Palantir Stock Before May 5th: Is It A Buy Or Sell?

Table of Contents

Palantir's Recent Financial Performance and Future Outlook

Revenue Growth and Profitability

Palantir's recent quarterly earnings reports provide crucial insights into its financial health. Examining key metrics like revenue growth, net income, and operating margins is essential for understanding the company's trajectory. For example, comparing Q4 2022 results to Q4 2021 reveals significant changes in revenue generation and profitability.

- Q4 2022 Revenue: [Insert actual revenue figure] – [Compare to Q4 2021 and highlight percentage change]

- Net Income Q4 2022: [Insert actual net income figure] – [Compare to Q4 2021 and highlight percentage change]

- Operating Margin Q4 2022: [Insert actual operating margin percentage] – [Compare to Q4 2021 and highlight percentage change]

- Significant Contracts: Mention any major contract wins or losses during the period and their impact on revenue projections.

Government vs. Commercial Sector Growth

Palantir's revenue stream is split between government and commercial sectors. Analyzing the growth trajectory of each is critical for assessing future performance.

- Government Sector Strengths: Stable government contracts, large potential budget allocations.

- Government Sector Weaknesses: Bureaucratic processes, potential funding cuts depending on political shifts.

- Commercial Sector Strengths: Rapid growth potential, diverse clientele, potential for larger scale contracts.

- Commercial Sector Weaknesses: Intense competition, longer sales cycles, greater reliance on market trends.

Competition and Market Position

Palantir operates in a competitive market. Understanding its competitive landscape is crucial for evaluating its long-term prospects. Key competitors include [list key competitors].

- Palantir's Advantages: Strong government relationships, advanced data analytics capabilities, robust security features.

- Palantir's Disadvantages: High prices, complex software, potential challenges in scaling operations to meet growing demand.

Factors Influencing Palantir Stock Price Before May 5th

Upcoming Earnings Report (if applicable)

The anticipation surrounding Palantir's upcoming earnings report (if applicable) significantly influences its stock price. Analysts' predictions and historical market reactions to earnings announcements offer valuable insights.

- Analysts' Consensus Estimate: [Insert consensus EPS estimate and revenue forecast]

- Range of Predictions: [Mention the high and low estimates from different analysts]

- Historical Market Reactions: [Discuss how the market typically reacts to positive or negative surprises in Palantir's earnings reports]

Geopolitical Factors and Market Sentiment

Geopolitical events and overall market sentiment heavily impact Palantir's stock price. Global instability, economic slowdowns, and shifting government priorities can influence investor confidence.

- Impact of Geopolitical Events: Discuss the potential impact of specific events like the war in Ukraine or global economic uncertainty on Palantir's government and commercial contracts.

- Correlation with Market Indices: Analyze the correlation between Palantir's stock price and major market indices like the Nasdaq.

Analyst Ratings and Price Targets

Financial analysts' ratings and price targets provide further insights into market sentiment. Monitoring changes in analyst recommendations can signal shifts in investor expectations.

- Consensus Rating: [Summarize the overall consensus rating from leading analysts – buy, sell, or hold]

- Price Target Range: [Present the range of price targets set by analysts]

- Recent Rating Changes: Highlight any significant changes in analyst ratings in recent months.

Risk Assessment for Palantir Stock

Valuation and Potential Overvaluation

Evaluating Palantir's valuation is crucial to determine whether the stock price accurately reflects its intrinsic value.

- P/E Ratio: [Insert Palantir's P/E ratio and compare it to industry averages]

- Price-to-Sales Ratio: [Insert Palantir's Price-to-Sales ratio and compare it to industry averages]

- Valuation Implications: Explain whether a high or low valuation suggests overvaluation or undervaluation.

Technological Risks and Innovation

Rapid technological advancements pose risks to Palantir's long-term viability. The company's ability to innovate and adapt is critical for maintaining its competitive edge.

- Potential Technological Disruptions: Discuss potential threats from emerging technologies and competitors' innovations.

- Palantir's R&D Efforts: Analyze Palantir's investment in research and development and its capacity for future innovation.

Financial Risks and Debt Levels

Analyzing Palantir's financial health, including its debt levels, is essential for understanding its risk profile.

- Debt-to-Equity Ratio: [Insert the ratio and interpret its implications]

- Interest Coverage Ratio: [Insert the ratio and interpret its implications]

- Potential Risks Associated with Debt: Explain the potential challenges associated with high debt levels.

Conclusion: Should You Buy or Sell Palantir Stock Before May 5th?

Based on our analysis of Palantir's financial performance, influencing factors, and inherent risks, a conclusive recommendation is challenging without complete knowledge of your specific risk tolerance and investment horizon. However, the information presented should guide you toward a more informed decision. Remember that this analysis is for informational purposes only and doesn't constitute financial advice. Consider conducting further thorough due diligence and consulting a qualified financial advisor before making any investment decisions.

Should you buy, sell, or hold Palantir stock before May 5th ultimately depends on your individual risk assessment and investment goals. Thoroughly research Palantir's financials and stay updated on market trends before making a decision. Remember to consider the potential risks and rewards involved before investing in Palantir stock or any other security.

Featured Posts

-

Ihsaas Transgender Athlete Ban Following A Trump Order

May 10, 2025

Ihsaas Transgender Athlete Ban Following A Trump Order

May 10, 2025 -

Harry Styles Responds To A Bad Snl Impression

May 10, 2025

Harry Styles Responds To A Bad Snl Impression

May 10, 2025 -

Madhyamik Pariksha Result 2025 Merit List And District Wise Analysis

May 10, 2025

Madhyamik Pariksha Result 2025 Merit List And District Wise Analysis

May 10, 2025 -

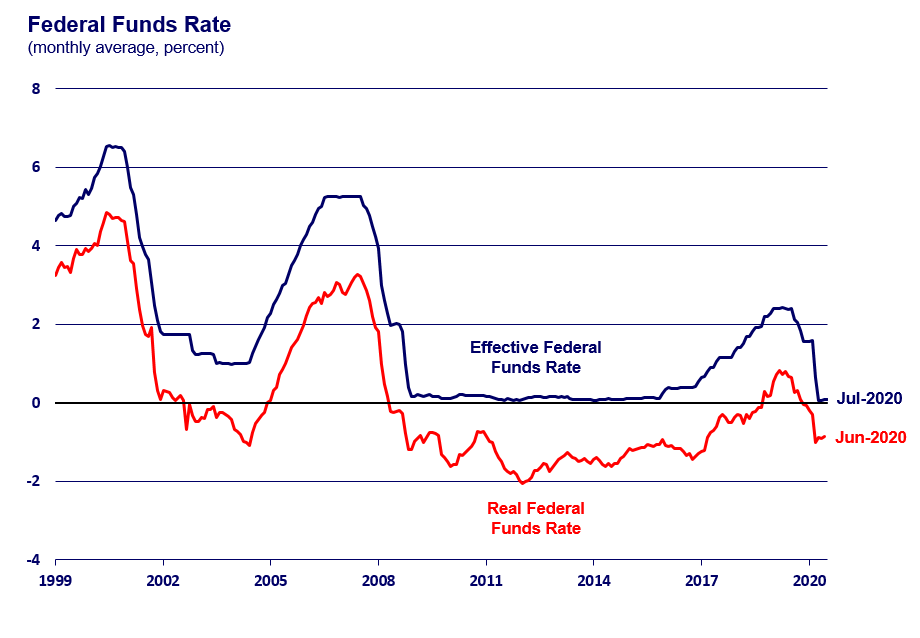

No Rate Hike U S Federal Reserve Addresses Inflation And Unemployment Challenges

May 10, 2025

No Rate Hike U S Federal Reserve Addresses Inflation And Unemployment Challenges

May 10, 2025 -

Potential Tariffs On Aircraft And Engines Examining Trumps Trade Policy

May 10, 2025

Potential Tariffs On Aircraft And Engines Examining Trumps Trade Policy

May 10, 2025