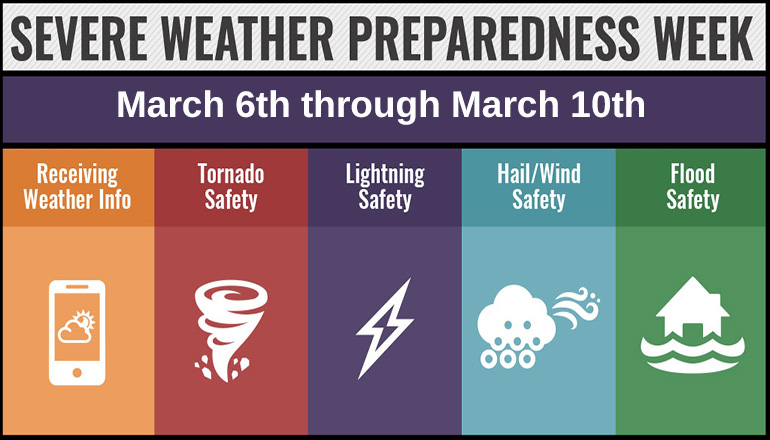

Severe Weather Preparedness Kentuckys Nws Focus For Awareness Week

Apr 29, 2025

Severe Weather Preparedness Kentuckys Nws Focus For Awareness Week

Apr 29, 2025 -

Market Crash Seven Stocks Lose 2 5 Trillion This Year

Apr 29, 2025

Market Crash Seven Stocks Lose 2 5 Trillion This Year

Apr 29, 2025 -

Minnesota Immigrants Finding Higher Paying Jobs A New Study

Apr 29, 2025

Minnesota Immigrants Finding Higher Paying Jobs A New Study

Apr 29, 2025 -

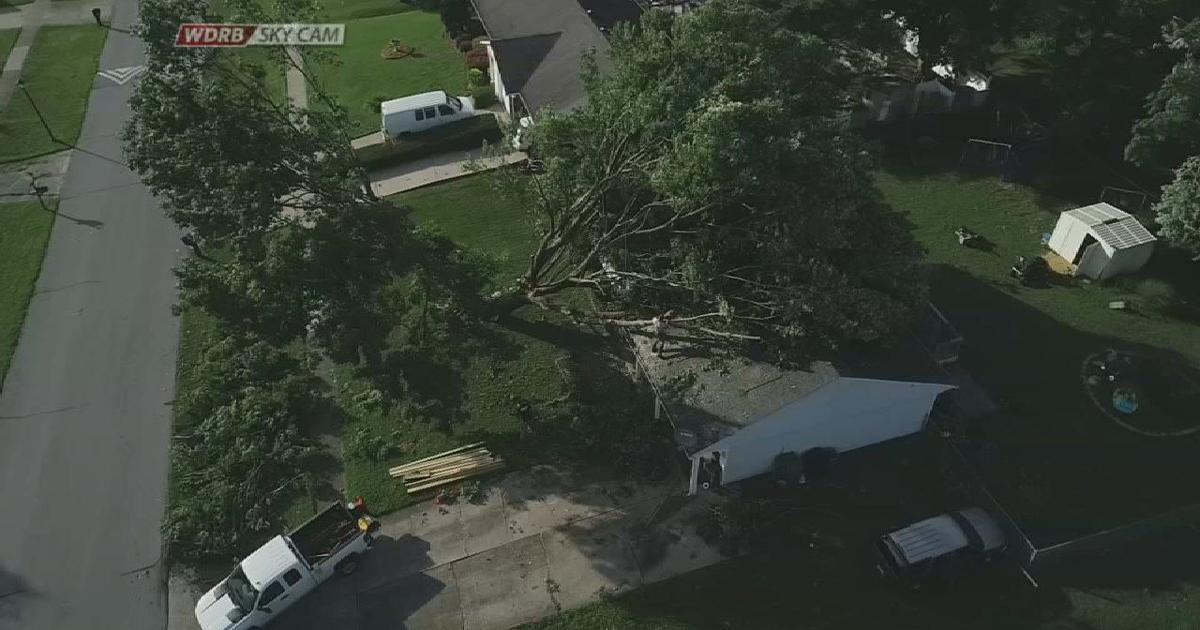

Louisville Opens Storm Debris Removal Request System

Apr 29, 2025

Louisville Opens Storm Debris Removal Request System

Apr 29, 2025 -

Air Crash Investigation Rebecca Lobachs Role In The Black Hawk Collision

Apr 29, 2025

Air Crash Investigation Rebecca Lobachs Role In The Black Hawk Collision

Apr 29, 2025

Latest Posts

-

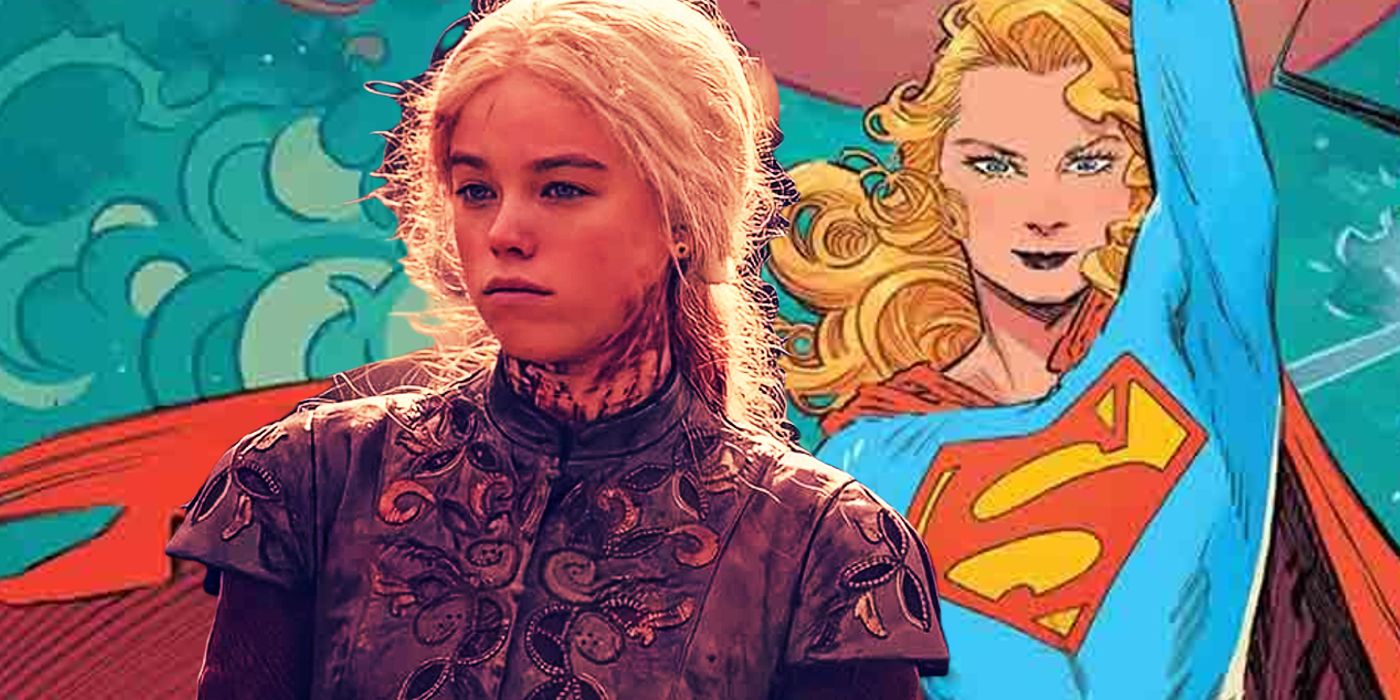

Milly Alcock As Supergirl In Netflixs Sirens A Look At The New Trailer

Apr 29, 2025

Milly Alcock As Supergirl In Netflixs Sirens A Look At The New Trailer

Apr 29, 2025 -

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025 -

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025 -

A Tremors Series For Netflix What We Know So Far

Apr 29, 2025

A Tremors Series For Netflix What We Know So Far

Apr 29, 2025 -

Is Tremors Returning To Netflix Updates And Rumors

Apr 29, 2025

Is Tremors Returning To Netflix Updates And Rumors

Apr 29, 2025