Student Loans: GOP's New Plan & What It Means For Pell Grants And Repayment

Table of Contents

The GOP's Proposed Changes to Student Loan Programs

The GOP's approach to student loan debt centers on a fundamental shift away from government intervention and towards market-based solutions. Their proposed reforms, often framed under the banner of "Republican student loan reform," aim to streamline the system and reduce the government's role. Key proposals under the umbrella of the "GOP student loan plan" include significant alterations to existing programs and the introduction of new initiatives. These student loan debt relief proposals, however, are met with considerable debate and scrutiny.

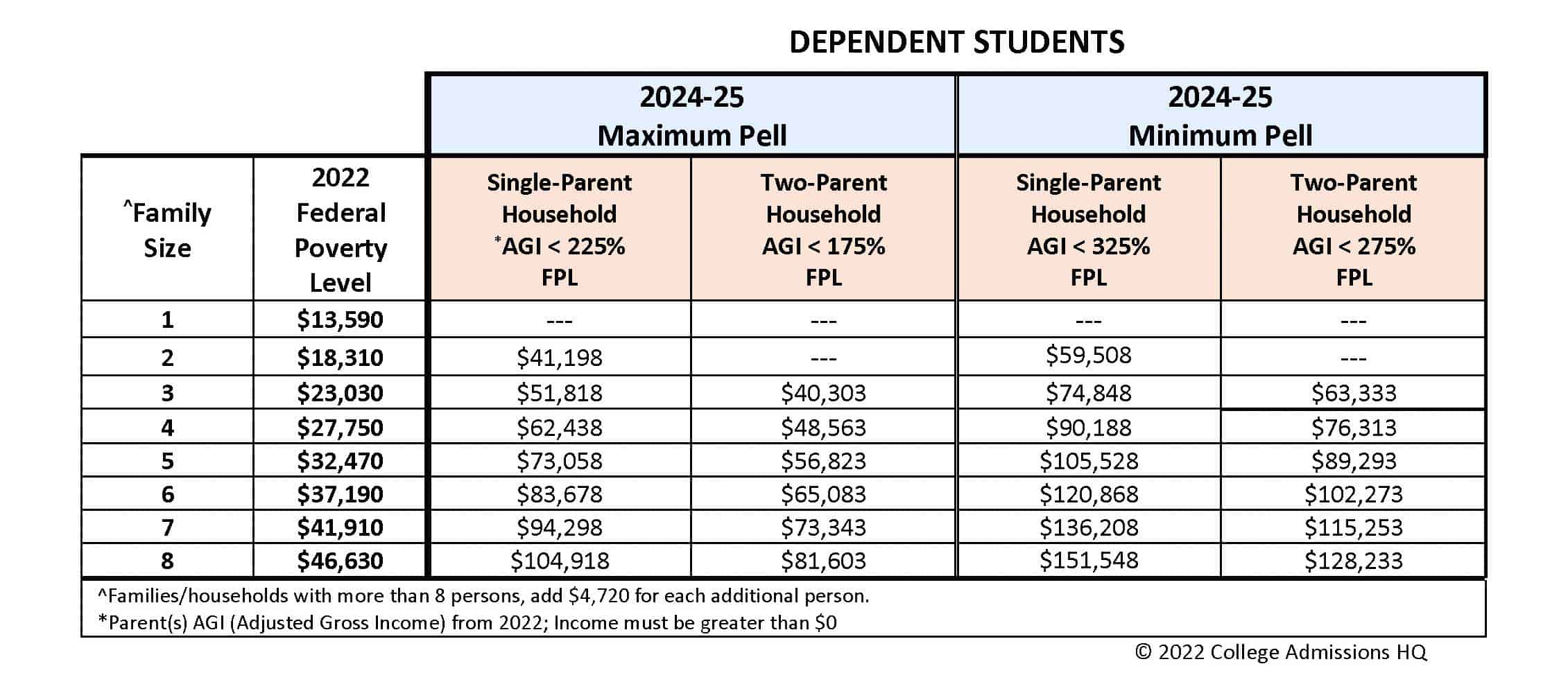

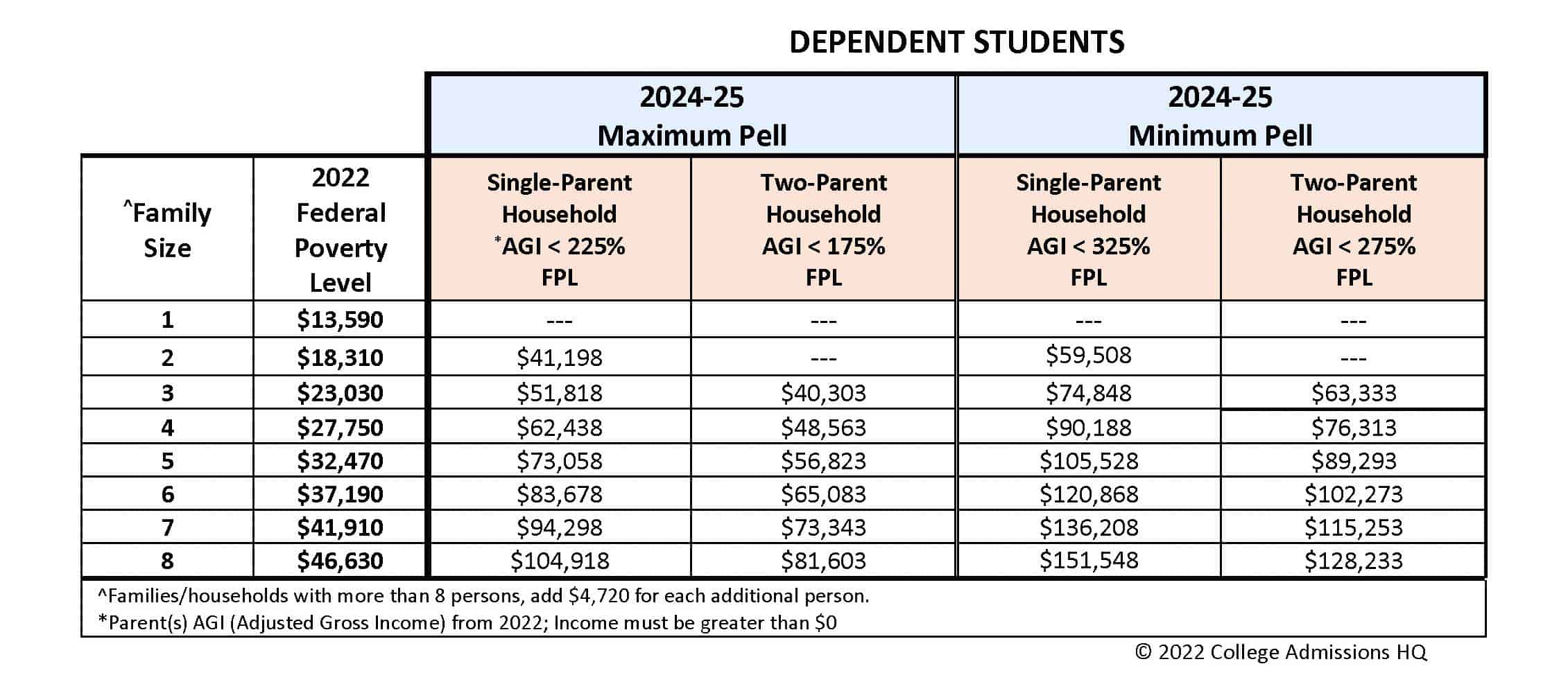

- Changes to Pell Grant eligibility requirements: The GOP’s plan may involve stricter eligibility criteria for Pell Grants, potentially reducing access for some low-income students.

- Modifications to income-driven repayment plans (IDR): Proposed changes might alter the calculation methods for IDR plans, potentially leading to higher monthly payments for some borrowers. This impacts student loan repayment plans significantly.

- Potential alterations to loan forgiveness programs: The GOP may seek to limit or eliminate existing loan forgiveness programs, increasing the overall debt burden for many borrowers.

- Focus on market-based solutions and private sector involvement: The plan emphasizes expanding the role of private lenders and market mechanisms in providing student loans and managing repayment. This could lead to a more diverse, but potentially less regulated, lending landscape.

Impact on Pell Grants: Increased Accessibility or Reduced Funding?

The GOP's proposed changes could significantly alter the landscape of Pell Grants, impacting Pell Grant funding and Pell Grant eligibility. While some argue that market-based reforms could increase efficiency and potentially free up more funds for Pell Grants, others fear that the proposed changes will lead to reduced funding and decreased accessibility, particularly for low-income students.

- Potential increases or decreases in Pell Grant amounts: The actual financial impact on Pell Grant amounts remains uncertain and is subject to ongoing debate. This uncertainty affects the affordability of higher education.

- Changes in eligibility criteria: Stricter eligibility requirements could exclude many students who currently rely on Pell Grants to finance their education.

- Impact on low-income students: Reduced access to Pell Grants could disproportionately affect low-income students, potentially widening the existing equity gap in higher education.

Repayment Plan Reforms: A More Streamlined System or Increased Burden?

The GOP's plan includes proposed reforms to student loan repayment plans, particularly those based on income-driven repayment (IDR). The potential impact of these changes on borrowers is a subject of intense discussion.

- Changes to IDR plan calculations: Altered calculation methods could lead to either more manageable or significantly higher monthly payments, depending on individual circumstances. This directly affects student loan debt management.

- Simplification or complication of repayment options: The reforms could potentially simplify the repayment process for some, but create added complexities for others.

- Impact on borrowers with varying income levels: The consequences of these changes would likely vary significantly depending on borrowers' income levels, potentially exacerbating existing inequalities. Understanding the details is crucial for effective student loan forgiveness programs.

Potential Long-Term Effects on Higher Education

The long-term consequences of the GOP's student loan plan extend far beyond the immediate impact on individual borrowers. The proposals could have profound effects on higher education affordability, the student debt crisis, and access to college.

- Impact on college enrollment rates: Increased costs and reduced access to funding could deter prospective students, potentially leading to lower enrollment rates across various institutions.

- Effects on different demographic groups: The impact of these changes is likely to vary across different demographic groups, potentially widening existing inequalities in access to higher education.

- Long-term economic consequences: Changes to the student loan system could have substantial long-term economic consequences, affecting both individual borrowers and the broader economy. The future of student loans is uncertain and depends significantly on the outcome of these political debates.

Conclusion: Understanding the GOP's Student Loan Plan and its Implications

The GOP's proposed changes to student loans present a complex picture, with potential benefits and drawbacks for students and the higher education system. The impact on Pell Grants and repayment options will be significant, potentially affecting access to higher education and increasing the burden of student loan repayment for many. Understanding these implications is crucial for making informed decisions about higher education and managing student debt. Stay informed about the evolving debate surrounding student loans and how proposed changes may affect your financial future. Research the specifics of the GOP's student loan plan and its potential impact on student loan repayment.

Featured Posts

-

New York Knicks The Landry Shamet Conundrum

May 17, 2025

New York Knicks The Landry Shamet Conundrum

May 17, 2025 -

Choosing The Best Australian Crypto Casino Site In 2025

May 17, 2025

Choosing The Best Australian Crypto Casino Site In 2025

May 17, 2025 -

Play At The Best No Id Verification Casinos In 2025

May 17, 2025

Play At The Best No Id Verification Casinos In 2025

May 17, 2025 -

Free Severance Streaming Where To Find Every Episode Legally

May 17, 2025

Free Severance Streaming Where To Find Every Episode Legally

May 17, 2025 -

Davenport Council Votes To Demolish Apartment Building

May 17, 2025

Davenport Council Votes To Demolish Apartment Building

May 17, 2025

Latest Posts

-

Fortnite The Latest Icon Skin Addition

May 17, 2025

Fortnite The Latest Icon Skin Addition

May 17, 2025 -

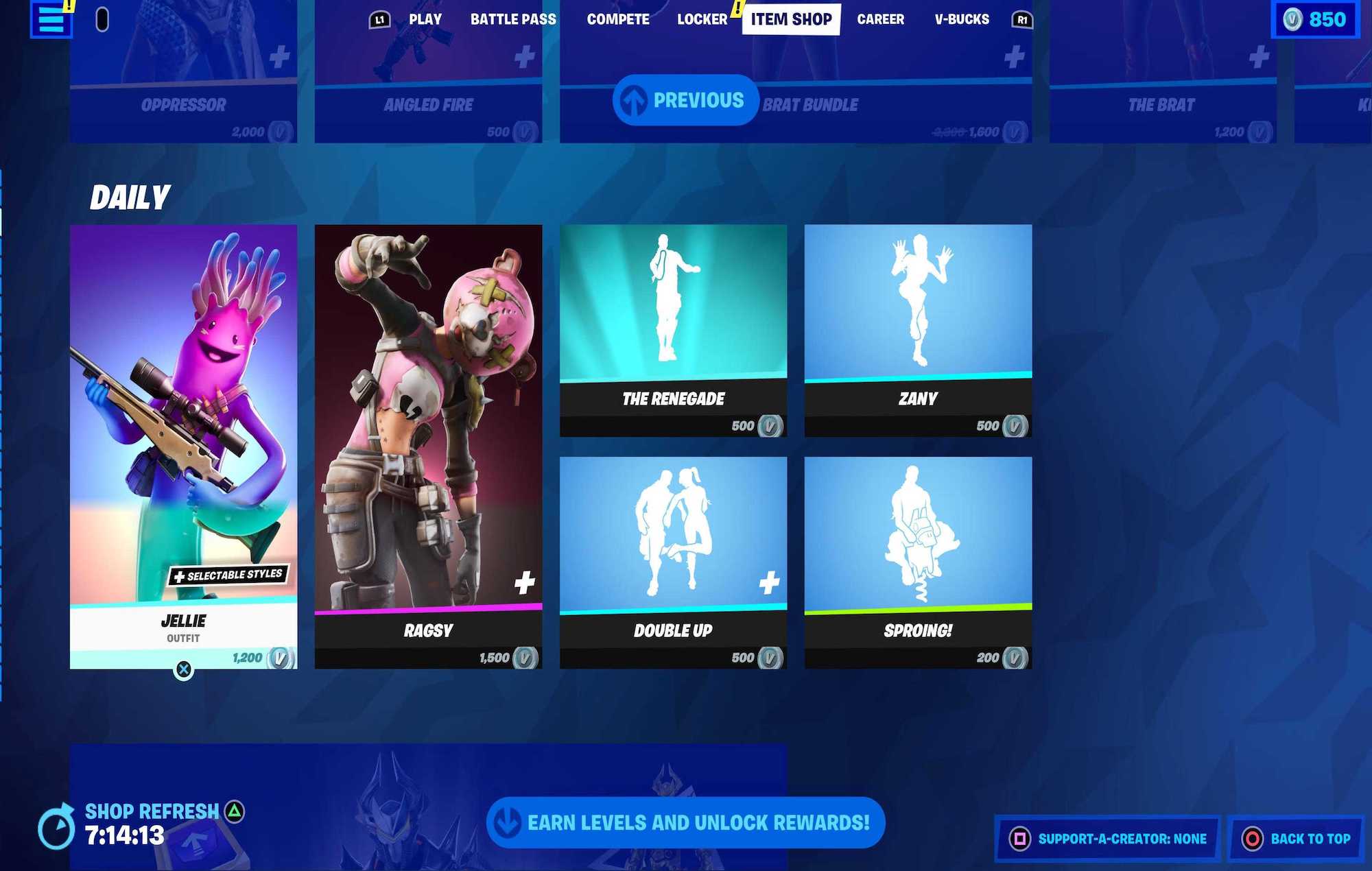

Fortnites Item Shop A New Feature To Help Players

May 17, 2025

Fortnites Item Shop A New Feature To Help Players

May 17, 2025 -

Fortnite Cowboy Bebop Collaboration How To Get The Freebies

May 17, 2025

Fortnite Cowboy Bebop Collaboration How To Get The Freebies

May 17, 2025 -

Leaked Fortnite Icon Skin First Look And Speculation

May 17, 2025

Leaked Fortnite Icon Skin First Look And Speculation

May 17, 2025 -

Fortnite Item Shop Enhanced A Helpful New Feature Explained

May 17, 2025

Fortnite Item Shop Enhanced A Helpful New Feature Explained

May 17, 2025