Potential Tariffs On Aircraft And Engines: Examining Trump's Trade Policy

Table of Contents

The Genesis of the Dispute: Airbus vs. Boeing Subsidies

The foundation of this trade conflict lies in a long-standing dispute between the United States and the European Union concerning alleged illegal subsidies provided to Boeing and Airbus, respectively. Both sides accused the other of receiving unfair government support, distorting the global aerospace market. This ultimately led to a tit-for-tat imposition of retaliatory tariffs.

WTO Rulings and Retaliatory Tariffs

The World Trade Organization (WTO) became the central arbiter in this conflict, issuing several rulings over many years. These rulings found both the US and EU guilty of providing prohibited subsidies. Consequently, both sides were authorized to impose tariffs on each other's goods.

- Key WTO Findings: The WTO found that both the US and the EU provided illegal subsidies to their respective aerospace giants, Boeing and Airbus.

- Timeline of Tariff Implementation: Tariffs were implemented in stages, starting with smaller levies and escalating to the significant amounts seen today. Specific dates and details varied depending on the rulings and subsequent appeals processes.

- Amounts of Tariffs: Tariffs levied varied significantly across different aircraft and engine parts, ranging from a few percent to over 25%. The exact percentages fluctuated according to WTO decisions and appeals.

Economic Impact of Subsidy Disputes

The economic repercussions of this subsidy dispute have been substantial, affecting both the US and EU aerospace industries.

- Job Losses: Estimates of job losses in both regions due to decreased production and investment have ranged into the thousands, significantly impacting livelihoods and local economies.

- Decreased Investment: Uncertainty created by the ongoing trade war discouraged investment in research and development, hindering innovation and future growth within the industry.

- Market Share Shifts: The imposition of tariffs shifted market share to some degree, favoring companies based in regions less affected by these trade measures, at the expense of those directly burdened.

Impact on the Global Aviation Industry

The ripple effects of aircraft and engine tariffs extended far beyond Boeing and Airbus, disrupting the intricate global supply chains upon which the aviation industry relies.

Disruption to the Supply Chain

The interconnected nature of aircraft manufacturing means that tariffs on one component can affect the entire production process.

- Delays in Aircraft Deliveries: Tariffs caused delays in deliveries of aircraft parts, leading to significant setbacks for airlines and impacting their operational schedules.

- Increased Costs of Parts: Tariffs directly increased the cost of imported aircraft parts, raising overall manufacturing costs and forcing producers to absorb some of this expense or pass it on to consumers.

- Shifts in Manufacturing Locations: Some companies were forced to explore alternative sourcing and manufacturing locations to avoid tariffs and maintain competitiveness.

Price Increases for Consumers and Airlines

The cost of these trade disputes was ultimately borne by consumers and airlines.

- Higher Ticket Prices: Increased production costs were translated into higher ticket prices, impacting affordability and potentially reducing air travel demand.

- Increased Operating Costs: Airlines face elevated operational costs due to the higher price of aircraft and maintenance, negatively affecting profitability.

- Reduced Air Travel: Higher fares may lead some passengers to opt for alternative transportation or forgo travel altogether.

Geopolitical Ramifications

The dispute had significant geopolitical implications, impacting international relationships and trade agreements.

- US-EU Relations: The trade dispute strained already tense relationships between the US and the EU, impacting wider diplomatic efforts.

- WTO's Authority: The dispute highlighted challenges to the WTO's authority and effectiveness in resolving trade disputes, highlighting the need for robust mechanisms.

- Potential for Escalation: The tit-for-tat nature of the tariff increases held the potential for a wider trade war and significant economic ramifications globally.

Navigating the Future: Potential Resolutions and Mitigation Strategies

Resolving the trade conflict requires concerted diplomatic efforts and strategic adaptation by businesses.

Trade Negotiations and Diplomatic Solutions

Several rounds of trade negotiations have been attempted between the US and EU.

- Key Players: Negotiations involved high-level officials from both governments, along with representatives from Boeing and Airbus.

- Challenges in Finding a Resolution: Reaching a consensus proved difficult due to the complexity of the issues and deeply entrenched positions.

- Potential Compromises: Potential compromises could include agreements on subsidy levels, dispute resolution mechanisms, and phasing out existing tariffs.

Strategies for Businesses to Mitigate Tariff Impacts

Aerospace companies need to adapt to navigate this volatile trade environment.

- Diversification of Suppliers: Reducing reliance on a single source of parts by diversifying suppliers to avoid trade restrictions and supply chain vulnerabilities.

- Investment in New Technologies: Investing in technologies that reduce reliance on imported parts or allow companies to manufacture components locally, increasing self-sufficiency.

- Lobbying Efforts: Engaging in lobbying efforts to influence trade policy and advocate for favorable regulatory environments.

Conclusion

Potential tariffs on aircraft and engines, stemming from the complex Airbus-Boeing subsidy dispute, have had profound economic, geopolitical, and industry-specific impacts. The disruption to global supply chains, increased costs for consumers and airlines, and strained international relations highlight the far-reaching consequences of this trade conflict. Understanding the intricacies of these tariffs remains crucial for navigating the future of global aviation trade. Stay informed about ongoing developments concerning aircraft and engine tariffs by following updates from the WTO, trade associations, and reputable news sources. Further reading on international trade policy and global relations will provide additional context and a deeper understanding of this critical issue.

Featured Posts

-

Postes Vacants A Dijon Rooftop Et Restaurants

May 10, 2025

Postes Vacants A Dijon Rooftop Et Restaurants

May 10, 2025 -

Should You Buy Palantir Technologies Stock In 2024

May 10, 2025

Should You Buy Palantir Technologies Stock In 2024

May 10, 2025 -

Should We See The Epstein Files Analyzing Ag Pam Bondis Decision

May 10, 2025

Should We See The Epstein Files Analyzing Ag Pam Bondis Decision

May 10, 2025 -

La Fires Fuel Rental Price Surge Is Price Gouging To Blame

May 10, 2025

La Fires Fuel Rental Price Surge Is Price Gouging To Blame

May 10, 2025 -

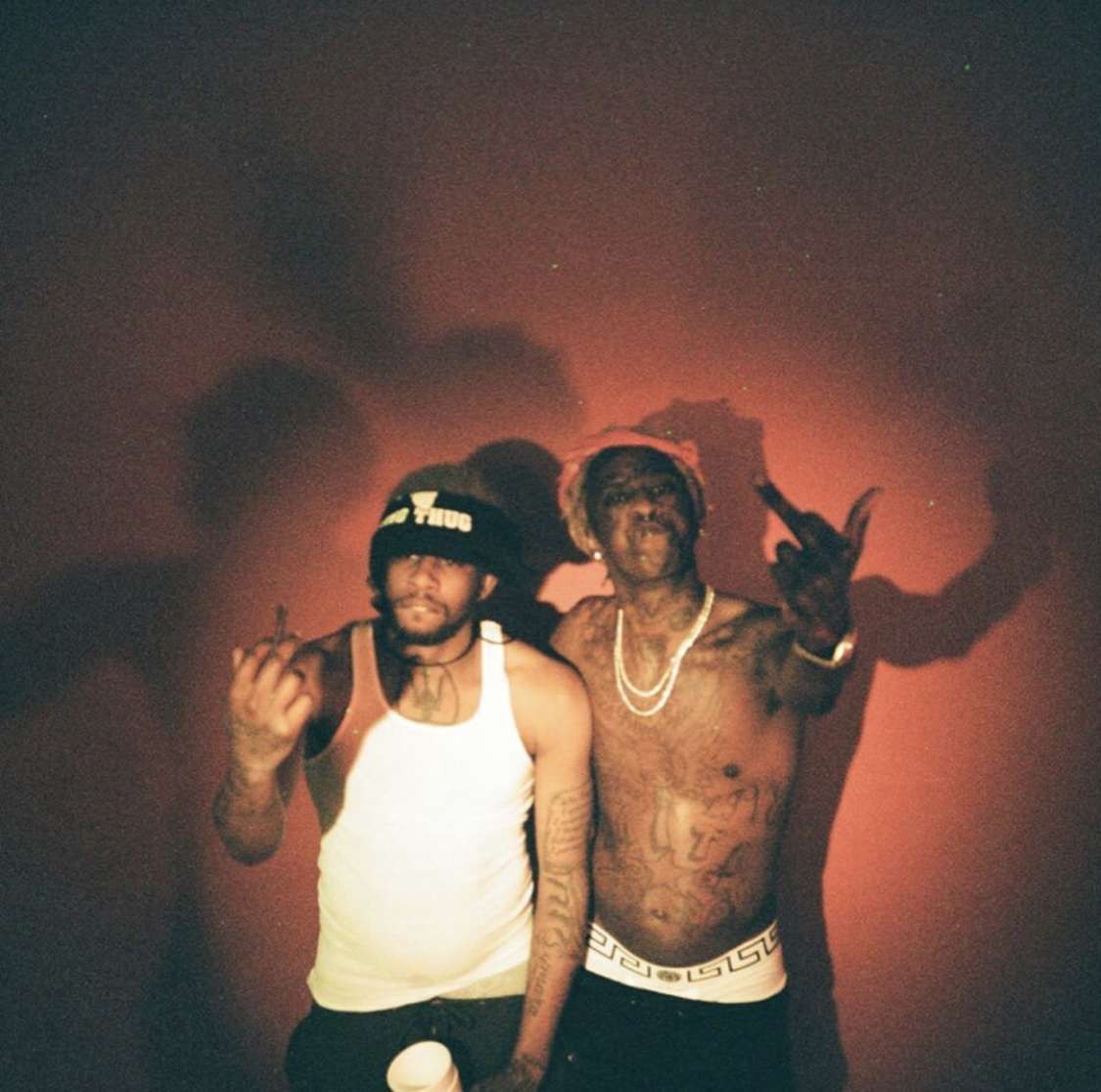

Is Young Thugs Back Outside Album Imminent A Look At The Rollout

May 10, 2025

Is Young Thugs Back Outside Album Imminent A Look At The Rollout

May 10, 2025