Market Volatility Forces Dow To Postpone Canadian Construction

Table of Contents

The Impact of Market Volatility on Construction Investment

Increased market volatility is making it considerably more challenging to secure financing for large-scale construction projects in Canada. The current economic climate, characterized by higher interest rates, rampant inflation, and heightened risk assessments, is significantly impacting investment decisions within the construction sector. This investment slowdown is directly linked to several key factors:

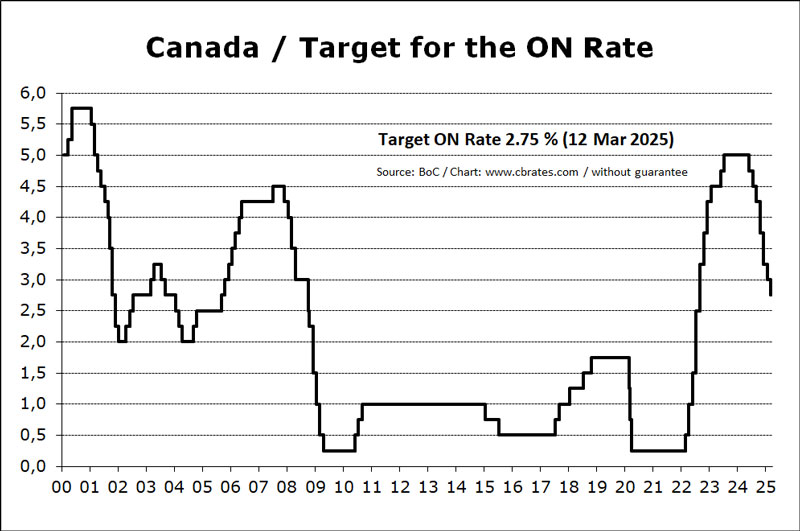

- Increased Borrowing Costs: Higher interest rates make borrowing money more expensive, rendering many projects less financially viable. The increased cost of capital significantly reduces the return on investment, making projects less attractive to investors.

- Investor Hesitancy: Unpredictable market conditions are creating significant hesitancy among investors. The uncertainty surrounding future economic growth and potential downturns makes them reluctant to commit large sums of capital to long-term construction projects. Risk aversion is at an all-time high.

- Inflationary Pressures: Soaring inflation is driving up the costs of materials and labor, further eroding profit margins and increasing the overall risk associated with construction projects. Managing these escalating costs is proving extremely difficult for developers.

- Stringent Risk Assessments: Financial institutions are conducting more stringent risk assessments before approving loans for construction projects. The increased perceived risk in the current market means many projects are deemed too volatile for investment.

Dow's Decision and its Implications for the Canadian Construction Sector

Dow's decision to postpone its Canadian construction projects is a significant indicator of the challenges facing the industry. The scale of these projects – [insert specific project details if available, e.g., "including the proposed expansion of the Toronto Transit Commission's subway line and the new high-rise development in downtown Vancouver" ] – highlights the considerable impact this decision will have on the Canadian economy. The consequences extend far beyond Dow itself:

- Project Delays: The postponement of these large-scale projects will undoubtedly lead to significant delays in infrastructure development and new housing supply across Canada.

- Job Losses: The delayed projects will inevitably result in job losses across various sectors, including construction workers, engineers, architects, and supporting industries. Estimates [cite source if available] suggest that thousands of jobs could be at risk.

- Supply Chain Disruption: The postponement will cause disruptions in the supply chain, affecting material suppliers and other businesses that rely on the ongoing flow of construction projects. This ripple effect can have a broad economic impact.

- Long-Term Effects on Infrastructure: Delays in infrastructure development could have long-term consequences for Canada's economic competitiveness and its ability to meet future infrastructure needs.

The Broader Economic Context of Construction Delays in Canada

Dow's decision is not an isolated incident but rather a reflection of broader economic challenges facing Canada. The current state of the Canadian economy, with its interconnectedness to the global market, is influencing decisions across all sectors, particularly the sensitive real estate and construction markets.

- Canadian Economic Outlook: The Canadian economy faces headwinds, including [mention specific economic challenges like high inflation, interest rate hikes, and global economic uncertainty]. These factors create an environment of uncertainty, making long-term investment decisions difficult.

- Impact on the Housing Market: Construction delays will exacerbate the existing housing shortage in Canada, potentially driving up housing prices further and reducing affordability for many Canadians.

- Government Policies: Government policies aimed at stimulating the construction sector, such as [mention specific government initiatives if any], may need to be reassessed or expanded to mitigate the impact of market volatility.

- Future Trends and Recovery: The timeline for recovery in the Canadian construction sector depends largely on several factors, including the duration of market volatility, government intervention, and investor confidence. Experts predict [cite predictions from reputable sources if available] a slow recovery, with potential for further delays.

Conclusion

Market volatility is significantly impacting the Canadian construction industry, as evidenced by Dow's decision to postpone several major projects. This decision highlights the challenges of securing financing, managing rising costs, and navigating uncertain economic conditions. The consequences are far-reaching, impacting job creation, infrastructure development, and the overall health of the Canadian economy. The ripple effect will likely continue to be felt throughout the supply chain and related industries for the foreseeable future.

To gain a deeper understanding of how market volatility affects Canadian construction, stay informed about market fluctuations by following financial news, industry reports, and consulting economic experts. Continued monitoring of market volatility and its effect on Canadian construction projects is crucial for businesses and individuals alike.

Featured Posts

-

Cannes 2025 Juliette Binoche To Head The Jury

Apr 27, 2025

Cannes 2025 Juliette Binoche To Head The Jury

Apr 27, 2025 -

Motherhood And Triumph Bencic In The Abu Dhabi Final

Apr 27, 2025

Motherhood And Triumph Bencic In The Abu Dhabi Final

Apr 27, 2025 -

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025 -

Three Year Trend Canadian Interest In Electric Vehicles Decreases

Apr 27, 2025

Three Year Trend Canadian Interest In Electric Vehicles Decreases

Apr 27, 2025 -

Werner Herzogs Bucking Fastard A Look At The Casting And Story

Apr 27, 2025

Werner Herzogs Bucking Fastard A Look At The Casting And Story

Apr 27, 2025

Latest Posts

-

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025 -

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025 -

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025 -

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025