Live Nation Entertainment (LYV): A Deep Dive Into Investment Options

Table of Contents

Understanding Live Nation Entertainment (LYV) and its Business Model

Live Nation's Core Businesses:

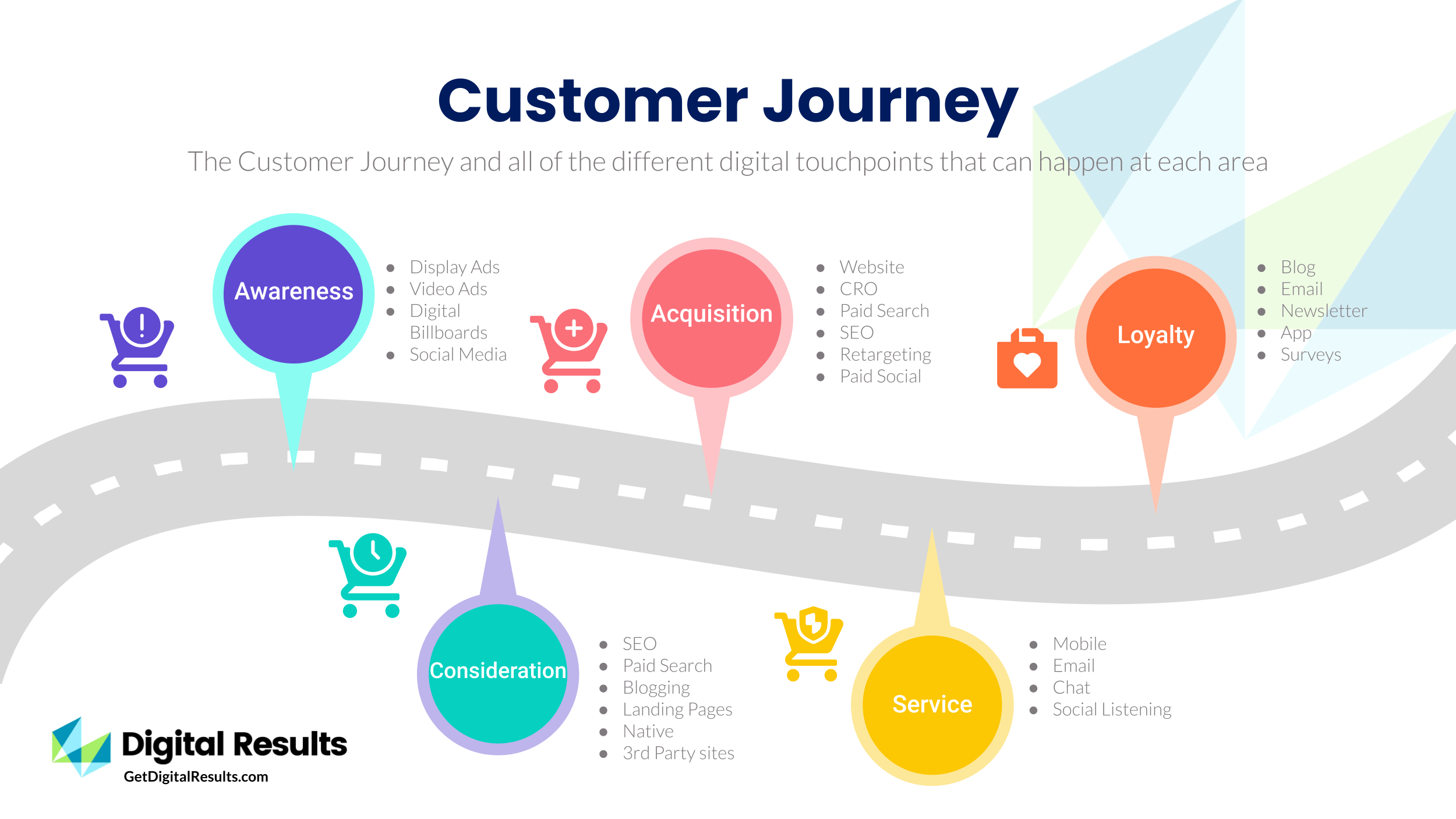

Live Nation Entertainment's business model is multifaceted, encompassing several key revenue streams that contribute to its market dominance. These include:

- Ticketing: Through Ticketmaster, Live Nation controls a significant portion of the global ticketing market, generating substantial revenue from ticket sales for concerts, festivals, and other events. This segment benefits from high transaction volumes and associated fees.

- Venues: Live Nation owns and operates a vast network of amphitheaters, arenas, and clubs worldwide, generating revenue from ticket sales, concessions, sponsorships, and other venue-related activities. This provides a significant and recurring income stream.

- Artist Management: Live Nation represents numerous artists, managing their tours, booking performances, and negotiating contracts, earning commissions and fees from these activities. This allows them to control a significant portion of the talent pipeline.

- Sponsorships: Live Nation secures sponsorships for events and venues, generating additional revenue streams through brand partnerships and advertising. This diversifies their revenue and reduces reliance on ticket sales alone.

Live Nation’s global reach and market leadership position it favorably against competitors. While competitors like AEG exist, Live Nation commands a larger market share, making it a dominant force in the live entertainment landscape. Understanding Live Nation revenue streams is crucial for assessing the company’s overall financial health.

Analyzing Live Nation's Financial Performance:

Analyzing LYV stock requires a careful examination of the company's financial performance. Reviewing historical data provides insight into revenue growth, earnings trends, and overall financial stability. Key financial ratios, such as the Price-to-Earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE), are vital tools for gauging the company's valuation and risk profile. Keeping abreast of financial news and announcements related to Live Nation earnings, debt, and other financial metrics is crucial for informed investment decisions. A thorough understanding of LYV stock price fluctuations in relation to these factors allows for better prediction of future performance.

Assessing the Risks and Rewards of Investing in LYV:

Like any investment, investing in Live Nation carries inherent risks and rewards.

Potential Risks:

- Economic Downturns: Recessions or economic instability can significantly impact consumer spending on entertainment, affecting ticket sales and overall revenue.

- Competition: Although Live Nation is a market leader, competition from other players in the entertainment industry can pose a challenge.

- Pandemic Impacts: The COVID-19 pandemic demonstrated the vulnerability of the live entertainment sector to unforeseen events that can disrupt operations and impact revenue.

- Geopolitical Events: Global instability and unforeseen events can disrupt international tours and events, impacting revenue streams.

Potential Rewards:

- High Growth Potential: The live entertainment industry demonstrates strong growth potential, particularly as the post-pandemic recovery continues. This positions LYV stock for significant long-term gains.

- Market Leadership: Live Nation's dominant market position provides a competitive advantage and contributes to its resilience.

- Diversified Revenue Streams: The multifaceted nature of Live Nation's business model reduces reliance on any single revenue source, mitigating some risks.

The volatility inherent in the entertainment sector should be considered before investing in LYV stock.

Exploring Different Live Nation Entertainment (LYV) Investment Options

Investing in LYV Stock Directly:

The most straightforward way to invest in Live Nation is by purchasing LYV stock directly through a brokerage account. This approach offers the potential for higher returns but also carries greater risk. Buying LYV stock involves opening an account with a brokerage firm (such as Fidelity, Schwab, or TD Ameritrade), depositing funds, and placing an order to buy shares. Selling LYV stock is equally straightforward through the same platform. The benefits of direct stock ownership include potential for high returns and direct control over your investment. Drawbacks include higher risk and the need for a deeper understanding of financial markets.

Investing in LYV Through ETFs or Mutual Funds:

A more diversified approach involves investing in exchange-traded funds (ETFs) or mutual funds that hold LYV stock as part of their portfolio. This strategy reduces risk by diversifying investments across multiple companies. Many ETFs and mutual funds focused on the consumer discretionary or entertainment sectors include LYV stock, providing exposure to Live Nation without the concentration risk of direct stock ownership. Specific ETFs or mutual funds holding LYV should be researched based on your investment goals and risk tolerance. This approach benefits from diversification, but potential returns might be lower compared to direct stock ownership.

Considering Options Trading for LYV:

(Optional Section - Include only if appropriate for the target audience)

Options trading offers a more complex approach to investing in LYV, allowing investors to buy or sell the right, but not the obligation, to buy or sell LYV stock at a specific price on or before a certain date. Options trading presents both significant risks and potential rewards. Call options can be used to bet on a price increase, while put options can be used to hedge against price declines. However, options trading requires a strong understanding of financial markets and risk management strategies. It's crucial to thoroughly research and understand options strategies before engaging in this type of trading.

Conclusion: Making Informed Decisions about Live Nation Entertainment (LYV) Investments

Investing in Live Nation Entertainment (LYV) presents a compelling opportunity within the dynamic live entertainment industry. This article has explored various investment options, from direct stock ownership to more diversified approaches through ETFs and mutual funds. We've highlighted the potential risks and rewards associated with investing in LYV, emphasizing the importance of conducting thorough research and understanding your own risk tolerance. Remember to consider your financial goals and investment horizon before making any decisions. Start your research on Live Nation Entertainment (LYV) investment options today and make informed decisions about your portfolio. Learn more about the diverse investment options available for Live Nation Entertainment (LYV) and build a successful investment strategy.

Featured Posts

-

Hol Vannak A Szazezreket Ero Targyak A Lakasodban Keresd

May 29, 2025

Hol Vannak A Szazezreket Ero Targyak A Lakasodban Keresd

May 29, 2025 -

Kaka Empire And Bio Foods Let Him Cook A New Culinary Show

May 29, 2025

Kaka Empire And Bio Foods Let Him Cook A New Culinary Show

May 29, 2025 -

Eurovision 2025 Understanding The Odds For The Netherlands C Est La Vie

May 29, 2025

Eurovision 2025 Understanding The Odds For The Netherlands C Est La Vie

May 29, 2025 -

Joan Mirs Eagerness And Luca Marinis Next Step At The Circuit Of The Americas

May 29, 2025

Joan Mirs Eagerness And Luca Marinis Next Step At The Circuit Of The Americas

May 29, 2025 -

Sally Hawkins In Bring Her Back A New Kind Of Resurrection

May 29, 2025

Sally Hawkins In Bring Her Back A New Kind Of Resurrection

May 29, 2025

Latest Posts

-

Deutsche Banks Digital Journey The Role Of Ibms Software Portfolio

May 30, 2025

Deutsche Banks Digital Journey The Role Of Ibms Software Portfolio

May 30, 2025 -

Epiroc Adr Programs Deutsche Banks Role As Depositary Bank

May 30, 2025

Epiroc Adr Programs Deutsche Banks Role As Depositary Bank

May 30, 2025 -

Mad By Sparks An In Depth Album Review

May 30, 2025

Mad By Sparks An In Depth Album Review

May 30, 2025 -

Ibm Software Fuels Deutsche Banks Digital Acceleration

May 30, 2025

Ibm Software Fuels Deutsche Banks Digital Acceleration

May 30, 2025 -

Deutsche Bank Appointed Depositary Bank For Epiroc Adr Programs

May 30, 2025

Deutsche Bank Appointed Depositary Bank For Epiroc Adr Programs

May 30, 2025