Investment News: Berkshire Hathaway's Positive Impact On Japanese Trading Stocks

Table of Contents

Berkshire Hathaway's Investment Strategy in Japan

Berkshire Hathaway's investment strategy in Japan reflects its core philosophy of long-term value investing. Unlike some short-term trading strategies, Berkshire focuses on building substantial positions in established, high-quality Japanese companies with strong fundamentals and a proven track record. This approach aligns perfectly with its investments in other global markets, prioritizing stable businesses poised for sustainable growth over speculative ventures. This long-term perspective fosters a deeper understanding of the companies and allows for a more informed decision-making process. This contrasts with more volatile, short-term trading strategies.

- Focus on established, high-quality companies with strong fundamentals. Berkshire targets companies with resilient business models and predictable earnings, minimizing exposure to excessive risk.

- Emphasis on building long-term relationships with Japanese management. This collaborative approach facilitates a thorough understanding of the companies' operations, future plans, and overall potential.

- Significant investments in diverse sectors of the Japanese economy. This diversification mitigates risk and exposes Berkshire to a wider range of growth opportunities within the Japanese market.

- A shift towards a more international investment portfolio, increasing exposure to Japanese markets. This strategic move demonstrates confidence in the Japanese economy's long-term prospects and its potential for substantial returns.

The Impact on Japanese Stock Prices

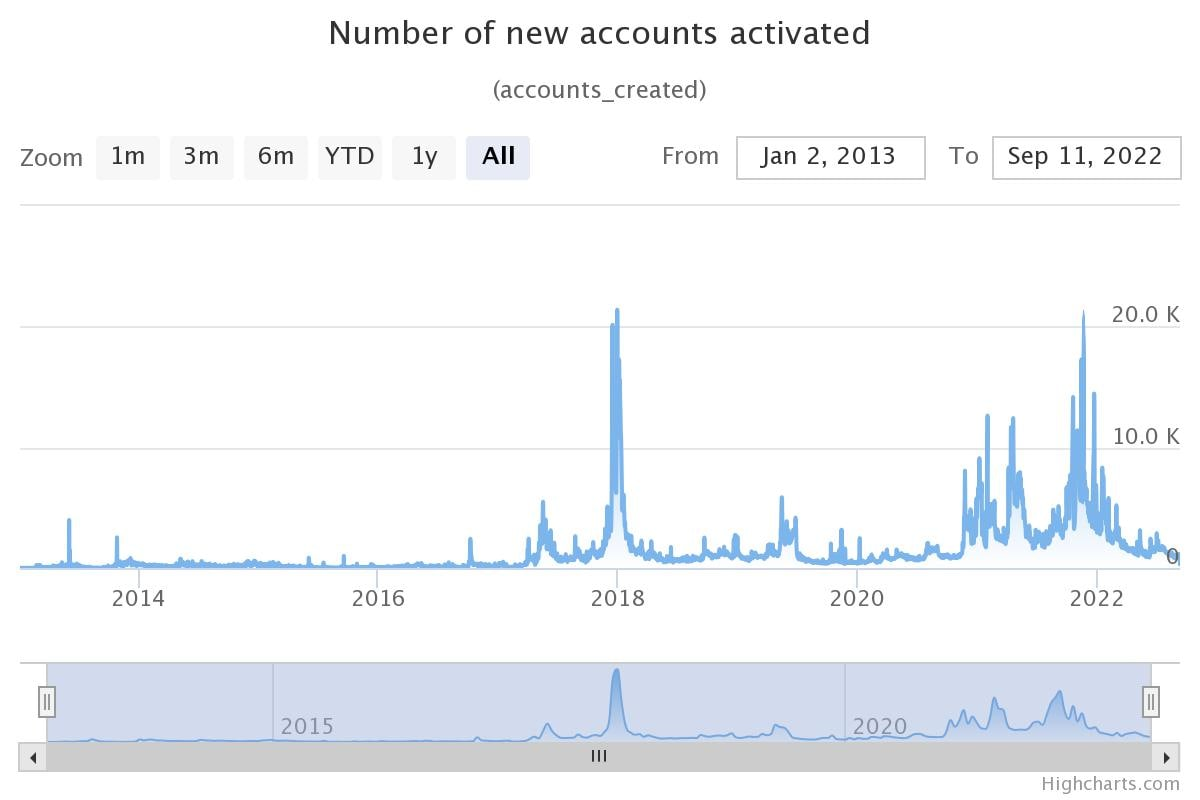

Berkshire Hathaway's investments have demonstrably impacted the Japanese stock market. The influx of capital and the endorsement from such a prominent investor have boosted investor confidence, leading to increased trading volume and, in many cases, significant stock price increases for the targeted companies. This positive effect isn't limited to the directly invested companies; it's also creating a spillover effect on similar businesses, bolstering the overall market sentiment.

- Specific examples of stocks that saw increased prices after Berkshire Hathaway's investment. Several Japanese companies have experienced notable share price appreciation following Berkshire's investments, underscoring the positive market response. Further research into specific examples will provide concrete evidence of this impact.

- Data showing increased market capitalization for invested companies. The increased stock prices have directly translated to a higher market capitalization for the companies receiving Berkshire's investment, signifying a significant boost in their overall valuation.

- Analysis of increased trading activity following the announcements of Berkshire Hathaway's investments. The news of Berkshire's investments has stimulated greater trading activity in the affected stocks, indicating heightened investor interest and engagement.

- Discussion on how the impact extends beyond the directly invested companies. The positive sentiment created by Berkshire's presence is boosting confidence in the wider Japanese market, impacting other related companies and sectors.

Implications for Investors

Berkshire Hathaway's success in Japan presents compelling implications for other investors. It highlights the potential for higher returns on investment (ROI) in similar Japanese companies with strong fundamentals. Moreover, it underscores the reduced risk associated with investing in established, well-managed businesses with a proven track record. The strategy emphasizes the benefits of geographic diversification within an investment portfolio to mitigate overall portfolio risk.

- Potential for higher returns on investment in similar Japanese companies. Investors may explore opportunities in undervalued Japanese companies with characteristics similar to those favored by Berkshire Hathaway.

- The reduced risk associated with investing in established, well-managed businesses. Investing in stable, reputable companies lowers the overall risk profile of an investment portfolio.

- The benefits of geographic diversification within an investment portfolio. Exposure to the Japanese market can improve the overall risk-adjusted return of a well-diversified portfolio.

- A positive outlook for the Japanese stock market based on current trends. Berkshire Hathaway’s confidence in the Japanese market signals a potentially promising investment environment.

Understanding Warren Buffett's Perspective

Warren Buffett's decision to invest heavily in Japan reflects his long-term vision and his assessment of the Japanese economy's underlying strength. His investment philosophy, focused on value and long-term growth, guides his choices, and his confidence in the resilience and stability of the Japanese market underscores his conviction. Understanding his market analysis and perspectives is crucial for investors considering similar strategies. His statements and public pronouncements provide insight into his reasoning and long-term outlook for the Japanese economy.

Conclusion

Berkshire Hathaway's investments in Japanese trading stocks have had a demonstrably positive impact on the market, boosting investor confidence, increasing trading volume, and driving up the value of targeted companies. This success highlights the potential for high returns combined with reduced risk inherent in investing in stable, well-managed Japanese businesses. For investors, this presents significant opportunities to diversify portfolios and potentially enhance their overall returns. The strategic moves of a renowned investor like Warren Buffett provide a clear indication of confidence in the Japanese market's future prospects.

Call to Action: Stay informed about the latest investment news concerning Berkshire Hathaway and its continued impact on Japanese trading stocks. Consider diversifying your investment portfolio with exposure to the Japanese market, following the lead of a renowned investor like Warren Buffett. Learn more about successful investment strategies in the Japanese market and take advantage of the opportunities presented by this dynamic and growing economy.

Featured Posts

-

The Hunger Games Directors Stephen King Horror Movie A 2025 Release

May 08, 2025

The Hunger Games Directors Stephen King Horror Movie A 2025 Release

May 08, 2025 -

Zerat E Largimit Pese Lojtare Te Psg Ne Rrezik Nga Luis Enrique

May 08, 2025

Zerat E Largimit Pese Lojtare Te Psg Ne Rrezik Nga Luis Enrique

May 08, 2025 -

Why Is Xrp Rising Examining Trumps Potential Role In Ripples Price Increase

May 08, 2025

Why Is Xrp Rising Examining Trumps Potential Role In Ripples Price Increase

May 08, 2025 -

Greenland A New Geopolitical Battleground Between The Us And China

May 08, 2025

Greenland A New Geopolitical Battleground Between The Us And China

May 08, 2025 -

Breaking Brazil Greenlights First Spot Xrp Etf Trump Weighs In On Ripple

May 08, 2025

Breaking Brazil Greenlights First Spot Xrp Etf Trump Weighs In On Ripple

May 08, 2025