Epiroc ADR Programs: Deutsche Bank's Role As Depositary Bank

Table of Contents

What are Epiroc ADRs and Why are they Important?

Epiroc ADRs (American Depositary Receipts) represent ownership in Epiroc AB, a Swedish company, but are traded on US exchanges in US dollars. This makes investing in Epiroc significantly easier for US-based investors compared to directly investing on the Stockholm Stock Exchange. Investing in Epiroc through ADRs offers several key benefits:

- Easier access for US investors: Avoid the complexities of international brokerage accounts and currency conversions.

- Trading in US dollars: Eliminate currency exchange risks and simplifies transaction calculations.

- Simplified brokerage and settlement processes: Experience a more familiar and streamlined trading process compared to international exchanges.

- Potential for currency diversification: Reduce reliance on a single currency, mitigating overall portfolio risk.

- Reduced transaction costs compared to direct investment in Sweden: Lower brokerage fees and reduced administrative burdens associated with international trading.

Investing in Epiroc ADRs provides US investors with exposure to a global leader in mining and infrastructure equipment, offering a valuable opportunity for international diversification within their portfolios.

Deutsche Bank's Role as Depositary Bank for Epiroc ADRs

Deutsche Bank acts as the depositary bank for Epiroc ADRs, a crucial role that ensures the efficient and secure operation of the ADR program. Their responsibilities are multifaceted and critical for both Epiroc and its ADR holders:

- Issuance and cancellation of ADRs: Deutsche Bank manages the creation and retirement of ADRs, ensuring an accurate count of outstanding shares.

- Maintaining records of ADR holders: They keep precise records of all ADR holders, facilitating dividend payments and other shareholder communications.

- Facilitating dividend payments to ADR holders: Deutsche Bank converts and distributes dividends paid by Epiroc in Swedish Kronor to ADR holders in US dollars.

- Acting as a point of contact for ADR holders: They serve as a primary point of contact for ADR holders addressing inquiries related to their investment.

- Ensuring compliance with US securities regulations: Deutsche Bank ensures that all aspects of the ADR program comply with relevant US laws and regulations.

Understanding the Importance of a Reliable Depositary Bank

The choice of a depositary bank is paramount for the success and security of an ADR program. A reliable depositary bank like Deutsche Bank provides several crucial benefits:

- Reduced risk of fraud and loss: A reputable institution offers a higher level of security and safeguards against potential fraud or loss.

- Confidence in accurate record-keeping: Investors can trust in the accuracy and integrity of their ADR holdings and dividend payments.

- Reliable dividend distribution: Smooth and timely distribution of dividends reduces uncertainty and maximizes returns.

- Enhanced investor protection: A strong depositary bank adds an extra layer of protection for investors’ interests.

- Compliance with international regulatory standards: Ensures adherence to all relevant regulations, fostering trust and transparency.

Investing in Epiroc ADRs: A Step-by-Step Guide

Investing in Epiroc ADRs is a relatively straightforward process for US investors. Here’s a simplified guide:

- Open a brokerage account with access to international markets: Many online brokers offer access to international exchanges.

- Find the Epiroc ADR ticker symbol: This information can be found on your broker's platform or through a financial news website.

- Place an order to buy Epiroc ADRs: Similar to buying any other stock, you'll place an order specifying the number of shares you want to purchase.

- Monitor your investment regularly: Keep track of the Epiroc ADR stock price and your overall portfolio performance.

- Consider your risk tolerance and investment goals: Investing in the stock market always carries risk. Ensure your investment aligns with your personal risk profile and financial objectives.

Disclaimer: Investing in the stock market involves risk, including the potential for loss. Consult with a financial advisor before making any investment decisions.

Conclusion

Epiroc ADRs offer US investors a convenient and efficient way to gain exposure to a leading global company in the mining and infrastructure sectors. Deutsche Bank's role as the depositary bank is crucial, providing security, reliability, and compliance for investors. The benefits of investing through a reputable depositary bank like Deutsche Bank cannot be overstated – it adds a layer of confidence and ensures a smooth investment experience. Learn more about Epiroc ADR programs and the advantages of investing through a trusted depositary bank like Deutsche Bank today. Visit Deutsche Bank's website or Epiroc's investor relations page for more information. Invest in Epiroc ADRs with confidence.

Featured Posts

-

Grand Est La Region Subventionne Un Concert De Medine Reactions Politiques

May 30, 2025

Grand Est La Region Subventionne Un Concert De Medine Reactions Politiques

May 30, 2025 -

Alastqlal Rmz Alkramt Walsyadt

May 30, 2025

Alastqlal Rmz Alkramt Walsyadt

May 30, 2025 -

Zheng Qinwens Madrid Open Upset Loss To Potapova

May 30, 2025

Zheng Qinwens Madrid Open Upset Loss To Potapova

May 30, 2025 -

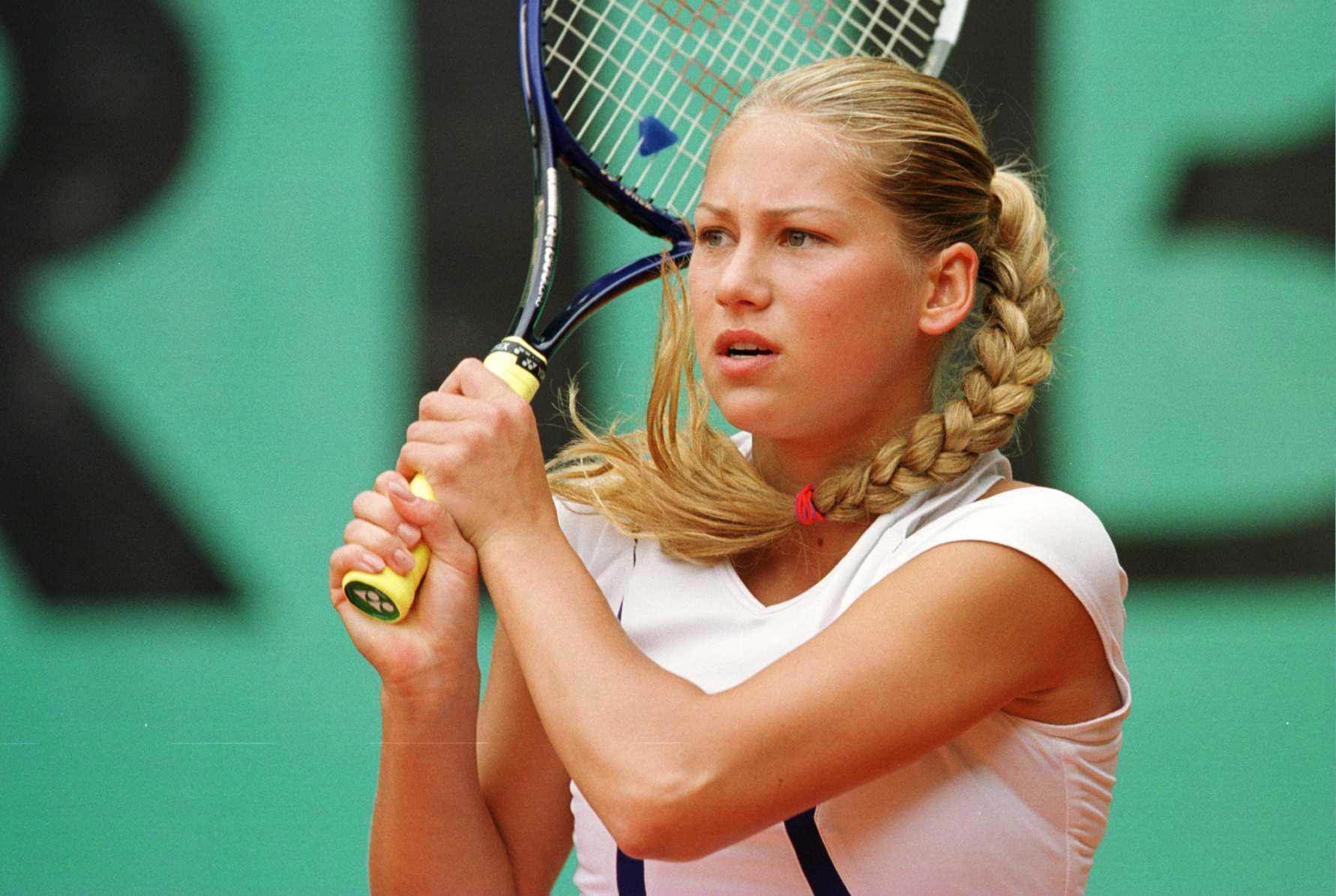

Remembering Anna Neagle A Look At Her Life And Legacy In British Cinema

May 30, 2025

Remembering Anna Neagle A Look At Her Life And Legacy In British Cinema

May 30, 2025 -

V Tolyatti Sostoitsya Otkrytiy Seminar Russkoy Inzhenernoy Shkoly

May 30, 2025

V Tolyatti Sostoitsya Otkrytiy Seminar Russkoy Inzhenernoy Shkoly

May 30, 2025