Malaysian Ringgit (MYR) Stability: Front-Loading And Export Opportunities

Table of Contents

Understanding Current Malaysian Ringgit (MYR) Stability

Factors Affecting MYR Stability:

The stability of the Malaysian Ringgit is influenced by a complex interplay of global and domestic factors. Understanding these factors is crucial for businesses looking to capitalize on export opportunities.

-

Global economic conditions: The strength of the US dollar, fluctuations in global commodity prices (especially palm oil and rubber, key Malaysian exports), and overall global economic growth significantly impact the MYR. A strong US dollar, for instance, can put downward pressure on the MYR.

-

Domestic economic policies: Malaysia's monetary policy, implemented by Bank Negara Malaysia (BNM), plays a vital role in managing inflation and maintaining MYR stability. Fiscal policies, including government spending and taxation, also influence the currency's value.

-

Political stability and investor confidence: Political stability and sound governance are essential for attracting foreign investment and bolstering investor confidence, which positively impacts the MYR. Uncertainty can lead to capital flight and MYR depreciation.

-

Foreign exchange reserves and current account balance: Malaysia's foreign exchange reserves act as a buffer against external shocks. A healthy current account balance (exports exceeding imports) strengthens the MYR. Recent data shows [Insert recent data on forex reserves and current account balance from a reputable source, e.g., Bank Negara Malaysia].

-

Recent trends and predictions: [Insert bullet points summarizing recent trends and predictions for MYR stability from reputable financial news sources like Bloomberg, Reuters, or The Edge Markets. Include specific forecasts and their sources for credibility].

Assessing Risk and Opportunities:

While periods of MYR stability offer significant opportunities, businesses must also be aware of potential risks. Volatility can still occur due to unforeseen global events or domestic policy shifts.

-

Potential Risks: Sudden shifts in global commodity prices, unexpected political events, or a deterioration in the global economic outlook can all lead to MYR volatility.

-

Opportunities: Periods of MYR stability reduce currency risk for exporters, allowing them to more accurately forecast revenue and plan for future investments. This predictability fosters confidence and encourages expansion.

-

Illustrative Examples: Companies exporting palm oil or electronics, for example, benefit from MYR stability because they can better predict their export earnings in foreign currencies. A stable MYR makes Malaysian products more price-competitive in the international market.

Front-Loading Strategies for Export Businesses

Effective front-loading strategies are crucial for mitigating the risks associated with MYR fluctuations and maximizing profits during periods of stability.

Hedging Currency Risk:

Hedging involves using financial instruments to mitigate the risk of currency fluctuations.

-

Hedging Strategies: Common hedging strategies include forward contracts (locking in a future exchange rate) and options (giving the right, but not the obligation, to buy or sell currency at a specific rate).

-

Benefits: Hedging protects export businesses from losses due to MYR depreciation. Even if the MYR weakens, hedged transactions ensure a predictable return in the exporter's home currency.

-

Examples: An exporter can use a forward contract to lock in a favorable exchange rate for a future export shipment, protecting their profits from potential MYR depreciation.

Optimizing Pricing and Payment Terms:

Strategic pricing and payment terms are essential for navigating MYR exchange rate variations.

-

Export Pricing: Businesses need to consider MYR exchange rates when setting export prices to remain competitive while maintaining profitability. Dynamic pricing models can help adjust prices based on real-time MYR fluctuations.

-

Payment Terms: Negotiating favorable payment terms with international buyers, such as advance payments or shorter payment cycles, reduces the risk of losses due to MYR volatility.

-

Currency Clauses: Clearly defining currency clauses in export contracts is vital to avoid disputes and ensure clarity on exchange rate responsibilities.

Improving Operational Efficiency:

Streamlining operations enhances competitiveness and reduces the impact of currency fluctuations.

-

Streamlining Export Processes: Improving efficiency in documentation, shipping, and logistics reduces costs and time-to-market, making businesses more resilient to exchange rate changes.

-

Supply Chain Management: Effective inventory control minimizes losses due to price fluctuations or delays.

-

Technology Investments: Investing in technology for efficient order processing and payments improves operational speed and accuracy.

Export Opportunities Driven by MYR Stability

A stable MYR opens doors to numerous export opportunities for Malaysian businesses.

Identifying Target Markets:

-

Market Research: Thorough market research is crucial to identify countries with strong demand for Malaysian products and services, considering factors such as consumer preferences, import regulations, and competition.

-

Growth Areas: Analyzing market trends helps identify sectors with high growth potential. This could involve focusing on niche markets or exporting to regions experiencing economic expansion.

-

Successful Industries: Malaysia's successful export industries, such as palm oil, electronics, and rubber products, can serve as examples for identifying promising export opportunities.

Leveraging Trade Agreements:

-

Trade Agreements: Malaysia's participation in trade agreements like the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership) offers reduced tariffs and streamlined trade procedures, improving export competitiveness.

-

Export Procedures: Understanding export procedures, documentation requirements, and relevant regulations is crucial for smooth and efficient exports.

-

Government Support: Malaysian exporters can benefit from various government support programs, such as export financing and market development assistance.

Building Strong International Partnerships:

-

International Relationships: Establishing strong relationships with international buyers and distributors is crucial for long-term export success. This involves building trust and ensuring reliable supply chains.

-

Market Entry Strategies: Employing effective market entry strategies tailored to specific target markets is essential for successful international expansion. This might involve direct exports, joint ventures, or establishing overseas subsidiaries.

-

Networking: Utilizing networking opportunities and participating in international trade shows facilitates building relationships and exploring new market possibilities.

Conclusion

The stability of the Malaysian Ringgit (MYR) presents significant opportunities for export-oriented businesses. By understanding the factors influencing MYR stability, implementing effective front-loading strategies, and identifying lucrative export markets, Malaysian companies can significantly enhance their profitability and competitiveness in the global marketplace. Don't miss out on these opportunities – actively analyze Malaysian Ringgit (MYR) stability and leverage its potential to boost your export success. Proactive management of MYR exchange rate risks, combined with a strategic approach to international trade, is crucial for long-term growth and sustainability. Start exploring your options for maximizing your export potential using MYR stability today!

Featured Posts

-

Warriors Vs Trail Blazers Game Time Tv Schedule And Streaming Options April 11th

May 07, 2025

Warriors Vs Trail Blazers Game Time Tv Schedule And Streaming Options April 11th

May 07, 2025 -

Maintaining Open Ais Nonprofit Status Challenges And Opportunities

May 07, 2025

Maintaining Open Ais Nonprofit Status Challenges And Opportunities

May 07, 2025 -

Caris Le Verts Future A Key Decision For The Cleveland Cavaliers

May 07, 2025

Caris Le Verts Future A Key Decision For The Cleveland Cavaliers

May 07, 2025 -

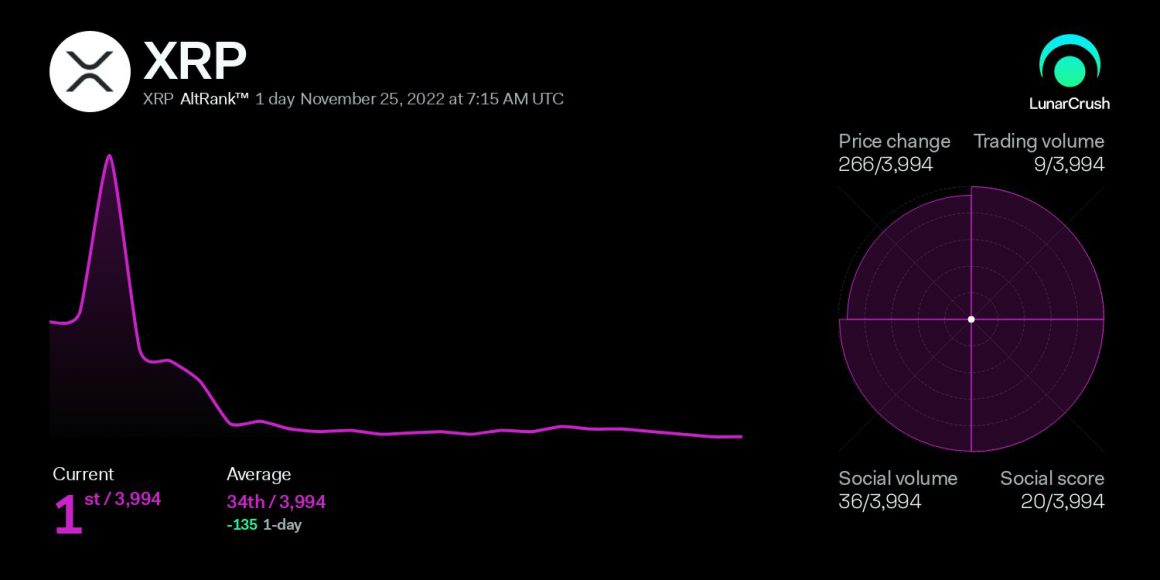

Xrps Rival Altcoin Projected For A Massive 5880 Rally

May 07, 2025

Xrps Rival Altcoin Projected For A Massive 5880 Rally

May 07, 2025 -

Hawkgirl Vs Madame Web Isabela Merceds Acting Preference

May 07, 2025

Hawkgirl Vs Madame Web Isabela Merceds Acting Preference

May 07, 2025

Latest Posts

-

Ukraine Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025

Ukraine Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025 -

Understanding High Stock Market Valuations Bof As Rationale For Investor Confidence

May 08, 2025

Understanding High Stock Market Valuations Bof As Rationale For Investor Confidence

May 08, 2025 -

Bof As Reassuring View Why Current Stock Market Valuations Shouldnt Worry Investors

May 08, 2025

Bof As Reassuring View Why Current Stock Market Valuations Shouldnt Worry Investors

May 08, 2025 -

Recent Market Trends Rise In Japanese Trading House Shares Linked To Berkshire

May 08, 2025

Recent Market Trends Rise In Japanese Trading House Shares Linked To Berkshire

May 08, 2025 -

Investment News Berkshire Hathaways Positive Impact On Japanese Trading Stocks

May 08, 2025

Investment News Berkshire Hathaways Positive Impact On Japanese Trading Stocks

May 08, 2025