Deutsche Bank: Appointed Depositary Bank For Epiroc ADR Programs

Table of Contents

Understanding the Role of a Depositary Bank in ADR Programs

A depositary bank plays a crucial role in managing American Depositary Receipts (ADRs). These banks act as intermediaries, facilitating the smooth functioning of ADR programs and ensuring efficient interaction between the issuing company (in this case, Epiroc) and international investors. The key functions of a depositary bank like Deutsche Bank include:

- Facilitating the issuance and transfer of ADRs: Deutsche Bank handles the process of creating and transferring ADRs, ensuring a streamlined process for investors to buy, sell, and trade these securities. This involves managing the underlying shares held in custody.

- Maintaining records of ADR holders: Accurate record-keeping is paramount. Deutsche Bank maintains a detailed register of all ADR holders, facilitating efficient dividend payments and other corporate actions.

- Acting as a liaison between the issuer (Epiroc) and the investors: The bank acts as a crucial communication channel, relaying information about corporate actions, financial statements, and other important announcements from Epiroc to its international investors.

- Handling dividend payments and other corporate actions related to the ADRs: Deutsche Bank ensures timely and accurate distribution of dividends and handles other corporate actions, such as stock splits and mergers, on behalf of Epiroc and its ADR holders. This includes converting foreign currency payments where necessary.

Choosing a reputable and experienced ADR custodian bank, like Deutsche Bank, is vital. Their expertise in managing ADR services and international securities ensures a secure and reliable investment environment for all stakeholders.

Benefits for Epiroc from Deutsche Bank's Appointment

Epiroc benefits significantly from this partnership with Deutsche Bank. The appointment offers several key advantages, including:

- Increased investor access and liquidity in the US market: Deutsche Bank's extensive network provides Epiroc with access to a much larger pool of US and international investors, leading to increased trading volume and liquidity for its ADRs.

- Enhanced brand reputation and credibility: Associating with a globally respected financial institution like Deutsche Bank enhances Epiroc's credibility and attracts further international investment.

- Streamlined processes for managing ADR programs: Deutsche Bank's expertise simplifies the administrative burden associated with managing ADR programs, allowing Epiroc to focus on its core business.

- Access to Deutsche Bank's global network and expertise in international finance: This collaboration provides Epiroc with invaluable access to Deutsche Bank's global network and expertise in navigating complex international financial markets, supporting their global expansion strategy. This enhances Epiroc's investor relations and strengthens their position in capital markets.

Benefits for Investors from the Deutsche Bank Partnership

This partnership between Deutsche Bank and Epiroc translates into numerous benefits for investors interested in Epiroc stock:

- Simplified access to invest in Epiroc through ADRs: Investing in Epiroc becomes more straightforward and accessible through the ADR program facilitated by Deutsche Bank, reducing barriers to entry for international investors.

- Increased trading efficiency and lower transaction costs (potentially): Deutsche Bank's efficient processes can contribute to lower transaction costs and increased trading efficiency for ADR holders.

- Confidence in the secure and reliable handling of their investments: Investors can have greater confidence in the security and reliability of their investments, knowing they are handled by a reputable and experienced institution like Deutsche Bank.

- Access to a wider range of investment options within a robust framework: This partnership opens up opportunities for a broader spectrum of investment strategies, ensuring a stable and secure environment for global investment opportunities. Investing in Epiroc via ADRs becomes easier and more appealing for those interested in international stocks.

Deutsche Bank's Expertise in International Finance

Deutsche Bank is a leading global financial institution with extensive experience in managing ADR programs and facilitating international investments. Their global reach and reputation for reliability provide a strong foundation for Epiroc's ADR program. Their expertise in Deutsche Bank ADR services and global banking ensures smooth and efficient operations within the financial markets.

Conclusion

The appointment of Deutsche Bank as the depositary bank for Epiroc's ADR programs marks a significant step towards enhancing global investor access and strengthening Epiroc's position in international markets. This partnership simplifies investment processes, providing benefits for both Epiroc and its international investors. The selection of a leading global financial institution like Deutsche Bank underscores Epiroc’s commitment to providing a seamless and reliable investment experience.

Call to Action: Learn more about investing in Epiroc through its ADR program and explore the opportunities available through Deutsche Bank's services. Find out how to access Epiroc's American Depositary Receipts (ADRs) and take advantage of this strengthened global investment opportunity. Research Deutsche Bank's ADR services and discover the benefits of working with a trusted depositary bank.

Featured Posts

-

Remembering Anna Neagle A Look At Her Life And Legacy In British Cinema

May 30, 2025

Remembering Anna Neagle A Look At Her Life And Legacy In British Cinema

May 30, 2025 -

La Sncf Face A La Crise Le Ministre Reagit A La Menace De Greve

May 30, 2025

La Sncf Face A La Crise Le Ministre Reagit A La Menace De Greve

May 30, 2025 -

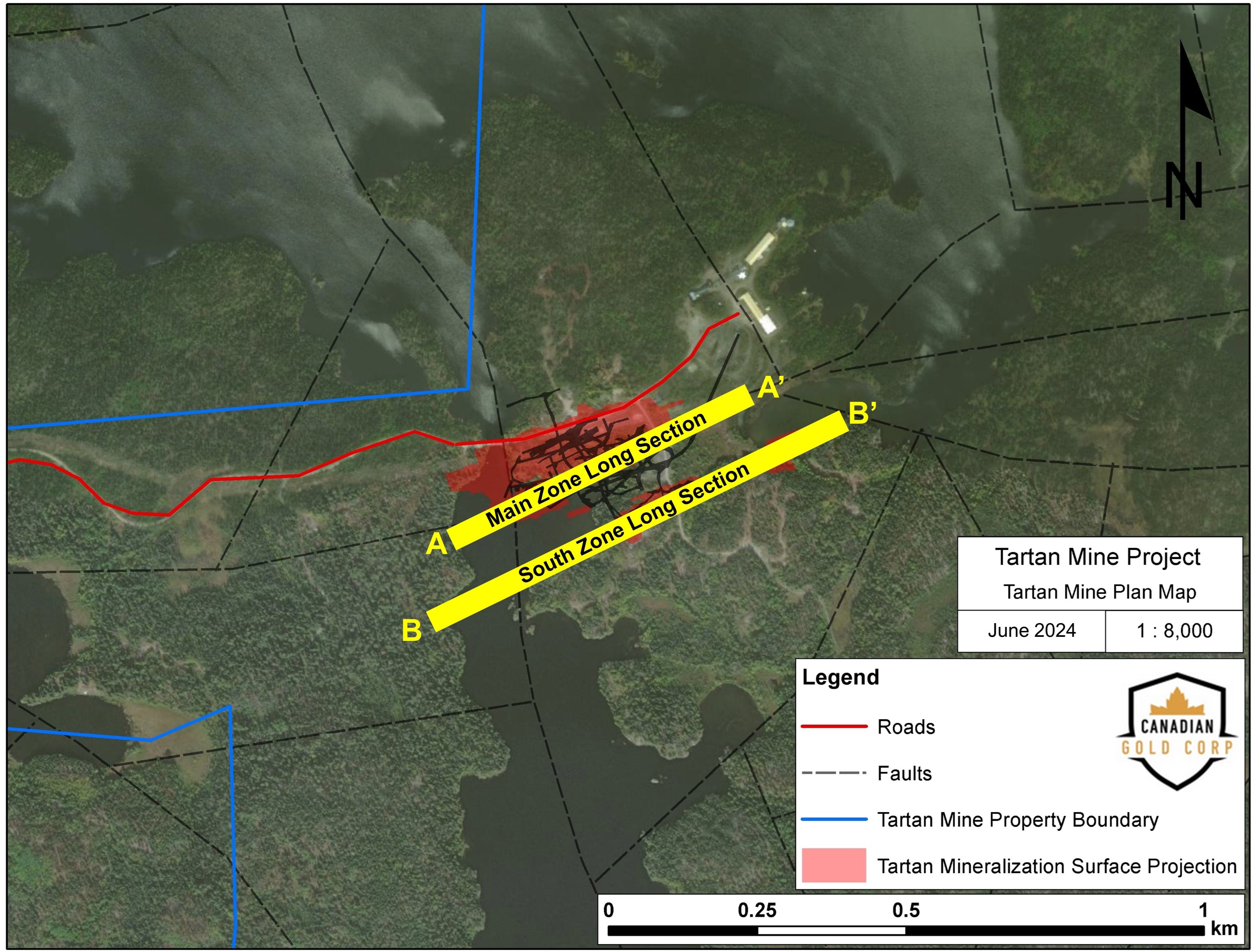

Canadian Gold Corp Secures Funding For Tartan Mine Ni 43 101 And Pea

May 30, 2025

Canadian Gold Corp Secures Funding For Tartan Mine Ni 43 101 And Pea

May 30, 2025 -

Updated Forecast Cool Wet And Windy Weather Hits San Diego

May 30, 2025

Updated Forecast Cool Wet And Windy Weather Hits San Diego

May 30, 2025 -

Histoire Moderne De La Deutsche Bank Succes Echecs Et Lecons Pour L Avenir

May 30, 2025

Histoire Moderne De La Deutsche Bank Succes Echecs Et Lecons Pour L Avenir

May 30, 2025